Is Now A Good Time For Buying A House With Rising Mortgage Rates? Gustan Cho Associates have been following the mortgage market closely. There has been quite a bit of news surrounding the key financial sectors of the United States economy including the housing market in recent weeks. Since the housing market is a major pillar of our economy, we would like to focus this article on the advice we have to start off the calendar year of 2022 with relation to mortgage lending. In this blog, we will detail some housing trends, mortgage rate market trends, and a few pieces of advice our team has to offer.

Is Now A Good Time For Buying A House With Rising Mortgage Rates: Volatile Rates

We follow the mortgage markets with a magnifying glass. Since the housing market drives our daily operations, it is important that we stay up to date on market trends. We would like to share our opinions of the housing market with you. Many experts feel the housing market is in for some twists and turns during 2022. We are now one month into the new year, and we have seen quite a bit of turmoil. And based on the research I have completed; housing experts and economists seem to be split on predictions for the growth of the housing market in 2022.

Will Rising Rates Be Permanent?

There seems to be an even split with experts who think the year-over-year sales growth in 2022 will continue on the trajectory we are on versus those experts who expect a slowdown. There are also numerous experts and economists who think the housing market will remain the same, which may not be a bad thing for potential homebuyers. We are currently in a pandemic era housing market that has been juiced by remote working and extra stimulus added to our economy. Record low-interest rates may be in the rearview mirror, but interest rates are still historically low.

Skyrocketing Home Prices Creating Many Buyers To Get Priced Out of the Housing Market

The rapid appreciation during the COVID-19 coronavirus has sent ripples through the entire housing market. Some areas of the country have seen a 33% appreciation number year over year. These are historic numbers that we have never seen before. If you look at recent history, not too long ago, the United States had a catastrophic housing market collapse. We would like to point out that during the real estate crash of 2008, mortgage guidelines were incredibly loose, and we are in a completely different environment. During the last crash, thousands of Americans were in adjustable-rate mortgages and saw their payments skyrocket which made their homes unaffordable.

Is Now A Good Time For Buying A House With Rising Mortgage Rates: Is It A Good Time To Buy A House In 2022?

Currently, the majority of Americans are in a 30-year fixed-rate mortgage product which will keep their payments more stable. But this does not mean we are 100% in the clear. Since home values have skyrocketed, a slight interest rate increase by the Federal Reserve could price many pre-approved clients out of the housing market. Because homes cost so much, a tick-up in interest rate can significantly increase your monthly payment.

The Ability To Repay Their New Mortgage Payment

We have guideline practices. in place to verify mortgage borrowers have the ability to repay their mortgage loans. Specifically referring to debt to income ratio requirements. The experts who feel the housing market is going to remain strong stated that the additions of inventory, specifically the additions of existing homes as well as new home completions will keep the market strong.

Will The Housing Market Go Through A Downturn?

However, for economists to see a downturn, they stated home affordability and higher interest rates will be the top factor for the housing market to decline. My personal opinion for the housing market in 2022 is we will not see the craziness we saw in 2021. As the year progresses, I think we are going to see a slowdown. We should see a very busy spring season as many families are looking to move their children for the upcoming school year for numerous different reasons, including pandemic restrictions for their children. After the spring, I feel like home sales will slow to a more normalized pace.

Federal Reserve Board Announce They May Hike Interest Rates as Many as 7 Times

Since the Federal Reserve has announced that they may hike interest rates as many as seven times during the calendar year, home affordability is going to tighten significantly. The Federal Reserve hiking interest rate is a tool used to curb inflation. The Federal Reserve is slowing purchases of mortgage-backed securities, which is going to have more of an effect on the housing market than the interest rate hikes.

Inflation Rate Out of Control

The Federal Reserve needs to get ahead of inflation and in my opinion, has done a horrible job up to this point. Some Fed members want there to be slow changes while others want a dramatic rate increase to stop inflation quicker. I also don’t feel like home prices will fall but I do think they will steady the pace of appreciation. Unfortunately for first-time homebuyers, this can make it difficult to enter the housing market. As millennials and Gen Z are now ready to purchase homes, these factors must be considered.

Is Now A Good Time For Buying A House With Rising Mortgage Rates: Changes In Mortgage Guidelines

There have been a few changes to mortgage guidelines already this year. Mainly the increased conforming and FHA loan limits across the nation. Since home prices appreciated an average of 18% across the nation, so did the conforming loan limits as well as the FHA loan limits for the calendar year of 2022. The Federal Housing Finance Authority (FHFA) takes year-over-year data of the average median home price across the nation. They then adjust the loan limits accordingly.

For the calendar year of 2022, lenders now have conforming loan limits of $647,200 and an FHA loan limit of $420,680. These are for all standard counties throughout the nation. Depending on where you live, you may be in a high-balance area where the loan limit is even higher.

Tougher Building Regulations

Freddie Mac and Fannie Mae have also updated their condominium requirements for homeowner associations. This change went into effect on the first of the year. And now, association management companies will have changed how they report the financial health of their association. This change comes because of the horrible tragedy that happened in Florida in 2021, where a condominium building collapsed.

Building Safety Standards

The Surfside condominium complex was a 12-story beachfront condominium in a Miami suburb. Nearly 100 people died from this tragedy. This was an eye-opening event for the condominium deferred maintenance requirements for the major mortgage-backed security firms, Fannie Mae and Freddie Mac. Fannie Mae and Freddie Mac purchase the majority of mortgage-backed programs on the secondary market in the United States.

Fannie Mae and Freddie Mac Responsibility In Keeping Housing Market Liquidity

It is estimated that these two entities purchase or guarantee about 70% of all mortgages in the United States. The additional requirements that must be completed by the condominium project include questions surrounding deficiencies that may cause the building to be evacuated for seven days or longer, a condo that is in need of substantial maintenance which could impact safety her habitability, note any repairs needed for major components of the project, a note of any repairs of the projects major structural mechanical elements, and if the project has failed to receive a certificate of occupancy or pass any local regulatory inspections or re-certifications. The additional information required by these associations is claimed to be temporary per Fannie Mae and Freddie Mac, however, there is no end date on this extra information requested.

Loan Level Pricing Adjustments on Mortgage Rates On Second Homes

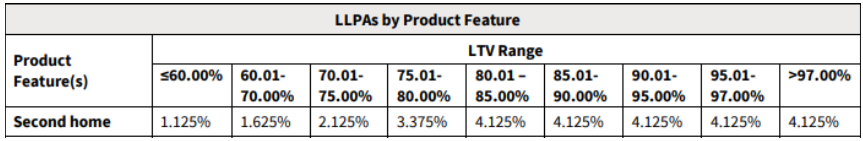

There have also been significant changes for conventional mortgage lending surrounding second homes in high-balance counties. Fannie Mae and Freddie Mac have added loan level price adjustment (LLPA) surrounding second homes. These dramatic increases will make it significantly more expensive to purchase a second home utilizing a conventional mortgage loan. If you are in the market to purchase a second home, you will experience a loan level pricing adjustment as high as 4.125%. Meaning you must budget for upfront costs accordingly.

Is Now A Good Time For Buying A House With Rising Mortgage Rates: Cost of Buying a Home

Depending on your down payment, purchasing a second home will now cost between 1.125% and 4.125% of the purchase price in extra upfront fees. This is going to have a significant impact and will go into effect on every mortgage loan that is not closed and funded prior to April 1, 2022. So, if you were in the market for a second home, we highly encourage you to get the ball rolling sooner than later.

(THE SCREENSHOT ABOVE IS FROM THE LINK BELOW)

http://singlefamily.fanniemae.com/media/30326/display

There have been some positive changes from Fannie Mae and Freddie Mac this year as well. Recently there has been an update surrounding self-employed individuals. Fannie Mae and Freddie Mac have retired their temporary COVID-19 requirements for self-employed income documentation. In order to get around the previous expanded guidelines, the most recent federal tax returns used for mortgage qualifications may not be older than 2020. What does this mean for self-employed borrowers?

Is Now A Good Time For Buying A House For Self-Employed Borrowers

It means that a profit and loss schedule as well as your three months bank statements are no longer required under the Covid temporary guidance. If your tax returns being used for qualifications are dated before 2020, then the Covid restrictions still apply. Most self-employed mortgage borrowers are required to submit the previous two years of tax returns to qualify. That being said, you should have 2020 completed now and even have the ability to file your 2021 as of January 24, 2022. Gustan Cho Associates are experts in self-employed lending. Feel free to reach out to our team for more information.

Refinancing Your Home Mortgage Before Rates Start To Skyrocket

One last piece of advice is if you plan to refinance your home, we suggest you start the process sooner than later. As the news continues to show rate hikes are in the near future. The Federal Reserve is predicted to raise interest rates numerous times during the calendar year of 2022, starting in March. We would hate to see you miss out on historically low rates. So, if you have attempted to refinance your house and have been turned down, please reach out to us today. We would love to put a second set of eyes on it without lender overlays. And even if we cannot help you today, we will put you on a financial plan to qualify as soon as possible.

Is Now A Good Time For Buying A House With Rising Mortgage Rates: Home Prices Keep Skyrocketing

Home values are currently through the roof. This is a great time to utilize your home equity to pay off other outstanding debts you may have. Consolidating your credit card debt into tax-deductible mortgage interest is highly beneficial. For more information on refinancing please reach out to our refinance expert, Mike Gracz, on (800) 900-8569 or via email at mike@gustancho.com. Gustan Cho Associates are available seven days a week to answer any mortgage-related questions you have. Many of our clients are clueless when it comes to the mortgage process. That is why we recommend you reach out to the experts. There is a ton of contradicting mortgage information online as each lending institution has its own set of lender overlays. We would love the opportunity to help you and your family with your mortgage needs. For any mortgage-related questions please contact Mike Gracz on (800) 900-8569 or you may send an email to mike@gustancho.com. Our team is growing to help serve the needs of all of our clients. We strive for a hassle-free process to get our clients to the finish line. We look forward to hearing from you.