This guide covers manufactured home financing requirements. Many home buyers of manufactured home financing have a difficult time getting it. The Department of Veteran Affairs (VA) and the U.S. Department of Housing and Urban Development (HUD) have the same mortgage guidelines on manufactured home financing. The reason is that lenders view manufactured homes as high-risk properties.

Most, if not all, lenders will have overlays on manufactured home financing. Mortgage lender overlays are additional lending guidelines on top of minimum federal mortgage lending guidelines.

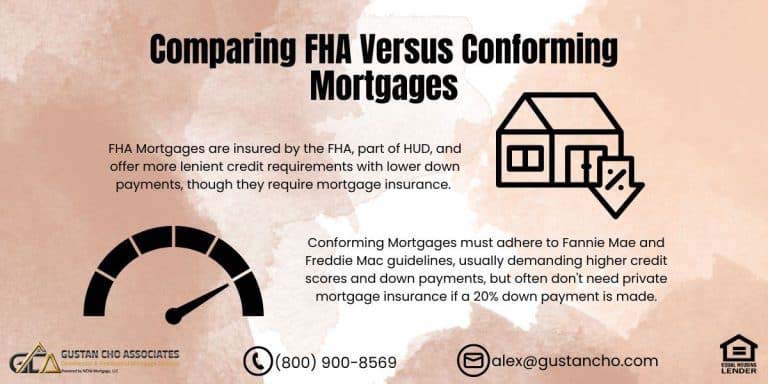

For instance, to be eligible for a Federal Housing Administration (FHA) loan with a 3.5% down payment, a prospective home buyer merely needs a credit score of 580. Nevertheless, while some lenders might approve the home buyer for a loan on a manufactured home, they might stipulate higher credit score requirements. As an immediate example, I can recall at least twelve lenders who mandate that applicants for manufactured home financing loans possess a credit score of 680 or above.

Manufactured Home Financing Requirements By Lenders

Credit Score: When seeking financing for a manufactured home, lenders generally expect a minimum credit score. Although the precise credit score requirement may differ, it is frequently higher than that necessary for conventional home loans. A favorable credit score enhances your likelihood of loan approval and secures a more favorable interest rate.

FHA loan programs allow manufactured home financing. The manufactured home financing requirements must be built on a solid concrete foundation. The minimum down payment is 3.5% for a home purchase.

The loan to value is 97.75% of a refinance mortgage on a manufactured home. Cash-out refinance mortgage loans on a manufactured home require a loan-to-value of 80% LTV. VA loans require no down payment. Fannie Mae and Freddie Mac require a 3% to 5% down payment on conventional loans on manufactured homes. Speak With Our Loan Officer for Getting Mortgage Loans

Manufactured Home Financing Requirements on Down Payment

You will likely need to make a down payment when financing a manufactured home. The required down payment amount can vary, but it is typically higher than what is required for traditional homes. It can range from 5% to 20% or more of the home’s purchase price.

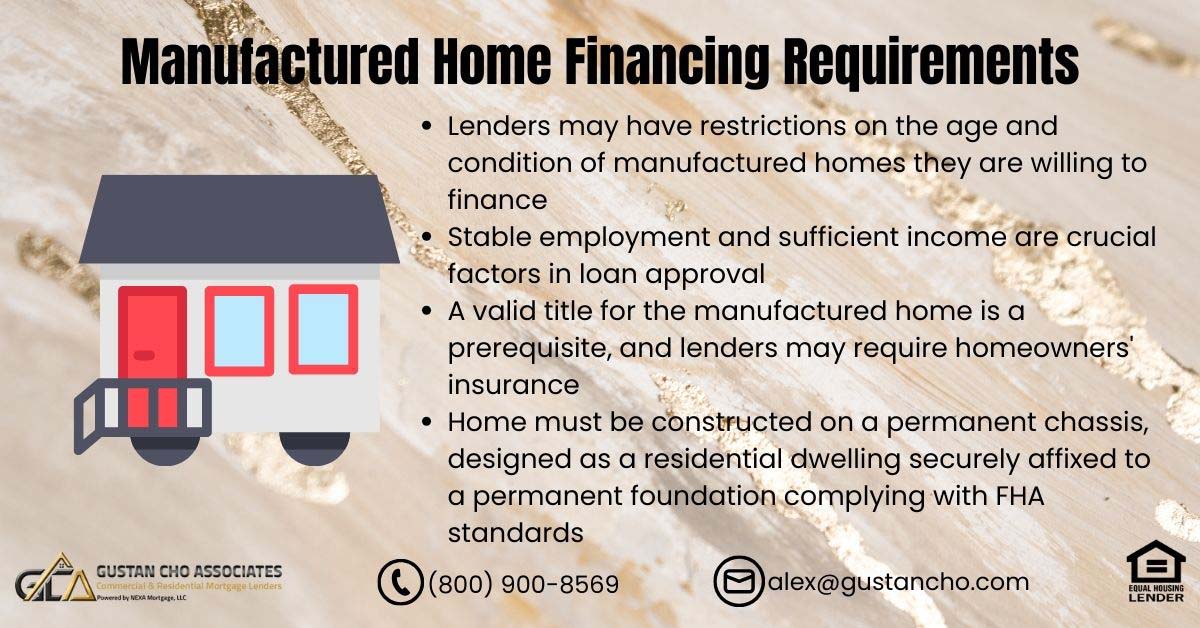

Lenders may have restrictions on the age and condition of the manufactured home they are willing to finance.

Older homes or homes in poor condition may have more limited financing options or require higher down payments. Lenders will assess your income and employment history to determine your ability to repay the loan. Stable employment and sufficient income are important factors in loan approval.

Facts Homebuyers Need To Know About Manufactured Home Financing Requirements

Gustan Cho Associates Mortgage Group does not impose any specific lending restrictions on manufactured homes. We are capable of providing financing to buyers with a credit score as low as 580 and requiring only a 3.5% down payment for FHA loans. In contrast, numerous other lenders specializing in manufactured home financing typically demand credit scores of 640 or above.

Borrowers can have outstanding collections and charged-off accounts and qualify for manufactured home FHA and VA loans.

The financing criteria for manufactured homes may differ based on the lender and the type of loan you are applying for. Nonetheless, there are certain standard requirements associated with financing a manufactured home. It is essential to bear in mind that these criteria may change, hence staying informed with the latest information from potential lenders is crucial. One prerequisite is having a valid title for the manufactured home, and in some cases, the lender might stipulate the necessity of obtaining homeowners insurance.

Get more help related to Manufactured home financing requirements

Manufactured Home Financing Requirements After Bankruptcy and Foreclosure

2-year waiting period requirements after Chapter 7 bankruptcy to qualify for VA and FHA manufactured home loans 3-year waiting period after a housing event (foreclosure, deed in lieu, short sale) to qualify for FHA loans. There is a 2-year waiting period after the housing event to qualify for VA loans.

Lenders will calculate your debt-to-income ratio to evaluate your ability to manage your monthly mortgage payments and other debts. A lower DTI ratio is generally more favorable.

Borrowers in a Chapter 13 bankruptcy repayment plan can qualify for VA and FHA loans one year into their Chapter 13 bankruptcy repayment. Borrowers in an active Chapter 13 bankruptcy repayment plan require trustee approval. There is no waiting period to qualify for manufacturer-home FHA or VA loans after the Chapter 13 bankruptcy discharge date.

Reverse Mortgages For Manufactured Homes

Owners of manufactured homes can also be eligible for reverse mortgages, provided they are 62 years old or older and possess equity in their manufactured home. The process for reverse mortgages on manufactured homes is identical to that for traditional homes. To qualify for specific financing options, the manufactured home might be required to be on a permanent foundation. This criterion ensures that the home is securely anchored and complies with safety and structural standards.

Prequalify for a mortgage in just five minutes.

Ownership of Land on Manufactured Home Financing Requirements

Owning the land where the manufactured home is situated can provide you with a broader range of financing alternatives. If you are leasing the land, obtaining financing may necessitate a long-term lease agreement. The guidelines for financing a manufactured home stipulate that the homeowner must be the owner of the land. Additionally, the manufactured home should be permanently constructed on a concrete foundation and have a floor area of at least 400 square feet.

There are overlays about credit for manufactured home financing borrowers. The minimum credit score for manufactured home financing is 620 for most lenders.

The necessity for elevated credit scores varies among manufactured home mortgage lenders. These lenders stipulate higher credit scores due to their categorization of manufactured homes as higher-risk investments. Your eligibility will be assessed by lenders based on the loan-to-value (LTV) ratio, which compares the loan amount to the appraised value of the manufactured home. Borrowers typically benefit from a more favorable position when the LTV ratio is lower.

Type of Property Guidelines To Meet Manufactured Home Financing Requirements

Manufactured homes need to have been built after June 15, 1976, to be able to finance it: They need to conform to the Federal Manufactured Home Construction and Safety Standards.

Per manufactured home financing requirements, the home cannot be located in a trailer park. It cannot be built in a flood zone to qualify for financing.

The dwelling must be constructed and maintained on a permanent chassis to comply with the financing requirements for manufactured homes. It should be specifically designed as a residential dwelling securely affixed to a permanent foundation that adheres to the standards and criteria set by the FHA.

Get Pre-Approved For Manufactured Home Financing

It is crucial to explore various options and assess proposals from different lenders to discover the most suitable financing option for your circumstances. Moreover, it is advisable to collaborate with lenders who specialize in manufactured home financing, as they may possess greater flexibility and expertise in this area.

Homebuyers of manufactured homes needing manufactured home financing contact us at Gustan Cho Associates Mortgages.

Apply online by clicking APPLY NOW FOR MANUFACTURED HOME FINANCING to get qualified and pre-approved. Or call us or text us at 800-900-8569 anytime for a faster response. Or email us at gcho@gustancho.com. We are available seven days a week, including holidays and weekends, to answer your questions. Talk With Our Loan Officer for Getting Mortgage Loans

Frequently Asked Questions (FAQ) – Manufactured Home Financing Requirements

- What is the main challenge when it comes to financing manufactured homes? Many lenders view manufactured homes as high-risk properties, making it more difficult for homebuyers to secure financing.

- Are there specific lending guidelines from government agencies for manufactured home financing? Yes, the Department of Veteran Affairs (VA) and the U.S. Department of Housing and Urban Development (HUD) have similar mortgage guidelines for manufactured home financing.

- What are mortgage lender overlays, and why do they matter for manufactured home financing? Mortgage lender overlays are additional lending guidelines imposed by lenders on top of minimum federal mortgage lending guidelines. These overlays can include higher credit score requirements, making it harder to qualify for a loan.

- What credit score is generally required for manufactured home financing? While credit score requirements vary among lenders, a favorable credit score is typically necessary for loan approval and securing a more favorable interest rate.

- Which government-backed loan programs allow manufactured home financing, and what are their requirements? FHA loans allow manufacturing home financing, but the home must be built on a solid concrete foundation, and the minimum down payment is 3.5%. VA loans require no down payment, while Fannie Mae and Freddie Mac loans may require a 3% to 5% down payment for conventional loans on manufactured homes.

- How much of a down payment is generally required for financing a manufactured home? Down payment requirements for manufactured homes can range from 5% to 20% or more of the home’s purchase price, depending on the lender and the home’s condition.

- Are there restrictions on the age and condition of the manufactured home for financing? Yes, older homes or those in poor condition may have limited financing options or require higher down payments. Lenders also assess income and employment history to determine loan eligibility.

- Can borrowers with lower credit scores qualify for manufactured home financing? Some lenders, like Gustan Cho Associates Mortgage Group, may accept credit scores as low as 580 for FHA loans, while others may require higher scores. Borrowers with outstanding collections and charged-off accounts can still qualify for FHA and VA loans.

- How does bankruptcy affect eligibility for manufactured home financing? The waiting period after Chapter 7 bankruptcy is typically 2 years for VA and FHA loans, while there is a 3-year waiting period after a housing event (foreclosure, short sale) for FHA loans. Borrowers in Chapter 13 bankruptcy repayment plans may qualify one year into their repayment, with trustee approval.

- Can owners of manufactured homes qualify for reverse mortgages? Yes, owners who are 62 years or older and have equity in their manufactured homes can qualify for reverse mortgages, similar to traditional homes. Permanent foundation requirements may apply.

- What are the ownership requirements for the land where the manufactured home is located? Owning the land is ideal for financing, but a long-term lease agreement may be necessary if you’re leasing the land. The manufactured home should have a concrete foundation with a minimum floor area of 400 square feet.

- What are the types of property guidelines for manufactured home financing? Manufactured homes must have been built after June 15, 1976, conform to federal standards, not be located in a trailer park, and not be in a flood zone to qualify for financing.

- How can borrowers improve their chances of securing manufactured home financing? Exploring various options and working with lenders specializing in manufactured home financing can be beneficial, as they may offer more flexibility and expertise in this area. Stay informed about the latest lending requirements from potential lenders.

Get Pre-Approved For Manufactured Home Financing

This blog about Manufactured Home Financing Requirements was updated on February 5, 2024.

Hello everyone, I’m super excited today. I saw comments from people who had already received a loan from Sabinhelps@gmail.com and then I decided to sign up based on their recommendations. A few hours ago, I confirmed a total of 10,000 euros that I had requested from my own bank account. This is really great news, and I advise anyone who needs a real loan to submit an application

Hey,

Loan testimonial between individual

I no longer believed in borrowing money because all the banks had rejected my file; I was indeed at my bank. But one day a friend recommended me to a private lender whose email she gave me. I tried with him by emailing him and it worked. I had the right person an honest private lender that I had been looking for for years. I got my loan of € 95,000 at a rate of 2% that allows me to live well at the moment and I regularly pay my monthly payments. You can contact him if you need a loan for various personal reasons. he took no filing fees or notary fees…etc. Two of my colleagues also received loans without any difficulty. Here’s his email: jopie.mandemakers@financier.com