FHA Approved Condos Versus Single-Family Homes: What’s the Best Choice for You?

Are you torn between buying an FHA-approved condo or a single-family home? You’re not alone! This decision can be overwhelming, especially if you’re a first-time homebuyer or looking to downsize. Don’t worry—this article will explain the advantages and disadvantages of each option, outline the 2024 FHA mortgage guidelines, and help you choose the best option for your future.

FHA loans are incredibly popular for homebuyers with lower credit scores or smaller down payments. But did you know these loans come with different requirements depending on whether you’re buying a condo or a single-family home? Let’s dive into everything you need to know about FHA-approved condos versus single-family homes.

Why FHA and Condos Have Had a Complicated History

Getting a condo with an FHA loan hasn’t always been easy. In the past, the rules were tight, making it tough for many condo places to get the thumbs-up for FHA loans. But good news came around in 2019 when the rules got a makeover.

Now, it’s easier for individual condo units to get approved by the FHA, even if the entire complex isn’t on the approved list. This shift means more choices for folks looking to buy, giving you a better shot at snagging your dream spot, whether it’s a snug condo or a standalone house.

So, when we talk about FHA approved condos versus single-family homes, the cool part is you have options. Condos are back on the table, thanks to the updated rules, offering more flexibility in what you can buy with an FHA loan. This means hunting for your perfect home just got a bit more exciting, with more doors open for finding that dream condo or house.

FHA-Approved Condo or Single-Family Home? Let’s Help You Choose the Right Option!

Contact us today to explore the benefits of both and find out which option is best for you.

FHA Approved Condos Versus Single-Family Home: What’s the Difference?

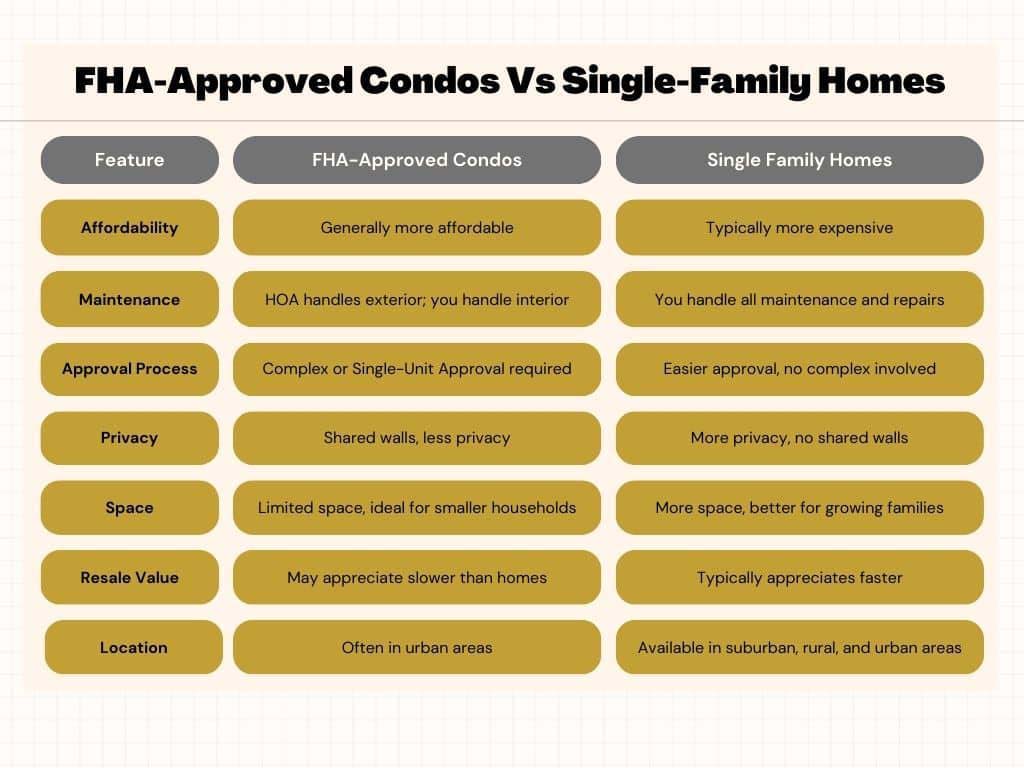

There are a few key differences when deciding between an FHA-approved condo versus single-family home. Both have unique advantages and difficulties, and your decision will be based on your way of life, financial position, and long-term objectives.

FHA Approved Condos: What You Need to Know

FHA-approved condos are a fantastic option for buyers looking for affordability and low-maintenance living. However, getting an FHA loan for a condo comes with some unique hurdles.

Here’s what you need to know about FHA-approved condos:

- Complex Approval: The entire condo complex must meet HUD’s strict guidelines to get on the FHA-approved list. This includes having enough cash reserves, proper insurance, and no more than 50% of the units being investor-owned. As of 2024, only about 7% of condo complexes in the U.S. are FHA-approved. But don’t worry—there’s a workaround if your dream condo isn’t on the list.

- Single-Unit Approval: Thanks to the 2019 guideline changes, you can now get an individual condo unit approved even if the complex isn’t FHA-approved. This process, known as FHA Single-Unit Approval or FHA Spot Approval, allows more flexibility but requires some extra steps.

- Maintenance and Fees: When you buy a condo, you’re responsible for the interior, while the condo association handles exterior maintenance. You’ll also pay monthly HOA fees, which cover things like landscaping, roof repairs, and amenities.

- Cost-Effective: Condos are usually cheaper than single-family homes, which makes them a good choice for first-time buyers or those looking to downsize.

Single-Family Homes: What You Need to Know

Single-family homes offer more space, privacy, and freedom compared to condos. They’re ideal for growing families or anyone who values having their own yard and no shared walls. Here’s what to consider:

- Greater Independence: When you own a single-family home, you have full control over your property. You don’t have to worry about HOA rules, and you can customize your home to your liking.

- Higher Costs: While single-family homes offer more freedom, they also come with higher costs. You’re responsible for all maintenance, repairs, and insurance. However, the investment can pay off in the long run, as single-family homes tend to appreciate more than condos.

- More Financing Options: FHA loans are widely available for single-family homes, and you don’t have to worry about complex approval processes as you do with condos. This makes getting a loan and moving into your new home easier and faster.

FHA-Approved Condos Versus Single-Family Homes: Which Is Right for You?

Now that you know the basics, let’s compare FHA-approved condos and single-family homes side by side. This comparison can assist you in determining which choice is most suitable for your requirements and way of life.

Pros and Cons of FHA-Approved Condos

Pros:

- Lower purchase price and down payment.

- Less maintenance with HOA covering exterior upkeep.

- Often located in desirable urban areas.

Cons:

- Strict HUD approval process for the complex.

- Monthly HOA fees can add up.

- Less privacy and smaller living space.

Pros and Cons of Single-Family Homes

Pros:

- Full control over your property and more privacy.

- Potential for higher appreciation.

- More space, both indoors and outdoors.

Cons:

- Higher upfront costs and ongoing maintenance.

- Limited financing options in certain markets.

- Typically located further from city centers.

How to Buy an FHA Approved Condo in 2024

You should know how to navigate the FHA approval process if you’re leaning toward a condo. Here is a step-by-step guide to help you secure your FHA-approved condo:

- Check the HUD-Approved Condo List: Start by visiting HUD’s Condominium portal. You can find FHA-approved complexes near you by searching with ZIP code, city, or state. If your desired complex is on the list, great! If not, don’t panic—there’s still a chance you can buy that condo.

- Consider Single-Unit Approval: You can apply for Single-Unit FHA Approval if the complex isn’t approved. This process requires at least 45 days to complete, so make sure your sales contract allows enough time.

- Gather Documentation: Just like any other FHA loan, you’ll need to provide your lender with standard documents, including:

- Last 60 days of bank statements

- Last 30 days of pay stubs

- Last two years of W-2s

- Last two years of tax returns (if required)

- Driver’slicense

- Complete the FHA Single-Unit Approval Questionnaire: This form must be filled out by the condo association and sent to HUD for approval. This service may have a fee, and it’s important to note that it is usually non-refundable.

- Work with a Lender Who Understands FHA Loans: Choosing the right lender is key. At Gustan Cho Associates, we specialize in FHA loans and can guide you through the process smoothly.

How to Buy a Single-Family Home with an FHA Loan in 2024

If you’ve already decided between FHA-approved condos versus single-family homes. And if a single-family home is more your style, here’s how to get started:

- Get Pre-Approved: Get pre-approved for an FHA loan before you begin your house hunting. This will give you a clear idea of your budget and show sellers you’re a serious buyer.

- Search for Homes in Your Price Range: With your pre-approval, start looking for homes that fit your needs. You’ll have plenty of options whether you want a big backyard or a quiet neighborhood.

- Make an Offer: Once you find the perfect home, your real estate agent will help you make an offer. If the seller accepts, you’ll move on to the next steps in the mortgage process.

- Complete the FHA Loan Process: Your lender will guide you through the rest of the FHA loan process, including the appraisal, underwriting, and final approval. Once everything checks out, you’ll be ready to close on your new home!

Ready to Buy a Home? Let’s Compare FHA-Approved Condos and Single-Family Homes!

Reach out now to explore your options and get pre-approved.

FHA Approved Condos Versus Single-Family Home: The 2024 Market Outlook

The housing market in 2024 is expected to remain competitive, with demand for condos and single-family homes continuing to rise. FHA loans will continue to be a popular option for buyers who need more flexible credit and down payment requirements.

The new single-unit approval guidelines for condos will make it easier for buyers to get into their dream homes, even if the entire complex isn’t FHA-approved. This is great news for first-time buyers and those looking for affordable housing in urban areas.

For single-family homes, FHA loans will remain a reliable financing option, especially for buyers in suburban and rural areas. With rising home prices, having the flexibility of an FHA loan can make all the difference in getting into a home you love.

Ready to Take the Next Step?

Whether you’re eyeing an FHA-approved condo or a single-family home, Gustan Cho Associates is here to help you every step of the way. Our team knows all about FHA loans and can help you through the process easily.

Why Choose Us?

- We provide a variety of mortgage options, including FHA loans and Non-QM mortgages.

- We’re available 7 days a week to answer your questions and provide personalized support.

- We work with all types of credit profiles, from perfect scores to credit-challenged buyers.

Get in touch with us now to learn how we can assist you in realizing your goal of owning a home. Whether you’re looking for an FHA-approved condo or a single-family home, we’ve got the expertise and resources to make it happen.

Conclusion: FHA-Approved Condos Versus Single-Family Home—Which One Is Right for You?

In the battle of FHA-approved condos versus single-family homes, the winner depends on your needs and financial goals. Condos offer affordability and low-maintenance living, making them ideal for first-time buyers or those looking to downsize. On the other hand, single-family homes provide more space, privacy, and long-term investment potential, which can be a better fit for growing families.

Remember, FHA loans are meant to help more people become homeowners. With proper guidance and a clear understanding of your options, you can confidently make the right decision.

If you’re ready to explore your options or need help navigating the FHA loan process, contact Gustan Cho Associates today. We’re here to help you every step of the way.

FAQs: FHA Approved Condos Versus Single-Family Homes

- 1. What are the main differences between FHA approved condos versus single-family homes? FHA-approved condos usually have lower prices and less maintenance, while single-family homes offer more space and privacy.

- 2. Can I buy any condo with an FHA loan? No, the condo must be on the HUD-approved list, or you can apply for single-unit approval if the complex isn’t approved.

- 3. What’s the process for getting a condo FHA approved in 2024? You can find a condo already on the HUD-approved list or apply for single-unit FHA approval, which takes about 45 days.

- 4. Why are FHA loans different for condos and single-family homes? FHA loans have stricter guidelines for condos because the entire complex must meet HUD’s requirements. In contrast, single-family homes don’t have that added layer.

- 5. What are the pros of choosing an FHA-approved condo over a single-family home? FHA-approved condos are usually cheaper, require less maintenance, and are often located in urban areas, making them great for first-time buyers.

- 6. Why might someone choose a single-family home instead of an FHA-approved condo? Single-family homes offer more privacy, space, and control over your property, ideal for growing families.

- 7. Are there extra fees for FHA-approved condos? Yes, you’ll likely pay monthly HOA fees for exterior maintenance and amenities you don’t have with single-family homes.

- 8. Is it easier to get an FHA loan for a single-family home? Yes, the process is simpler for single-family homes since you don’t need to worry about the entire complex being approved.

- 9. How do I know if a condo is FHA-approved? You can check HUD’s condominium portal by ZIP code to see if the condo is approved.

- 10. Which is better for investment: FHA approved condos versus single-family homes? Single-family homes tend to appreciate faster and offer more flexibility, making them a stronger long-term investment.

If you have any questions about FHA Approved Condos Versus Single-Family Home, please contact us at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about FHA Approved Condos Versus Single-Family Homes was updated on August 21st, 2024.

FHA-Approved Condo or Single-Family Home? Let’s Help You Make the Right Choice!

Reach out now to discuss your options and get started on your home buying journey.