This ARTICLE On Trump Flees New York To Florida Due To High-Taxes Was PUBLISHED On November 4th, 2019

We have written numerous articles about New Yorkers fleeing the state to other low-taxed states like Florida, Texas, Tennessee, Alabama, and countless others.

- The state of New York, especially in New York City, is in a financial crisis

- The only solution state and local politicians seem to have is to raise taxes

- Besides raising taxes, lawmakers are creating new taxes which is not only creating a burden on individual taxpayers but businesses as well

- There is no other state where there is a mass migration of businesses and taxpayers like New York

- Increasing taxes is the first solution politicians resort to in the event of a budget shortfall

- However, in order for this plan to work, politicians need to cut spending

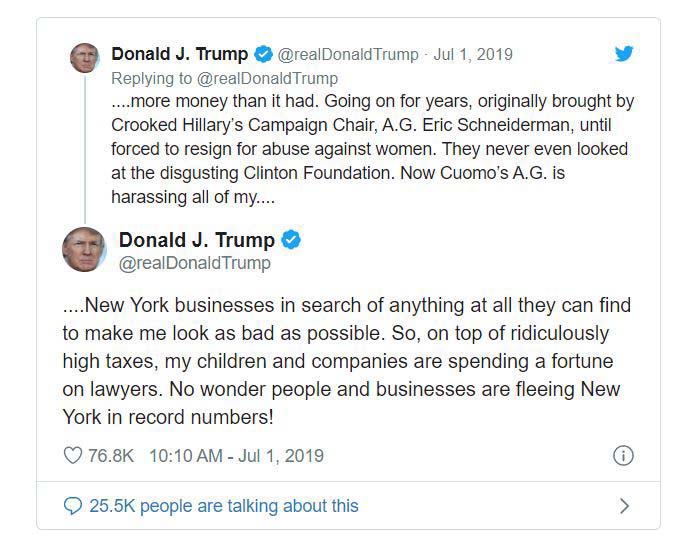

- One thing politicians need to really focus is raising taxes and creating new taxes can backfire big time

- It can hurt the state more financially than help

- Increasing taxes and creating taxes will create anger among individual taxpayers and force them to flee the state like it is happening in Illinois

- Midland Metals Products, a company based in Chicago for over 98 years recently left the city to Indiana due to high Chicago and Illinois state taxes

- Like many other New York taxpayers, President Trump announced he and his family are leaving New York to Florida

In this article, we will cover and discuss Trump Flees New York To Florida due to the high taxes and cost of doing business in New York.

Trump Flees New York To Florida After His Term To Lower Tax Obligations

President Trump, a billionaire businessman and the current U.S. President of the United States, plans on exiting New York due to lowering his tax obligations.

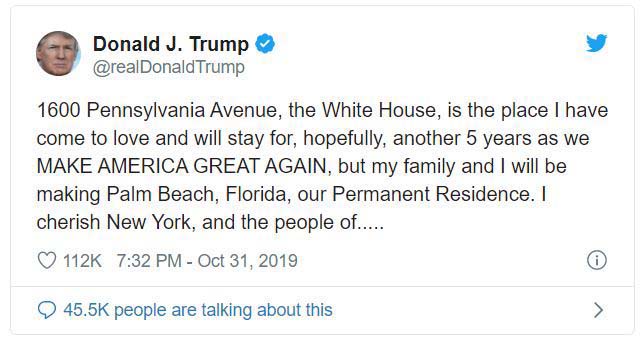

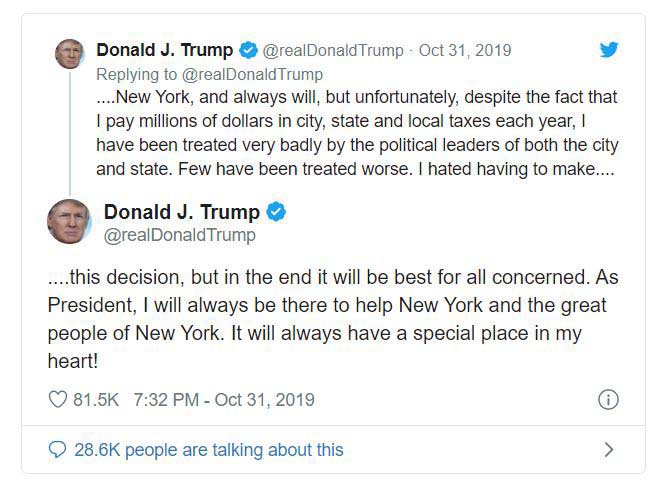

- President Trump tweeted last Thursday that he is hoping in getting re-elected in 2020 and staying in the White House for the next five years

- However, Trump made his decision in leaving New York and setting his permanent residence in Palm Beach, Florida

- Palm Beach will be his permanent primary residence

- President Trump made New York his home for many years

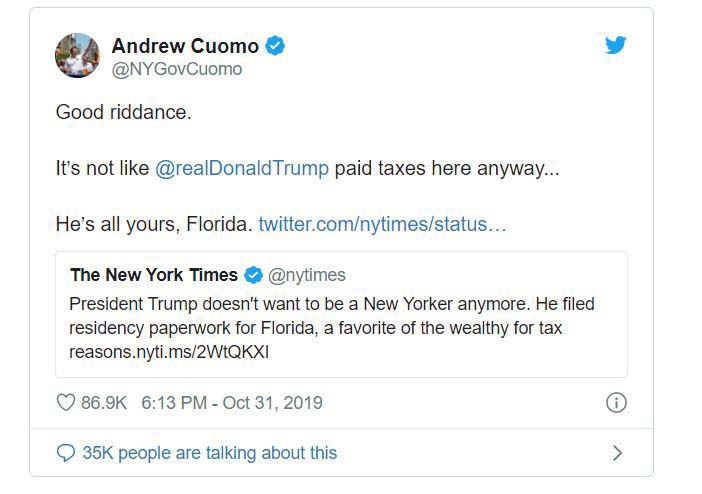

The exit of President Trump and his family follows other New Yorkers leaving the state to other lower-taxed states. The tax increases by New York politicians are backfiring.

Trump Flees New York To Florida Is Official And Not Just Talk

Many high profile people may just talk about leaving a state as a threat to political leaders.

- However, this is not the case with President Trump

- President Donald Trump and First Lady Melania officially filed documents changing their official primary residences from New York to Palm Beach, Florida a few weeks ago

The Trump Estate, where the family second home compound is, is Mar-a-Lago. Mar-a-Lago is located in Palm Beach, Florida.

Why Is Florida Raking In Billions When New York Is On The Verge Of Bankruptcy

The government needs to run like a business.

- One of the most important factors with a successful company is to keep on generating new customers

- Same with city, county, and state government

- What does a state need to do to attract new businesses and taxpayers?

- Would you as a CEO of a company move to a state with high taxes?

- Would a CEO of a company move to a state like New York that is in financial crisis and the politicians keep on raising taxes and creating new ones?

- Most likely not

- Many states like Florida are thriving

- They are raking in billions and have a massive migration to their state due to low taxes at all levels and lower cost of living

- Florida has no state income taxes

- The state has no estate tax

- There is no inheritance tax in Florida

- New York’s state income tax rate surpasses the 8.0% mark

- President Trump has had enough

- Donald Trump was born in Queens, New York

- New York has been his primary residence all of his life. However, like many New Yorkers, he had enough

Reasons Why Taxpayers Are Fleeing New York

New York is one of the states where there is a mass exodus of taxpayers moving to lower-taxed states.

- Andrew Cuomo admitted that the state is experiencing a severe shortage of revenues

- New York’s tax increases and high taxes have hurt the middle class

The state has a $2.3 billion budget shortfall below estimated revenue projections.

Data And Numbers Prove High-Taxed States Are Getting Backfired

New York, as well as California, are going to aggressively audit taxpayers leaving their states. This goes for both businesses and individual taxpayers.

Government Should Be Run Like A Business

Why are some states on the verge of bankruptcy and have high taxes and other states are thriving? It is because states like Florida with low taxes are running their state like a business. Competent politicians are key. It seems like states with a financial crisis has incompetent politicians. Their only solution is to increase taxes and create new taxes. This is not the way to go. Many individual taxpayers and businesses are leaving high taxed states. New York, Illinois, and California are the three top high taxed states in the nation. Illinois Governor J.B. Pritzker recently doubled the state’s gas tax. Not only is he increasing taxes across the board, but he is also creating new taxes for Illinoisans. J.B. Pritzker proved his incompetence and lack of experience by approving wage increases to all state lawmakers. Lawmakers need to do something to attract new individual taxpayers and businesses to their state. Increasing taxes, creating new taxes, and being on the verge of bankruptcy is not the way. This is a developing story at Gustan Cho Associates Mortgage News. We will update our viewers with new updates in the coming days and weeks. Stay Tuned!!!