In this blog, we will cover and discuss homeowners doing a fast-track low-interest FHA streamline refinance in Alabama for homeowners with a current FHA loan. Homeowners can qualify for an FHA streamline refinance in Alabama with bad credit, no appraisal, no income verification, plus no closing costs. Borrowers can have very low credit scores and recent late payments on any credit tradelines with the exception of their current FHA loan.

No Cost FHA Streamline Refinance in Alabama

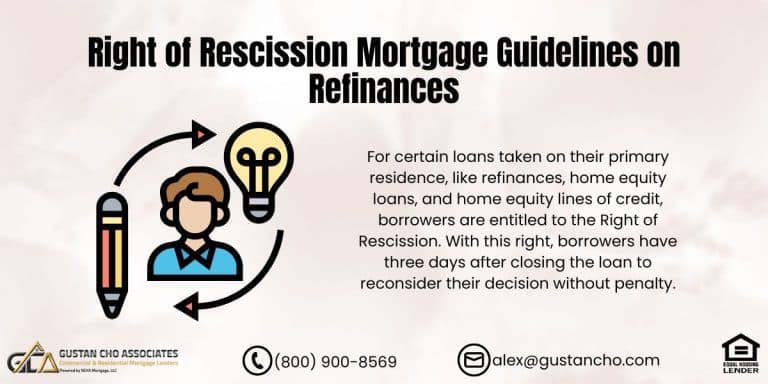

Traditionally, the decision on whether or not to refinance has meant balancing the savings of a lower monthly payment against the costs of refinancing. But in recent years, many lenders have introduced “no-cost” and low-cost refinancing on FHA streamline refinance in Alabama. This minimizes or completely eliminates the out-of-pocket expenses of refinancing. These refinancing packages compensate with a higher interest rate, or by including some of the costs in the amount that is financed. In this article, we will discuss and cover FHA streamline refinance in Alabama.

Learn Eligibility criteria and documentation needed and FHA streamline refinance in Alabama with Gustan Cho Associates with minimal hassle paperwork and documentation and required common refinance questions.

Financing options are offered with low-value, fast-streamlined finance documentation and steps to refinance. With Gustan Cho Associates, value paperwork with fast and little documentation for Alabama homeowners on refinance. FHA streamline refinance offered at low rate with fast and hassle refinance resources refinance options. In this guide, we will cover FHA streamline refinance in Alabama and frequently asked questions.

Lower your FHA payment in Alabama—fast

Streamline refi with simple docs, quick turn times, and competitive pricing

Net Tangible Benefit With FHA Streamline Refinance in Alabama

One of the requirements with FHA Streamline Refinance in Alabama is that the homeowner needs to get a net tangible benefit in order for a loan officer to proceed with their FHA Streamline Refinance Mortgage.

There are strict HUD guidelines on refinancing with an FHA Streamline where a borrower needs to save a certain amount from their existing mortgage.

With a standard full refinance mortgage loan, the most often cited rule of thumb is that the interest rate for the new mortgage must be about 2 percentage points below the rate of current mortgage for refinancing to make sense. However, with the newer low and no-cost refinancing programs, it can be worth your while to refinance to obtain a smaller reduction in interest rates.

How Long Will Homeowner Stay In Their Home?

How long you expect to stay in your home is also a factor to consider. If you’ll be moving in a few years, the month-to-month savings may never add up to the costs that are involved in refinancing. Homeowners need to realize that there are closing costs involved with a refinance.

Closing costs consist of tax stamps, appraisal, origination fees, and attorney’s fees if there will be an attorney involved in the refinancing and title charges.

Depending on the interest rate on your new refinance mortgage loan, it might take anywhere of several months to more than a year to recoup your refinance closing costs. Your mortgage broker will help you by advising you on whether or not it will be worthwhile for you to refinance.

FHA Streamline Refinance in Alabama with Low Rates

With an FHA Streamline Refinance in Alabama with low rates, you can enjoy faster approval with decreased monthly payments. In this case, Gustan Cho Associates helps Alabama homeowners refinance fast with no lender overlays.

Reasons Why Homeowners in Alabama Like FHA Streamline Refinancing

- The FHA Streamline Refinance is the fastest way for Alabama homeowners with an FHA loan to achieve a lower payment.

- With the Streamline program, there is less paperwork, no calculation of appraisal in most cases, and a prioritized automatic examination of the applicant’s credit history.

- Borrowers in Alabama, particularly those in Birmingham, Huntsville, and Montgomery, can obtain streamline refinances to secure lower rates and increase their cash flow.

Refinancing Benefits of an FHA Loan in Alabama

- Reduced housing costs: Potential for a lower rate and payment.

- No appraisal requirement: Most borrowers qualify, which helps if values are flat or mixed in your neighborhood.

- Reduced documentation: Income, asset, and employment verification of a standard refinance is not required

- Faster closings: Often weeks faster than a full credit-qualifying refinance.

- MIP refund credit: This may apply if your current FHA loan is recent (declines monthly after closing of your existing FHA loan).

Lender credits: Available to offset closing costs; all or a portion of the costs can be included in the loan amount.

- Gustan Cho Associates is known for having no lender overlays on FHA, meaning we strictly adhere to HUD guidelines, without additional rules that convert yes files to no files after overlays are added.

Recommendations for FHA Streamline Qualifications in Alabama

FHA Loan on the Property

- For an FHA Loan Streamline Refinance in Alabama, to qualify, you must already possess an Alabama FHA loan.

Seasoning Requirement (Time & Payments)

- A minimum of 210 days must have elapsed since the closing of the current FHA loan and

- A minimum of what has been described as six days in a month with timely payments have been made and confirmed to have not been late in the last three months (with no three omissions of potential 30-day late payments).

Net Tangible Benefit (NTB) Test

- HUD makes the determination on the apparent monetary savings for the borrower.

- The monetary value of a loan drops if there is a mortgage refinance.

Payment History & Credit

- On-time housing payments are key.

- FHA Streamline financing is non-credit-qualifying (less documentation needed).

- In unique situations requiring a distressed borrower, e.g., a loan with non-performance for a reasonable period.

Occupancy & Property Type

- Fully Eligible is the classification of FHA for Primary residences.

- Second homes or investment properties may be eligible according to certain guidelines of HUD if the FHA insures the loan.

- We can evaluate your situation through direct consultation.

- Can you handle the seasoning and NTB tests?

- Gustan Cho Associates can handle everything.

No Appraisal FHA Streamline in Alabama: When It Applies

- In most Alabama streamline scenarios, you do not need a new appraisal.

- That’s a big win if you’re uncertain about your home’s value or if you want to sell it a. lot faster.

- One option, a streamlined appraisal, is used when you want to roll in certain costs that exceed standard limits or when you need to document maximum financing in a special situation.

- We will help you determine the path with the lowest total cost.

Alabama FHA Mortgage Insurance

- CRM: Upfront Mortgage Insurance Premium (UFMIP) is similar to other loans and will be financed in the loan.

- MIP (paid monthly MIP): The annual MIP still applies, and the loan term and the loan amount determine the mortgage payment.

- Over the years, HUD has modified MIP tenure. We will quote the current schedules to determine if you qualify for MIP UFMIP refund credits from the loan.

Lock today’s low FHA rates with confidence

Get a smart lock strategy and float-down protection when available

Alabama Specific Consideration For FHA Streamline:

- Closing timelines: Alabama is known for being fast when it comes to refinance loan closings.

- Streamlining closings can be done more efficiently if the process is simplified due to reduced documentation.

- Taxes and title: Alabama has competitive property tax rates.

- These will be analyzed and re-established at closing to ensure your new payment is as accurate as possible.

- Condos and remote properties: No appraisal streamline options can benefit condo owners and rural property owners where comparable are limited.

FHA Streamline Refinance Rates in Alabama (How to Get the Lowest)

- The market and the specifics of your file cause low rates on a streamline.

- In an effort to get the best rates considered:

- Lock rates (we’ll monitor daily pricing fluctuations).

- Get a lender credit: Select a loan option with a higher interest rate to reduce or eliminate the cash due at closing.

- Maintain a clean mortgage payment history: Pricing is more favorable with a consistent payment history.

- Select a lender with no overlays to avoid unnecessary adds to the rate or fees.

Credit-Qualifying vs. Non-Credit-Qualifying Streamline in Alabama

Non-Credit Qualifying (Predominant Form)

- Easiest to no proof of income or employment required.

- No DTI calculations in many scenarios.

- The quickest way to get a closing date.

Credit Qualifying (When Needed)

- In the case of removing a borrower due to recent late payments or other risk factors.

- There is a need to check credit, income, and debt.

- Still less complicated than a full FHA rate and term refinance

- We will explain which version best fulfills your goals while remaining cost-effective and on time.

Costs and Cash to Close on an Alabama FHA Streamline

- Appraisal: Customary waived on no-appraisal streamlines.

- Title, recording, and escrow set up: Standard Alabama fees.

- Prepaids/escrow: Taxes and insurance escrow account funding for your new escrow account.

- UFMIP: Typically financed.

- It may help cover third-party fees, thereby reducing the borrower’s costs.

- We will prepare a work fee and a loan estimate, allowing you to evaluate and calculate the savings against the monthly payment costs and the breakeven period.

Step-by-Step Process To Submit An Application for an FHA Streamline Refinance In Alabama

The application is done in a few minutes and is reviewed the same day.

- Online or phone application with Gustan Cho Associates.

- Please send your mortgage statement, ID, and any other documents that may be requested.

- We confirm EH seasoning with NTB to offer rate/credit options, as well as no-appraisal approval.

- Sign and done with the electronic rate lock and initial disclosure. We will also title a document.

- The file is Clear to close; set the appointment for closing with the Alabama attorney.

- They usually can do it much faster than a typical refinance.

An Alabama FHA Streamline Refinance: Who Gains the Most?

Anyone with Higher Current FHA Rates

- If you have any loans with a highly competitive fixed rate, then the payment drop will be substantial.

ARM to Fixed

- Converting an ARM to a fixed rate enhances payment stability, often satisfying the NTB test, even if the payment change is minor.

Homes With Uncertain Values

- The no-appraisal option for a value mixed streamline is a case of focusing on payment savings instead of comps.

Get a real Alabama payment estimate

Calculate PITI with local taxes and insurance for a true monthly number

What sets Gustan Cho Associates apart for FHA Streamline refinances in Alabama

Lender overlays do not exist on FHA— the deal is

Alabama streamline refinance specialists (single-family, townhomes, and condos)

- Rapid and clear feedback and cost evaluation side-by-side.

- Pricing that is fair and lender-credit options to reduce the amount of cash to close.

Would you like to see how much you can save?** Call 800-900-8569 or Apply Now to discover all the FHA Streamline options available in Alabama.

- Tuscaloosa, Alabama Streamline Refinance With No Appraisal.

- For most situations, you will not need an appraisal.

What is The Streamline Appraisal Process in Alabama?

- In most situations, no appraisal is required; however, there are instances when a streamline is conducted with an appraisal, and the loan officer will provide the lowest-cost option.

Am I Allowed to Incorporate the Closing Costs into the Loan Amount?

- Yes, in many cases.

- Prepaids and UFMIP are financed regularly, and most of the costs associated with the third party can be covered with lender credits associated with the rate you prefer.

What’s The Waiting Period For an FHA Streamline?

- The FHA closing date marks the beginning of the waiting period.

- The waiting period is estimated to be 210 days, and you must also complete six on-time payments.

- A 30-day lateness is completed and disregarded.

- We verify this information early on.

Am I Required To Reside in The House?

- The house is a primary residence, which is eligible for full qualification.

- Other second homes or investment property loan cases that have already been FHA-insured are also eligible.

- This is done on a case-by-case basis, as per the guidelines for FHA.

Is Mortgage Insurance Still Applicable?

- Yes.

- The UFMIP is usually done as a loan. Then, the annual MIP is charged monthly, depending on the period and LTV.

- We calculate the current MIP schedule and the refund credits derived from your loan.

Is It Possible To Remove a Borrower With a Streamline?

- Yes, but that usually needs a credit-qualifying streamline, which is changeable.

- We’ll provide you with that information. Is your lock?

How Long Can We Take To Close in Alabama?

- In Alabama, the closing period is quickly shortened.

- This can last up to 30 days.

- This is based on the assumption that you don’t need the credit exam and qualification.

I Have a Late Mortgage Payment. What Are The Consequences?

- A recent late payment can render the file non-credit-qualifying, even if the standards set by HUD for payment history are not met.

- We will work to make sure your options don’t disrupt the refinance in the long run.

FHA Streamline Refinance in Alabama: Get Your Quote Right Now.

- Almost all borrowers who have an FHA loan on their home can lower their payment and bypass the appraisal.

- Closing speeds are also faster for these borrowers.

- Call Gustan Cho Associates at 800-900-8569 or go to the FHA Streamline Refinance in Alabama page to complete the online application for your loan.

- There you can find the low rates for today and the straightforward savings strategy.

FHA Streamline Refinance in Alabama Mortgage Process

Alabama homeowners who are planning on staying in their current home for several years or more, it might be worthwhile to consider refinancing. Alabama homeowners who are only planning on staying in their home for a short while might not be able to recoup refinance closing costs so refinancing may not be the best option for them.

They might be better off with paying the higher current home mortgage rates they are paying if they are not able to recoup closing costs.

Alabama homeowners who have any questions and need a free credit evaluation to see if a refinance mortgage is beneficial, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We have no lender overlays on government and conventional loans. On FHA Streamline Refinance Mortgages, there is no appraisal required, no credit required, and no income verification required. Most FHA Streamline Refinance in Alabama take less than 30 days to close.

Talk to an Alabama FHA streamline specialist

Local expertise, no overlays, and on-time closings statewide