Quick Take: 2025 Mortgage Reserve Requirements

- FHA: 0–1 month (manual = 1, multi-unit = 3–6)

- VA: 0 months (manual = 1–2, multi-unit = up to 6)

- Conventional: 0 months for single-family, 2–6 months for second homes, 6+ for investments

- Jumbo: 6–12 months, depending on loan size/credit

- Non-QM: 3–12 months depending on program

If you’re planning to buy a home or refinance, you might hear your lender talk about “reserves.” These are not the same as your down payment or closing costs.

Reserve requirements on a home loan are extra funds you must have left over after the deal closes — a safety cushion that proves you can keep paying your mortgage even if something unexpected happens.

At Gustan Cho Associates, we work with borrowers nationwide, including those denied elsewhere, to get them approved — even when reserves are required. In this guide, you’ll learn:

- What reserves are and why lenders require them.

- How much reserves you may need for different loan types.

- When automated underwriting systems (AUS) ask for reserves.

- Creative ways to meet reserve requirements.

- Why reserves are smart even if your lender doesn’t require them.

What Are Reserve Requirements on a Home Loan?

Reserves are liquid funds you keep after closing — measured in months of your total housing payment (PITI: principal, interest, taxes, and insurance). If you have a homeowners association (HOA), dues are included in this monthly figure.

Example: If your total housing payment is $2,000 a month and your lender requires 3 months of reserves, you must have $6,000 in your bank, retirement, or investment accounts after paying your down payment and closing costs.

Reserves show the lender that you can still make your mortgage payment if your income changes or an emergency occurs.

Know the Reserve Rules Before You Apply

Mortgage lenders often require reserves — see how much you’ll need.

Closing Cost On Home Purchase And Refinance Transactions

All mortgage transactions, whether they are purchase and/or refinances, have closing costs. Most homebuyers do not have to come up with any closing costs. Closing costs are covered with sellers concessions and/or lender credit. Mortgage Reserves are normally not required by lenders on single-family home purchases.

- However, there are cases where the Automated Underwriting System will condition mortgage reserves

This normally happens with borrowers with the following:

- Lower credit scores

- Prior derogatory credit items

- Outstanding collections

- Charge offs

- No credit tradelines

When Are Reserve Requirements on a Home Loan Needed?

For many borrowers with strong credit, stable income, and a single-family home purchase, reserves may not be required at all. But certain situations trigger an AUS or manual underwriting requirement:

- Low credit scores (under 620 for conventional loans, under 600 for FHA).

- Recent late payments, especially after bankruptcy or foreclosure.

- High debt-to-income ratio (DTI).

- Multiple-unit properties (2–4 units).

- Gift funds for the entire down payment.

- Non-QM, jumbo, or condotel loans.

Mortgage Reserve Requirements by Loan Type (2025)

| Loan Type | 1-Unit Primary | 2–4 Units | Second Home | Investment Property | Non-QM / Jumbo / Condotel |

|---|---|---|---|---|---|

| FHA | 0–1 month (manual) | 3–6 months | N/A | N/A | N/A |

| VA | 0 months | Up to 6 months (if rental income used) | N/A | N/A | N/A |

| Conventional | 0 months | 3–6 months | 2–6 months | 6+ months | 12 months for high-balance |

| Non-QM | Varies | Varies | Varies | Varies | 3–12 months |

| Jumbo | Varies | Varies | Varies | Varies | 6–12 months |

FHA Loan Reserve Requirements in 2025

FHA loans typically do not require reserves for single-family homes if the borrower is approved through Automated Underwriting Systems (AUS). However, in cases of manual underwriting—used when AUS issues a “refer”—borrowers are required to have one month’s reserves. For 2-4 unit properties, the reserve requirement varies by lender and risk profile, generally ranging from three to six months. It’s important to note that reserves cannot be gifted; they must consist of the borrower’s own verified funds.

Do VA Loans Require Reserves? Rules for 2025

VA loans typically require no reserves for single-family homes approved through AUS. But there are exceptions:

- Manual underwriting: 1–2 months reserves.

- Multi-unit properties: up to 6 months reserves if rental income from additional units is being counted.

Conventional Mortgage Reserve Requirements (Primary, Second Home, Investment)

Fannie Mae and Freddie Mac rules often waive reserves for well-qualified borrowers buying a primary single-family home. However:

- Second homes: usually require 2–6 months reserves.

- Investment properties: 6 months reserves for the subject property, plus extra reserves if you own other financed homes.

- 2–4 unit primary homes: 3–6 months reserves are common.

How Much Savings Do You Need for a Mortgage?

Learn how lenders calculate reserve requirements and what counts as assets.

Non-QM and Jumbo Loan Reserve Rules Explained

If you’re applying for a non-QM loan, jumbo loan, or condotel financing, expect higher reserve requirements:

- Non-QM loans: typically 3–12 months of reserves.

- Jumbo loans: often 6–12 months reserves depending on loan size and credit profile.

- Condotel loans: up to 12 months reserves, with a portion in cash and the rest in liquid assets.

How Automated Underwriting Systems Trigger Reserve Requirements

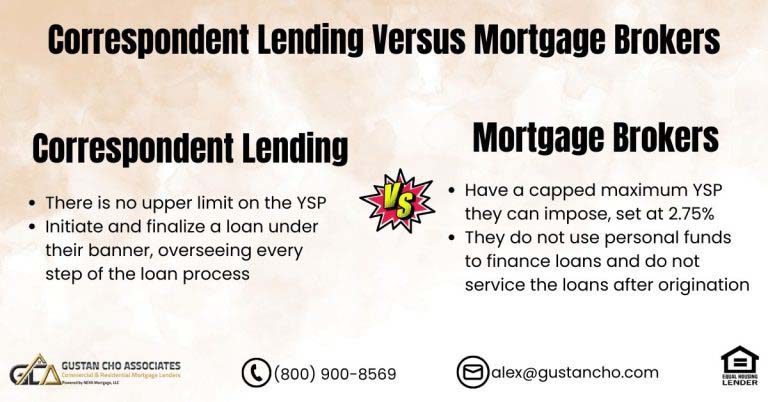

Your lender uses an AUS — Fannie Mae’s Desktop Underwriter (DU) or Freddie Mac’s Loan Product Advisor (LPA) — to determine if reserves are needed.

AUS may require reserves if:

- Your credit history is thin or has recent derogatory marks.

- Your down payment is 100% gift funds.

- You have no significant assets in your name.

- You’re buying a multi-unit property.

If Fannie Mae requires reserves but Freddie Mac does not, your loan officer might try running the file through the other AUS to get an approval without reserves.

Acceptable Sources for Reserves

Reserves are all about using your own cash! You can pull from checking or savings accounts, certificates of deposit (CDs), and retirement accounts like 401(k)s or IRAs, as long as you can show you have access to those funds. Plus, stocks, bonds, mutual funds, and money market accounts are all fair game. Just a heads up—gift funds can’t be used for reserves; they’re only good for your down payment and closing costs.

Creative Solutions to Meet Reserve Requirements on a Home Loan

If you don’t have enough reserves, here are options we’ve helped borrowers use:

Add Your Name to a Joint Bank Account with a Family Member (Must be a Real Joint Owner)

This allows you to leverage the combined funds to meet reserve requirements. This option provides transparency in ownership and can help demonstrate financial stability to lenders.

Move Funds from Retirement Accounts Into an Accessible Account — with Documentation.

Moving money from your retirement account to a more accessible one can help boost your savings, especially if you have the right paperwork. Just make sure you’re aware of any tax consequences, and that the funds are available when you’re ready to apply for that home loan.

Sell Assets (with a Paper Trail).

Selling personal assets such as vehicles, jewelry, or collectibles can significantly increase your reserves. Maintaining a clear paper trail of the transaction, including receipts and sale agreements, is crucial to provide proof of the funds’ sources to the lender.

Re-run AUS Through the Other System to Remove the Reserve Condition.

Utilizing an alternative Automated Underwriting System (AUS) may lead to different outcomes regarding reserve requirements. By re-evaluating your application through another system, you may eliminate certain conditions and improve your chances of loan approval.

Why You Should Have Reserves Even If Not Required

Even if your lender doesn’t ask you to keep some money set aside, it’s a smart move to do so. You never know when an emergency will happen, and repairs can be expensive. For example, fixing a busted furnace in the winter can cost you anywhere from $3,000 to $6,000, and sorting out a roof leak can run you between $2,000 and $8,000. Even car repairs can set you back, averaging around $1,500 to $5,000. Without some financial backup, a surprise expense could lead to missed payments, hurting your credit score and making refinancing trickier.

Real-Life Example

A first-time homebuyer in Illinois bought an older home with no reserves after closing. A few months later, the furnace broke during a cold snap, and pipes froze — repairs totaled over $3,000. With no savings and maxed-out credit cards, the buyer had to get a payday loan at a high interest rate.

Had they kept even 2 months of reserves, the repair would have been covered without debt.

Reserve Requirements on a Home Loan for Multi-Unit Properties

Buying a duplex, triplex, or fourplex? Expect stricter rules:

- FHA: 3–6 months reserves.

- Conventional: 6 months reserves for the subject property; additional reserves for other financed properties.

- VA: May require reserves if rental income from other units is used.

How to Calculate Your Reserve Requirement

- Add your monthly:

- Mortgage principal and interest.

- Property taxes.

- Homeowners insurance.

- HOA dues (if applicable).

- Multiply by the number of months required.

Example: $1,800 total PITI × 3 months = $5,400 reserves needed.

Loan Programs With Higher Reserve Requirements

Certain loan programs carry higher reserve requirements due to the associated risk involved. This includes non-QM loans designed for self-employed borrowers, often relying on bank statements or profit and loss statements for qualification. Additionally, condotel financing, portfolio loans, and high-balance jumbo loans also typically require greater reserve amounts to ensure financial stability and mitigate potential lending risks.

Be Mortgage-Ready With the Right Reserves

Don’t let savings requirements surprise you — prepare before you apply.

Bottom Line: Reserve Requirements on a Home Loan Don’t Have to Stop You

Reserve requirements on a home loan can seem intimidating, but they’re simply a safety net — for both you and your lender. With the proper planning and guidance, they don’t have to be a dealbreaker.

At Gustan Cho Associates, we have no lender overlays, work with over 210 wholesale investors, and know creative solutions to help you meet reserve requirements. Even if another lender has denied you, we can often get you approved.

Get Help with Reserve Requirements on a Home Loan Today

Borrowers who need a five-star national mortgage company licensed in 50 states with no overlays and who are experts on reserve requirements on a home loan, please contact us at 800-900-8569, text us for a faster response, or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Related> Reserves For First Time Home Buyers

Frequently Asked Questions About Reserve Requirements on a Home Loan:

Q: What are Reserve Requirements on a Home Loan?

A: Reserve requirements on a home loan are basically the extra cash you need to have saved up after you’ve paid your down payment and closing costs. Lenders want to see this as evidence that you can keep up with your mortgage payments if something unexpected comes up.

Q: How do Lenders Measure Reserve Requirements on a Home Loan?

A: Lenders measure reserve requirements on a home loan in months of your total housing payment, called PITI (principal, interest, taxes, and insurance). HOA fees are also included if you have them.

Q: When do Reserve Requirements on a Home Loan Apply?

A: Reserve requirements on a home loan usually apply if you have low credit scores, a high debt-to-income ratio, gift funds for your down payment, or are buying a multi-unit, second home, or investment property.

Q: Do FHA Loans have Reserve Requirements on a Home Loan?

A: FHA loans usually don’t require reserves for single-family homes approved by automated underwriting. However, manual underwriting or buying 2–4 units may require 1–6 months of reserves.

Q: Do VA Loans have Reserve Requirements on a Home Loan?

A: Most VA loans don’t require reserves for a single-family home. But you may need reserves if the loan is manually underwritten or you’re buying a multi-unit property and using rental income to qualify.

Q: How Much are Reserve Requirements on a Home Loan?

A: Reserve requirements on a home loan can range from 1 month to 12 months of PITI, depending on the loan type, property type, and your credit profile. Jumbo and condotel loans usually require more.

Q: Can I Use Gift Funds to Meet Reserve Requirements on a Home Loan?

A: No. Reserve requirements on a home loan require money from your own account, such as checking, savings, retirement accounts, or investments. Gift funds can only be used for the down payment and closing costs.

Q: What Counts as Acceptable Reserves for Reserve Requirements on a Home Loan?

A: Acceptable reserves include money in checking or savings accounts, CDs, retirement accounts, stocks, bonds, and mutual funds — as long as you can prove and access your own.

Q: How Can I Meet Reserve Requirements on a Home Loan if I Don’t have Enough Savings?

A: You can add your name to a joint account with a family member, move funds from retirement accounts, sell assets, or ask your lender to re-run your loan through another automated system that might not require reserves.

Q: Why Should I have Reserves Even if My Lender Doesn’t Require Them?

A: Even if you meet your lender’s rules without reserves, having extra money aside can protect you from late payments or financial stress if you face emergency repairs, job changes, or big expenses after moving in.

This article about “Reserve Requirements on a Home Loan By Mortgage Lenders” was updated on September 26th, 2025.

Turn Your Assets Into Approval Power

Reserves could make the difference in your loan approval. Learn how to qualify.