How To Get a Mortgage in Puerto Rico: Your Guide

Are you ready to trade chilly winters and high federal taxes for sunny beaches, a warm climate, and incredible tax savings? More people from the mainland United States are moving to Puerto Rico, and it’s easy to see why. With no federal income tax and stunning scenery, Puerto Rico is quickly becoming a dream destination for homebuyers.

But how do you get a mortgage in Puerto Rico? We’re here to walk you through the entire process and show you how easy it can be to purchase or refinance a home in Puerto Rico in 2025.

Whether you’re looking to settle down or invest in real estate, getting a mortgage on the island isn’t much different than what you’re used to in the U.S. Let’s explore everything you need to know about securing a mortgage in Puerto Rico.

Can I Get a Mortgage in Puerto Rico Using a U.S. Loan?

Absolutely! Since Puerto Rico is a U.S. territory, homebuyers can access all U.S. mortgage loans. This includes government-backed loans like FHA, VA, and USDA loans, as well as conventional mortgages. You can even explore non-QM loans (non-qualified mortgages), which are great if you have a unique financial situation, such as being self-employed or having a lower credit score.

The good news is that many mortgage brokers, like Gustan Cho Associates, are licensed to help you secure a loan for a property in Puerto Rico. Whether you’re buying a home for the first time, refinancing, or looking for an investment property, they’ve got you covered. They specialize in helping borrowers with all credit profiles, including those with credit scores as low as 500.

Ready to Own a Home in Puerto Rico? Let’s Make It Happen!

Contact us today to explore your financing options and start your journey to homeownership.

Why Buy a House in Puerto Rico?

Puerto Rico is an attractive location for purchasing real estate for numerous reasons. Here are a couple of them:

- Tax incentives: Puerto Rico offers great tax benefits for investors. Residents do not pay federal income tax, and there is no capital gains tax. Instead, you only pay 4% of your income to Puerto Rico, which is a significant savings compared to most U.S. states.

- Affordable housing: Homes in Puerto Rico are still more affordable than many areas in the U.S. While prices are rising, you can still find properties that fit various budgets.

- Tropical paradise: With breathtaking beaches, lush landscapes, and a warm climate year-round, living in Puerto Rico can feel like a permanent vacation.

Whether you’re moving for a slower pace of life or looking to invest in real estate, Puerto Rico offers something for everyone.

How To Get a Mortgage in Puerto Rico: The Step-by-Step Process

Getting a mortgage in Puerto Rico is similar to the process on the U.S. mainland, but there are a few key steps you should know about to make it easier. Let’s break it down step by step:

1. Get Pre-Qualified

Before you start looking for a home, get pre-qualified for a mortgage. This helps you know how much money you can borrow and your mortgage rates. Different lenders have different requirements, so it’s a good idea to compare them to find one that suits your needs.

At Gustan Cho Associates, we assist homebuyers with various credit situations. Regardless of whether your credit score is low or you have significant debt, we can link you with lenders that provide FHA, VA, USDA, and non-QM loans to assist you in getting pre-qualified for a mortgage in Puerto Rico.

2. Find a Real Estate Agent

Once pre-qualified, it’s time to find a real estate agent who knows the Puerto Rico market. Real estate agents are less common in Puerto Rico than in the U.S., so it’s important to find someone knowledgeable about local property laws and neighborhoods. Since Spanish is the primary language on the island, look for a bilingual agent if you are not fluent in Spanish.

3. Make an Offer

Once you’ve found the right home, your agent will help you make an offer, just like in the mainland of the U.S. Your agent will talk to the seller to get you the best deal in terms of price and conditions.

4. Get Pre-Approved

Before final approval, your lender will carefully check your income, credit, and financial situation. This step is crucial because it confirms your financing and ensures you’re prepared to purchase.

5. Home Inspection

Just like in the U.S., you’ll want to have the home inspected to ensure no major issues could cost you later. Your agent can help you find a reputable home inspector in Puerto Rico.

6. Closing

It’s time to close on your new home! In Puerto Rico, the closing process usually takes 15 to 45 days. Both the buyer and seller need to be at the closing, which takes place at the lender’s office. You will sign the necessary papers, pay closing costs, and officially become a homeowner!

Mortgage Options Available in Puerto Rico

One of the biggest questions homebuyers ask is, “What types of mortgages can I get in Puerto Rico?” The great news is that there are plenty of options available, including:

- FHA Loans: These are excellent options for first-time buyers or individuals with lower credit scores. A lower down payment, sometimes as little as 3.5%, is needed, and they are open to buyers with credit scores of 580 or more.

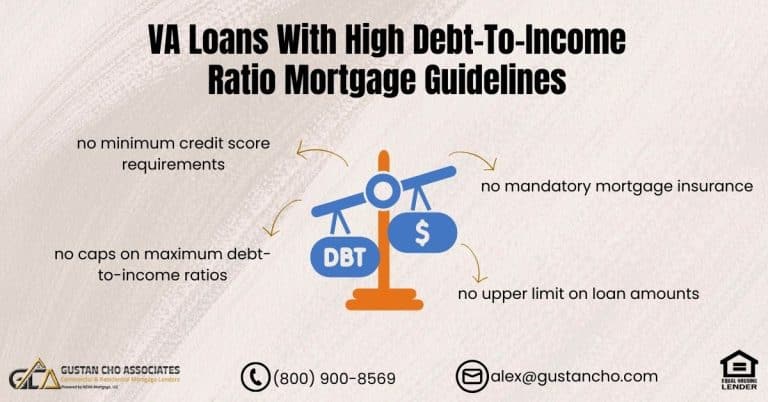

- VA Loans: If you’re a veteran or active-duty service member, you can take advantage of VA loans, which offer zero down payment and competitive rates.

- USDA Loans: If you’re buying a home in a rural area, USDA loans offer 100% financing with no down payment. Puerto Rico has several rural areas that qualify for this program.

- Conventional Loans: These loans are standard and usually necessitate better credit scores and larger down payments, but they might offer reduced interest rates.

- Non-QM Loans: If you’re self-employed, have poor credit, or need a special loan, non-QM loans might be the right choice. Gustan Cho Associates focuses on these loans, which include bank statement loans, no-doc loans, and DSCR loans for investors.

How To Get a Mortgage in Puerto Rico With Bad Credit

If you have bad credit, don’t worry. You can still get a mortgage in Puerto Rico. Gustan Cho Associates specializes in helping buyers with low credit scores, high debt-to-income ratios, and even past financial issues like charge-offs and collections.

Here’s how you can still qualify for a mortgage in Puerto Rico, even with bad credit:

- FHA Loans: These loans are available for borrowers with credit scores as low as 500. FHA loans may be your best bet if you have a higher debt-to-income ratio.

- Non-QM Loans: If you don’t meet traditional lending guidelines, a non-QM loan can help. These loans don’t require tax returns or pay stubs, and you can qualify using bank statements, assets, or rental income.

At Gustan Cho Associates, we have access to hundreds of non-QM loan programs that allow people with bad credit to get a mortgage in Puerto Rico.

Dreaming of a Home in Puerto Rico? Let’s Turn That Dream into Reality!

Contact us today to get personalized assistance and find the best financing options for your new home.

Finding the Right Neighborhood in Puerto Rico

When buying a home in Puerto Rico, location is everything. There are several key areas to consider, each offering something unique:

- San Juan: The capital city, offering a mix of urban living and cultural attractions. It’s the largest city in Puerto Rico, and home prices have steadily risen.

- Dorado: Just outside San Juan, Dorado provides a peaceful way of life while remaining easily accessible to the city. Families looking for top-notch schools and a relaxed environment will find this a perfect choice.

- Palmas Del Mar: A gated community in Humacao, perfect for those seeking a luxury lifestyle. Palmas Del Mar offers beachfront homes, golf courses, and private schools.

No matter your chosen location, working with an experienced agent to locate the ideal home in the perfect neighborhood is important.

Why Choose Gustan Cho Associates?

When buying a home in Puerto Rico, you want to work with a lender who understands the island’s unique market. Gustan Cho Associates is widely known nationwide for assisting individuals in obtaining mortgages that may not be available through other lenders. With no lender overlays, access to over 210 wholesale lenders, and experience with non-QM loans, we’re the go-to resource for homebuyers in Puerto Rico.

We work with clients seven days a week, including evenings, weekends, and holidays. Whether you have bad credit, need a non-QM loan, or want expert guidance, we’re here to help.

Ready to Get a Mortgage in Puerto Rico?

The time to begin your homebuying journey in Puerto Rico is now if you are prepared. Home prices are rising, but they’re still affordable compared to many U.S. markets. Whether you’re looking for a vacation home, investment property, or a place to settle down, Puerto Rico offers incredible opportunities.

Get pre-qualified today by contacting Gustan Cho Associates at 800-900-8569 or filling out our online form. We’ll guide you through the process and show you how easy it is to get a mortgage in Puerto Rico in 2025.

Frequently Asked Questions About How to Get a Mortgage in Puerto Rico:

Q: Can I Get a Mortgage in Puerto Rico with a U.S. Loan?

A: Yes! Since Puerto Rico is a U.S. territory, you can access all U.S. mortgage loans, including FHA, VA, USDA, and conventional loans. The process is very similar to getting a mortgage on the U.S. mainland.

Q: What are the Steps to Getting a Mortgage in Puerto Rico?

A: The process starts with getting pre-qualified, finding a real estate agent, making an offer on a home, getting pre-approved, inspecting the home, and finally closing the deal. It’s almost the same as buying a home in the U.S.

Q: How Can I Get a Mortgage in Puerto Rico with Bad Credit?

A: You can still get a mortgage in Puerto Rico even with bad credit. Options like FHA loans (with scores as low as 500) or non-QM loans for unique situations can help you get approved.

Q: What Types of Mortgages are Available in Puerto Rico?

A: There are several options, including FHA loans (low down payment), VA loans (zero down payment), USDA loans (100% financing in rural areas), conventional loans, and non-QM loans for self-employed or bad credit borrowers.

Q: How Much Do Homes in Puerto Rico Cost Typically?

A: The price of homes varies based on location. In popular areas like San Juan and Dorado, average home prices range from $175,000 to $319,000.

Q: Can I Get a Mortgage in Puerto Rico if I’m Self-Employed?

A: Yes, you can! Non-QM loans are ideal for self-employed borrowers who need traditional income documentation like tax returns. You can qualify using bank statements or assets.

Q: Do I Need a Bilingual Real Estate Agent in Puerto Rico?

While not required, having a bilingual real estate agent in Puerto Rico is beneficial, particularly if you are not fluent in Spanish. This guarantees seamless communication during the purchasing process.

Q: How Long Does it Take to Close on a Home in Puerto Rico?

A: The closing process typically takes 15 to 45 days, similar to the U.S. mainland. Both the buyer and seller must be present during the closing, which takes place at the lender’s office.

Q: What are the Best Neighborhoods in Puerto Rico to Buy a Home?

A: Some top areas include San Juan for urban living, Dorado for a quieter lifestyle close to the city, and Palmas Del Mar for luxury beachfront living.

Q: Why Should I Choose Gustan Cho Associates to Get a Mortgage in Puerto Rico?

A: Gustan Cho Associates helps buyers with different credit histories and financial situations. They have access to over 210 wholesale lenders and can help you get a mortgage that fits your needs, even if you’ve been turned down elsewhere.

This blog about “Easy Guide on How To Get a Mortgage in Puerto Rico in 2025” was updated on October 11th, 2025.

Planning to Relocate to Puerto Rico? Secure Your Mortgage with Confidence!

Contact us today to learn about the mortgage options available to you and get pre-approved for your new home.