This ARTICLE On Illinois Home Values Decline Due To Rising Property Taxes Was PUBLISHED On December 7th, 2019

Illinois holds the second-place record for having the highest property taxes.

- New Jersey holds the throne as having the highest property tax rate in the Nation

- However, New Jersey’s property taxes have stabilized

- Many counties in Illinois still plan on increasing property taxes to meet its budget deficit

- One example is Chicago

- Chicago is the highest taxed city in the country

- Chicagoans pay an average of 10.75% combined in city, county, and state taxes

- Chicago Mayor Lori Lightfoot is facing a major dilemma on how to balance the city’s budget

- The pension debt and the recently promised Chicago Teacher’s Union contract is bleeding the city

- A panel of economists is warning Chicagoans to plan on multiple property tax increases during Lightfoot’s tenure

- Illinois home values have been dropping due to high property taxes

- While the rest of the Nation is enjoying rising home values, Illinoisans are facing home values dropping due to high property taxes

In this article, we will cover and discuss Illinois Home Values Decline Due To Rising Property Taxes.

Property Taxes Versus Illinois Home Values

Illinois has a history of high property taxes.

- Property owners accept the fact Illinois has the second-highest property tax rate in the U.S.

- So why all this fuss with Illinois property tax rates now?

- The state is in big trouble

- This holds true for Chicago. Illinois Governor J.B. Pritzker and Chicago Mayor Lori Lightfoot exhausted all possible tax increases

- The two also created new taxes for Illinoisans and is counting on the newly passed legislation on marijuana sales which takes effect on January 1st, 2020

- However, with all the tax hikes and newly created taxes, the state still cannot meet its debt obligations

- The city and the state are still broke and are resorting to property tax hikes

- The combination of constant property tax hikes, an economy that is deteriorating, outmigration of businesses and taxpayers is causing Illinois home values to plummet

Why is the U.S. economy and the housing market booming but Illinois is on the verge of bankruptcy and Illinois home values plummeting? The combination of incompetent and inexperienced politicians running the government has a lot to do with it. Public corruption is another big factor why Illinois is losing billions of dollars.

Investing In Real Estate With Illinois Home Values Dropping

A home is most people’s biggest investment in their life.

- Homebuyers have an investment in mind when they purchase their first home

- For most American consumers, the equity in their homes is their biggest net worth

- A home is where a family unit develops and grows

- Most people buy a home so their housing expenses will be stable and will not increase year after year like rent

- However, with rising property taxes with no caps, many homeowners will be uncertain about how much their housing payments will be in the future

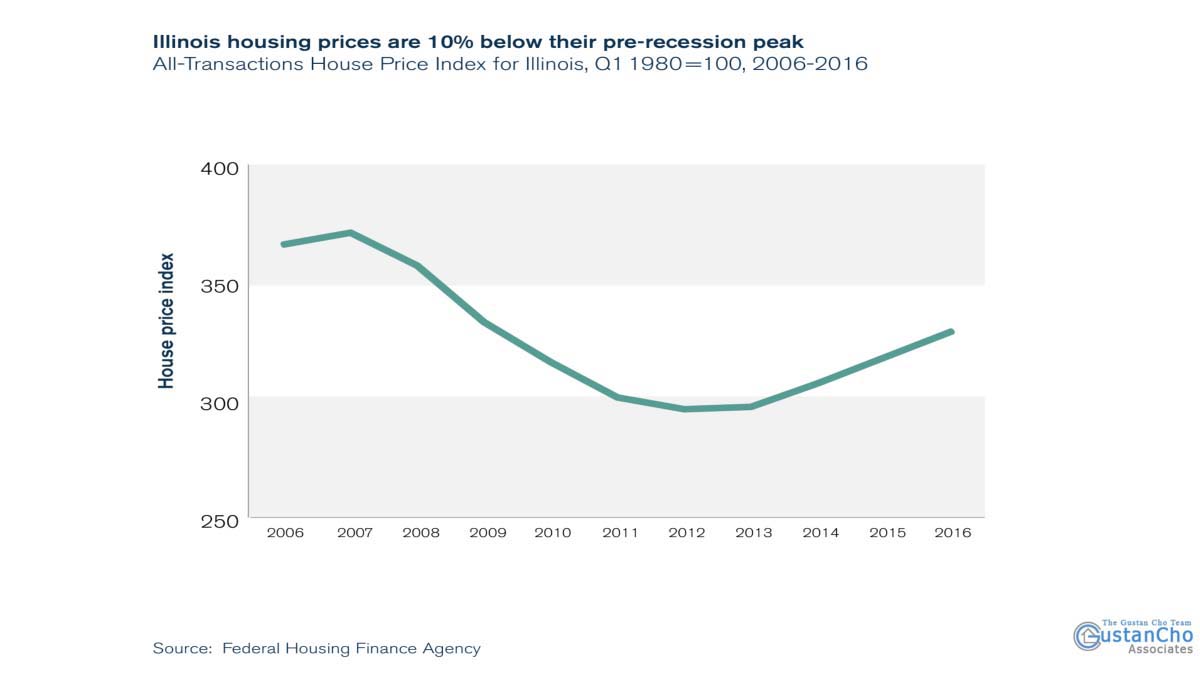

- Data show Illinois home values dropped 10% since 2006

- However, property taxes have increased by more than 51%

See the graph and data below:

Illinois is one of the very few states where home values did not recoup since the 2008 Great Recession.

Sluggish Housing Market

Illinois home values has remained stagnant and is not catching up with the rest of the nation according to data by the Federal Housing Finance Agency.

- Home values is weak statewide but much worse in Chicago

- Common sense says that will lower home values means lower tax rates, right?

- Wrong!!!

- While Illinois home values dropped, property taxes increased by more than 51% alarming many homeowners

- According to data by the Bureaus of Economic Analysis, nonfarm personal income only rose by 10% over the above time period

The data has been adjusted for inflation.

Continuing Property Tax Hikes Alarming Taxpayers

Property taxes are growing at a rate of six times faster than Illinoisans household incomes, making the bills drive down Illinois home values.

Property taxes are used to pay government services. Funding for public schools, police, fire, parks, and city maintenance is paid with property tax revenue. City services benefits homeowners and businesses so property taxes is necessary.

High Property Taxes Has Negative Impact To Home Values

Recent research shows high property taxes impacts Illinois home values.

- Mismanagement and inexperienced politicians can often lead to higher overall taxes

- Government leaders should have experience in running an organization

- It is not how much you make but what you spend

- This is why communities who have budget surpluses and low taxes have government leaders who have run larger businesses and/or government agencies

Illinoisans Fleeing To Other Lower Taxed States

More Illinoisans are thinking of fleeing Illinois to other lower taxed states such as Indiana, Tennessee, Kentucky, Texas, Georgia, Florida, North Carolina, Alabama.

- Changes in the state’s population affects housing values

- With countless businesses and residents leaving Illinois to other lower taxed states, this is creating changes in housing demand

- Lower demand for housing means lower property values

- Increase of population and inmigration of businesses creates higher housing demand for the state

With the exodus of Illinoisans due to high property taxes means lower housing demand and therefore lower real estate values.

Illinois Financial Crisis And Solutions

Illinois Governor J.B. Prtizker, Mayor Lori Lightfoot, and thousands of politicians seem lost and clueless to solving the financial mess city, county, and the state government is in.

- More Illinoisans are moving out than moving in

- Increasing taxes and creating new taxes is not the way to attract new businesses and residents

- What good is it to tax Illinoisans high tax rates when there is mass exodus of businesses and taxpayers fleeing to other low taxed states?

Government leaders do not seem to understand this basic concept.

Follow The Business Model Of Lower Taxed States

Low taxed states like Florida (no state income taxes) and dozens of others are raking in billions and have not debt due to low taxes. Illinois needs to reduce not just property taxes but other taxes across the state in order for the housing market to come back.

Illinois is a great state that needs a total financial overhaul. To start with, Illinois politicians should set their pride aside and follow the lead of governors of profitable states. What are they doing right that Illinois is not. Politicians cannot have egos during this time in crisis in Illinois. If they are not qualified, they need to make way of competent experienced public servants who can handle the job.