Fannie Mae and Freddie Mac Explained: What’s the Difference?

If you’re considering purchasing or refinancing a home, you’ve likely heard of Fannie Mae and Freddie Mac—two major names in the mortgage industry. But what exactly do they do, and how do they differ? Here, we’ll break down the essentials to help you understand the difference between Fannie Mae and Freddie Mac and how they can impact your mortgage options in 2025.

What Are Fannie Mae and Freddie Mac?

In simple terms, Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs) that help make home loans more accessible and affordable. These companies don’t lend money directly to borrowers. Rather, they acquire mortgages from banks and various lenders, which enables those lenders to provide additional home loans at reasonable rates.

- Fannie Mae: The Federal National Mortgage Association was founded in 1938 as part of the New Deal to help stabilize and expand the mortgage market.

- Freddie Mac: The Federal Home Loan Mortgage Corporation was established in 1970 to enhance the mortgage market and increase liquidity in the housing sector.

Why Do Fannie Mae and Freddie Mac Matter?

Fannie Mae and Freddie Mac help millions of Americans buy homes. They do this by buying loans from lenders, which gives those lenders more cash to offer new mortgages. This process helps keep mortgage rates steady and creates affordable financing options, especially for middle-income borrowers.

Ready to Buy a Home? Explore Fannie Mae and Freddie Mac Loan Options Today!

Contact us today to learn how these loan programs can help you achieve homeownership.

Fannie Mae and Freddie Mac: How Do They Differ?

While both companies support homeownership similarly, they do so with slightly different approaches. Here are the primary differences that matter most to borrowers:

1. Types of Loans They Prefer

-

- Fannie Mae typically works with larger banks and focuses on loans for homebuyers with strong credit profiles.

- Freddie Mac often partners with smaller lenders, including credit unions, and may be more flexible with borrowers with moderate credit histories.

2. Underwriting Guidelines

Think of Fannie Mae and Freddie Mac’s underwriting systems as two different grocery store checkouts with their own eligibility rules for accepting coupons.

Fannie Mae’s checkout uses the Desktop Underwriter (DU) system with strict guidelines. If your coupon does not meet these specific requirements, it will be declined.

On the other hand, Freddie Mac’s checkout uses the Loan Product Advisor (LPA) system, which may have more flexible rules. This means that a coupon that didn’t pass Fannie Mae’s system could still be accepted by Freddie Mac’s, particularly if the coupon comes from a larger purchase or has a unique offer attached.

In this way, even if a mortgage application is not approved by Fannie Mae due to factors like a higher debt-to-income (DTI) ratio or fewer credit accounts, it may still have a chance with Freddie Mac, just like some coupons that might work at one store but not another.

3. Debt-to-Income (DTI) Ratio Requirements

As of 2025, Fannie Mae and Freddie Mac have updated their DTI guidelines to improve mortgage access. Here’s a quick comparison:

- Fannie Mae: Typically allows a DTI ratio up to 45% but can go up to 50% if the borrower has compensating factors, such as a higher credit score or additional cash reserves.

- Freddie Mac: Allows a similar range, but its guidelines are more flexible for borrowers with higher DTIs, which can be beneficial if you have a mix of other strong financial factors.

How These Differences Impact You as a Borrower

Understanding the difference between Fannie Mae and Freddie Mac gives you a clearer picture of which lender better fits your financial profile. For instance, if you’re working with a lender and find that you don’t qualify through Fannie Mae’s guidelines, Freddie Mac’s more lenient DTI or credit history requirements could provide an alternative pathway to approval.

Key Benefits of Fannie Mae and Freddie Mac Mortgages

Recently, Fannie Mae and Freddie Mac revised their guidelines to adapt to the evolving demands of the market, facilitating home purchases for individuals with less-than-ideal credit. Let’s take a look at some advantages that they provide to borrowers:

1. Lower Down Payment Options

Fannie Mae and Freddie Mac offer low down payment options—as low as 3% for qualified buyers—through programs like Fannie Mae’s HomeReady® and Freddie Mac’s Home Possible®. These programs are especially valuable for first-time homebuyers or those with limited savings.

2. Competitive Interest Rates

Since Fannie Mae and Freddie Mac buy mortgages in bulk, they help reduce rates, making homeownership more affordable. They aim to keep mortgage payments low, allowing buyers to secure favorable financing terms.

3. Flexible Credit Requirements

Freddie Mac and Fannie Mae are important players in the mortgage lending market, but they have different rules for credit.

Freddie Mac offers more options for homebuyers with lower credit scores or limited credit histories. This means that people who haven’t built much credit or faced financial issues can still get a mortgage.

In contrast, Fannie Mae has stricter rules. They usually require borrowers to have at least three credit accounts, known as “tradelines.” A tradeline is any account on a credit report, such as credit cards, mortgages, or auto loans. Each account shows how well the borrower pays their bills and how much they owe. Fannie Mae looks for borrowers with a stronger credit history, showing they can responsibly handle different types of credit.

In summary, Freddie Mac might be a better choice if you have a weaker credit background. Fannie Mae may be a better fit if you have a solid credit history.

4. Support for High DTI Ratios

For borrowers with higher DTI ratios, Freddie Mac’s guidelines can sometimes be more accommodating, especially if you have other strong financial indicators, such as additional assets or a higher credit score.

Confused About Fannie Mae and Freddie Mac Loan Options? Let Us Help!

Contact us today to see how these programs can help you secure a home loan.

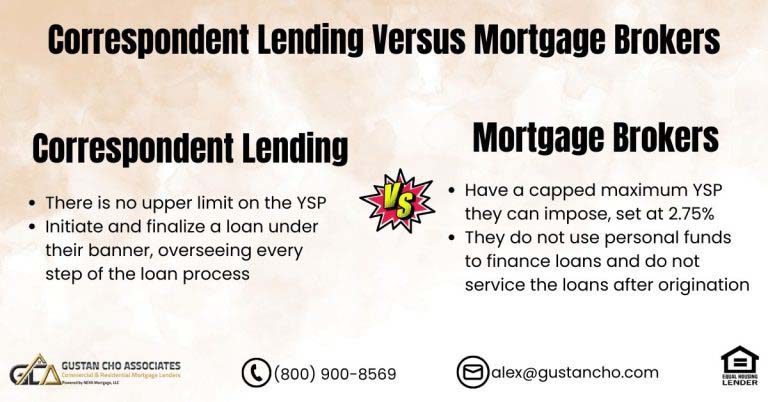

How Fannie Mae and Freddie Mac Affect Mortgage Lenders

Fannie Mae and Freddie Mac offer essential support for lenders by purchasing a large volume of conforming loans. This process provides lenders with liquidity, enabling them to continue offering new loans to more homebuyers. When you apply for a mortgage, your lender may choose to sell your loan to Fannie Mae or Freddie Mac, depending on which GSE’s guidelines your loan meets.

What Are the Pros and Cons?

Here’s a quick look at the pros and cons of Fannie Mae vs. Freddie Mac:

- Fannie Mae Pros:

- Works well for borrowers with higher credit scores and established credit histories

- Typically used by larger national lenders

- Freddie Mac Pros:

- More lenient with credit requirements

- Can accommodate higher DTIs and a broader range of financial situations

- Cons for Both: Both Fannie Mae and Freddie Mac have specific guidelines, which may not be as flexible as some non-conforming loans (e.g., jumbo loans or non-QM loans).

Key Updates to Fannie Mae and Freddie Mac Guidelines

Significant changes introduced by Fannie Mae and Freddie Mac in 2025 may impact how individuals navigate their mortgage processes.

- Increased DTI Flexibility: Both entities are examining the possibility of compensating factors, such as reserves or a strong history of on-time payments, for borrowers with DTIs exceeding 45% to help them qualify for home loans.

- Expanded Options for Limited Credit Profiles: Freddie Mac is now more flexible for borrowers with limited credit history, especially those with a strong record of making alternative payments, like regular rent. This change allows more buyers, who may have been overlooked before, to secure loans.

- Streamlined Refinance Options: Both GSEs have enhanced their refinance programs to support existing homeowners seeking to lower their interest rates or improve loan terms.

Choosing Between Fannie Mae and Freddie Mac Loans

If you’re working with a lender, you may not always know whether your loan will go to Fannie Mae or Freddie Mac immediately. However, understanding your credit profile and DTI can help you make informed choices.

Making the Most of Your Mortgage Options

When you’re ready to move forward, keep these tips in mind to maximize your chances of approval:

- Check Your DTI Ratio: Lenders typically calculate your DTI based on your monthly debts and income. Fannie Mae and Freddie Mac may allow higher ratios if you have compensating factors like a larger down payment or significant savings.

- Review Your Credit Report: Fannie Mae and Freddie Mac’s regulations can often be affected by problems on your credit report. Review your credit report and correct any errors to improve your chances of being approved.

- Ask About Alternatives: If you don’t qualify under Fannie Mae’s DU system, ask your lender about Freddie Mac’s LPA, as it might be more accommodating to your financial profile.

Conclusion: The Difference Between Fannie Mae and Freddie Mac

In short, Fannie Mae and Freddie Mac both play important roles in the mortgage industry, helping make homeownership more accessible and affordable for millions of Americans. While their purposes are similar, their guidelines offer slight variations that can impact your loan options.

As you navigate your home-buying or refinancing journey, consider these differences and ask your lender which option might best fit your situation.

If you have questions about the difference between Fannie Mae and Freddie Mac or want to explore which option aligns with your financial goals, contact our team at Gustan Cho Associates. We’re here to help you find the best loan options for your unique needs, whether buying your first home or refinancing an existing mortgage.

Ready to start your journey? Contact us today to find out how Fannie Mae and Freddie Mac loan options could work for you. Call us at 800-900-8569 or email alex@gustancho.com. We’re available seven days a week to guide you toward affordable homeownership.

Related> Fannie Mae offers 3% down payment mortgages

Fannie Mae vs. Freddie Mac: Know the Difference

Learn how these two giants impact your mortgage approval, rates, and options.

Frequently Asked Questions About the Difference Between Fannie Mae and Freddie Mac:

Q: What is the Difference Between Fannie Mae and Freddie Mac?

A: The difference between Fannie Mae and Freddie Mac mainly lies in who they work with and their loan requirements. Fannie Mae generally works with larger banks, while Freddie Mac often works with smaller lenders and has more flexible rules for borrowers with moderate credit scores.

Q: Why Do Fannie Mae and Freddie Mac Exist?

A: Fannie Mae and Freddie Mac exist to make home loans more affordable. They buy mortgages from lenders, which helps those lenders keep cash on hand to offer more loans to homebuyers.

Q: Can I Choose Between Fannie Mae and Freddie Mac for My Loan?

A: Usually, your lender decides whether to go with Fannie Mae or Freddie Mac based on your financial profile. Understanding the difference between Fannie Mae and Freddie Mac helps you know which fits your needs better.

Q: Which One has Lower Down Payment Options, Fannie Mae or Freddie Mac?

A: Fannie Mae and Freddie Mac provide programs with low down payment options, such as Fannie Mae’s HomeReady® and Freddie Mac’s Home Possible®. Both programs permit down payments as low as 3% for qualifying buyers, which is beneficial if you lack substantial savings for a down payment.

Q: Does the Difference Between Fannie Mae and Freddie Mac Affect My Interest Rate?

A: Your interest rate will depend more on your credit score, loan size, and other factors than whether the loan goes through Fannie Mae or Freddie Mac. Both aim to keep rates affordable.

Q: Which is Better for Buyers With Higher Debt-to-Income Ratios (DTI)?

A: Freddie Mac is often more flexible with higher DTI ratios. If your DTI ratio is a bit high, you might have a better chance with Freddie Mac than Fannie Mae.

Q: What’s the Biggest Benefit of Understanding the Difference Between Fannie Mae and Freddie Mac?

A: Knowing the difference between Fannie Mae and Freddie Mac helps you understand what to expect during the loan approval process. If you get turned down by one, the other might offer a second chance based on their unique guidelines.

Q: Do Fannie Mae and Freddie Mac Allow Loans for People with Credit Challenges?

A: Fannie Mae and Freddie Mac provide alternatives for borrowers experiencing specific credit challenges. However, Freddie Mac typically demonstrates greater leniency for borrowers with lower credit ratings or limited credit history.

Q: Can I Refinance with Fannie Mae or Freddie Mac if I Already have a Mortgage?

A: Indeed, Fannie Mae and Freddie Mac provide refinancing alternatives enabling homeowners to reduce their interest rates or enhance their loan conditions. Each organization has specific programs aimed at simplifying the refinancing process.

Q: How do Fannie Mae and Freddie Mac Help the Mortgage Industry?

A: Fannie Mae and Freddie Mac purchase mortgages from lenders to maintain stability in the mortgage sector and guarantee that lenders have the capital required to issue new loans. This support contributes to making mortgages more accessible for all.

This blog about “What Is The Difference Between Fannie Mae And Freddie Mac” was updated on July 9th, 2025.

Fannie Mae and Freddie Mac Loans – The Key to Affordable Homeownership!

Contact us now to discuss how you can take advantage of these mortgage options.