In this blog, we will discuss and cover appraisal issues during the home buying and mortgage process. The word “appraisal” can be an ugly word when things don’t go right. All lenders require a home appraisal on borrowers purchasing and/or refinancing a home. The home appraisal is the report lenders rely on as the collateral on the mortgage.

The appraisal determines the value of a property. A lender requires appraisals so they know how much the asset is worth what they are lending. Gustan Cho Associates are experts in appraisal for each mortgage product. The importance of the appraisal, the appraisal process, and what to do when appraisal issues arise.

What Is A Home Appraisal And Its Importance To Lenders

An appraisal is a very important part of the mortgage process. An appraisal is defined as “a valuation of a property by the estimate of an authorized person” by Merriam-Webster Dictionary. A real estate appraisal will determine the value of a given property. There are very strict guidelines the appraiser must follow when coming up with the value.

Think of it this way; if you were lending large sums of money to somebody, you would want to know how much their collateral is worth before making that decision. That is the basic principle behind an appraisal.

Worried About a Low Appraisal? We’ll Help You Navigate It

From disputes to renegotiations, we guide you through every appraisal challenge. Talk to a Mortgage Expert About Appraisal Issues Today!How The Appraisal Process Work After The 2008 Real Estate Crash

After the real estate crash of 2008, strict guidelines were put in place to prevent overestimated home values. The majority of the country had property values way higher than they really should’ve been. This caused a burst in the real estate market and we all know what happened with that.

Now appraisers must be registered with HUD to complete FHA and or VA appraisals. They have a strict rule book for how appraisals must be conducted. This is a good system for all parties. It protects the borrower from buying something overpriced home as well as the lender for not overlending on a property.

What Does The Appraisal Have To Do With The Mortgage?

An appraisal is integral to the mortgage process and is closely intertwined with securing a loan for a property purchase. Lenders require a property appraisal when granting a mortgage. This helps mitigate their risk by ensuring they don’t finance more than the property’s worth, safeguarding against potential losses in case of borrower default.

The appraisal helps establish the loan-to-value (LTV) ratio, impacting loan terms such as interest rates and the necessity of private mortgage insurance (PMI). It is a crucial part of the underwriting process, as lenders use the appraised value to assess if the property meets their lending criteria. Suppose the appraised value falls below the purchase price.

In that case, it can influence the lender’s decision to approve the loan or necessitate additional conditions. Lastly, appraisals protect borrowers from overpaying, allowing renegotiation if the appraisal value is lower than the agreed-upon purchase price. Ultimately, the appraisal directly shapes the mortgage by influencing loan terms and approval decisions and ensuring informed transactions for lenders and borrowers.

Appraisal Management Company

This is why appraisals are now ordered through an AMC or appraisal management company. Once the AMC receives an appraisal order, all licensed appraisers who are signed up with that AMC have an equal opportunity to accept the appraisal order. It is on a first-come-first-serve basis. Once an appraiser accepts the bid, they will schedule an inspection time with the homeowner (or listing agent).

On average, an appraisal takes 7 days from the date ordered to receive the actual report. Once the report is received, an underwriter will go through it with a fine-tooth comb to make sure they agree with the appraiser’s remarks. Sometimes revisions are needed.

Typical And Common Home Appraisal Issues

One of the most common issues with home appraisals during the mortgage process is when the appraiser comes up short with the appraised value of the purchase price of the home. The appraised value is the most common issue with appraisals. When the appraised value is lower than the purchase price or amount needed to complete a refinance, borrowers are upset.

As stated above, the third-party unbiased appraisal protects both the lender and the borrower. Of course, it is frustrating, and the borrower is out a good chunk of money, but it does protect them from buying an asset overvalued.

Condition of The Property Does Not Meet The Minimum Property Standards

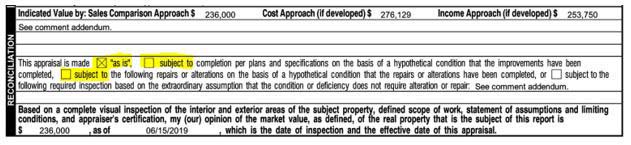

There are conditions of the property that can become appraisal issues. An appraised value will either come back “as is” or “subject to” repairs. An appraisal is different than a home inspection. But an appraiser will still notice major deficiencies. Any damage from a leaky roof or missing drywall will need to be addressed prior to closing on the mortgage.

Photos will be taken of damaged areas and those items will need to be fixed. Once the seller completes the repairs, the appraiser will go back out there and confirm the repairs are completed. There is a trip fee involved that the borrower must pay for. Appraisal Issues can be fixed. Below is a photo of an appraisal that shows the property is in “as is” condition:

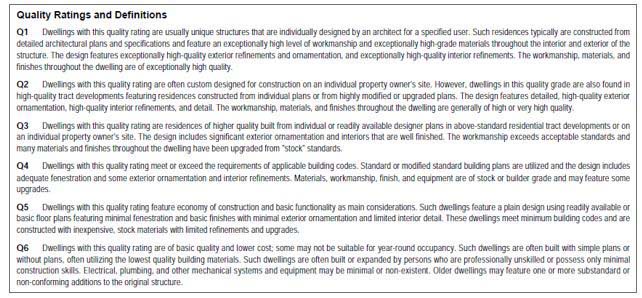

There are also quality ratings. Most lenders can lend on C4 and better ratings, see below:

Meeting Local Building Code Standards

The property being appraised for a new home mortgage need to meet the minimum codes of the building code requirements for the individual municipality. Many states have specific building codes and appraisers will look out for those items. For example, California has specific rules regarding hot water heater straps.

An appraiser must take photos of the hot water heater with the straps connected. There must also be a carbon monoxide detector. Your loan officer should know of any local codes to be on the lookout for when house hunting. Something as minor as a missing carbon monoxide detector will cause a delay in the appraisal process.

Home Didn’t Appraise as Expected? Don’t Panic—You Have Options

We’ll help you handle low values, repairs, or lender-required conditions. Schedule Your Free Appraisal Review Consultation Now!What Happens When There Are Appraisal Issues?

A lender is prohibited from ordering an additional appraisal to achieve an increased property value or lower/eliminate deficiencies or repairs needed. You have one shot with an appraisal. There are times when more than one appraisal is needed, but it is uncommon.

A lender may only order a second appraisal if an underwriter determines the first appraisal is materially deficient and the appraiser is unable to resolve the deficiencies. The lender must document the deficiencies and have both appraisals in the loan file. A borrower is not allowed to pay for the second appraisal. It must be paid for by the lender.

Appraisal Issue Solutions

The majority of the time if there is an appraisal issue, the buyer and seller must come to a compromised agreement or walk away from the deal. If the appraised value comes in low, the lender may only base their loan on the appraised value. This means the seller must lower the purchase price or the buyer must pay the difference in cash.

Are Appraisal Issues Common During the Homebuying Process?

Appraisal issues are part of the home buying process. They do come up from time to time. While they are frustrating, the appraisal process is very important. Gustan Cho Associates are appraisal experts.

For questions about the content on this article and/or other mortgage-related topics, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available seven days a week for any appraisal-related question. Please check out our Blog on APPRAISALS VS HOME INSPECTIONS for more details.

Home Appraisal Issues During Mortgage Approval Process

A residential home appraisal is mandatory and required for all home buyers and homeowners doing a refinance mortgage. Most homes are priced right. Seller’s realtors do an extensive market analysis on comparable properties before they recommend a selling market listing price to their sellers. Low home appraisals issues are not common.

However, it does happen. In the following paragraphs, we will discuss and cover Home Appraisal Issues During Mortgage Approval Process.

Solutions With Home Appraisal Issues

This can cause a delay in closing on the home because three things need to happen. The seller lowers the purchase contract to the appraised value of the property. The home buyer needs to request a home appraisal rebuttal from the mortgage lender. The lender does an appraisal rebuttal with the Appraisal Management Company. The buyer and seller need to negotiate a new purchase price on the home somewhere in the middle of the appraised value and purchase price.

Typical Home Appraisal Issues

There are other home appraisal issues that do come up where the property does not meet FHA and/or HUD property guidelines. Examples of these issues are the following:

- mold issues

- broken windows

- peeling paint

- non-functional items such as toilet, electrical, plumbing, garage door openers, and HVAC systems

FHA Versus Conforming Appraisals

FHA appraisals and Conventional loan appraisals are similar. With FHA, emphasis on security and safety is addressed. Requires that the subject property be secure and safe. All appraisers will require that the subject property is habitable and ready to move in condition.

Defects Found By Appraiser

If the appraiser notes defects on the home, the defects need to be corrected and a re-inspection will be required by the same appraiser. Examples of defects on the subject property include:

- non-functioning systems like the garage door

- plumbing

- electrical

- HVAC

- broken windows

- peeling paint

- mold

- other items deemed as unsafe and not secure

Items such as an older roof that has at least 3 years of life remaining and where there is no leakage are fine. However, a leak from the roof or broken gutters needs to be corrected. There is an additional cost for the appraiser to come back out and sign off on the repairs. The cost of the repairs can be paid either by the seller and/or by the buyer.

In the event, that the seller does not want to pay for the repairs, the buyer can pay for the repairs as long as the seller’s consent in giving them access to the home for the repairs to be done.

Cases Where Repairs Cannot Be Done

Many times when a home buyer purchases a foreclosure, the subject property can have many deferred maintenances where it will not pass the minimum standards of the appraisal. A substantial amount of repairs may be required. However, if it is a bank-owned property (REO), the bank may not want to do any work on the property and sometimes will not grant access to even the buyers to do the repairs.

Also, all utilities need to be on for the home appraisal. This can create a problem during the wintertime when many homes are winterized and all utilities are shut down.

Do Your Due Diligence Before Ordering a Home Appraisal So You Do Not Encounter Appraisal Issues

Before proceeding with the mortgage approval process, homebuyers should make sure that they will not encounter a situation like this where the sellers do not cooperate. There is no way you will get a clear to close on a residential mortgage loan if the appraiser notes that the subject property does not meet minimum FHA and/or Fannie Mae home appraisal standards.

If you are purchasing a bank-owned property, many banks will not pay for repairs and sell the property as-is. However, many will let the home buyers do the repair and grant them access to the property.

HomePath Properties

HomePath properties are homes that are owned by Fannie Mae. Anyone can purchase a HomePath property. HomePath mortgage loan programs which are conventional mortgage loans required no appraisals and no private mortgage insurance. HomePath Mortgage Loan Programs got discontinued by Fannie Mae.

HomePath properties can have deferred maintenance if buyers are purchasing the property. HomePath loans used to be available for owner-occupied single-family homes, second/vacation homes, and investment homes. Home Buyers can purchase a HomePath property via other loan programs such as FHA loan programs, VA loan programs, and traditional conventional loan programs.

Home Appraisal Issues And Appraisal Review By Mortgage Lender

Just because homebuyers get an appraisal that has been valued at the purchase price does not mean that everything is alright. Lenders have an appraisal review department where the appraisal gets reviewed by an in-house underwriter.

This quality control measure is taken to make sure everything on the appraisal report is justified to protect the lender’s collateral. Most of the time, the appraisal review goes smoothly and it is just a matter of formality. Unfortunately, there are times when the lender’s appraisal review department does not agree with the appraisal.

If this is the case, the lender orders a second appraisal. For example, if the comparable sales listed on the home appraisal are not within a one square mile radius, the appraisal review underwriter may question that. I had a recent case where the subject property was on five contiguous lots.

Appraisal Issues If the Appraisers Cannot Have Comparable Sales Close to Subject Property

The appraiser needed to go 4 miles to get comparable sales. In this case, the lender requested a second appraisal and everything came out okay. There are other times when the appraisal comes in at the purchase price value but the internal appraisal review underwriter will not agree on the value and lower the value.

There are lenders that are notorious for slashing the appraisal value to a lower value. This is because they do not agree with the appraiser and the purchase price. Homebuyers who need to qualify for a mortgage with a lender with no mortgage overlays can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or borrowers can email us at alex@gustancho.com. Gustan Cho Associates has no overlays on FHA, VA, USDA, and Conventional loans.

FAQs About Appraisal Issues During Home Buying and Mortgage Process

-

1. What is a home appraisal, and why is it important to lenders? A home appraisal is a property valuation conducted by a certified appraiser. Lenders require appraisals to assess the property’s value, which is collateral for the mortgage. This valuation helps lenders determine how much they are willing to lend based on the property’s worth.

-

2. How does the appraisal process work after the 2008 real estate crash? Following the 2008 real estate crash, stricter guidelines were implemented to prevent overestimated home values. Appraisers must now adhere to regulations set by HUD, especially for FHA and VA appraisals. This ensures more accurate valuations and protects both borrowers and lenders.

-

3. What does the appraisal have to do with the mortgage? Appraisals are integral to the mortgage process as they help lenders assess risk and determine loan terms. The appraised value influences the loan-to-value ratio, interest rates, and the need for private mortgage insurance. Additionally, appraisals are crucial for underwriting decisions and protect borrowers from overpaying for properties.

-

4. How are appraisals ordered and conducted? Appraisals are typically ordered through an Appraisal Management Company (AMC). Once ordered, a licensed appraiser schedules an inspection of the property. The appraisal report is usually received within 7 days. The lender then reviews the report to ensure accuracy and may request revisions.

-

5. What are some common home appraisal issues? Common appraisal issues include discrepancies between the appraised value and purchase price and property condition issues that need to meet minimum standards. These issues may require negotiation between the buyer and seller or repairs to be completed before closing.

-

6. What happens when there are appraisal issues? If appraisal issues arise, solutions may involve renegotiating the purchase price, requesting an appraisal rebuttal, or ordering a second appraisal. However, lenders are limited in ordering additional appraisals, and borrowers need help paying them.

-

7. Are appraisal issues common during the home buying process? While appraisal issues can occur, they are not necessarily common. However, they are an important aspect of the home-buying process. They should be addressed promptly to ensure a smooth transaction.

-

8. How can buyers avoid appraisal issues? Buyers can minimize appraisal issues by conducting due diligence before ordering an appraisal, ensuring the property meets minimum standards, and being prepared to negotiate if discrepancies arise.

If you have further inquiries about appraisal issues or other mortgage-related topics, feel free to contact Gustan Cho Associates at 800-900-8569, text for a faster response, or email at alex@gustancho.com. Our team is available seven days a week to assist you.

This blog about Appraisal Issues During Home Buying and Mortgage Process was updated on April 8th, 2024.

I want to get a nice home, but I’m not sure how to choose one that I can afford. It makes sense that working with an appraiser would be beneficial! That seems like a good way to ensure that I get everything together properly. I want to thank the great articles from Gina Pogol of Gustan Cho Associates for her writing about mortgages and credit boosting.

Hello. Good afternoon. If I am working part time now for over two years, and now also have a full time job for about 45 days, can both incomes be used to qualify for a mortgage? The full time job started 45 days ago. The part time job I have had for over 2 years. I am working at both jobs now together (part time and full time). Please let me know. Thank you so much.

To have both jobs count, you need to have been at both jobs for 2 years. You can use your full time job but not your part time job.

Buying a home from an estate with a conventional loan. Structure is sound and dry, but has some soffit and guttering issue. Will this affect my ability to close? I offered more than several cash buyers and the seller would revert to them before making any repairs. Thanks, Ken.

It will be noted on the appraisal if the issue needs to be fixed.

It’s good to know that an underwriter will look at the appraiser’s remarks thoroughly. That could help a homeowner get the best price possible. Or it could work against them depending on the appraiser.

Good morning,

I’m reaching out because we would like to talk about our options to refinance our 1st and 2nd mortgage. I’ve listed some basic information as a start.

There are a couple of things I’d like to share so you are aware:

1) Our credit report shows we have not been late with our primary mortgage since August 2020. However, our credit report shows 21 late payments prior to August 2020 From November 2018 to February 2019, we were making partial payments as part of our forbearance agreement with SPServicing. When the forbearance period was over, we resumed our regular payments – however – we were unable to pay in full the amount past due. Though we paid our mortgage monthly, SPServicing continued to report us as late to the credit reporting agencies because of the portion of the mortgage that was not paid as part of the forbearance. We are current and there are no late fees on our account. We can provide proof upon request. Can you refinance a mortgage that has 21 late reports but 10 consecutive on time payments in 12 months?

2) Can you refinance a 1st and 2nd mortgage with an estimated LTV of 84%? I’m hearing it has to be 80%.

3) Can you refinance the 1st mortgage only so the LTV is less than 80%? I’m hearing lenders are not pursuing subordinations with 2nd mortgage companies?

I don’t want to waste your time but if you can help – we would sincerely appreciate your assistance.

Our loan matures on August 1st with a balloon rider attached (even though there is a conditional right to refinance rider attached to the note holder will not honor it).

Thank you and I look forward to your reply.

Christy

Dennis Credit Scores:

Experian: 733

Equifax: 752

TransUnion: 742

FICO Score 8: 733

Mortgage Lending: 680

Sandra Credit Scores:

Experian: 724

Equifax: 729

TransUnion: 732

FICO Score 8: 724

Mortgage Lending: 678

Dennis DTI: 44% (co-signer on son’s student loans)

Sandra DTI: 35%

First Mortgage – Spservicing Principal Balance: $324,781.17

Second Mortgage – Shellpoint Mortgage Service Principal Balance: $35,064.76

Zillow Estimated home value: $423,701

Redfin Estimated home value: $426,207

My mom has been thinking about getting the right appraisal for her home because she wants to make sure that it can be sold properly. She would really like to get the work done by a professional because it will allow them to be more effective. I liked what you said about how in the case that the first appraisal is deficient she can order a second one to be done. Good afternoon Gustan,

I hope all is well.

Will you refer me to recommended no tax return requirement super jumbo lenders licensed in New York, please?

I’m sure you’re busy. Thanks in advance for your assistance. I appreciate it. Looking forward to learning more. Here’s to a great day!

All the best,

Craig Adams Tyler