In this blog, we will cover and discuss the credit score mortgage guidelines for home purchase and refinance. What is a Good credit score and credit score mortgage guidelines? Credit score mortgage guidelines vary between mortgage loan programs. All loan programs, with the exception of VA loans, have minimum credit score mortgage guidelines.

Lenders look at borrowers with good credit scores as fewer risk borrowers. Borrowers with higher credit scores often get better mortgage rates. Some think a 640 credit score is a good credit score on FHA loans.

A 640 credit may be a good credit score on FHA loans but may be a very low credit score on conventional loans. Homebuyers who plan on buying a home in the very near future should consider raising their credit scores to get the best mortgage rates. Same for homeowners needing to refinance. Remember that higher credit scores mean lower mortgage rates. In this article, we will cover and discuss credit score mortgage guidelines for home purchase and refinance.

What Does My Minimum Credit Score Have To Be For a Mortgage?

Your credit score affects your life in more ways than one. When you apply for a loan or credit card, lenders make their decisions in part on your credit health. Not only that, but your credit score can affect the interest rates you’ll pay for car loans, credit cards, lines of credit, and mortgages. FICO or credit scores range from 300 to 850. With the higher scores use lower credit risk. Knowing where your credit scores are at all times is important to getting the best rate possible on any type of credit.

The Importance of Credit Scores During The Mortgage Process

Credit scores are used to assess risk during the mortgage process. Credit scores are the biggest factor in pricing mortgage rates. The minimum credit score required to qualify for a mortgage loan can vary depending on the lender and the type of mortgage program. However, a FICO credit score 620 is often considered the minimum for conventional loans. Government-backed loans like FHA loans may accept lower credit scores, sometimes as low as 500, with a larger down payment. Apply for mortgage loans with minimum credit scores, click here

Impact of Credit Score on Interest Rate

Your credit score impacts the rate you’re offered on a mortgage. Higher credit scores are associated with lower rates. In comparison, lower credit scores may result in higher interest rates or additional fees.

Credit Score Ranges

Credit scores range from 300 to 850. A breakdown of credit score ranges and mortgage eligibility is as follows:

- Excellent (800-850): Borrowers with excellent credit scores are typically offered the lowest interest rates and have the easiest time qualifying for mortgages.

- Very Good (740-799): Borrowers with good credit scores qualify for competitive rates and favorable loan terms.

- Good (670-739): While still considered a good credit score, borrowers in this range may not qualify for the best interest rates and terms but are still generally eligible for most mortgage programs.

- Fair (580-669): Borrowers with fair credit scores may have more limited mortgage options, face higher interest rates, or require larger down payments.

- Poor (300-579): Borrowers with poor credit scores may need help to qualify for a mortgage through traditional lenders and may need to explore alternative options or improve their credit before applying.

Credit History

Besides credit scores, lenders consider your credit history when evaluating your mortgage application. Other than credit scores, mortgage lenders look at credit payment history, the length of credit history, types of credit tradelines, and derogatory marks like bankruptcies or foreclosures.

Compensating Factors

In some cases, borrowers with lower credit scores may still qualify for a mortgage if they have compensating factors such as a high income, a large down payment, or a low debt-to-income ratio. However, these factors vary depending on the lender and loan program. It’s important to note that these are general guidelines, and specific requirements can vary between lenders and mortgage programs. Suppose you’re considering applying for a mortgage. In that case, you should consult multiple lenders to compare rates, terms, and eligibility requirements based on your financial situation.

Credit Score Mortgage Guidelines Needed To Buy a House?

The minimum credit score requirement to buy a house depends on the loan program. FHA and VA loans allow borrowers to have credit scores down to 500 FICO. Conventional loans require 620 FICO. We have non-QM loans and non-QM jumbo mortgages with credit scores down to 500 FICO. The difference between bad credit and good credit scores may only be just a few points but it can make a world of difference when getting financing. FICO scores are used by lenders who decide whether a credit score is excellent, good, fair, poor, or bad. Below is a credit score range. Apply for mortgage loan with any credit score which mentioned below.

- Bad 549 & Below

- Excellent 750 and above

- Good 700 to 749

- Fair 650 to 699

- Poor 550 to 649

Do Credit Scores Fluctuate During The Mortgage Process?

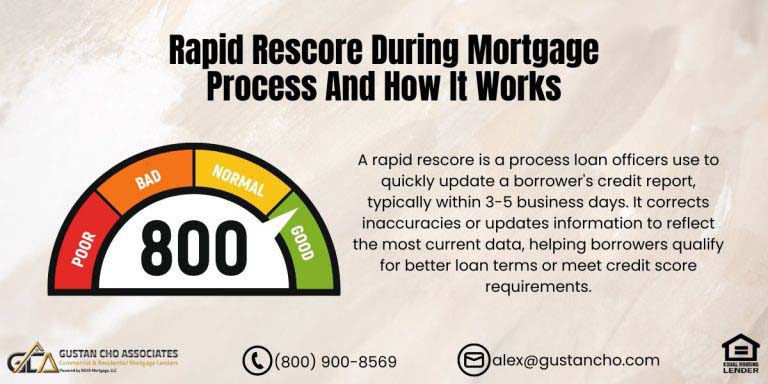

Most lenders consider a credit score between 700 to 740 to be good, but the cutoff can be anywhere between 620 to 699. So a drop of just one point can really have an effect on your rate. Remember credit score are not fixed They can fluctuate on a daily basis with every payment, every monthly balance, every account. You have credit reports at each of the three bureaus: Equifax, Experian, and Transunion. The credit scores for each report can be different because not every creditor reports to all three.

How Is Your Credit Scores Calculated?

Each bureau calculates your credit score. Your credit score can change from month to month. Credit scores are formulated based on payment history, the amount of available credit you have and use, whether you have applied for new credit and the types of credit you use, and the age of your credit history

What Factors Determine Mortgage Rates?

There are various credit scoring models. Mortgage lenders use the FICO 2 scoring model. FICO uses filters that the bureaus use to calculate scores. Depending on what type of credit you wish to obtain the filters will vary with different vendors whether it’s a car loan a credit card company or a bank they all use different filters. When it comes to buying a house, your credit score is important, not only for approval but also to determine your interest rate. So you usually need a credit score of 620 or better to qualify for a conventional loan, VA or FHA loan. Of course, you can use a mortgage broker that has the ability to do loans as low as 500 credit scores but there will be limitations. Apply for mortgage loans with minimum credit scores, click here