This guide covers skyrocketing home prices due to the housing shortage facing homebuyers. The U.S. is facing a severe housing shortage of homebuyers and skyrocketing prices. The housing market was booming before the coronavirus outbreak in February 2020. All states had governors exercise their executive stay-at-home orders and were shut down.

Under the watch of President Donald J. Trump, unemployment rates hit historic lows. However, the U.S. economy took a hit for the worse under the watch of Joe Biden. At its peak, over 50 million Americans filed for unemployment.

The unemployment rate was under 3.5% before the coronavirus pandemic. At its peak, the unemployment rate is close to 20% in the U.S. However, the economy rebounded under the leadership of President Donald J. Trump and his administration. After Joe Biden wormed his way to the presidency, the economy went haywire and downhill. In the following paragraphs, we will discuss the reasons for the housing shortage in the United States.

What Is Causing The Housing Shortage in the United States

The housing shortage in the United States is a complex and persistent issue affecting many parts of the country for several years. This shortage is characterized by a lack of affordable and available housing options, especially in high-demand urban areas. There are several key factors contributing to the housing shortage.

NIMBYism (Not In My Backyard): Opposition from residents who do not want new housing developments in their neighborhoods, often referred to as NIMBYism, can hinder the construction of affordable housing projects.

The U.S. population has been steadily growing, driven by natural population increase and immigration. This population growth has increased the demand for housing in many areas. The construction of new housing units has not kept pace with the growing demand. Various factors contribute to slow construction, including zoning regulations, land use policies, labor shortages, and supply chain disruptions.

Zoning and Land Use Regulations

Building new homes has increased due to rising construction material prices, labor costs, and regulatory requirements. These higher costs can deter developers from building affordable housing. Local governments, state governments, and the federal government all play roles in addressing this issue.

Policy solutions can include zoning reforms, tax incentives, subsidies for affordable housing development, and efforts to reduce construction costs.

Zoning and land use regulations can limit the housing density in certain areas, making it difficult to meet the housing demand in high-demand urban centers. Some argue that these regulations need to be reformed to allow for more housing construction. In the following paragraphs, we will discuss skyrocketing home prices due to the housing shortage facing an uncertain U.S. economy.

Gentrification and Economic Factors

In some cases, the redevelopment of urban neighborhoods and the influx of more affluent residents can drive up property values and displace lower-income residents, exacerbating the housing shortage for vulnerable populations.

Economic conditions, such as low-interest rates and the availability of financing, can influence housing demand and affordability.

The housing shortage has significant consequences, including rising home prices, increased rents, homelessness, overcrowding, and housing instability. It disproportionately affects low-income individuals and families who struggle to find affordable housing options. Efforts to address the housing shortage typically involve policy changes, increased funding for affordable housing programs, and incentives for developers to build more affordable units.

Surging Home Prices Despite Housing Shortage and Political Unrest

The U.S. has a new president, Joe Biden. There is a lot of talk that Joe Biden and countless democrats have cheated in the 2020 election. Fact-checking is in progress, and we will soon find out whether we have a real president or a fake president who cheated. Time will tell whether or not Biden and Harris cheated to get elected.

The first nine months under the Biden Administration have been disastrous. The border wall construction has been halted indefinitely.

However, the housing market is strong. There is a housing shortage in the United States. Mortgage rates are still at historic lows. The unemployment rate today is under 5%. The economy is booming despite the policies of Joe Biden and Kamala Harris, which is setting the country back. Inflation has skyrocketed. Biden and Secretary of State Antony Blinken have decimated Afghanistan due to their poor leadership, killing 13 Americans. The country is headed towards higher interest rates.

Strong Real Estate Market and Housing Shortage

The lowest mortgage rates in the history of the United States fuel the housing market. Mortgage rates are under 3.0% for a 30-year fixed-rate mortgage. Never in the United States have so many renters applied for a mortgage to purchase a home. More homebuyers are looking for a home to purchase than an inventory of homes. Demand is so strong housing prices are rising like never before. Many apartment renters in mismanaged cities like Chicago are fleeing to the suburbs and buying homes.

Housing Shortage Is Skyrocketing Home Prices

Homebuyers are pulling the trigger to purchase a home today rather than waiting. This is mainly due to the lowest mortgage rates in history. 30-year fixed-rate mortgages are under 3.0%. However, homebuyers are facing a major dilemma, which is a major housing shortage and increasing home prices. The housing shortage remains a complex and multifaceted problem that requires ongoing attention and collaboration at all levels of government and with various stakeholders to ensure that housing is accessible and affordable for all Americans.

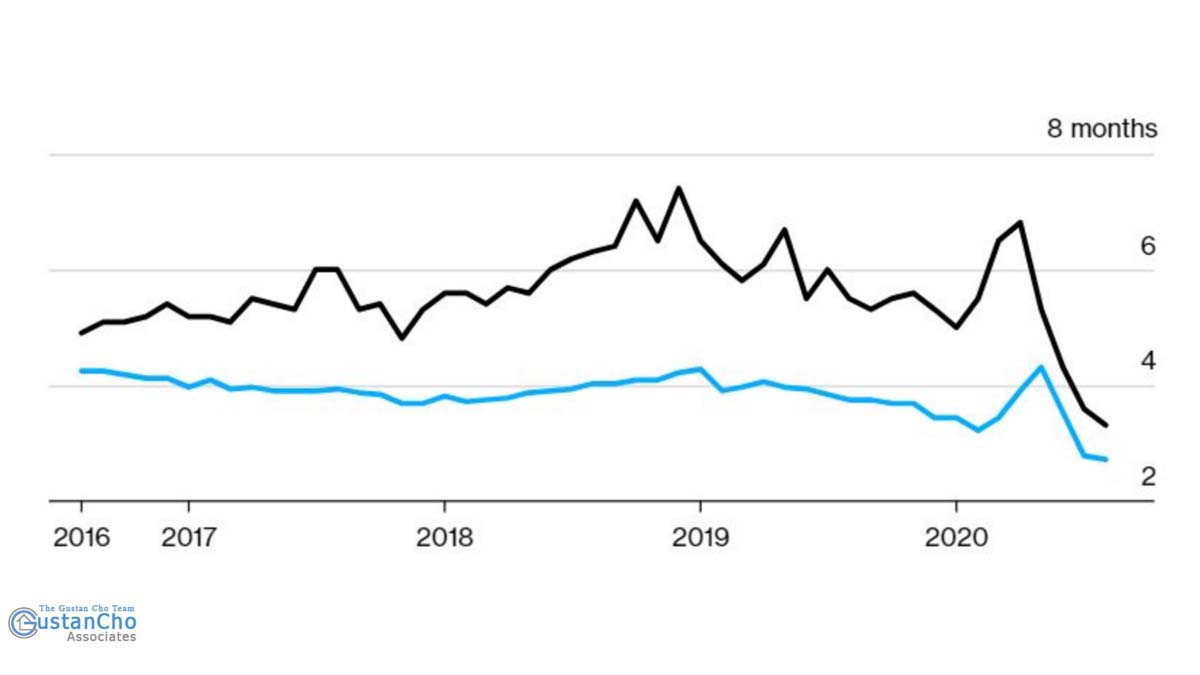

See the graph showing how the inventory of homes is getting scarce:

American Homes Get Scarce: The Decline in months’ Supply of Available single-family homes

Not just analysts but most homebuilders were bracing themselves for another housing meltdown worse than the 2008 financial crisis. Things turned out the opposite way. The coronavirus outbreak created a major exodus of city dwellers to the suburbs. Renters in high-priced apartments started migrating to the suburbs to get more homes for the money and more space.

Chicago, which an incompetent Mayor runs, has never seen the number of taxpayers moving out of the city to the suburbs.

Why would anyone live in a city like Chicago that has major riots, the highest murder rate in the nation, high crime rates, public corruption, high taxes, and incompetent politicians who keep on raising taxes and are clueless about running city government?

What Experts Say About The Housing Shortage of Homes

At the rate of home prices skyrocketing, it will shut many home buyers out of the market. The demand for homes is great. However, a severe shortage of inventory will skyrocket home prices, which will affect first-time homebuyers or homebuyers looking for affordable housing.

The U.S. Department of Housing and Urban Development (HUD) and the Federal Housing Finance Agency (FHFA) have increased the maximum loan limits for the past four years.

Major national homebuilders are thriving with business. However, the construction cost has skyrocketed due to the high cost of lumber and other home-building supplies. Due to the rising costs of lumber and construction materials, homebuilders have no choice but to raise home prices. Homebuilders are hoping and praying the cost of lumber will drop significantly.