This blog post will explore the Fannie Mae-Freddie Mac charge-off guidelines applicable to conventional loans. Gustan Cho Associates has recently received numerous inquiries regarding conventional mortgages and charged-off accounts. These queries have come from prospective borrowers and loan officers, emphasizing the importance of educating our readers on this topic.

The Fannie Mae-Freddie Mac Charge-Off Guidelines outline distinct criteria for handling collection and charged-off accounts on conventional loans for primary residences, secondary homes, and investment properties. For primary owner-occupant conventional loans on primary homes, outstanding collections and charged-off accounts are not mandatory for payment.

Traditional loans are alternatively referred to as conforming loans. These loans must meet the guidelines set by Fannie Mae and Freddie Mac so that these organizations can buy them on the secondary market. Finding the exact guidelines can be challenging. In the following sections, we will discuss the charge-off guidelines from Fannie Mae and Freddie Mac for conventional loans.

Common Questions On Conventional Loans

The specific questions raised pertain to the Fannie Mae-Freddie Mac Charge-Off Guidelines. Is it obligatory to resolve charge-offs before the closing? Should a 5% payment of the charged-off amount be factored into your monthly debt-to-income ratio computations? To tackle these inquiries, it is essential to recognize that the guidelines differ between charged-off accounts linked to mortgages and those not related to mortgages. As non-mortgage charged-off accounts are more prevalent, let’s begin our conversation by addressing them.

Ready to purchase your dream home with a Conventional Loan?

Contact us today to see if a Conventional Loan is right for you!Single-Family Home Mortgage Guidelines

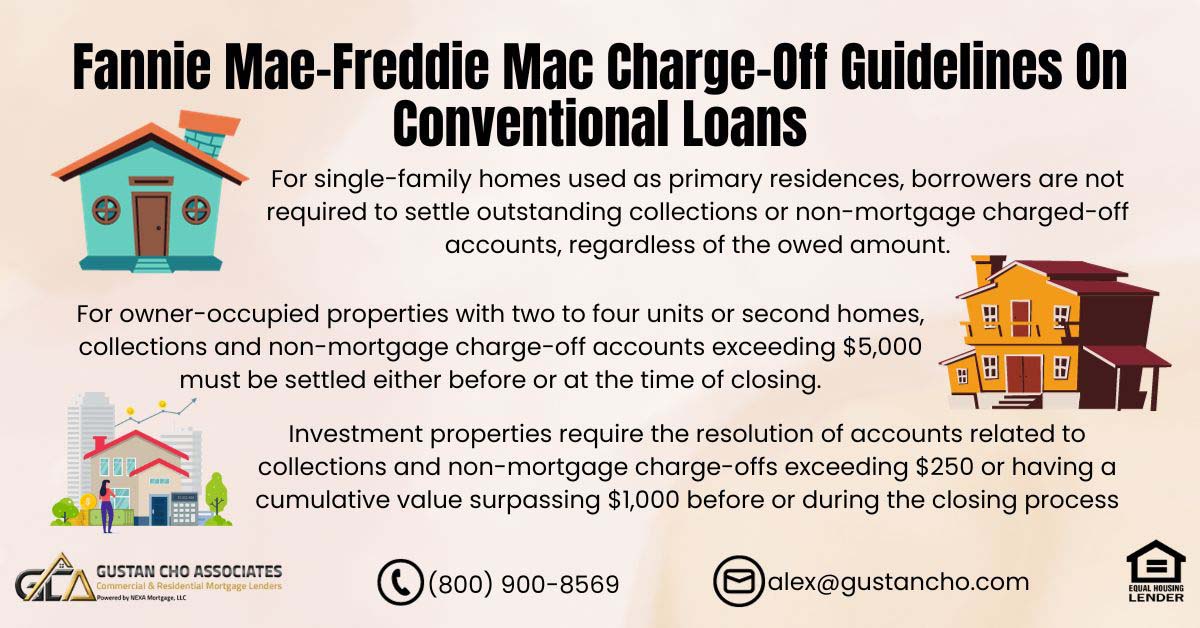

The Fannie Mae and Freddie Mac Charge-Off Guidelines outline particular regulations for managing outstanding collections and accounts with non-mortgage charge-offs, which depend on the property type.

Borrowers with primary residences that have one unit do not have to pay off outstanding collections or non-mortgage charge-off accounts. This means that no matter how much is owed, they are not required to settle these accounts.

However, for owner-occupied properties with two to four units or for second homes, if collections or non-mortgage charge-off accounts are over $5,000, borrowers must pay them off completely either before or at closing. This requirement is part of the Fannie Mae and Freddie Mac Charge-Off Guidelines to ensure a complete financial review for these properties.

For investment properties, the rules are stricter. Collections and non-mortgage charge-off accounts of $250 or more, or if the total amount exceeds $1,000, must be fully settled. This requirement is outlined by the Charge-Off Guidelines from Fannie Mae and Freddie Mac. It highlights the need to address financial issues linked to collections and charge-offs for investment properties. These accounts must be resolved before or during closing to help evaluate risks.

Fannie Mae-Freddie Mac Charge-Off Guidelines to Qualify for Conventional Loans

We will look at the details of mortgage accounts marked as charged off. This includes different types of mortgages, such as first and second liens, home equity lines of credit, home improvement loans, and loans for manufactured housing.

To evaluate these mortgage accounts, the Automated Underwriting System (AUS) plays a key role in identifying charged-off accounts. An account is labeled as charged off when the AUS shows a Mortgage Origination Program (MOP) code of “9.” This code indicates that the system recognizes the account as charged off.

It is important to understand that these guidelines focus solely on the charged-off status. The AUS findings do not indicate other actions like foreclosure, deed-in-lieu of foreclosure, or pre-foreclosure sale. Codes “8,” “DIL,” or “PFS” do not appear with the charge-off designation, which helps keep the assessment clear. This separation highlights the need to follow the Fannie Mae-Freddie Mac Charge-Off Guidelines when managing mortgage accounts.

AUS Findings on Housing Events

When using the Automated Underwriting System (AUS) and you find a charge-off on a mortgage account, the lender must document that this event happened four years or more before the new loan’s disbursement date. If the lender can prove that the loan meets the extenuating circumstance guidelines, a charge-off that occurred two or more years before the new loan disbursement may be acceptable. However, relying on extenuating circumstances can be difficult, as approvals are rare and strict.

It’s important to remember that getting approvals based on extenuating circumstances is challenging and not often successful. Lenders should be careful when considering this option. Fannie Mae and Freddie Mac require careful documentation for these cases. This helps ensure compliance and lowers the risks of charge-offs identified by the Automated Underwriting System (AUS).

Extenuating Circumstances

It has been a long time since we have been able to get an extenuating circumstance approved. For charged-off mortgage accounts, we need to show where the event took place. Generally, it should have happened more than a few years ago. If you have questions, please contact us; these guidelines can be confusing.

Fannie Mae-Freddie Mac Charge-Off Guidelines On 5% Hypothetical Payment

Looking at the second question: Do you need to include 5% of the charge-off amount in your monthly debt-to-income ratio? In short, no. You may not need to pay off the collection, depending on the type of home and how you plan to use it. Most conventional loans are for primary residences, so you don’t have to pay the charged-off amount before closing in these situations. Next, let’s review the Fannie Mae and Freddie Mac Charge-Off Guidelines to understand the rules in detail.

For more information please see: http://www.fanniemae.com/content/guide/selling/b3/5.3/09.html

Lender Overlays Versus Fannie Mae-Freddie Mac Charge-Off Guidelines

Many lenders have extra rules about charged-off accounts that go beyond Fannie Mae’s standard guidelines. These lenders often require borrowers to settle these accounts before closing, which isn’t necessary, according to Fannie Mae. At Gustan Cho Associates, we pride ourselves on being direct lenders with no extra requirements. We focus on following the agency rules without lender overlays.

Unlike some lenders, we work to make the mortgage process easier by removing unnecessary obstacles. We know that charged-off accounts on your credit report can be worrying, but our approach follows Fannie Mae guidelines.

If you have questions about traditional home loans or what happens when a lender writes off your debt, please contact our expert, Alex Carlucci. You can text him at 800-900-8569 or email us at alex@gustancho.com.

Whether you speak with Alex or any of our experienced loan officers, we’re here to help you understand the mortgage process. The Gustan Cho Associates team is available all week, including nights, weekends, and holidays.

Your understanding of the Fannie Mae and Freddie Mac Charge-Off Guidelines is very important to us.

FAQ: Fannie Mae-Freddie Mac Charge-Off Guidelines On Conventional Loans

What are the Fannie Mae-Freddie Mac Charge-Off Guidelines, and why are they important for conventional loans?

The Fannie Mae-Freddie Mac Charge-Off Guidelines outline criteria for handling collection and charged-off accounts on conventional loans. Conventional loans must adhere to these guidelines to be eligible for purchase by Fannie Mae and Freddie Mac on the secondary market.

Is it mandatory to resolve charge-offs before closing on a conventional loan?

For primary residences with a single unit, borrowers are not obligated to clear outstanding collections or non-mortgage charged-off accounts. However, for owner-occupied properties with two to four units or second homes, collections and non-mortgage charge-off accounts exceeding $5,000 must be settled before or at closing. Investment properties have stricter requirements, with accounts over $250 or exceeding $1,000 cumulatively needing resolution.

Should 5% of the charged-off amount be factored into monthly debt-to-income ratio computations?

No, incorporating 5% of the charge-off amount into the debt-to-income ratio is not mandatory, especially for primary residences. The obligation to settle charged-off amounts before closing depends on property characteristics and occupancy.

How are charged-off mortgage accounts assessed under the guidelines?

he Automated Underwriting System (AUS) identifies charged-off mortgage tradelines. Events must have occurred four or more years before the new loan disbursement, or extenuating circumstances can be considered if the event happened two or more years prior. However, approval for extenuating circumstances is rare and challenging.

How do lender overlays affect Fannie Mae-Freddie Mac Charge-Off Guidelines?

Some lenders impose additional requirements, such as settling accounts before closing, which do not align with Fannie Mae guidelines. Gustan Cho Associates operates without lender overlays, strictly following agency requirements.

Where can I find more information about these guidelines?

You can refer to the official Fannie Mae guidelines at this link for detailed information.

This blog about Fannie Mae-Freddie Mac Charge-Off Guidelines On Conventional Loans was updated on January 29th, 2024.

It’s remarkable to go to see this web site and reading the views of

all friends regarding this article, while I am also keen of getting knowledge.