2024 Guide to Low Credit Score Pricing Adjustments: Understanding Your Options to Save on Your Mortgage

Ready to buy or refinance but worried about how your credit score affects your mortgage rate? Don’t stress—understanding low credit score pricing adjustments can help you save on your mortgage. Let’s break down how these adjustments work, what they mean for you, and how to get the best rates, even if your credit score isn’t perfect.

What Are Low Credit Score Pricing Adjustments?

Low credit score pricing adjustments are extra costs that lenders add to your mortgage rate based on your credit score. These fees, known as Loan-Level Pricing Adjustments (LLPAs), help lenders handle the risks of providing loans to borrowers with lower credit ratings. The higher the risk, the more a lender charges to make up for it.

If you have a low credit score, these adjustments could mean a slightly higher rate or extra fees at closing. However, you can manage these costs with the right strategies and work toward a better mortgage deal.

Why Does Credit Score Impact Mortgage Rates?

Your credit score is like your financial report card—it shows how responsible you’ve been with past loans and payments. Lenders use it to predict how likely you are to make timely payments. Generally, a lower score means higher risk and higher risk means higher rates. But there’s good news: you can improve your score and reduce the impact of these adjustments over time.

Worried About Pricing Adjustments Due to Low Credit Scores? Let’s Find the Best Option for You!

Contact us today to learn how we can find the best loan solution with competitive pricing for your credit situation.

Credit Score Tiers and How They Affect Rates

Credit Score Ranges: Lenders typically have “tiers” or ranges for credit scores, each with different pricing adjustments. Here’s a general breakdown of credit score tiers and how they affect mortgage rates:

- Excellent (760-850): Lowest rates, minimal or no pricing adjustments

- Good (700-759): Moderate rates, minor adjustments

- Fair (650-699): Higher rates, moderate adjustments

- Poor (600-649): Higher rates, significant adjustments

- Very Poor (Below 600): Highest rates, steep adjustments

You’ll typically need a 740+ score for conventional loans to secure the best rates. For FHA, VA, and USDA loans, lenders usually require a 680+ score to qualify for favorable terms. However, these programs often have more lenient requirements than conventional loans.

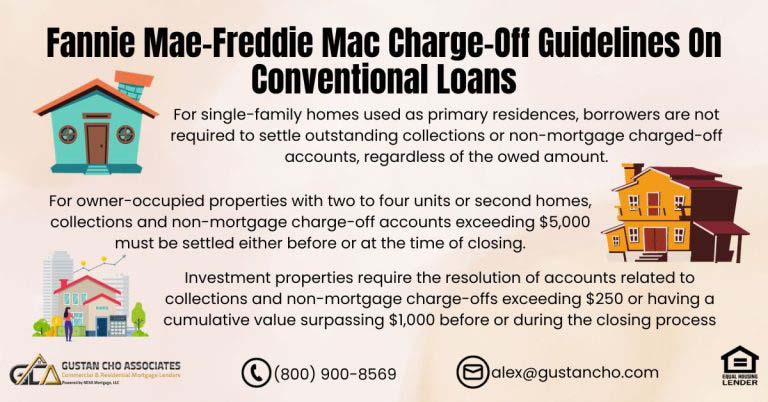

How Pricing Adjustments Work for Different Loans

- Conventional Loans: Conventional loans base pricing adjustments on both credit score and loan-to-value ratio (LTV). If your LTV is above 80% (meaning your down payment is less than 20%), you’ll see extra adjustments that increase your rate. These adjustments reflect the additional risk of a lower down payment.

- Government Loans (FHA, VA, USDA): The good news? FHA, VA, and USDA loans generally don’t apply pricing adjustments for low down payments. These government-backed loans are partially insured, so lenders are protected even if borrowers default. This makes them perfect for individuals with low credit ratings who require adaptable solutions.

Real-Life Example: How Low Credit Score Pricing Adjustments Impact Costs

Let’s say you’re buying a $200,000 home with an FHA loan and putting down 3.5%:

- Borrower A (720 credit score): Quoted a 4.25% rate with no discount points.

- Borrower B (580 credit score): Quoted a 5.5% rate and must pay 2% discount points (around $4,000 in fees).

Borrower B’s lower credit score means a 1.25% higher rate and extra fees. Improving their score to 620 could save Borrower B from paying those points. This example highlights how improving your credit score can significantly affect your pay.

2024 Updates on Low Credit Score Pricing Adjustments

New Guidelines for Loan Pricing Adjustments in 2024: In 2024, lenders are introducing new credit scoring models that include more comprehensive factors, like rental payment history, which can benefit borrowers with limited credit histories. Additionally, lenders are using inclusive methods to reduce pricing adjustments for borrowers actively improving their financial situations.

Strategies to Manage and Reduce Pricing Adjustments

Improving your credit score can reduce or even eliminate these adjustments, saving you thousands. Here are some easy, actionable steps:

1. Pay Down Debt

Reducing your credit utilization ratio—the amount of credit you’re using compared to your limit—can improve your score. Aim to keep it below 30% of your total credit limit.

2. Make On-Time Payments

Payment history is a big part of your score. Every on-time payment boosts your credit and shows lenders you’re reliable.

3. Dispute Credit Report Errors

Errors in your credit report can hurt your credit score. Check your report once a year and dispute any discrepancies.

Other Factors That Affect Loan-Level Pricing Adjustments

It’s not just your credit score that impacts your mortgage rate. Other factors can lead to adjustments, such as:

- Type of Property: Condos and multi-family homes often have higher pricing adjustments than single-family homes.

- Loan Amount: Loans under $200,000 may see slight adjustments since they’re considered higher risk for lenders.

- High Debt-to-Income Ratio: Borrowers with higher debt-to-income ratios face more adjustments, as lenders see them as more likely to miss payments.

What Are Discount Points, and Should You Buy Them?

Discount points provide an opportunity to “buy down” your interest rate, offering a significant advantage if you’re facing a higher rate due to credit challenges. Each discount point represents 1% of the total loan amount and generally reduces your interest rate by about 0.25%. Here’s how this process works:

If your loan is $200,000 and you buy one point (1%), you’ll pay $2,000 upfront and reduce your rate by 0.25%. Buying points can make the monthly payment more affordable for many low-credit borrowers.

When Should You Buy Discount Points?

Buying discount points can be a wise choice if you intend to live in your home for an extended period. On the other hand, if you expect to refinance in a few years, it may be more advantageous to conserve your cash and forgo the points.

Low Credit Score Pricing Adjustments Got You Concerned? We Have Solutions for You!

Contact us today to learn how we can help you navigate pricing adjustments and secure a mortgage that fits your budget.

Alternative Loan Programs for Low Credit Borrowers

Some programs are specifically designed to help borrowers with low credit scores:

- FHA Loans: FHA loans are an appealing choice for borrowers with credit scores starting at 580. These loans offer flexible options and do not impose pricing adjustments for lower down payments, making homeownership more accessible to a broader audience.

- VA Loans: If you’re a veteran, VA loans often offer competitive rates without steep credit score requirements or pricing adjustments.

- Non-QM Loans: These are non-traditional loans for borrowers with unique financial situations, like self-employed individuals. While rates are typically higher, non-QM loans may be an option if you don’t meet standard requirements.

Finding the Best Mortgage Rate with Low Credit Score Pricing Adjustments

- Shop Around for Lenders: Each lender has different policies on low credit score pricing adjustments. By comparing quotes from several lenders, you can find the best rate available for your situation.

- Consider a Larger Down Payment: A bigger down payment lowers the loan-to-value ratio, which can counterbalance certain pricing changes. This can assist you in obtaining a more favorable rate even if your credit score is not great.

- Explore Lender Credits: Some lenders offer credits to help cover closing costs. While these may increase your rate slightly, they can offset upfront fees, which is helpful if you need to minimize out-of-pocket expenses.

What to Expect at Closing with Low Credit Score Pricing Adjustments

When it’s time to close, be prepared for any upfront fees or adjustments due to your credit score. Here’s a checklist to help you stay prepared:

- Review Your Loan Estimate: This document will list all fees and adjustments, including any based on your credit score.

- Ask About Lender Credits or Points: Make sure you understand your options for paying (or avoiding) extra costs.

- Finalize Your Interest Rate Lock: Locking in your rate protects you from market changes. This is especially useful if your rate has pricing adjustments.

Key Takeaways on Low Credit Score Pricing Adjustments

If your credit score is holding you back from the best mortgage rate, there are ways to work around it. Improving your score, making a larger down payment, or shopping around can help you secure a favorable deal. Working with a knowledgeable loan officer can make all the difference in managing these adjustments and getting a mortgage that fits your budget.

Ready to secure the best mortgage rate? Connect with a mortgage expert at Gustan Cho Associates to explore your options for low credit score pricing adjustments and take the first step toward your new home.

Frequently Asked Questions About Low Credit Score Pricing Adjustments:

Q: What are Low Credit Score Pricing Adjustments?

A: Low credit score pricing adjustments are extra fees or higher interest rates that lenders impose on your mortgage when your credit score is below average. These adjustments help lenders cover the added risk of lending to borrowers with lower credit.

Q: Why Does a Low Credit Score Mean Higher Mortgage Costs?

A: A poor credit score indicates a greater risk to lenders. To mitigate this risk, lenders might apply higher interest rates or additional charges, referred to as low credit score pricing adjustments.

Q: Can I Still Get a Good Mortgage Rate with a Low Credit Score?

A: Absolutely! It’s possible to secure a mortgage even with a poor credit score. However, you might encounter pricing adjustments due to that low score. Enhancing your credit score, raising your down payment, or exploring different lender alternatives can assist you in obtaining a more favorable interest rate.

Q: How do Low Credit Score Pricing Adjustments Affect my Monthly Payment?

A: These adjustments can increase your interest rate, which raises your monthly payment. Even a small increase in the rate due to low credit score pricing adjustments can make a noticeable difference in your monthly payment.

Q: Are There Any Mortgage Programs that Help Borrowers with Low Credit Scores?

A: Yes, loan programs such as FHA and VA are intended for borrowers with lower credit ratings and typically include fewer pricing adjustments for low credit scores than conventional loans.

Q: Can I Lower the Impact of Low Credit Score Pricing Adjustments?

A: Improving your credit score, making a larger down payment, and shopping around for lenders can help you reduce or avoid some of the costs of low credit score pricing adjustments.

Q: What is a “Discount Point,” and How Can it Help Me?

A: A discount point is an upfront fee that lowers your interest rate. Paying points can help you offset the impact of low credit score pricing adjustments, making your mortgage more affordable over time.

Q: Does the Type of Property I Buy Affect Low Credit Score Pricing Adjustments?

A: Yes, certain properties like condos or multi-family homes may have higher pricing adjustments than single-family homes, especially if you have a low credit score.

Q: How Much Difference Does a Higher Credit Score Make on my Mortgage Rate?

A: An improved credit score can significantly reduce your interest rates and fees. With each increase in score tier, you may see fewer low credit score pricing adjustments, resulting in lower costs.

Q: Can I Refinance to Remove Low Credit Score Pricing Adjustments in the Future?

A: Yes, once your credit score gets better, you can refinance to lower your rate and reduce any extra costs from low credit score pricing adjustments applied to your initial loan.

This blog about “Low Credit Score Pricing Adjustments on Mortgage Loans” was updated on November 7th, 2024.

Concerned About High Mortgage Rates Due to Your Credit Score? Let’s Talk About Your Options!

Reach out today to discuss how we can help you get a mortgage despite low credit.