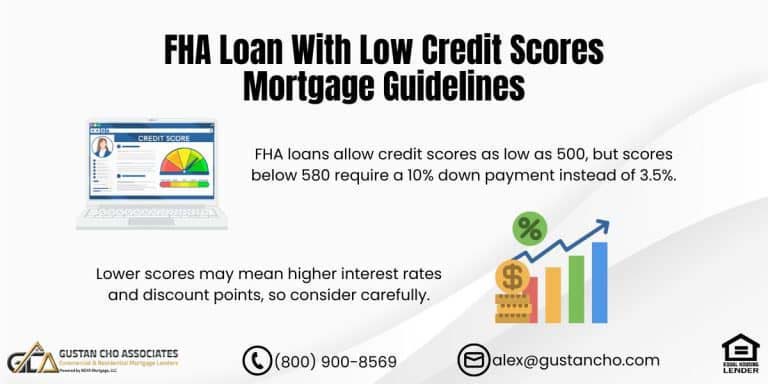

This guide covers the frequently asked question can I get denied for FHA loan with good credit on home purchase. You can qualify for an FHA loan with credit scores down to 500 but you will not get an FHA loan approval with a 700 credit score if you have late payments in the past 12 months.

HUD, the parent of FHA, is more generous with bad credit than any other loan program. You cannot get a 3.5% down payment home purchase FHA loan with good credit but recent late payments.

You can possible get an FHA loan with recent late payment with a larger down payment but not with a 3.5% down payment. The chances of getting approved for an FHA loan with lower credit scores is better if you have been timely in the past 12 months than getting approved for an FHA loan with higher credit scores but with recent late payments. In the following sections, we will cover getting denied for FHA loan with good credit and how to get approved when denied.

Can You Get Denied For FHA Loan With Good Credit?

Most homebuyers think that you cannot get denied for FHA Loan with good credit. It is not just borrowers that think this way. But many loan officers pre-approve borrowers just by looking at the borrower’s credit scores. Loan officers review credit and income and figure there is no way that a borrower can get denied for FHA Loan with good credit. Over 80% of the borrowers Gustan Cho Associates represent are folks who either got denied or could not qualify with their lender. I have the utmost respect for these borrowers. This is because they do not take no for an answer. They either contact others or surf the internet and somehow get referred to Gustan Cho Associates. Click Here for get review about the denied FHA loan

Reason For Getting Denied For FHA Loan With Good Credit

The number one reason for stress during the mortgage process or last-minute mortgage loan denial is because the loan officer did not properly qualify borrowers. Unfortunately, loan officers are human. They can make mistakes. But their mistakes such as not taking time to properly qualify borrowers will not just affect the borrower, but the borrower’s family, the sellers, both the buyer’s and seller’s realtors, and everyone involved in the mortgage process.

Reasons For Denied For FHA Loan With Good Credit

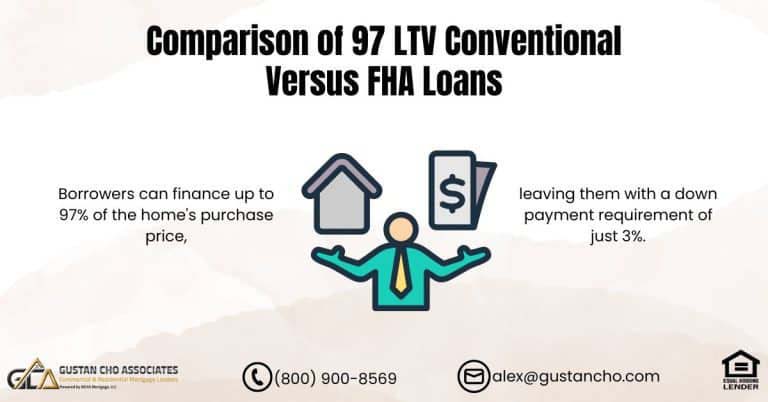

Two main factors in qualifying for an FHA are meeting the minimum credit score requirements and having a qualified income. To qualify for a 3.5% down payment home purchase FHA loans, the borrower needs at least a 580 credit score. Borrowers also need to meet the minimum debt to income ratios. Mortgage borrowers rely on their loan officers to get pre-qualified and pre-approved.

There should be no reason why a pre-approved borrower cannot close on their home loan. Not just close on their mortgage loans but not close it on time.

Unfortunately, that is not always the case. Stress during the mortgage process and mortgage denials do happen. There is no reason why anyone should go through stress during the mortgage process. There is no reason why a pre-approved borrower should not close on their loan.

Denied For FHA Loan With Good Credit on a Home Purchase Because of Late Payment History

There are times where borrowers get denied for FHA Loan With Good Credit and here are the reasons why: There are many borrowers who are told by a loan officer they do not qualify for an FHA Loan because they had either one or more 30 days late payment on their debts on their credit report. For example, here is a case scenario:

- I just had a borrower call me this morning because she had a mortgage loan denial from a lender she went to due to late payment in May 2018

- The loan officer told her that she cannot qualify for an FHA Loan until next May 2019

- This was because of a 30-day late payment in the past 30 days

- The loan officer from the other lender qualified this borrower by reviewing her credit, her income, and submitted the file for processing and underwriting

- Once the borrower received her mortgage disclosures

- Borrower signed the docs required and emailed it back

The mortgage loan package was registered and submitted to a mortgage processor.

FHA Case Number

The mortgage processor then ordered the FHA Case Number and ordered the home appraisal: The borrower paid the $475 appraisal fee to the AMC, the appraisal management company, and thought everything was fine. The mortgage processor scrubbed the file. Made sure that the file was complete as possible so once the mortgage underwriter issued a conditional loan approval, there would be very little conditions. The file was then submitted to underwriting and assigned to a mortgage loan underwriter for a conditional loan approval. The mortgage underwriter then issued a last-minute mortgage loan.

Late payments in the past 12 months is the worst thing you can have when trying to qualify and get approved for a mortgage loan. Outstanding collections and charge-offs do not have to be paid but lenders expect timely payments.

Denial was due to her having a 30-day late payment on her credit report from a Capital One Visa payment. She missed her $25.00 a month minimum payment. Again, the loan officer relayed the message to this borrower that the reason she was denied was that lender has overlays that require on-time payments for the past 12 months. However, this loan officer is wrong and told this borrower the wrong information: HUD does not have a requirement that all monthly payments need to be paid timely for the past 12 months. I have qualified countless borrowers who had not just one 30 day late payment in the past 12 months, but multiple late payments in the past 12 months. Talk to us about you loan related issue, we will help you

Agency Guidelines Versus Lender Overlays

Denied For FHA Loan With Good Credit: Borrowers can have great credit and high credit scores but if they had late payments in the past 12 months, that can be cause for mortgage denial. You can have great credit and high credit scores but if you have credit disputes, the mortgage process can come to a halt. The mortgage process will be held in suspense until the credit disputes are retracted. Retracting credit disputes will lower consumer credit scores.

Credit Repair During The Mortgage Process

Those who went through a credit repair program and got derogatory credit items removed will most likely have good credit. However, any public records removed from consumer credit reports will get discovered. You cannot have any credit disputes, unless exempted disputes, during the mortgage process. Medical collections, non-medical collections that are two years old or older, non-medical disputes with zero balance are exempt from credit disputes during the mortgage process.This is because all lenders will do a third-party public record search through Data Verify and/or Lexis Nexus.

Denied From One Lender Due To 30 Days Late In Past 12 Months

Borrowers with good credit with late payments in the past 12 months cannot just assume they qualify for an FHA loan: Most lenders will not approve a borrower for any type of home loan if they had a 30-day late payment in the past 12 months.

Lenders understand that borrowers can have had periods of late payments due to extenuating circumstances such as periods of unemployment and medical issues.

But lenders want to see they no longer have financial issues: Good timely recent payment history is the best predictor of them being able to be timely with their mortgage payments going forward. However, one or two late payments is not a deal killer. There are lenders like myself that will approve borrowers with one or two late payments in the past 12 months.

Late Payments After Bankruptcy and Foreclosure

Lenders do not want borrowers to have any late payments after bankruptcy, short sale, deed in lieu of foreclosure, or foreclosure. One late payment after a bankruptcy and foreclosure can be an automatic mortgage denial from most lenders. Borrowers can have good credit and high credit scores with late payments after bankruptcy, deed-in-lieu of foreclosure, short sale, and foreclosure.

You cannot assume that just because you have good credit and high credit scores that you will qualify for an FHA loan if you have late payments after bankruptcy and foreclosure.

The good news is that some lenders like Gustan Cho Associates will consider late payments after bankruptcy, deed-in-lieu of foreclosure, short sale, and foreclosure. But there has to be a good reason for the late payments after bankruptcy or foreclosure. If you had late payments after bankruptcy or foreclosure and are having a tough time qualifying for a mortgage, contact us at Gustan Cho Associates at gcho@gustancho.com. Or call us at 800-900-8569. Text us for a faster response. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.