This ARTICLE On Housing Starts Decrease In July But Permit Numbers Increase Was PUBLISHED On August 23rd, 2019

Housing Starts Decrease In July 2019 which sent mixed signals to real estate and mortgage industry analysts and experts.

- Data released earlier this week showed that new construction of homes dropped 4% in the month of July

- However, real estate and mortgage experts do not expect this trend to continue due to increased new construction building permit applications by home builders nationwide

- Many were surprised to see that the new construction of homes dropped more than 4.0% in July 2019

- This marks the second-lowest rate for this year

- Many are not concerned due to the builder’s permit application rose than previous months

- This is a positive sign of increased housing starts in the coming months

In this article, we will cover and discuss housing starts decrease in the month of July 2019 and how it affects the housing markets in the near future.

Analyzing Housing Starts Decrease Data

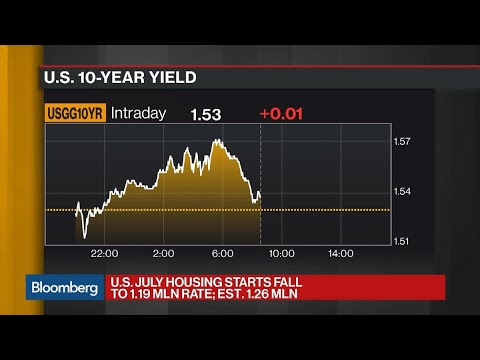

Data from the U.S. Commerce Department suggests housing starts decrease in July from the previous month. Housing starts decrease to an annual rate of 1.191 million in July 2019 from 1.241 the previous month of June. Investors and market experts were expecting an annual rate of 1.25 million housing starts for the month of July.

Mortgage Rates are at a 36-month low. Par mortgage rates today are at 3.55%.

Housing Market And Mortgage Rates Today

Mortgage rates are at a 3-year low. Home prices are increasing. Both HUD and the FHFA increased FHA and Conforming Loan Limits for the past three years due to increasing home prices. Mortgage rates have been sliding since the beginning of 2019. Today’s mortgage rates are at 3.55% as of today August 23rd, 2019. Low mortgage rates are now making home affordability for home buyers. This holds especially true for first time home buyers. Most homebuyers who closed on their home loans last year in 2018 can get a net tangible benefit today by refinancing.

For more information about the contents of this article and/or other mortgage-related topics, please contact us at Gustan Cho Associates at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com.