This blog will cover investing in real estate in The Virgin Islands.

In recent years, the United States Virgin Islands have seen an unprecedented boom in tourism. Money started trickling into the island through investments and tourism. This means that even the hospitality industry has directly benefited from this boom and, therefore, has created opportunities for all. Investors around the globe are getting attracted to invest in the U.S. Virgin Islands.

John Strange is a senior loan officer who has helped countless homebuyers and real estate investors qualify and get approved for financing in the U.S. Virgin Islands, shared the following:

Even cruise ships worldwide have been docking on the island’s beaches, which tells you how serious the boom is. With increased tourism, the property market has also massively improved, as many tourists settle on the island.

In this article, we want to look at why buying a property in the Virgin Islands could be the best decision. More and more investors are not just buy primary and second homes but are putting skin in the game and cashing in on commercial real estate in the U.S. Virgin Islands. We will be discussing how you should go about it.

But first, let’s look at some facts about these islands. In the following paragraphs, we will discuss buying a house in the Virgin Islands.

Can You Own Property in the Virgin Islands?

Yes, individuals can own property in the U.S. Virgin Islands. The United States Virgin Islands are a part of the United States, but they are not an incorporated territory, which means that they must follow all federal laws and regulations. As such, property ownership rights are generally similar to those in the mainland United States. It is recommended to seek advice from local authorities or legal experts to obtain accurate information on property ownership in the U.S. Virgin Islands, as regulations and procedures may differ.

Thinking About Investing in Real Estate in the Virgin Islands?

Run the numbers on cash flow, appreciation, and rental demand before you buy

Buying a House in The Virgin Islands With non-Traditional Home Loans

It is a no-brainer that a homebuyer with 800 credit scores, perfect credit, on-time payment history, no collections, and charged-off accounts, no prior bankruptcy or foreclosure, and a low debt-to-income ratio can get a mortgage when buying a house in the U.S. Virgin Islands. However, how about homebuyers who had a little dent in their credit?

Self-Employed Borrowers Buying a House in The Virgin Islands

How about the self-employed borrower who has an established business but utilizes the unreimbursed business expenses of the IRS tax code? How about the retiree who has worked hard all their lives and is living off their assets? In the following paragraphs, we will especially focus on buying a house in the U.S. Virgin Islands with bad credit. We will also cover buying a house in the U.S. Virgin Islands with credit scores down to 500 FICO.

Some Facts About The Virgin Islands

The U.S. Virgin Islands are a group of islands organized and recognized as part of the U.S. territory. Geographically, these islands are part of the Virgin Islands archipelago and are found on the Leeward Islands of the Lesser Antilles, west of the British Virgin Islands and east of Puerto Rico.

The Islands in The Virgin Islands

In terms of composition, the U.S Virgin Islands has three main islands: Saint John, Saint Croix, and Saint Thomas, plus 50 other minor islands and cays, representing a total land area of about 134 square miles. The capital, Charlotte Amalie, is on Saint Thomas Island. This territory was sold to the U.S. by Denmark in 1917 for $25,000,000 and has been a U.S. territory since then.

What Is The Biggest Industry in The Virgin Islands

The biggest industry in the islands is tourism, with an estimated 3 million people visiting annually. The tourism industry contributes about 60% of the GDP. Other sectors of the economy include; small-scale manufacturing, rum production, and also agriculture. Here are more facts about the territory of the U.S Virgin Islands:

The Population of The U.S. Virgin Islands

The current population on these islands is about 105,100 people. Most of the population (76%) is African-American, while 15.6% is white. Others take up the remaining percentage.

Population Growth in The Virgin Islands

The population growth is currently at negative 0.5% per year.

Median Income in The U.S. Virgin Islands

The median house income is $40,600 on Saint John Island, $38,200 on Saint Thomas Island, and $36,000 on Saint Croix Island.

How Much is Property Tax in the Virgin Islands?

For property taxes, for any property worth up to $350,000, the tax rate is about 2%, and 5% for property exceeding that price tag. There are no local income taxes on the islands.

Education in The Virgin Islands

There are three high schools, two alternative schools, one middle school, and 13 elementary schools across the U.S. Virgin Islands. Generally, all these schools on the islands are above average.

Weather in The Virgin Islands

The islands have a tropical climate, with temperatures throughout the year ranging between 25 and 30 degrees Celsius. However, hurricanes are more likely to hit the islands during August and September.

What Are The Median Home Prices in The Virgin Islands

The median home listing price on Saint Thomas Island is $560k, while the price per square foot is $440. In St Croix, property ranges from $300k to $700k

Renters vs. Owners In The Virgin Islands

Due to the tax breaks, buying a home on the islands is logically beneficial compared to renting, which is why most property investors prefer to buy.

Why Invest In The Virgin Islands?

Capital tax breaks are one of the top reasons investors are flocking to the island’s property market. The U.S. Treasury announced and approved capital tax break zones to reduce taxes in specific island areas. Also, the island’s government announced a property tax amnesty to reduce the tax burden among property investors. If you invest in any of these areas, you will pay considerably low property taxes, unlike any other state in the United States.

Infrastructural projects – the kind of infrastructural projects undertaken on the islands should also tell you about the region’s future. As you know, infrastructure developments do always have a direct impact on property prices in that area. Projects are going on in St. Croix, St. Thomas, and St. John that have, in turn, increased job opportunities, thereby, economic growth of the entire region.

These projects range from pacing roads to reconstructing seriously damaged properties, businesses, and other crucial facilities like hospitals, schools, and electrical infrastructure.

High rental occupancy – as you can see from the points above, many people are coming to U.S. Virgin Islands every year to the point where they have even outpaced hotel capacity. This means that demand for rentals is rising, making this the perfect opportunity for investors looking to invest in investment properties.

Tips For Buying Property in The Virgin Islands?

The truth is that buying property on the islands is the same as buying on the U.S. mainland. From the buying process to how the title is handled, including all the guarantees and protections in the Constitution. However, here are the top tips to remember when buying property, especially rental property.

How Do You Plan on Managing Your Rental Properties?

How you will manage the property – when you buy an investment property in the U.S. Virgin Islands, you have to think about how to manage it. The good news is that several property management firms and other experienced managers could help you actualize your dream of owning a rental property in this paradise.

Marketing Rental Property For Qualified Tenants

Marketing the property – compared to a couple of decades ago, marketing rental property in the U.S. was quite hard and didn’t use to reach a wider audience. However, with websites such as Airbnb, VBRO, and HomeAway, marketing has become quite easy. All you need to do is create an account on these websites and begin marketing.

Since everyone is there, you can also choose to market the property on social media. And if you are looking to rent on the islands, you should head to these platforms to find a property that suits your needs.

Not Sure How to Finance Real Estate in the Virgin Islands?

DSCR, second home, and investment loans may all be on the table

Buying a Property in The U.S. Virgin Islands

How to fund the investment – you should know that mortgage is always available from local lenders. And as we have already said, most things on the islands are the same as that on the U.S mainland. This means that when it comes to mortgages, not only can you be able to get a mortgage.

You can also apply for all types of mortgages in the U.S., including FHA, VA, Jumbo loans, conventional mortgages, and many more.

Get the needed help – if you are a renter looking for an apartment on the island, you should get much-needed help from local property agents, who would help you find the best property in the ideal location on the islands – based on your needs.

Where is the Best Place to Live in the Virgin Islands?

Determining the “best” place to live in the Virgin Islands can be subjective and depends on individual preferences, such as lifestyle, budget, access to amenities, proximity to employment opportunities, and desired climate. Each island in the U.S. Virgin Islands (St. Thomas, St. Croix, and St. John) offers unique advantages.

Is St Thomas a Good Investment?

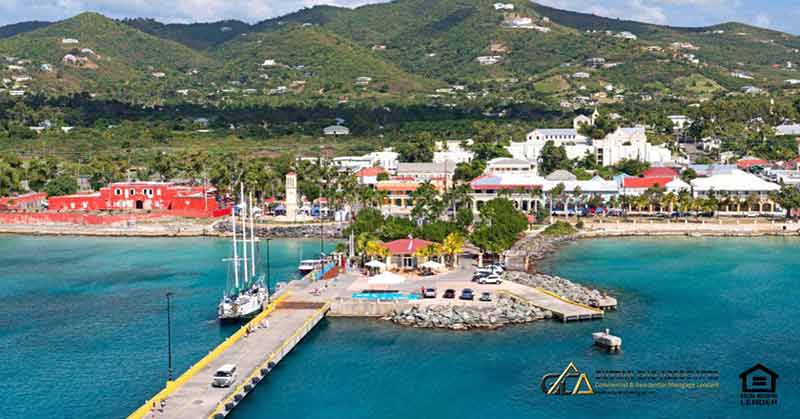

St. Thomas – ST Thomas is the most inhabited island in the U.S Virgin Islands and is the most commercialized, not forgetting that it has become a regular stopping-off point for Caribbean cruise ships. The island is approximately 30 square miles and does have the most beautiful turquoise water and jungle cliffs, which makes it quite beautiful.

This, together with a wide range of restaurants, entertainment, and other fun activities, makes the island overrun by tourists eager to get a piece of it. When it comes to the property market on the island, you will find properties of all kinds, from luxury mansions to condos and villas. Even smaller properties for smaller families are plentiful, ranging from 150,000 USD to 250,000 USD.

The Island of St. Croix

St. Croix is the largest island of the Virgin Islands by landmass and largely contains rainforests, sugar plantations, and old forts. The main towns on this island are relatively quiet and don’t have much going on. However, when it comes to property, it is a pretty nice place to live.

Many homes sit on large pieces of land, which means you not only get the home but also land you can cultivate. You will also find many schools, medical centers, and shopping centers. So, this is the place to be if you are looking for a quiet life on the U.S. Virgin Islands.

Buying Investment Properties in The Virgin Islands

Investing in real estate can be lucrative, especially in a unique and desirable location like the Virgin Islands. With its breathtaking natural beauty, vibrant culture, and thriving tourism industry, the Virgin Islands offer an attractive opportunity for individuals looking to invest in property.

Whether you’re considering buying a single-family home, a condo, or an investment property, this guide will provide valuable insights to help you navigate investing in real estate in the Virgin Islands. From understanding the local market to choosing the right location and property type, well cover essential considerations to ensure a successful investment journey in this stunning Caribbean paradise.

Worried About Risk When Investing in the Virgin Islands?

We’ll go over insurance, storms, vacancies, and backup strategies

What Makes The Virgin Islands Attractive For Real Estate Investors

The Virgin Islands, consisting of the U.S. Virgin Islands and the British Virgin Islands, possess several unique aspects and benefits that make them an attractive investment location. Some of these include strong tourism industry: The Virgin Islands have a robust tourism sector, attracting millions of visitors each year.

This steady influx of tourists provides a consistent demand for rental properties, making it an ideal market for investment properties.

Tax incentives For Real Estate Investors in The Virgin Islands

The Virgin Islands offer attractive tax incentives for real estate investors, including tax breaks on capital gains, property taxes, and even residency programs for investors. These incentives can significantly enhance the financial advantages of investing in the region.

Stable real estate market

The real estate market in the Virgin Islands has shown resilience and stability over the years. While there may be fluctuations, the long-term trend indicates a positive outlook, making it a favorable environment for investors seeking reliable returns.

Diverse property options

The Virgin Islands offer a range of property types, from luxurious beachfront estates to charming villas and modern condos. This diversity allows investors to tailor their investment strategy to meet their specific goals and preferences.

Cultural and recreational opportunities

Beyond the financial benefits, investing in real estate in the Virgin Islands allows individuals to immerse themselves in the rich

local culture and take advantage of the myriad recreational activities available, such as boating, snorkeling, hiking, and exploring historical landmarks.

The allure of owning property in this tropical paradise goes beyond just the potential financial returns. It allows investors to enjoy the lifestyle benefits of living in a world-renowned destination while capitalizing on the lucrative real estate market.

Understanding the Virgin Islands Real Estate Market

To understand the Virgin Islands real estate market comprehensively, it is crucial to examine the local market trends and conditions. The Virgin Islands, consisting of the United States Virgin Islands (USVI) and the British Virgin Islands (BVI) are renowned for their stunning natural beauty, pristine beaches, and favorable tax environment.

These factors, combined with a vibrant tourism industry, contribute to the unique characteristics of the real estate market in the region.

Buying and Investing in The Virgin Island Property

Despite occasional fluctuations, the Virgin Islands real estate market has experienced steady growth and resilience in recent years. The Virgin Island real estate market has attracted diverse buyers, including residents, international investors, retirees, and second-home buyers.

The property market in the Virgin Islands encompasses a mix of residential properties, vacation homes, luxury villas, commercial properties, and land for development. The Virgin Islands’ real estate market has experienced appreciable property value appreciation over the past decade due to limited land supply and high demand. The rental demand in the Virgin Islands remains robust, driven by tourism and a mix of local and expatriate residents.

U.S. Virgin Islands Real Estate Appreciation Potential

The Virgin Islands real estate market has witnessed appreciable property value appreciation over the past decade. The limited supply of land for development, combined with the region's desirability, has contributed to a consistent upward trajectory in property prices.

However, it is important to note that appreciation rates can vary between islands and within different neighborhoods. Popular areas with high demand, such as beachfront or hillside properties, tend to experience higher appreciation rates.

Rental Market Forecast and Demand in The Virgin Islands

Rental demand in the Virgin Islands remains robust due to the regions appeal as a tourist destination. Both short-term vacation rentals and long-term rentals cater to the needs of visitors, expatriates, and seasonal workers. Vacation rentals, especially in popular areas like St. Thomas, St. John, and Tortola, offer investors an opportunity for attractive rental income during peak tourism seasons.

Long-term rentals also have a stable market, driven by the demand from residents, professionals and individuals relocating to the islands.

Choosing the Right Location within the Virgin Islands

The Virgin Islands comprise various islands with unique characteristics and investment potential. In the following sections, we will make a comparison of some key islands.

St. Thomas

St. Thomas, part of the USVI, is the most developed and populated island, offering a range of amenities and infrastructure. It is known for its bustling cruise ship port, vibrant shopping areas, and diverse dining options. The real estate market on St. Thomas provides opportunities for both commercial and residential investments, with high rental demand driven by tourism and a large local population.

St. John

St. John, also part of the USVI, is a smaller and more tranquil island known for its pristine natural beauty, including the Virgin Islands National Park. The real estate market in St. John primarily caters to luxury home buyers and vacation rental investors seeking privacy and a serene environment.

Tortola

Tortola is the largest and most populated island in the BVI, offering a mix of residential and commercial real estate opportunities. The island serves as a major financial and business hub for the BVI, attracting both residents and businesses. The real estate market in Tortola provides options for commercial investments, rental properties, and land development.

Virgin Gorda

Virgin Gorda, another island in the BVI, is renowned for its stunning beaches and unique geological formations, such as The Baths. The real estate market in Virgin Gorda primarily focuses on luxury properties, catering to high-end buyers seeking exclusivity and natural beauty.

Choosing the right location is crucial when considering real estate investments in the Virgin Islands. Each island in the Virgin Islands offers unique characteristics, investment opportunities, and lifestyle options. Here are some factors to consider when selecting a location.

Accessibility

Consider the ease of access to the island. St. Thomas has major airports with direct flights, making it more accessible for international travelers. St. Croix and St. John can be reached by ferry or private boat from St. Thomas. Assessing transportation infrastructure, including airports, ferry services, and road networks, is essential for convenience and connectivity.

Amenities and Services

Evaluate the areas availability of essential amenities and services. Look for proximity to grocery stores, medical facilities, schools, and recreational facilities. St. Thomas, being the most developed island, offers a wide range of amenities and services. St. Croix has a mix of urban and rural areas with good amenities.

St. John, with its more limited development, may have fewer amenities but offers a serene and nature-focused lifestyle.

Lifestyle and Atmosphere

Consider the lifestyle and atmosphere that align with your preferences. St. Thomas provides a vibrant and cosmopolitan lifestyle with a bustling urban environment. St. Croix offers a more relaxed and laid-back atmosphere, embracing its cultural heritage. St. John offers a peaceful and secluded lifestyle for those seeking privacy and a connection with nature.

Investment Potential

Evaluate the investment potential of the location. Research each island's historical property appreciation rates, rental demand, and market trends. Factors such as tourism activity, population growth, and planned developments can indicate the potential for future returns on investment.

St. Thomas offers attractive investment potential with its strong tourism industry and diverse real estate market. With its affordable lifestyle and potential for agro-tourism, St. Croix presents unique investment opportunities. St. Johns exclusivity and luxury property market make it an attractive choice for high-end buyers and vacation rental investors.

Natural Beauty and Surroundings

Consider the natural beauty and surroundings of the location. The Virgin Islands are known for their pristine beaches, lush landscapes, and crystal-clear waters. Assess the proximity to scenic spots, national parks, and outdoor recreational activities that align with your interests.

Local Regulations and Laws

Familiarize yourself with local regulations and laws that govern real estate ownership and investment in the Virgin Islands. Understand the process of acquiring property, tax implications, and applicable restrictions or requirements. It is advisable to conduct thorough market research, visit the islands, and consult with local real estate professionals, and seek expert advice to make an informed decision when choosing the right location within the Virgin Islands for your real estate investment.

Property Types for Investment in the Virgin Islands

When considering real estate investments in the Virgin Islands, exploring the various available property types is important. Each property type has its unique characteristics, advantages, and considerations. Here is an analysis of the investment options in the Virgin Islands.

Single-Family Homes

Single-family homes offer the advantage of privacy and the potential for long-term rental income or owner occupancy. Depending on the location and amenities, they range from modest residences to luxury villas. Single-family homes are particularly attractive to families or individuals seeking a permanent residence or a second home in the Virgin Islands.

Pros and Benefits Buying Single-Family Homes

Privacy and control over the property. Potential for long-term rental income or personal use. Appreciation potential based on location and property condition.

Cons and Negatives of Investing in Single-Family Homes

Higher maintenance and upkeep responsibilities compared to condos. Limited scalability for rental income compared to vacation rentals. Higher upfront costs for purchase and ongoing expenses.

Investing in Condominiums in The U.S. Virgin Islands

Condos investments is one of the most popular real estate investments for primary homebuyers, buyers of second homes and real estate investors for rental income. Condos are a popular investment option, especially in areas with high tourism activity. They provide an affordable entry point into the market.

Condominium units often come with amenities such as swimming pools, gyms, and security. Condos are favored by vacation rental investors due to their convenience, low maintenance requirements, and potential for consistent rental income.

Pros and Benefits of Investing in Condominiums in The U.S. Virgin Islands

- More affordable entry point for investment.

- Access to shared amenities and facilities.

- Potential for steady rental income, especially in high-demand tourist areas.

- Lower maintenance and management responsibilities compared to single-family homes.

Cons and Negatives of Investing in Condos in The U.S. Virgin Islands

- Monthly condo fees and association rules.

- Limited control over building decisions and property modifications.

- Possibility of higher competition in the condo rental market.

Make Your Virgin Islands Dream Home an Investment, Too

Blend lifestyle and wealth-building with smart financing

Investing in Property For Vacation Rentals

Investing in vacation rentals, such as beachfront villas or luxury vacation homes, is a lucrative opportunity in the Virgin Islands. The regions popularity as a tourist destination ensures a steady stream of visitors seeking accommodations. Vacation rentals can generate higher rental income during peak tourism seasons, but they require careful management and marketing efforts to attract guests.

Pros and Benefits of Vacation Rental Properties in The U.S. Virgin Islands

Higher rental income potential, especially during peak tourist seasons. There is flexibility to use the property for personal vacations. Ability to cater to luxury and high-end travelers. Possibility of leveraging property management services for hassle-free operation.

Cons and Negatives of Investing in Vacation Rental Properties in The Virgin Islands

Seasonal fluctuations in rental demand. Requires careful marketing, management, and guest satisfaction efforts. Potential for higher wear and tear due to short-term rental turnover. Regulatory requirements and licensing for vacation rentals.

Legal and Regulatory Considerations for Real Estate Investments in the Virgin Islands

No matter how small or big of a real estate or business investor you are, you should take the time to educate yourself and understand the local laws, rules, and regulations for real estate investments in the Virgin Islands.

When investing in real estate in the Virgin Islands, it is crucial to have a solid understanding of the local laws and regulations that govern property ownership and investment. Key considerations include:

General Knowledge and Understanding of Property Ownership in The Virgin Islands

Familiarize yourself with the laws regarding property ownership, including the process for acquiring and transferring ownership rights. The Virgin Islands follows a fee-simple ownership system, similar to the United States, where individuals have full ownership and rights to their property.

Alien Landholding License

Non-U.S. citizens and non-residents of the Virgin Islands must obtain an Alien Landholding License to purchase a property. This process involves an application and approval by the government, which assesses factors such as the economic benefit to the territory and compliance with other legal requirements.

Understand and Have General Knowledge of Condominium Laws in The Virgin Islands

If investing in a condominium property, understand the laws and regulations specific to condominium ownership, including the formation of homeowners associations, payment of monthly fees, and adherence to association rules and bylaws.

Overview of Property Taxes, Zoning Restrictions, and Permits Required

Property Taxes: Familiarize yourself with the property tax structure in the Virgin Islands. Property taxes are levied based on the assessed value of the property. The rates and assessment methods may vary between the different islands. Consult local tax authorities or professionals for detailed information on property tax rates and calculations.

Zoning and Planning Rules and Regulations in the Virgin Island

Understand the zoning regulations that govern the use and development of land on the specific island where you plan to invest. Zoning restrictions dictate the allowable uses for different areas, such as residential, commercial, or agricultural. Ensure compliance with the applicable zoning requirements when considering property development or modifications.

Building Permits and Development Approvals

Determine the permits and approvals required for property development or renovations. The Virgin Islands has its building codes and regulations; obtaining the necessary permits is essential. Engage with local authorities and professionals to navigate the permit application process effectively.

Working with Local Professionals to Ensure Compliance with Legal Requirements

Engaging local professionals is highly recommended to navigate the legal and regulatory landscape in the Virgin Islands. We will cover the consultants and advisors who you should have retain for a consultation or keep on retainer to represent your best interests.

Real Estate Attorney

Retain the services of a reputable real estate attorney with experience in Virgin Islands property law. They can guide you through the legal aspects of property transactions, review contracts, assist with due diligence, and ensure compliance with local regulations.

Real Estate Agent

Work with a knowledgeable and experienced local realtor who can provide insights into the local market, property values, and investment opportunities. They can help identify suitable properties and negotiate transactions on your behalf.

Hiring a Property Manager or Property Management Company

Consider hiring a professional property management company if investing in rental properties. They can handle tenant screenings, rent collection, property maintenance, and ensure compliance with rental regulations.

Hiring a Tax and Financial Advisor

Consult a tax advisor familiar with both U.S. and The Virgin Islands tax laws to understand the tax implications of your real estate investments. They can assist with structuring ownership, advise on tax deductions, and ensure compliance with tax obligations. By working with local professionals, you can ensure compliance with legal requirements, understand the intricacies of property transactions, and navigate any challenges that may arise during the investment process in the Virgin Islands.

Financing Options for Real Estate Investment in the Virgin Islands

When it comes to financing options for real estate investment in the Virgin Islands, there are several avenues you can explore. Whether you’re interested in residential or commercial properties, various options are available to suit your investment needs. Below are several financing options you may want to consider.

Traditional Bank Loans

This is a common and straightforward financing option where you can approach local or international banks operating in the Virgin Islands for a mortgage loan. The loan terms, interest rates, and eligibility criteria may vary among banks, so shopping around and comparing offers is essential.

Local Credit Unions

Credit unions are member-owned financial institutions that provide loans and other financial services. In the Virgin Islands, several credit unions offer real estate loans. They often offer competitive interest rates and may have more lenient lending criteria than traditional banks.

Government-backed Loans

In the Virgin Islands, government programs or initiatives may provide financing options for real estate investments. These programs

could include loan guarantees or subsidized interest rates for certain types of properties or specific target groups. Research local government agencies or consult a real estate professional to explore these options.

Private Money Lenders

Private money lenders, or hard money lenders, are individuals or companies offering short-term loans secured by real estate. They typically have more relaxed eligibility criteria but charge higher interest rates. Private lenders can be an option for investors who need quick financing or have difficulty obtaining traditional bank loans.

Seller Financing Options

In some cases, the property seller may be willing to provide financing directly to the buyer. This arrangement, known as seller financing or owner financing, involves the seller acting as the lender and receiving regular payments from the buyer. The terms and conditions of the seller financing can be negotiated between the parties involved.

Real Estate Investment Groups

Joining a real estate investment group can provide access to pooled funds and financing options. These groups typically consist of multiple investors pooling resources to fund real estate projects. By becoming a member of such a group, you can leverage the collective buying power to finance your investments.

Crowdfunding Platforms

Real estate crowdfunding platforms allow multiple investors to contribute smaller amounts of money towards a specific real estate project. These platforms connect investors with developers or sponsors who require project funding. Crowdfunding can be an option for those looking for alternative financing options with potentially lower investment amounts.

Before pursuing any financing option, assessing your investment goals, evaluating the associated risks, and considering your financial situation is crucial. Working with a qualified real estate agent, attorney, or mortgage advisor can provide valuable guidance and help you make informed decisions.

Additionally, familiarize yourself with local laws, regulations, and taxation requirements for real estate investments in the Virgin Islands.

Already Have a Property Picked Out in the Virgin Islands?

Let us match it with the right loan program and structure

Top Reasons To Invest In Real Estate in The Virgin Islands

The Virgin Islands is one of the best places to buy U.S. property because the market is growing. You should do it now. Properties are plenty in the islands, especially St. Croix and St. Thomas, and quite affordable. This might no longer be the case in the future. If you need any assistance on anything, you can always hire a local property agent and a resourceful mortgage broker with a proven track record and a wide network of contacts.

Investing in real estate in the Virgin Islands presents attractive opportunities given its exceptional location, dynamic market trends, and prospects for property appreciation and rental demand. By diligently assessing local market conditions and evaluating investment potential across various islands, investors can make well-informed choices and attain success in their investment endeavors.

If you have any questions about Investing in Real Estate in The Virgin Islands or you need to qualify for FHA loans with a lender with no overlays on government or conforming loans, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com . The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQ: Investing in Real Estate in The Virgin Islands

- 1. Can foreigners own property in the Virgin Islands? Yes, individuals, including foreigners, can own property in the U.S. Virgin Islands. The islands are a part of the United States, and property ownership rights are generally similar to those in the mainland United States. However, consulting with local authorities or legal experts for precise information on property ownership regulations and procedures is advisable.

- 2. What are the key factors driving real estate investment in the Virgin Islands? Real estate investment in the Virgin Islands is an attractive option due to various factors. These include a booming tourism industry, investor tax incentives, a stable real estate market, diverse property options, and abundant cultural and recreational opportunities.

- 3. What tax incentives are available for real estate investors in the Virgin Islands? The Virgin Islands offer various tax incentives for real estate investors, including tax breaks on capital gains, property taxes, and residency programs for investors. These incentives can significantly enhance the financial benefits of investing in the region.

- 4. How do I finance a real estate investment in the Virgin Islands? The financing choices for real estate investments in the Virgin Islands are comparable to those in the continental United States. Local lenders offer mortgages for various property types, including FHA, VA, jumbo loans, and conventional mortgages. It’s recommended to consult with a local loan officer or financial advisor to explore financing options tailored to your needs.

- 5. What are some tips for buying property in the Virgin Islands, especially for rental investments? When buying property in the Virgin Islands for rental investments, consider property management, marketing strategies, and funding options. Engage with local property management firms for efficient property management, leverage online platforms for marketing rental properties, and explore financing options from local lenders.

- 6. Where is the best place to live in the Virgin Islands? The best place to live in the Virgin Islands depends on individual preferences, such as lifestyle, budget, amenities, and climate. Popular options include St. Thomas, known for its commercialization and vibrant atmosphere, and St. Croix, offering a quieter lifestyle with ample natural beauty and amenities.

- 7. Is St. Thomas a good investment for real estate? St. Thomas presents various investment opportunities in real estate, including luxury properties, condos, and villas. With its commercialization, vibrant tourism industry, and stunning natural landscapes, St. Thomas attracts tourists and real estate investors seeking lucrative opportunities.

- 8. What is the real estate appreciation potential in the U.S. Virgin Islands? Over the last decade, the real estate market in the U.S. Virgin Islands has seen significant growth in property values due to high demand and limited land availability. Popular areas with high demand, such as beachfront or hillside properties, tend to experience higher appreciation rates.

- 9. What is the rental market forecast and demand in the Virgin Islands? Rental demand in the Virgin Islands remains robust, driven by tourism and a mix of local and expatriate residents. Both short-term vacation rentals and long-term rentals cater to the needs of visitors, expatriates, and seasonal workers, offering investors opportunities for attractive rental income during peak tourism seasons.

- 10. What are the key islands in the Virgin Islands, and what are their characteristics for investment?St. Thomas: The most developed and populated island, offering a range of amenities and infrastructure suitable for commercial and residential investments.St. John: A smaller and tranquil island known for its pristine natural beauty, catering primarily to luxury home buyers and vacation rental investors.Tortola: The largest and most populated island in the BVI, serving as a major financial and business hub, offering a mix of residential and commercial real estate opportunities.Virgin Gorda: Renowned for stunning beaches and unique geological formations, focusing primarily on luxury properties for high-end buyers.

- 11. What are the important factors to consider when choosing a location in the Virgin Islands for real estate investment? Accessibility, Amenities and Services, Lifestyle and Atmosphere, Investment Potential, Natural Beauty and Surroundings, and Local Regulations and Laws.

- 12. What investment properties are available in the Virgin Islands, and what are their pros and cons? Single-family Homes, Condominiums, and Vacation Rental Properties each have unique characteristics, advantages, and considerations regarding rental income potential, management responsibilities, and upfront costs.

- 13. What legal and regulatory considerations should investors be aware of when investing in real estate in the Virgin Islands? Property ownership laws, Alien Landholding License requirements, condominium laws, property taxes, zoning regulations, and building permits. I work with local professionals such as real estate attorneys, agents, and property managers.

- 14. What financing options for real estate investment in the Virgin Islands are available? Traditional Bank Loans, Local Credit Unions, Government-backed Loans, Private Money Lenders, Seller Financing, Real Estate Investment Groups, and Crowdfunding Platforms offer various avenues for financing, each with its eligibility criteria and terms.

- 15. What are the top reasons to invest in real estate in the Virgin Islands? The growing market, abundance of properties, affordability, and prospects for property appreciation and rental demand make investing in the Virgin Islands attractive, especially with the assistance of local professionals such as property agents and mortgage brokers.

This blog about Investing in Real Estate in The Virgin Islands was updated on March 25th, 2024.

Want a Vacation Home That Pays for Itself?

Explore Airbnb/VRBO and long-term rental options in the Virgin Islands