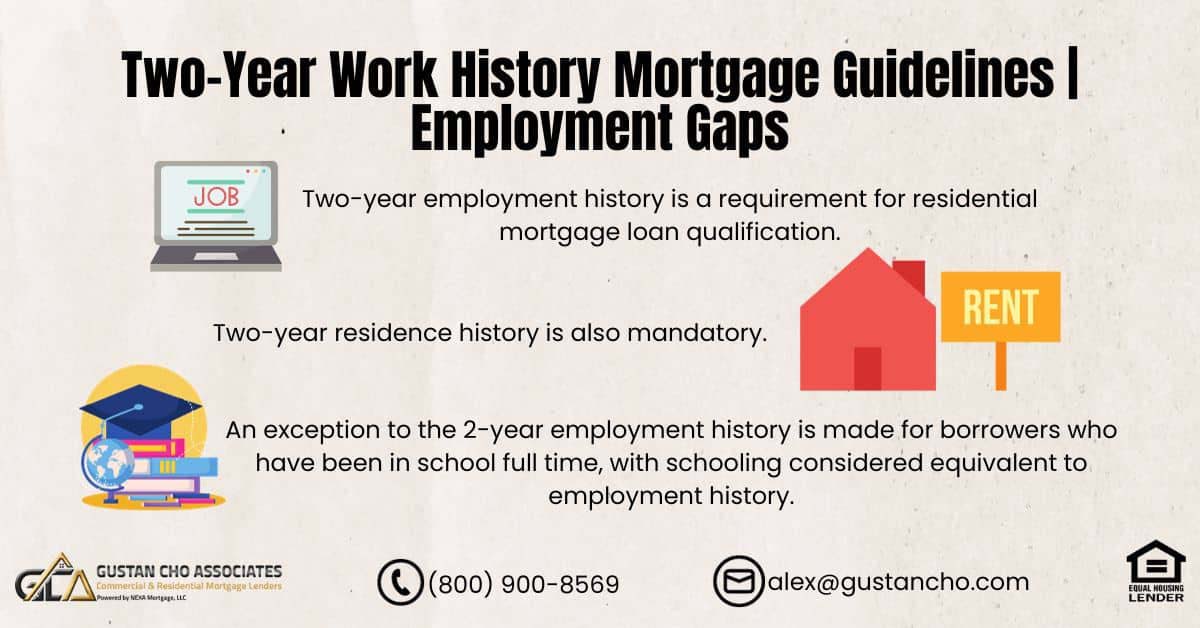

This blog post delves into the crucial aspects of the Two-Year Work History Mortgage Guidelines. It explores the significance of maintaining a consistent employment record when seeking approval for a mortgage loan and addresses considerations related to employment gaps. The eligibility criteria for a residential mortgage loan hinge on two essential prerequisites. According to the two-year work history mortgage guidelines, a stable 2-year employment history is obligatory. Additionally, a 2-year residence history is a key requirement for qualification. It’s important to note that a specific exception exists to the 2-year employment history rule. Individuals who have pursued full-time education are granted an exception, with their schooling period being considered equivalent to employment history, aligning with the two-year work history mortgage guidelines.

What Is Considered Full-Time Schooling When Applying For a Mortgage

The eligibility criteria for mortgages, as outlined in the two-year work history mortgage guidelines, include recognizing full-time schooling as equivalent to prior work experience. This applies to lending institutions such as HUD, VA, USDA, Fannie Mae, and Freddie Mac. To qualify for a mortgage, individuals must demonstrate a two-year history of full-time employment or schooling. In the case of full-time schooling, applicants must submit their school transcripts to the lender for verification. The two-year work history mortgage guidelines specifically acknowledge the importance of a sustained commitment to full-time work or education to ensure eligibility for mortgage approval. Within these guidelines, full-time schooling encompasses various educational pursuits that meet the criteria for equivalent work experience. This underscores the inclusive nature of the mortgage eligibility criteria, recognizing that a consistent two-year dedication to education is a valid qualification for prospective homebuyers. As applicants navigate the mortgage application process, adherence to the two-year work history mortgage guidelines ensures a comprehensive evaluation of their qualifications, whether rooted in full-time employment or educational endeavors. The following is considered full-time schooling:- Vocational school

- Trade school

- College

- Graduate school

- Law School

- Medical School

- Dental School Veterinary School

- Certification schools such as beautician schools, police, and fire academies

How Far Back Do Mortgage Lenders Look at Employment History?

Two-Year Residential History

Prospective home buyers must furnish a two-year employment history alongside a two-year residence history per the two-year work history mortgage guidelines. This documentation is crucial for the mortgage loan application process, whether it entails living with family or renting an independent residence. It is imperative to ensure that a comprehensive and documented two-year residential history is submitted to meet the stipulated guidelines and facilitate a smooth mortgage approval process. This requirement underscores the significance of stable employment and residential backgrounds in evaluating mortgage applications. Compliance with the two-year work history mortgage guidelines requires prospective home buyers to present a two-year employment history and a corresponding two-year residence history. Whether individuals reside with family or rent their own homes, it is imperative to provide documented evidence of this residential history as part of the mortgage loan application. This dual requirement emphasizes the importance of evaluating the stability and consistency of employment and living situations when considering mortgage approvals. Meeting these guidelines ensures a comprehensive assessment of the borrower’s financial stability and commitment to responsible homeownership.Two-Year Work History Mortgage Guidelines With Job Gaps

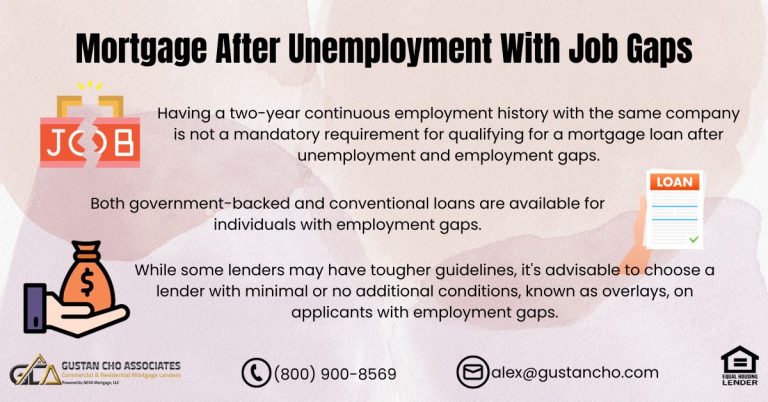

Mortgage guidelines regarding a two-year work history do not imply that borrowers must have a continuous two-year employment record. It is acceptable for borrowers to be currently employed for six months, even if they had a period of unemployment in the past three years. However, a crucial requirement is an 18-month employment history before the period of unemployment. Lenders simply aim to see that borrowers have been steadily employed for a total of two years, whether there were continuous employment, employment gaps, or multiple job changes. These guidelines represent the minimum mandatory standards established by HUD and Fannie Mae.

Mortgage guidelines regarding a two-year work history do not imply that borrowers must have a continuous two-year employment record. It is acceptable for borrowers to be currently employed for six months, even if they had a period of unemployment in the past three years. However, a crucial requirement is an 18-month employment history before the period of unemployment. Lenders simply aim to see that borrowers have been steadily employed for a total of two years, whether there were continuous employment, employment gaps, or multiple job changes. These guidelines represent the minimum mandatory standards established by HUD and Fannie Mae.

Mortgage Lender Overlays on Gaps In Employment

Lenders may impose overlays beyond the minimum federal guidelines. For instance, several banks, credit unions, and mortgage lenders may introduce their overlays, specifying that there should be no employment gaps in the last two years. Some lenders may express a preference against individuals who frequently change jobs within the past two years. It’s important to note that these specifications are not dictated by federal mortgage guidelines but are instead specific to the lender’s overlays. Talk to our expert for lender overlays on gaps in employment, Click HereHow Long of a Gap In Employment Can You Have To Get Mortgage

For example, all that is required to qualify for a borrower is via federal mortgage guidelines to get approve/eligible per DU FINDINGS for a mortgage is the following:- borrowers have been unemployed for six months or less and just got a new full-time job need 30 days of paycheck stubs from a new employer in order to close on a mortgage loan

- If unemployed for six or more months, then need to have been on a new job for at least six months to qualify for a mortgage

Cases Where Home Buyers Cannot Prove 2-Year Employment History

In certain situations, a prospective homebuyer may face challenges in demonstrating a 2-year employment history. Take, for instance, an immigrant who arrives in the country secures a well-paying job, and recently obtains a green card. Despite having the financial capacity to afford housing payments, they are ineligible for a conforming mortgage loan due to the absence of a 2-year employment history. In such cases, the individual must wait for a 2-year employment history seasoning before becoming eligible for a residential mortgage loan.What Are Mortgage Guidelines For Non-Permanent Resident Alien?

Additional instances often involve situations where an employee is engaged in full-time work within the country but lacks a green card. In such cases, the employer compensates the worker in cash, resulting in no recorded income. Subsequently, upon obtaining legal status, including a green card and social security card, the employer transitions to paying the employee through a payroll check, classifying them as W-2 employees. Despite the worker’s lengthy employment history with the same employer, securing a residential mortgage loan becomes challenging due to the absence of documented income, despite the existence of a two-year employment record.Mortgage Loan Program For Those Without 2-Year Employment History

We provide an alternative portfolio mortgage loan program for prospective homebuyers who do not have a 2-year employment history. However, eligibility for the expatriate portfolio mortgage loan program requires the borrower to fulfill certain criteria, including a 20% down payment, a maximum debt-to-income ratio of 40%, and reserves equivalent to one year’s worth of principal, interest, taxes, and insurance. The expatriate portfolio mortgage loan program offers a 30-year adjustable rate mortgage with options including 3/1 ARM, 5/1 ARM, and 7/1 ARM. Apply for mortgage loan, click hereFAQs: Understanding Two-Year Work History Mortgage Guidelines

- Why is a two-year work history important for mortgage approval? Mortgage lenders often require a two-year work history to assess an applicant’s financial stability and commitment to homeownership. This guideline helps evaluate a borrower’s ability to maintain consistent employment, a crucial factor in determining mortgage eligibility.

- Are there exceptions to the two-year work history rule? Yes, individuals who have pursued full-time education, such as vocational school, college, or graduate school, are granted an exception. The schooling period is considered equivalent to employment history, aligning with the two-year work history mortgage guidelines.

- How is full-time schooling defined under these guidelines? Full-time schooling includes various educational pursuits such as vocational school, trade school, college, graduate school, law school, medical school, dental school, veterinary school, and certification schools (e.g., beautician schools, police, and fire academies).

- How far back do mortgage lenders look at employment history? While traditional employment history requires two continuous years, the two-year work history mortgage guidelines offer flexibility. Individuals can substitute professional school transcripts for traditional employment records, recognizing full-time schooling as a valid qualification.

- Can individuals with gaps in employment still qualify for a mortgage? Yes, borrowers can have employment gaps, and it is acceptable for them to be currently employed for six months, even if there was a period of unemployment in the past three years. The key is to have an 18-month employment history before the period of unemployment.

- Are there lender overlays on employment gaps? Some lenders may impose overlays beyond federal guidelines, specifying preferences against employment gaps or frequent job changes. Borrowers should be aware that federal mortgage guidelines do not dictate these specifications but are specific to the lender’s overlays.

- How long of a gap in employment is acceptable for mortgage approval? Per federal guidelines, borrowers unemployed for six months or less, and those with six or more months of unemployment but a new job for at least six months, may qualify for a mortgage. However, individual banks and credit unions may impose additional conditions, known as overlays.

- What if a homebuyer cannot prove a two-year employment history? In cases where a prospective homebuyer faces challenges proving a two-year employment history, an alternative portfolio mortgage loan program may be available. This program typically requires a 20% down payment, a maximum % debt-to-income ratio of 40%, and reserves equivalent to one year’s worth of principal, interest, taxes, and insurance.

- What if an individual lacks a documented income despite having a two-year employment record? In situations where an individual lacks documented income despite a two-year employment record, securing a residential mortgage loan may be challenging. Some may explore alternative mortgage loan programs tailored for those without a two-year employment history, provided they meet specific criteria.

- How can immigrants or non-permanent resident aliens qualify for a mortgage? Immigrants without a two-year employment history may face challenges, and in certain situations, they may need to wait for a two-year employment history seasoning before becoming eligible for a conforming mortgage loan. However, alternative mortgage loan programs may be available for those without a documented two-year employment history.