Buying a Foreclosed Home: A First-Time Homebuyer’s Guide for 2024

If you’re considering buying a foreclosed home as a first-time buyer, you’ve probably heard it can be a great way to get a house for less. But what does the process involve, and is it the right choice for you? Buying a foreclosed home comes with its own set of rewards and challenges.

This guide will walk you through everything you need to know to make an informed decision in 2024.

What Does Buying a Foreclosed Home Mean?

A foreclosed home is a property that a homeowner couldn’t continue paying for, leading the lender to take it back. Once the lender gains ownership, they typically list the property for sale to recoup their losses. Foreclosed homes can offer good deals but often come with risks, like repairs and competition from cash buyers.

How to Buy a Foreclosed Home in 2024

Buying a foreclosed home is similar to purchasing any other property but with a few extra steps. Here’s how you can navigate it:

1. Understand the Stages of Foreclosure

Before diving in, it’s essential to know the three main stages of foreclosure:

- Pre-Foreclosure: The homeowner is behind on payments but still owns the home. You may be able to negotiate a deal directly with the owner.

- Auction: If the property owner does not resolve the debt, the estate is auctioned off to the highest bidder, often for cash.

- Real Estate Owned (REO): If the home doesn’t sell at auction, it becomes bank-owned. If a property goes to a sheriff’s sale and does not sell to a winning bidder, the property will become a real estate-owned property. This is the stage where most first-time buyers enter the market.

2. Know Where to Find Foreclosures

In 2024, finding foreclosed homes is easier than ever, thanks to online tools. Here are some reliable places to start:

- Government Websites: HUD.gov, Fannie Mae’s HomePath, and Freddie Mac’s HomeSteps list government-owned properties.

- Real Estate Sites: Websites like Zillow, Redfin, and RealtyTrac offer foreclosure listings.

- Local Resources: Check with county offices, real estate agents, and local banks for foreclosure opportunities.

3. Get Pre-Approved for a Loan

Before shopping, get pre-approved for a mortgage. If the home needs significant repairs, look into special financing options like:

- FHA 203(k) Loans: These loans bundle the cost of the home and renovations.

- Conventional Loans: Some lenders may allow financing for foreclosures if the property meets basic appraisal standards.

Is Buying a Foreclosed Home Always a Good Deal?

Foreclosed homes typically come with lower price tags, but that doesn’t automatically make them a great deal. So, what should you think about? Here are a few key factors to keep in mind:

Compare Prices in the Market

Foreclosed homes are usually listed at market value. However, lenders may lower the price if the property sits unsold for a while. Research comparable properties in the area to ensure you get a good deal.

Account for Renovations

Most foreclosed homes need repairs. Some common issues include:

- Broken plumbing or electrical systems.

- Mold or water damage.

- Neglected roofing or structural issues.

Budget for repairs, and consider hiring a professional contractor for an estimate before making an offer.

Factor in Competition

In 2024, the foreclosure market continues to be highly competitive. Cash buyers and investors frequently lead auctions, but this shouldn’t deter you. You can gain a valuable edge in your home search by teaming up with a knowledgeable real estate agent.

Steps to Buy a Foreclosed Home

Step 1: Hire the Right Team

Having the right professionals by your side is crucial. Look for:

- A Real Estate Agent: Choose someone with experience in foreclosures who knows the local market well.

- A Home Inspector: They’ll identify potential issues with the property.

- A Mortgage Broker: They can help you find the best financing options.

Step 2: Conduct a Thorough Inspection

Even though foreclosed homes are often sold “as-is,” getting an inspection is vital. Some key areas to check include:

- Foundation and structure.

- Plumbing and electrical systems.

- Roof condition and potential leaks.

Step 3: Make a Competitive Offer

Once you’ve done your research, submit an offer. Your agent can help you decide on a competitive bid based on comparable properties and the home’s condition.

Step 4: Close the Deal

After accepting your offer, you’ll go through the standard closing process. This step may take longer for foreclosures, especially for short sales or government-owned properties.

Buying a Foreclosed Home: Pros and Cons

Pros:

- Lower Price: Foreclosures can often be purchased below market value.

- Investment Potential: Renovating and reselling can yield profits.

- Immediate Equity: Buying below market value gives you equity from the start.

Cons:

- Property Condition: Many foreclosures need significant repairs.

- Longer Timelines: Short sales and government-owned properties can take months to close.

- Risk of Competition: Investors and cash buyers may outbid you.

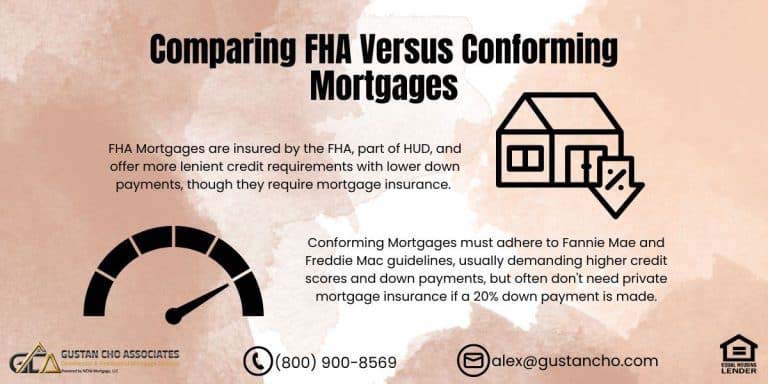

Financing a Foreclosed Home

- FHA 203(k) Loans: These loans are perfect for first-time buyers purchasing foreclosed homes that need repairs. They let you finance both the purchase and renovation costs.

- Conventional Loans: A conventional loan might be the best option if the foreclosed home is in good condition. Be sure the property meets appraisal standards.

- Cash Offers: If you have cash, you’ll have a competitive advantage, especially at auctions. However, keep in mind the added repair costs.

2024 Market Trends in Foreclosures

The foreclosure market in 2024 is evolving:

- Increased Inventory: Some areas are seeing more foreclosures as mortgage forbearance programs from the pandemic era end.

- Slightly Lower Competition: High interest rates have deterred some investors, giving first-time buyers a better chance.

- Rising Renovation Costs: Due to inflation, budget extra for repairs.

Key Takeaways for First-Time Buyers

- Do Your Homework: Research the market and compare prices.

- Be Prepared for Repairs: Budget for renovations, inspections, and surprises.

- Hire Experts: Work with experienced professionals to guide you through the process.

- Be Patient: Foreclosure purchases can take longer than traditional home sales.

Buying a foreclosed home in 2024 can be a rewarding experience if you know what to expect. By preparing adequately and having a dependable team, you can discover a property that aligns with your financial plans and objectives.

Ready to Buy Your Dream Foreclosed Home? Let’s Make It Happen!

At Gustan Cho Associates, we specialize in helping first-time homebuyers navigate the complexities of buying foreclosed homes, from securing financing to closing the deal.

Purchasing a foreclosed property can be a wise choice for first-time homebuyers aiming to stretch their budget and increase their equity. However, having the right team and resources to guide you through the process is essential.

Take the first step today! Contact us now to get pre-approved and connect with an expert who will make your dream of homeownership a reality. Call us at 800-900-8569

or email alex@gustancho.com to schedule a free consultation!

Don’t wait—foreclosed properties move fast, and the perfect home for you might be just around the corner. Let’s turn your vision into your new address!

Frequently Asked Questions About Buying a Foreclosed Home:

Q: What Does Buying a Foreclosed Home Mean?

A: Buying a foreclosed home means purchasing a property the previous owner lost due to unpaid mortgage payments. The lender takes ownership and sells the home, often at a lower price, to recover the owed money.

Q: Is Buying a Foreclosed Home a Good Deal?

A: It can be. Buying a foreclosed home often comes with a lower price tag, but you need to consider repair costs and other expenses. Always compare prices and factor in renovations to determine if it’s a good deal.

Q: How do I Find Foreclosed Homes for Sale?

A: You can find foreclosed homes by:

- Checking government websites like HUD.gov.

- Browsing real estate sites like Zillow and Redfin.

- Reaching out to nearby real estate agents who focus on foreclosure properties.

Q: Can I Get a Mortgage When Buying a Foreclosed Home?

A: Yes, you can. Loans like FHA 203(k) and conventional mortgages can finance a foreclosed home, especially if it meets certain appraisal standards. Getting pre-approved helps you know your budget.

Q: What are the Steps to Buying a Foreclosed Home?

A: The steps include:

- Getting pre-approved for a loan.

- Hiring an experienced real estate agent.

- Searching for foreclosed homes.

- Conducting a thorough inspection.

- Making a competitive offer.

- Closing the deal.

Q: Do Foreclosed Homes Need a Lot of Repairs?

A: Often, yes. Many foreclosed homes have been neglected and may need repairs like fixing plumbing, electrical systems, or structural issues. Always budget for renovations when buying a foreclosed home.

Q: Is Buying a Foreclosed Home Risky?

A: There are risks, such as:

- Hidden repair costs.

- Longer closing times.

- Competition from cash buyers.

- Buying the property “as-is” without warranties.

Q: Can First-Time Homebuyers Purchase a Foreclosed Home?

A: Absolutely! Buying a foreclosed home can be a great option for first-time buyers looking to save money. Just make sure you’re prepared for the extra steps involved.

Q: How Long Does it Take to Buy a Foreclosed Home?

A: The timeline varies:

- Bank-owned properties: Usually 30–60 days.

- Short sales: This can take 4–8 months. Be patient and prepared for possible delays.

Q: Should I Get a Home Inspection When Buying a Foreclosed Home?

A: Yes, definitely. A home inspection helps you understand the property’s condition and what repairs are needed. Even though foreclosed homes are sold “as-is,” an inspection is crucial.

This blog “Buying a Foreclosed Home as First-Time Homebuyers” was updated on December 5th, 2024.

Take First Step Toward Making Your Dream A Reality

Apply Online And Get recommendations From Loan Experts

Thanks for the tip that having a real estate agent is essential for foreclosure home buying. My husband and I will be moving a different city soon because of his new job assignment. Making sure that we can secure a home early would benefit us a lot for sure. I like to thank Gustan Cho Associates for referring me to Tammy Trainor of Capital Lending Network, Inc. Tammy Trainor went above and beyond the call of duty. I cannot believe how smart Tammy was. Thank you Tammy Trainor of Capital Lending Network, Inc.