Down Payment Guidelines on Home Purchase on Traditional Mortgages

Down Payment Guidelines on FHA Loans

For example, under HUD Down Payment Guidelines, the homebuyer needs to come up with 3.5% on FHA loans. Homebuyers need a minimum of a 580 credit score to qualify for a 3.5% down payment FHA loan. Mortgage borrowers can qualify for FHA loans with under 580 credit scores and down to 500 FICO. However, per HUD Down Payment Guidelines, borrowers with under 580 credit scores and down to a 500 FICO need to put a 10% versus a 3.5% down payment on a home purchase. Many homebuyers can easily afford a new mortgage housing payment. However, coming up with a down payment is the issue most homebuyers face. In this article, we will discuss and cover the Down Payment Guidelines On Home Purchase Mortgage Loans.

What Are The Down Payment Guidelines Versus Closing Costs

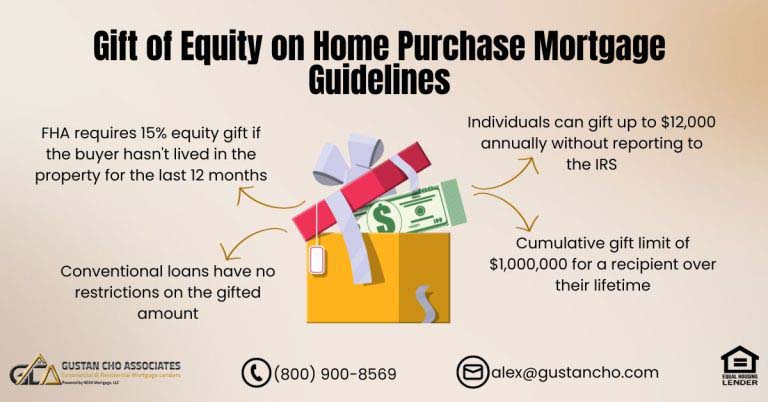

With the exception of VA and USDA loans, all mortgage programs require a minimum down payment requirement. There are two types of costs involved when buying a home. The first cost is the down payment. The second is the closing costs. The down payment is a fixed percentage. The amount required depends on the loan program. Closing costs vary on various factors including the area the property is located. Most of our borrowers at Gustan Cho Associates Mortgage do not have to worry about covering closing costs. Our team of experienced loan originators will instruct the buyer’s realtors on how to get seller concessions so the buyer does not have to pay for closing costs out of their pocket. If the homebuyer is short of covering the closing costs with the sellers’ concessions, the lender can give a lender credit to cover the shortage.

How Much Home Can I Afford Versus Qualify

A home is most people’s largest investment in their lives. There are many thoughts homebuyers should consider prior to pulling the trigger on a home purchase. When homebuyers get a pre-approval by the loan officer, find out what the monthly payments PLUS other housing expenses are. Mortgage underwriters do not take utilities, personal finances, education expenses, child care, elderly care, vacation, and other personal expenses when qualifying borrowers for a mortgage. Seriously think about the maximum housing payments you will be able to afford. You do not want to be house rich and poor in keeping up with your lifestyle. In the following paragraphs, we will discuss and cover the frequently asked questions by first-time homebuyers when buying a home.

Down Payment Guidelines For First-Time Homebuyers

Down Payment Guidelines on Conventional Loans

Lowering PITI By Putting Larger Down Payment Than The Required Minimum Down Payment Guidelines

Homebuyers can put a larger down payment on a home purchase than the minimum required. Some buyers want a lower monthly housing payment so they put more money down on a home purchase. Others want to put the bare minimum down. According to the National Association of Realtors, the average down payment for first-time homebuyers was 6%. The down payment data skyrockets to a 12% down payment for all homebuyers. The average down payment for repeat home buyers is 16% according to NAR data. In the following paragraph, we will discuss and cover the down payment requirements on government and conventional loans.

Down Payment Guidelines on Government and Conventional Loans

Below is the minimum down payment mortgage guidelines on government and conventional loans:

- HUD requires a 3.5% down payment for homebuyers with at least a 580 credit score or higher and a 10% down payment for homebuyers with credit scores under 580 down to 500 FICO

- Veteran’s Affairs (VA) loans: 0% down, 100% financing on VA Mortgage

- U.S. Department of Agriculture (USDA) loans: 0% down, 100% financing on USDA Loans

- Conventional loan 97 (available from Fannie Mae and Freddie Mac): 3% down

- Conventional loans for repeat homebuyers require a 5% down payment

- The HomeReady Mortgage (backed by Fannie Mae): 3% down

- Second-home conventional loans require a 10% down payment

- Investment property conventional loans require a 15% to 30% down payment, depending on the type of properties

All conventional loans with greater than 80% loan to value require private mortgage insurance.

Non-QM Down Payment Guidelines Versus Traditional Government and Conventional Loans

In 2023 it was estimated that almost 70% of Americans have $1,000 in their savings account. This information was broken down further where 45% of respondents said they had ZERO dollars in their savings account. This is not a good trend for saving to buy a house. The down payment hurdle is often the hardest obstacle in the home buying journey. Most homebuyers can easily afford the proposed new housing payment on a home purchase. However, coming up with the down payment is a big barrier for most Americans.

Speak With Our Loan Officer for conventional Loans

Minimum Down Payment Guidelines Versus Private Mortgage Insurance

For more information about this article and/or other mortgage-related topics, please contact us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, on weekends, and holidays.