This guide covers what are the FHA loan limits for one-to-four unit properties in Illinois. FHA loan limits for one-to-four unit properties depends on the particular county the property is located as well as the type of housing. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about FHA loan limits for one-to-four unit properties in Illinois:

FHA loan limits for two-to-four unit properties have higher loan limits than single family properties such as single family homes, condominiums, and town homes.

Illinois is somewhat different than any other states for homebuyers. Property taxes are paid in arrears in Illinois and home buyers will get property tax prorations by home sellers when buying a home. In this article, we will discuss and cover What Are The FHA loan limits for one-to-four unit properties in Illinois.

Maximum Loan Amount Homebuyers Can Borrow

Homebuyers considering buying a home in Illinois with a government or conventional Loan, there are maximum loan limits they can borrow. In this article, we will discuss FHA loan limits for one-to-four unit properties. We will also discuss and cover the maximum amount a homebuyer can borrow with a FHA loan for a home purchase in Illinois. FHA loan limits for one-to- four unit properties are the amount of home loan a borrower can borrow using a FHA loan.

HUD, the parent of the Federal Housing Administration sets the FHA loan limits for one-to-four unit properties depending on the county the property is located.

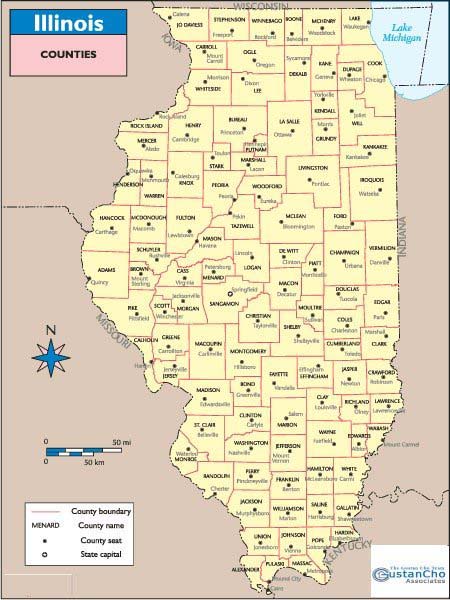

FHA loan limits for one-to-four unit properties is not the same throughout Illinois. The state of Illinois consists of a total of 102 counties. Illinois now has a uniform FHA loan limits. In the past, Chicago and its surrounding counties had higher FHA loan limits. Homebuyers who plan on purchasing higher priced homes with FHA loans in Illinois should check what the maximum loan limits for the county they plan on making a home purchase offer.

Know Your FHA Loan Limits in Illinois

Find out the maximum FHA loan amounts for 1–4 unit properties.

FHA Loan Limits For One-to-Four Unit Properties In Chicago And Surrounding Suburbs

The City of Chicago is the second largest city in the United States and the biggest city in the state of Illinois. Homes in the city of Chicago and suburbs are priced higher than the rest of Illinois. HUD realized the fact that Chicago and its surrounding counties had much higher home values so they considered it a high cost area where FHA loan limits were substantially higher than the rest of the state. However, this has changed and Chicago and its surrounding suburbs has a uniform FHA loan limit cap as the rest of the state. Chicago and its surrounding counties have FHA loan lImit capped at $524,225 for single family units. single family units are the following:

- Single Family Homes

- HUD approved condominiums

- Townhomes

Here Are The Following Counties With FHA Loan Limits Illinois of $524,225 for Single Family Homes:

- Cook County

- McHenry County

- DeKalb County

- Kendall County

- Grundy County

- DuPage County

- Will County

- Lake County

- Kane County

Cook County is the home of the City of Chicago and by far the most populous county in Illinois. Cook County has the highest concentration of two-to-four unit properties out of all counties in Illinois.

Boone County And Winnebago County Illinois

Two Illinois Counties in Northern Illinois Bordering the State of Wisconsin Are the Following:

- Winnebago County.

- Boone County.

- Boone County and Winnebago County are sister Illinois counties because they are next to each other.

- FHA Loan Limits in Boone County Illinois and Winnebago County Illinois is capped at $524,225 on single family units.

What are the FHA Loan Limits for One-to-Four Unit Properties: Remaining Counties of Illinois

Illinois has 102 Counties and the remaining 91 counties of Illinois has the standard FHA Loan Limit of $524,225 on single family homes, condos, and town homes.

- Two-to-four unit properties have higher loan limits.

- FHA is does not lend to borrowers.

- HUD’s function is to insure mortgage loans that meet HUD Guidelines to lenders who originate and lend home loans that meet HUD Guidelines in the event borrowers default on their FHA loans and go into foreclosure.

FHA Loan Limits For One-to-Four Unit Properties on All Illinois Counties

Below Are the Nine Highest Cost Areas of Illinois:

- For the above nine counties the loan limit for a single family unit is $524,225.

- For the above nine counties surrounding Chicago, the FHA Loan Limit For a two unit property is $671,200.

- For the above nine counties surrounding Chicago, the FHA Loan Limit For a three unit property is $811,275.

- For the above nine counties bordering Chicago, the FHA Loan Limit For a four unit property is $1,008,300.

- Cook County

- McHenry County

- DeKalb County

- Kendall County

- Grundy County

- DuPage County

- Will County

- Lake County

- Kane County

Below Are The Two Medium Cost Areas of Illinois

- For the above nine counties the loan limit for a single family unit is $524,225.

- For the above nine counties surrounding Chicago, the FHA Loan Limit For a two unit property is $671,200.

- For the above nine counties surrounding Chicago, the FHA Loan Limit For a three unit property is $811,275.

- For the above nine counties surrounding Chicago, the FHA Loan Limit For a four unit property is $1,008,300.

- Boone County

- Winnebago County

Below Are The Rest of the Counties of Illinois and Their FHA Loan Limits For One-to-Four Unit Properties

- The loan limit for a single family unit is $524,225

- FHA Loan Limit For a two unit property is $671,200

- FHA Loan Limit For a three unit property is $811,275

- FHA Loan Limit For a four unit property is $1,008,300.

- Adams County

- Alexander County

- Bond County

- Brown County

- Bureau County

- Calhoun County

- Carroll County

- Cass County

- Champaign County

- Clay County

- Christian County

- Clark County

- Clinton County

- Coles County

- Crawford County

- Cumberland County

- DeWitt County

- Douglas County

- Edgar County

- Edwards County

- Effingham County

- Fayette County

- Ford County

- Franklin County

- Fulton County

- Gallatin County

- Greene County

- Hancock County

- Hamilton County

- Hardin County

- Henderson County

- Henry County

- Iroquois County

- Jackson County

- Jasper County

- Jefferson County

- Jersey County

- Jo Daviess County

- Johnson County

- Kankakee County

- Knox County

- LaSalle County

- Lawrence County

- Lee County

- Lincoln County

- Logan County

- Livingston County

- Macon County

- Macomb County

- Macoupin County

- Madison County

- Massac County

- Marion County

- Marshall County

- Mason County

- McDonough County

- McLean County

- Menard County

- Mercer County

- Monroe County

- Montgomery County

- Morgan County

- Moultrie County

- Ogle County

- Peoria County

- Perry County

- Pike County

- Platt County

- Pope County

- Putnam County

- Pulaski County

- Randolph County

- Rock Island County

- Saline County

- Sangamon County

- Schyler County

- Scott County

- Shelby County

- St. Clair County

- Stark County

- Stephenson County

- Tazewell County

- Union County

- Vermilion County

- Wabash County

- Warren County

- Washington County

- Wayne County

- White County

- Whiteside County

- Williamson County

- Woodford County

Illinois FHA Loan Limits Explained for Multi-Unit Homes

Learn how much you can borrow for 1–4 unit properties under FHA guidelines.

FHA Loan Limits For One-to-Four Unit Properties in Illinois

FHA loans are a smart choice for many Illinois homebuyers. In 2025, the FHA sets the maximum loan amount for a single-family home in the state at $524,225. The limits rise if you buy a duplex, triplex, or four-family home. The maximum amount for a four-family dwelling is $1,008,300.

Illinois is divided into 102 counties. For 2025, every county will use the same base FHA floor. This is good news for both city and country homebuyers, as it creates a consistent benchmark whether you are looking in Chicago, Springfield, or a more rural area.

How the limits affect you depends on the number of units you plan to purchase. For the one-unit limit of $524,225, you will pay a minimum 3.5% down payment if your credit score is at least 580. The down payment rises to 10% if your score is between 500 and 579. If you move to a two-unit building, the maximum loan will jump to about $670,750. Loan limits rise for three- and four-unit buildings, reflecting the higher property values and rents you will collect. To qualify for FHA backing, you need a steady job history, and your monthly mortgage payment and other debt must not exceed 43% of your income. If you are a first-time buyer, many FHA-approved lenders can add a non-occupant co-borrower to help you qualify.

2025 Quick View: Illinois FHA Loan Limits (1–4 Units)

For any case number assigned January 1–December 31, 2025, every Illinois county uses the FHA **low-cost “floor.” Your maximum FHA base loan amount is:

- 1-unit: $524,225

- 2-unit: $671,200

- 3-unit: $811,275

- 4-unit: $1,008,300

These numbers are set nationally by HUD each year and are 65% of the FHFA conforming loan limit for a single-unit home ($806,500 in 2025).

Thanks to the consistent floor across Illinois, you will know what you can borrow no matter where you look. This clarity simplifies budgeting and planning, making FHA loans an effective option for homeownership in every corner of the state.

HUD’s official 2025 loan limits and county lookup confirm that all 102 Illinois counties—including the Chicago-Naperville-Elgin MSA (Cook, DuPage, Lake, Kane, Will, McHenry)—follow the limits listed here.

What “Loan Limit” means (and what it doesn’t)

- The FHA loan limit is the top amount FHA will insure for the base loan on a home of that size in a specific area.

- The Up-Front Mortgage Insurance Premium (UFMIP) can be added to the base loan and does not reduce the loan limit. (You can also pay UFMIP in cash.)

Example: For a 1-unit home in Illinois, the base FHA loan can reach $524,225. If you finance the 1.75% UFMIP, the final loan amount goes above $524,225 since UFMIP is calculated after the limit.

Why is Illinois at The Bottom in 2025

HUD sets limits for FHA loans using the local median sale prices and then checks them against national floor and ceiling levels. In 2025, the floor is 65 percent of the conforming loan limit, while the ceiling only applies to the country’s more costly parts. Because Illinois counties’ 2025 median prices stay below the floor, the limits for every unit in the state will automatically snap to the floor.

FHA Loan Limits for One-to-Four Unit Properties: Multi-Unit (2–4) Properties What To Know

You can use FHA mortgages to purchase 2–4 unit properties, provided you make one unit your primary residence. If you buy a triplex or fourplex, FHA will assess a self-sufficiency rule: the projected net rental income, calculated after adjusting for vacancies, must cover the principal, interest, taxes, insurance, and any mortgage insurance premium. This test often becomes the key factor affecting how much you can borrow for triplex or fourplex properties.

- Quick Check: County Examples (Same Limits Statewide).

- Cook, DuPage, Lake, Kane, Will, McHenry: 1 unit 524,225; 2 units 671,200; 3 units 811,275; 4 units 1,008,300.

- Sangamon (Springfield), Champaign (Champaign-Urbana), Winnebago (Rockford), Peoria, Madison, St. Clair, McLean: Same Limits As Above,

HUD’s 2025 spreadsheet and the online public do identical listings for all Illinois counties.

FHA vs. Conventional in Illinois (2025)

- Illinois 1-Unit FHA Floor: $524,225.

- Conventional Conforming (Baseline 1-Unit): $806,500.

- If your desired sales price pushes your FHA loan over $524,225 for a 1-unit (or over the multi-unit ceiling), consider going Conventional, Jumbo, or making a larger down payment to stay within the FHA ceiling.

- Check the latest caps.

FHA Loan Limits for One-to-Four Unit Properties: How to Check Your County Limits

To find the current FHA limits for your county, visit HUD’s FHA Mortgage Limits lookup tool. You can find data by county, property unit count, and year. For 2025, Illinois counties match the limits shown above.

How to Get Approved in Illinois

- Minimum Down Payment: Qualify with as little as 3.5% down and good credit.

- Closing Costs and Prepaids: The seller can cover these (within FHA constraints) or through lender credits.

- DPA Programs: Down Payment Assistance programs do not raise FHA limits.

- They help pay for your cash-to-close.

- 3–4 units: Include the self-sufficiency test in pre-approval plans.

Buying a Multi-Unit Property in Illinois? Know FHA Limits

Make sure your financing aligns with FHA maximums for 1–4 units.

FAQs: FHA Loan Limits For One-to-Four Unit Properties in Illinois (2025)

What Are The 2025 FHA Loan Limits for FHA Loan Limits for One-to-Four Unit Properties?

- The limits are $524,225 for a one-unit, $671,200 for a two-unit, $811,275 for a three-unit, and $1,008,300 for a four-unit.

- These limits apply to case numbers assigned from 1/1/2025 to 12/31/2025.

Do Counties in the Chicago Area, Like Cook and DuPage, Have Different Limits?

No. In 2025, every Illinois county, including those in the Chicago metro area, will use the FHA floor limits listed above.

Are These Limits The Same As The Maximum Purchase Price?

Not exactly. They are the maximum base loan amount for FHA financing. Your purchase price can be greater if your down payment covers the extra amount.

Can I Add The Up-Front MIP To The Loan Amount?

Yes. The Up-Front MIP can be added to the loan and does not count toward the loan limit.

Are Limits Different For Multi-Unit Properties?

Yes, the limits increase with the number of units. See the 2-, 3-, and 4-unit limits above.

Do FHA Loans for 3-4 Units in Illinois Require a Self-Sufficiency Test?

Yes. The net rental income (after accounting for vacancy) must be equal to or greater than the combined PITIA payment.

Why Are Illinois Limits Set at The Floor?

HUD’s methodology for 2025 keeps Illinois counties under high-cost thresholds, so the national floor applies statewide.

How Do FHA Limits Compare to Conventional Limits?

The FHA’s floor is set at 65% of the FHFA conforming limit, translating to $523,613 for a one-unit property in 2025.

Where Can I Verify The Official Limits?

The limits are found in HUD’s Mortgagee Letter 2024-21 and the HUD loan-limit dataset.

Will The Limits Shift Again in 2026?

Yes, HUD evaluates limits each year. Always check the HUD website in November or December for the upcoming year’s numbers.

Qualifying For 2-to-4 Unit FHA Mortgage Loans

Chicago has the most concentration of two to four unit properties. Buying a two to four unit property as an owner occupant property is allowed with 3.5% down payment.

Here is the FHA loan qualification requirements for 2 to 4 unit property mortgage loans

- 3.5% down payment

- 580 credit scores

- All FHA Guidelines applies

- 6% sellers concessions allowed by sellers for buyer’s closing costs

- Reserves may be required

- 75% of rental income can be used as qualifying income

- Conventional Loans require 5% down payment on owner occupant 2-to-4 unit mortgage loans.

If you have any questions on FHA loan limits for one-to-four unit properties, please contact us at Gustan Cho Associates. Buyers of 2-to-4 unit properties can contact Gustan Cho Associates at 800-900-8569 or text us for a faster response to get qualified for 2-to-4 unit mortgage loans. Borrowers can also email their mortgage inquiry at gcho@gustancho.com.

Maximize Your FHA Loan Potential in Illinois

Understand the limits for one-to-four unit properties and secure the right loan.