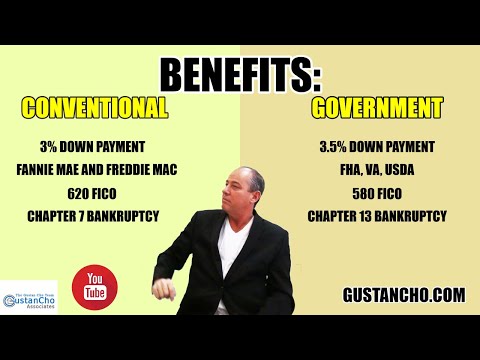

This guide will cover the difference between FHA versus conforming loans. We will discuss FHA versus conforming loans mortgage lending guidelines and the benefits of each home loan program. There are three different types of government loans: FHA loans, and VA loans. USDA loans. Conventional loans benefit over FHA loans on waiting period requirements on mortgage loans included in bankruptcy. If you have a mortgage included in the bankruptcy, the waiting period is four years from the discharge date of bankruptcy on conventional loans. The finalization date of the housing event does not matter.

With FHA loans, it is different. There is a three-year waiting period from the recorded date of the foreclosure, deed-in-lieu of foreclosure, or short sale. The recorded date is when the deed was transferred from the borrower’s name into the lender’s name or the date of the sheriff’s sale after the bankruptcy discharged date.

Government loans are for primary owner-occupant homes only. Second home and investment properties are not eligible for FHA, VA, or USDA loans. Fannie Mae and Freddie Mac allow financing on second homes and investment properties on conventional loans. In the following paragraphs, we will cover FHA versus conforming loans.

What Are Conventional Loans?

The two most popular loan programs in the United States are FHA and Conventional loans. Conventional loans are not government-backed loans. Conventional loans are often called conforming loans because they need to conform to Fannie Mae and Freddie Mac Guidelines. Eric Jeanette of Gustan Cho Associates explains the role of Fannie Mae and Freddie Mac as follows:

Lenders follow Fannie Mae and Freddie Mac Agency Guidelines on conventional loans because they need to sell the conventional loans on the secondary mortgage bond market once they fund the loan. Lenders use their warehouse line of credit to fund conventional loans. Once they fund the conventional loan, they need to sell the loan they fund to relieve the warehouse line of credit so they can fund more loans.

Selling them on the secondary mortgage bond market provides liquidity to fund more loans. Fannie Mae and Freddie Mac are the two mortgage giants that are the biggest buyers of conforming loans. The role of Fannie Mae and Freddie Mac is to provide liquidity in the mortgage markets to keep housing affordable to hard-working Americans.

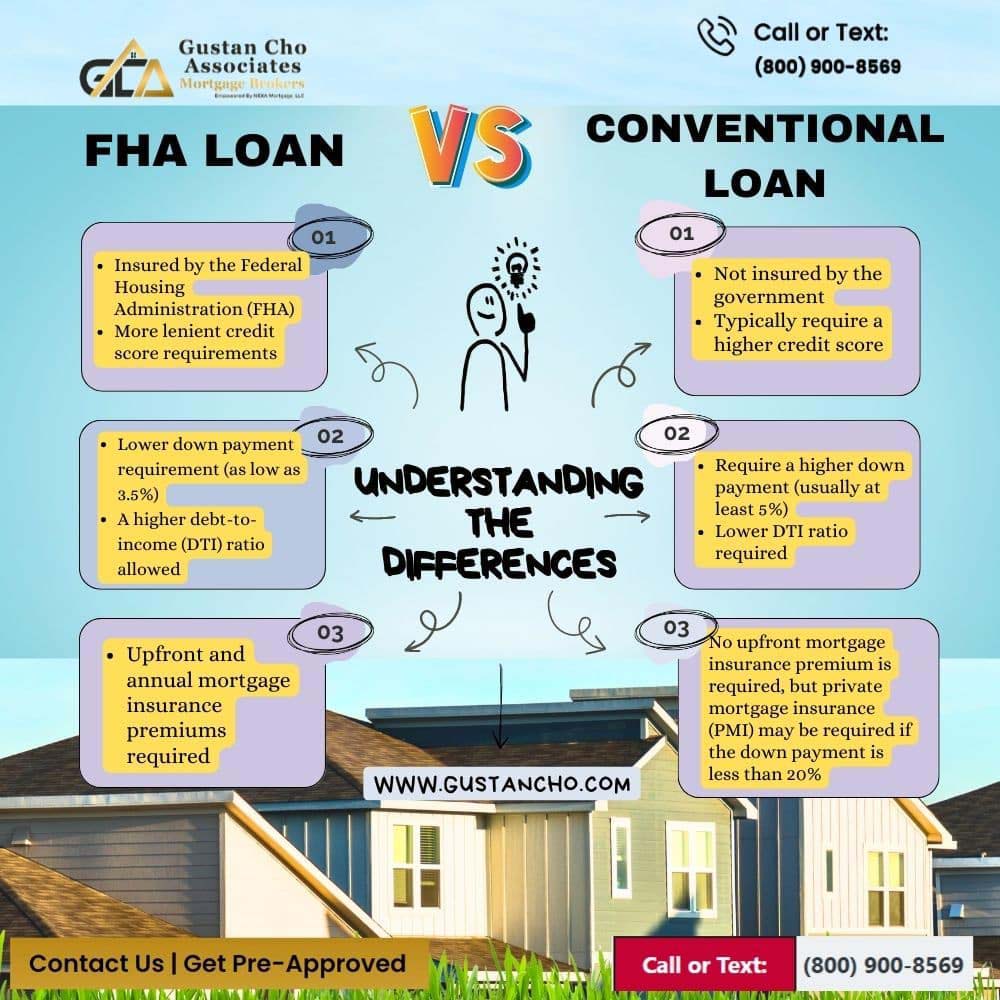

Understanding The Major Differences Between FHA Versus Conventional Loans

FHA and Conventional loans are the nation’s two most popular loan programs. A loan officer will review the differences between the two home mortgage programs and recommend which mortgage benefits you most. Many people think FHA loans are loans for home buyers with bad credit, low credit scores, or other credit issues. This may be true, but it is not always the case.

There are cases where home buyers with excellent credit and income choose FHA versus Conforming Loans, which we will cover in later paragraphs of this blog.. Some home buyers who qualify for conventional loans choose FHA loans instead. This is because FHA offers better terms on the particular property purchase or refinance mortgage program.

For example, FHA loans only require a 3.5% down payment on 2 to 4 owner-occupant multi-family homes, whereas Fannie Mae and Freddie Mac require a 15% down payment on conventional loans. You can go up to a 46.9% front end and 56.9% back end debt to income ratio on FHA loans to get an approve/eligible per automated underwriting system (AUS).

Cases Where Buyer Does Not Qualify For FHA But Qualify For Conventional Loans

There are new Fannie Mae Mortgage Lending Guidelines that went into effect last August 2014 about the mortgage part of bankruptcy. For borrowers with prior mortgages included in the bankruptcy, new Fannie Mae and Freddie Mac Guidelines are in effect that may benefit borrowers who had prior mortgages included in bankruptcy. As long as the person did not reaffirm the mortgage, the new guidelines state if the person had a prior included in the bankruptcy, there is a four-year waiting period from the discharge date of the bankruptcy.

The date of the foreclosure, deed-in-lieu of foreclosure, deed-in-lieu of foreclosure, or short sale does not matter. This holds true even though the foreclosure, deed-in-lieu of foreclosure, or short sale was not finalized and transferred out of the homeowner’s name years after the bankruptcy discharge date. The deed can be transferred out of the homeowner’s name into the lender’s name or other owner’s name after the discharge date of the Chapter 7 Bankruptcy at a later date. Regardless, the waiting period for foreclosure starts from the bankruptcy’s discharge date.

Homeowner, the borrower cannot reaffirm the mortgage after the bankruptcy. There is a four-year waiting period to qualify for a conventional loan if borrowers had a prior mortgage included in their bankruptcy to qualify for conventional loans.

Benefits Of Multi-Unit Properties Between Government And Conforming Loans

Home buyers purchasing a two to four-unit building or multi-unit property (up to 4 units are considered residential properties), a great benefit with FHA Versus Conforming Loans. HUD, the parent of FHA, requires homebuyers to put a 3.5% down payment on 2 to 4-unit owner-occupant multi-family properties.

Conventional loans do not have a maximum front-end debt-to-income ratio, but the maximum debt-to-income ratio is 50% DTI to get an approve/eligible per AUS. Depending on the borrower’s situation, FHA versus Conforming loans may or may not have their benefits. Some buyers do not have any other choice but to go with an FHA loan. Others can only go with a conventional and do not qualify for FHA loans.

Conforming Guidelines require a 15% down payment on 2 to 4-unit owner-occupant multi-family home purchases. The homebuyer must live in one unit as a primary owner-occupant resident. After one year, the owner of the multi-family unit can qualify for another owner-occupant primary home if they need to upgrade to a single-family home.

Student Loan Guidelines

HUD requires that 0.50% of the outstanding student loan balance be counted as the borrower’s hypothetical monthly debt. Deferred student loans are no longer exempt from FHA Mortgages. Income Based Repayments or IBR are allowed under HUD Student Loan Guidelines as long as the minimum monthly payment exceeds one dollar.

Deferred student loans over 12 months are no longer exempt from debt-to-income ratio calculations. However, Fannie Mae and Freddie Mac allow Income Based Repayments (IBR) as long as the student loan payments are reported on all three credit bureaus. This holds true even though the income-based repayment is at zero monthly payments.

The zero monthly IBR payment is used for debt-to-income ratio calculations on conventional loans. Borrowers with high student loan payments can use conventional or FHA loans.

Disadvantages Of FHA Versus Conforming Loans

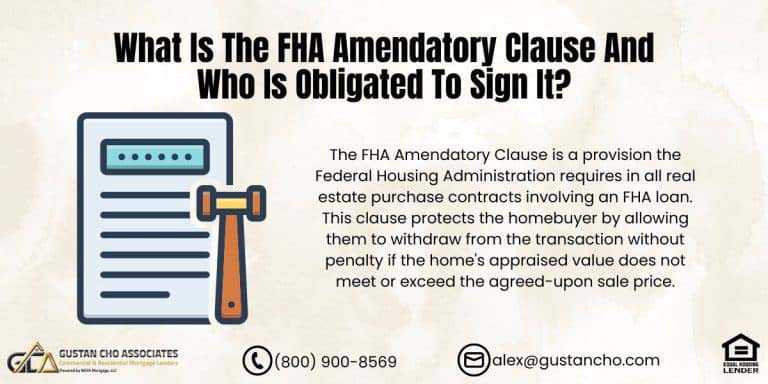

One of the major disadvantages of FHA versus conforming loans is that with FHA loans, there is an upfront FHA mortgage insurance premium. Also, there is a lifetime annual mortgage insurance premium for the life of all 30-year fixed-rate FHA loans. This holds true no matter what the homeowner’s loan-to-value is.

The VA had similar concerns about the alarming skyrocketing home prices like HUD and decided to lower the cash-out refinance loan-to-value cap. However, on the purchase side, the loan-to-value remains 100% loan-to-value. Lenders can still offer 100% financing on VA loans.

With conventional loans, there is no upfront private mortgage insurance. But private mortgage insurance exists if the homeowner has less than 20% equity. Also, private mortgage insurance is not mandatory for all 30-year fixed-rate conventional loans. Once the borrower has a loan to value that is at 80% or lower, the private mortgage insurance can be canceled on conventional loans. Private mortgage insurance is much cheaper than FHA mortgage insurance premiums for borrowers with higher credit scores. Private mortgage insurance can be canceled once the homeowner has at least 20% equity in their home.

Cash-Out Refinance Mortgage On FHA Loan Versus Conventional Loan

HUD, the parent of FHA, recently lowered the maximum loan to value on cash-out refinance FHA loans from 85% to 80% LTV. The main reason HUD made this change was due to skyrocketing home prices throughout the nation.

Home prices have been going up yearly for the past ten years. However, the median home prices have been increasing at a higher-than-normal pace over the past five years. Both government and private mortgage industry experts are concerned with the higher home prices and want to avoid a potential housing and credit meltdown like the 2008 financial crisis. It is not just HUD that lowered the loan to value cap on cash-out refinances.

The U.S. Veterans Administration has lowered its loan-to-value on cash-out refinances from 100% LTV to 90% loan-to-value on VA loans. Fannie Mae and Freddie Mac did not change their loan to value cap on cash-out refinances. The loan-to-value on cash-out refinances remains at 80% LTV. To qualify for a home mortgage with a national mortgage company licensed in multiple states with no lender overlays, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.