The Federal Housing Administration (FHA), a segment of the United States Department of Housing and Urban Development, was established in 1934. Its primary mission is to foster homeownership among Americans, particularly those with moderate incomes, less-than-perfect credit, and minimal down payments. The FHA plays a vital role not as a lender but as a government-sponsored entity that provides insurance for home loans offered by private lenders.

This insurance protects lenders if a borrower defaults and the subsequent foreclosure, helping mitigate the financial loss lenders incur. Lenders who wish to be eligible for this insurance must obtain approval from the Department of Housing and Urban Development (HUD). These HUD-approved lenders must adhere strictly to the underwriting guidelines outlined in the HUD 4000.1 FHA Handbook, also known as the FHA TOTAL Scorecard.

A key requirement imposed by the FHA on lenders is that all necessary parties involved in the real estate transaction complete and sign the FHA amendatory clause. This clause is essential for the buyer’s protection, ensuring they are not legally bound to purchase a home if its appraised value exceeds the sale price.

This article explains the FHA amendatory clause and its obligations on parties involved in FHA-backed real estate transactions.

When Is The Amendatory Clause Required During The Home Purchase Process

Amendatory Clause, attached to the real estate purchase contract to minimize risks for FHA buyers needs to be signed by the following people:

- Buyers

- Sellers

- Buyers Real Estate Agent

- Sellers Real Estate Agent

The FHA Amendatory Clause was created to help protect the home buyers interests in a real estate transaction.

FHA Amendatory Clause: Know Before You Sign

Buying a home with an FHA loan? The amendatory clause protects you as a buyer. Apply Now And Get recommendations From Loan Experts

Roles and Responsibilities in the FHA Amendatory Clause

The FHA amendatory clause is a critical element in home buying processes involving FHA loans, delineating specific roles and responsibilities for the parties involved. Here’s a detailed explanation of who needs to sign the clause and the responsibilities assigned to each participant:

Buyers

- Signing Requirement: The buyer must sign the FHA amendatory clause. This confirms that they understand the terms and are only obligated to complete the purchase if the appraisal supports the agreed-upon price.

- Responsibility: Buyers are responsible for ensuring that they are fully informed about the implications of the clause. They must understand that they can withdraw from the purchase without losing their earnest money if the appraisal is lower than the price.

Sellers

- Signing Requirement: Sellers are also required to sign the amendatory clause. Their signature confirms acknowledgment that the sale is contingent upon the appraisal matching or exceeding the sale price.

- Responsibility: Sellers need to recognize that the transaction could be renegotiated or even nullified if the appraisal comes in lower than expected. They should also be prepared for the possibility of returning the buyer’s earnest money if the buyer chooses to withdraw based on the clause.

Real Estate Agents

- Signing Requirement: While real estate agents are not required to sign the FHA amendatory clause themselves, they play a crucial role.

- Responsibility: Real estate agents representing buyers and sellers should ensure that their clients understand the implications of the amendatory clause. They should facilitate the signing process before proceeding with the appraisal and ensure all parties are informed about the potential outcomes based on the appraisal results.

Lenders

- Signing Requirement: Lenders do not sign the amendatory clause but are integral to the process.

- Responsibility: Lenders are responsible for ordering the property appraisal and ensuring it is conducted fairly and impartially. They must also ensure that the clause is included in the contract documentation and is signed by the required parties before loan processing proceeds.

Escrow Officers

- Signing Requirement: Escrow officers do not sign the clause but are involved in the transaction process.

- Responsibility: They are responsible for holding and, if necessary, returning the earnest money deposit based on the outcomes dictated by the FHA amendatory clause. They also ensure that funds are disbursed according to the contract terms and the appraisal results.

The amendatory clause of the FHA establishes a safeguarding framework for real estate transactions that include FHA financing, benefiting both buyers and sellers. Its purpose is to establish the responsibilities and obligations of each party, ensuring that the sale of the property goes forward only if the financial aspects are solid, thus protecting the interests of everyone involved. This clause is a testament to the structured approach of FHA loans designed to minimize risks and promote fair dealings in the housing market.

Role And Function Of FHA

HUD, the parent of FHA, promotes lenders to originate and fund FHA Home Loans to home buyers, first time home buyers, and buyers with less than perfect credit. The function and role of FHA are to insure residential mortgage loans that have been originated and funded by FHA approved lenders. FHA will reimburse these FHA approved lenders against borrowers who fail to repay their mortgage loan and go into default.

Due to this guarantee and government insurance by HUD, lenders can offer home loans with very little down payment at very low-interest rates.

- FHA charges mortgage insurance premiums on every loan they insure

- There is an upfront one-time mortgage insurance premium

- There is also an ongoing lifetime annual FHA mortgage insurance premium on 30 year fixed rate mortgages

- The FHA mortgage insurance premium goes into a special FHA fund

- This fund is used to pay out default by borrowers who default on their loan

- FHA loans are extremely popular

Over a third of home loans originated in the United States are FHA Home Loans.

Importance Of FHA Amendatory Clause

The Federal Housing Administration mandates that all real estate purchase contracts include a specific provision known as the FHA Amendatory Clause. This clause minimizes risks and protects home buyers during property transactions. Its primary function is to amend any terms in the purchase contract that would otherwise result in the home buyer forfeiting their earnest money deposit.

Additionally, it addresses conditions where the buyer might be penalized or required to provide additional funds to close the deal if the property’s appraisal does not match the originally agreed-upon sales price. This ensures buyers are safeguarded against unexpected financial burdens if the property valuation exceeds expectations.

Implications of Not Signing the FHA Amendatory Clause

Improperly signing the FHA amendatory clause has serious legal and financial repercussions for real estate deals.

Buyer Consequences

- Financial Risk: If the purchaser fails to sign the FHA amendatory clause and the property’s appraised value is less than the negotiated purchase price, they might be legally obligated to buy the property at a higher price.

- Loss of Earnest Money: In cases where the buyer wishes to withdraw from the transaction due to the appraisal shortfall but still needs to sign the amendatory clause, they may forfeit their earnest money deposit. This could result in a significant financial loss.

Seller Consequences

- Legal Exposure: If the seller fails to sign the FHA amendatory clause and the transaction proceeds without it, they may face legal challenges from the buyer if the appraisal is lower than the sales price. The buyer could seek damages or pursue legal action to rescind the contract.

- Market Perception: Sellers may face reputational damage if perceived as unwilling to adhere to standard real estate procedures. This could impact their ability to attract future buyers and negotiate favorable terms.

Loan Processing Issues

- Loan Approval Delays: Lenders typically require the FHA amendatory clause to be signed before processing the loan application. Provide this documentation promptly to ensure loan approval and subsequent closing, causing inconvenience to both parties.

- Loan Denial: In extreme cases, lenders may deny financing altogether if the documentation, including the FHA amendatory clause, is not provided. This would force the buyer to seek alternative financing or abandon the purchase altogether.

Escrow Challenges

- Disputed Funds: If the transaction proceeds without the FHA amendatory clause and disputes arise regarding the earnest money deposit, escrow officers may face challenges in determining the appropriate course of action. Resolving such disputes can prolong the closing process and may require legal intervention.

The FHA amendatory clause is a formality and a crucial component of real estate transactions involving FHA loans. Failure to properly sign this document can lead to legal, financial, and procedural challenges for buyers and sellers. All parties must understand the implications of non-compliance and ensure the necessary documentation is in place to protect their interests and facilitate a smooth transaction process.

Who Signs the FHA Amendatory Clause—and Why It Matters

Don’t close on your home without understanding this required form. Get a Quick Breakdown of What You Need to Sign

Interaction with Appraisals: The Role of the FHA Amendatory Clause

The FHA amendatory clause is essential in real estate deals with FHA loans. Its primary purpose is to ensure that the amount lent by the FHA does not exceed the property’s market value, which is determined through an appraisal. The appraisal also assesses the property’s condition to meet FHA safety and soundness standards.

The FHA amendatory clause allows buyers to withdraw from a contract without penalty if the appraisal is lower than the purchase price. This protects buyers from overpaying and aligns the loan amount with the property’s market value. Sellers may need to renegotiate the sale price based on the appraisal, which can cause delays in closing.

Lenders must include the FHA amendatory clause in the sales contract to protect the buyer and maintain the integrity of the FHA’s lending practices. This ensures compliance with FHA lending limits and safeguards the buyer’s financial interests.

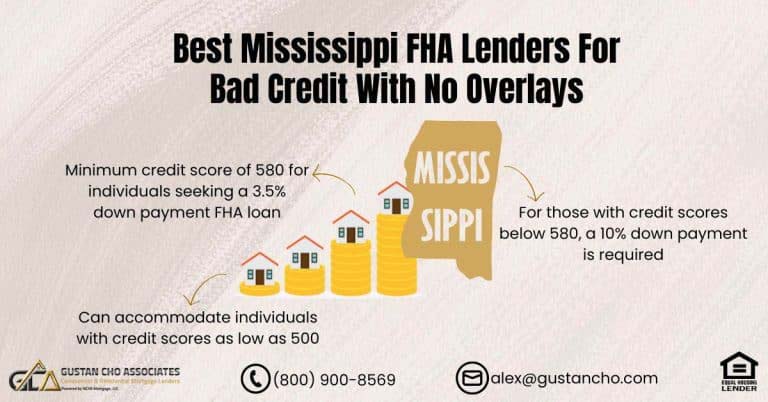

FHA Loan Requirements

The FHA Amendatory Clause is important when using an FHA loan to purchase a property. It ensures that the loan amount does not exceed 96.5% of the property’s sales price and requires its appraised value to match the sales price. This protects the lender and borrower and ensures sufficient collateral in case of default.

In cases where the property’s appraised value is lower than the sales price, the contract must be adjusted to reflect this lower value. Subsequently, lenders will provide financing for 96.5% of this new, amended price. The FHA Amendatory Clause also provides a safety net for home buyers, allowing them to withdraw from the transaction without penalty if the purchase contract price exceeds the home’s appraised value.

Both buyers and sellers have the option to renegotiate the sales price in light of the appraisal findings. This clause must be signed by all parties involved in the transaction, including buyers, sellers, and their respective real estate agents. However, signing a new FHA Amendatory Clause or any other amendatory clause is unnecessary if a new sales price is negotiated following a low appraisal.

The requirement for the FHA Amendatory Clause is waived for properties owned by specific entities, such as the United States Department of Housing and Urban Development (HUD), mortgage lenders, in-home sales managed by Fannie Mae, Freddie Mac, or VA, or those that are not primary residences.

Exceptions and Special Cases to the FHA Amendatory Clause

While the FHA amendatory clause is a standard requirement in most real estate transactions involving FHA loans, there are exceptions and special cases where the clause may not apply. Understanding these exceptions can help buyers, sellers, and professionals navigate the specifics of their real estate transactions more effectively.

Government Entities as Sellers

The FHA amendatory clause is often waived when a government entity sells property, such as HUD (Housing and Urban Development) foreclosures. This is because these entities typically sell properties “as-is” and have processes and conditions that supersede typical FHA requirements.

Foreclosures

Like government entity sales, homes purchased as foreclosures, particularly those owned by banks or acquired through sheriff sales, might not require the FHA amendatory clause. This is because such properties are usually sold without any warranties regarding the condition, and the buyer often accepts the risks associated with purchasing under these circumstances.

Direct Sales by Builders

In some instances, properties purchased directly from builders where the buyer uses FHA financing may not require an FHA amendatory clause. Builders often have purchase agreements that provide similar protections or may have pre-negotiated terms that do not include the clause.

Sales Involving Non-Traditional Financing

Transactions not involving FHA loans typically do not require an FHA amendatory clause. This includes conventional loans, VA loans, or any other non-FHA financing methods where the specific protections of the FHA amendatory clause are not stipulated.

Refinancing Scenarios

In refinancing scenarios where the original purchase used an FHA loan but the current refinancing does not, the FHA amendatory clause would not apply. The clause is irrelevant since the transaction does not involve a new sale or purchase price but rather a renegotiation of existing terms.

Streamlined FHA Refinancing

The FHA amendatory clause is generally optional for FHA streamlined refinancing, which allows lower documentation and easier qualification processes. This refinancing option is intended for existing FHA loans. It focuses on reducing rates or changing loan terms, not property valuation.

The FHA amendatory clause provides critical buyer protections in typical FHA loan scenarios. Still, its requirements can vary based on the nature of the sale and the type of financing involved. Recognizing when the clause does or does not apply is essential for all parties to ensure compliance with FHA regulations and to protect their interests in different real estate transaction scenarios.

If you have any questions about the FHA Amendatory Close or you need to qualify for loans with a lender with no overlays on government or conforming loans, please contact us at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQ: What Is The FHA Amendatory Clause And Who Is Obligated To Sign It?

- 1. What is the FHA Amendatory Clause? The FHA Amendatory Clause is a provision the Federal Housing Administration requires in all real estate purchase contracts involving an FHA loan. This clause protects the homebuyer by allowing them to withdraw from the transaction without penalty if the home’s appraised value does not meet or exceed the agreed-upon sale price.

- 2. Why was the FHA Amendatory Clause created? It was created to minimize risks for buyers and to ensure that they do not forfeit their earnest money deposit or incur additional costs to close the deal if the appraisal value is less than the purchase price.

- 3. Who needs to sign the FHA Amendatory Clause? The contract must be signed by the buyer, seller, and the buyer’s and seller’s real estate agents involved in the transaction. This ensures that all parties are aware of and agree to the potential implications of the appraisal results.

- 4. What happens if the FHA Amendatory Clause is not signed? Not signing the clause can lead to significant legal and financial repercussions. Buyers may be compelled to purchase the property at a higher price than its appraised value, potentially losing their earnest money if they withdraw. Sellers might face legal challenges or reputational damage, and lenders could experience delays in loan processing or even deny the loan.

- 5. How does the FHA Amendatory Clause interact with property appraisals? The clause is closely tied to the appraisal process. Suppose an appraisal reveals the property’s market value is less than the sale price. In that case, the clause allows the buyer to exit the transaction without financial penalty. This prevents the buyer from overpaying for a property and aligns the loan amount with the appraised value.

- 6. Are there any exceptions to the FHA Amendatory Clause requirement? Yes, exceptions include properties being sold by government entities like HUD, direct sales by builders, foreclosure sales, and transactions not involving FHA loans. Also, the clause is generally not required in FHA streamline refinancing situations.

- 7. What role do lenders play regarding the FHA Amendatory Clause? While lenders do not sign the clause, they are responsible for ensuring that it is included in the contract documentation and signed by the required parties before loan processing can proceed. They must also order a fair and impartial property appraisal.

- 8. What is the importance of the FHA Amendatory Clause in FHA-backed real estate transactions? The clause establishes a safeguarding framework that benefits both buyers and sellers by ensuring the property sale will proceed only if the financial aspects are verified to be solid through an appraisal, thus protecting the interests of all involved.

By understanding these aspects of the FHA Amendatory Clause, participants in FHA-backed real estate transactions can better navigate the complexities of home buying and selling, ensuring their interests are protected.

This blog about What Is The FHA Amendatory Clause And Who Is Obligated To Sign It was updated on April 18th, 2024.

FHA Loan? Understand the Required Amendatory Clause

Buyer, seller, and agent must sign—but we’ll walk you through it. Talk to an FHA Specialist Now

Seems it protects the buyer at the determent of the seller.