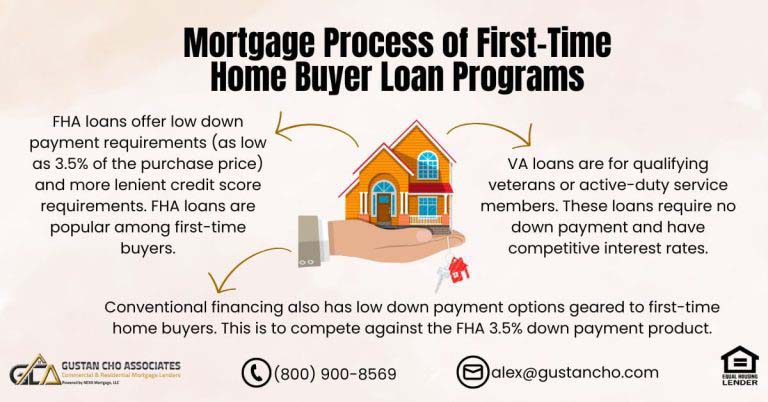

This guide covers the benefits of FHA loans for first time homebuyers. There are many benefits of FHA loans for first time homebuyers. There are also the benefits of FHA loans for homebuyers with prior bad credit, bankruptcy, foreclosure, deed-in- lieu of foreclosure, and short sale. FHA loans make home ownership possible with only a 3.5% down payment. Alex Carlucci, a senior mortgage loan originator at Gustan Cho Associates says the following about the benefits of FHA loans:

Homebuyers can have credit scores as low as 580. Homebuyers with credit scores down 500 can still qualify for an FHA loans with 10% down payment. FHA offers extremely flexible guidelines.

First time homebuyers who do not have the required 3.5% down payment can get the down payment gifted. Parents, brothers, sisters, grand parents, sons, daughters, cousins, in laws, or other family members can qualify to become non-occupant co-borrowers. Multiple non-occupant co-borrowers are allowed with FHA home loans. In the following paragraphs, we will cover the benefits of FHA loans for first time homebuyers and borrowers with bad credit with low credit scores.

Benefits of FHA Loans for First-Time Homebuyers

For many first-time homebuyers, affording a home can feel out of reach. FHA loans, backed by the Federal Housing Administration, can change that.

Learn the benefits of FHA loans for first-time homebuyers: low down payments, flexible credit guidelines, and high limits up to $1,209,750 in high-cost areas.

These mortgages let borrowers with lower credit scores and smaller down payments step onto the property ladder more easily. Homebuyers with unpaid collection and charged off accounts can qualify for FHA loans without having to pay outstanding collections and/or charged off accounts off.

Jumpstart Your Homeownership with FHA Loans

Enjoy low down payments and flexible credit requirements tailored for first-time buyers.

What Is an FHA Loan and How Does It Work?

An FHA loan is a mortgage insured by the FHA, a division of HUD. The FHA’s insurance protects lenders against losses, which lets borrowers enjoy lower down payments—often as low as 3.5 percent—higher debt-to-income ratios, and more flexible credit score requirements. The loan process and interest rates are similar to conventional loans, but the qualifying standards are more forgiving.

Only 3.5% Down Payment with 580+ Credit Score

With an FHA loan, you’ll only need a 3.5% down payment if your credit score is 580 or higher. If your score is between 500 and 579, you can still get a loan—just put down 10%. This makes FHA loans a great choice if you don’t have much savings or are working on your credit.

Flexible Credit Score Standards

Conventional loans usually ask for credit scores of 620 or higher, but FHA loans welcome scores as low as 500. The lower your score, the bigger the down payment, but many first-time buyers find they can qualify and buy their first home even if their credit is still a work in progress.

Higher Debt-to-Income Limits

FHA loans allow a debt-to-income (DTI) ratio of up to 56.9%, especially if you have strong reserves or a solid payment history to back you up. This cushion helps many first-time buyers stay on track when student loans or credit card debt is part of the picture.

FHA Limits—2025 FHA Loan Limits You Need

New limits for FHA loans in 2025 are as follows:

- National Floor (Low-Cost Areas): $524,225 for a one-unit family home.

- High-Cost Area Cap: $1,209,750 for a one-unit family home in high-cost regions—many counties in California, New York, and similar areas.

- Special Areas (Alaska, Hawaii, Guam, U.S. Virgin Islands): $1,814,625 for one-unit homes in these places.

Supports Down Payment Help

You can combine FHA loans with local and state down payment help grants. These programs may pay for your down payment and closing costs, making buying a home much more affordable.

Friendlier Approval After Financial Setbacks

FHA loans accept past money problems better:

- Two-year wait after Chapter 7 bankruptcy.

- One year of on-time payments after Chapter 13 discharge with the trustee is okay.

- Regular loans usually require much longer waiting times.

Simple FHA Streamline Refinance

Once you have an FHA loan, you can apply for an FHA Streamline Refinance. If your payments have been on time, this quick refinance usually does not require income checks, appraisals, or credit checks.

Seller Contributions Up to 6%

FHA loans give sellers a better deal when helping cover your closing costs. While regular loans cap seller contributions at about 3–6%, FHA lets sellers pitch in as much as 6% of the sale price. That means less cash you have to bring to the closing table.

Why First-Time Homebuyers Should Consider an FHA Loan

FHA loans break down roadblocks to homeownership. With low down payments, flexible credit standards, and higher loan limits, they are tailor-made for first-time buyers, especially in pricey areas. Plus, when you pair them with down payment assistance and the simple FHA streamline refinance, they stay one of the smartest choices for your first home.

FHA Limits—2025 FHA Loan Limits You Need

New limits for FHA loans in 2025 are as follows:

- National Floor (Low-Cost Areas): $524,225 for a one-unit family home.

- High-Cost Area Cap: $1,209,750 for a one-unit family home in high-cost regions—many counties in California, New York, and similar areas.

- Special Areas (Alaska, Hawaii, Guam, U.S. Virgin Islands): $1,814,625 for one-unit homes in these places.

Supports Down Payment Help

You can combine FHA loans with local and state down payment help grants. These programs may pay for your down payment and closing costs, making buying a home much more affordable.

Friendlier Approval After Financial Setbacks

FHA loans accept past money problems better:

- Two-year wait after Chapter 7 bankruptcy.

- One year of on-time payments after Chapter 13 discharge with the trustee is okay.

- Regular loans usually require much longer waiting times.

Loan Term Flexibility

FHA loans are not one-size-fits-all. You can choose from:

- 30-year fixed-rate.

- 15-year fixed-rate.

- Adjustable-rate mortgages (ARMs).

This allows you to find the payment plan that matches your budget.

First-Time Buyer? Choose FHA for Easy Approval

Secure financing with as little as 3.5% down and expert support through every step.

Why First-Time Homebuyers Should Consider an FHA Loan

FHA loans break down roadblocks to homeownership. With low down payments, flexible credit standards, and higher loan limits, they are tailor-made for first-time buyers, especially in pricey areas. Plus, when you pair them with down payment assistance, and the simple FHA streamline refinance, they stay one of the smartest choices for your first home.

Frequently Asked Questions (FAQs) on the Benefits of FHA Loans

What is the FHA loan limit for 2025?

- The FHA loan limit for a single-family home nationwide is $524,225.

- For high-cost areas, the limit is $1,209,750.

- In special areas (like Alaska, Hawaii, Guam, and the U.S. Virgin Islands), the cap hits $1,814,625.

Can I get an FHA loan with low credit?

- Yes—if your score is 580 or above, you only need 3.5% down.

- If your score is between 500 and 579, you’ll need 10% down.

Is there mortgage insurance on FHA loans?

- Yes—FHA loans come with an upfront mortgage insurance premium (usually 1.75%) and a monthly premium that continues for the life of the loan, no matter your credit or down payment.

Can the seller cover my closing costs?

- Yes—FHA rules let the seller pay up to 6% of the sale price toward your closing costs.

Is an FHA loan assumable?

- Yes—someone can take over your FHA loan by simply stepping into your shoes at your current interest rate, making your home more valuable when you sell.

Can I refinance my FHA loan?

- Yes—once you’ve built a solid payment history, you can do an FHA Streamline Refinance, which cuts down the paperwork and often skips the appraisal and income verification.

Benefits of FHA Loans on Gift Funds

HUD, the parent of FHA, allows down payments to be gifted. HUD allows 100% of the down payment to be gifted by family members. A gift letter needs to be signed by the donor of the gift. Gift funds need to be a gift and not a loan. Deposit slip and sourcing of the gift funds leaving the donor’s account and being transferred to the home buyers bank account needs to be provided to the lender.

Benefits of FHA Loans Compared to Conventional Loans

Mortgage rates for FHA loans are normally lower than conventional mortgage rates. However, HUD requires mandatory upfront mortgage insurance premium. Upfront FHA MIP is a one time fee of 1.75% of the mortgage amount. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about the benefits of FHA loans:

Upfront FHA MIP can be rolled into the mortgage loan balance. FHA also requires mandatory annual mortgage insurance premium to be paid monthly along with the mortgage loan borrower’s mortgage payment.

Annual FHA MIP is escrowed along with the homeowner’s property insurance and principal and interest. The annual mortgage insurance premium is 0.55%.

The Benefits of FHA Loans and Mortgage Lending Guidelines

FHA mortgage underwriting guidelines are much more relaxed than conventional guidelines. Minimum FHA down payment requirements are 3.5% down payment. Conventional loan minimum down payment requirements are at 5%. Minimum credit score requirements for FHA loans are 500. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about the benefits of FHA loans:

If credit scores fall between 500 and 579 FHA requires that you have a 10% down payment. To qualify for a 3.5% down payment FHA loan, borrowers need a credit score of at least a 580 or better.

Minimum credit scores to qualify for a conventional loan is 620. FHA standards on debt-to-income ratios are much more lenient than conventional guidelines. FHA borrowers can have a debt to income ratio of up to 56.9% DTI and still get an approve eligible per DU FINDING. Need credit score of 620 or higher to get 56.9% DTI AUS Approval. Borrowers with credit scores under 620 the debt-to-income ratios are capped at 43% to get AUS Approval. Conventional loan programs debt to income ratio requirements are capped at 50% maximum. Many high credit score borrowers who have a higher debt-to-income ratios who do not qualify for a conventional loan can qualify for an FHA loans.

Shorter Waiting Periods After Bankruptcy and Foreclosure

Other benefits of FHA loans versus conventional loans is that the mandatory waiting period is shorter after bankruptcy and foreclosure. To qualify for an FHA loan after Chapter 7 bankruptcy discharge, the waiting period is only two years from the discharge date of the bankruptcy.

There is a mandatory 4 year waiting period after Chapter 7 bankruptcy to qualify for conforming loans. There is a mandatory waiting period of 3 years after a foreclosure to qualify for FHA loans.

The minimum waiting period after a foreclosure to qualify for conventional loans is 7 years. The waiting period is 3 years after a deed in lieu of foreclosure and short sale to qualify for an FHA loans.

Waiting Period After Deed In Lieu And Short Sale To Qualify For Conventional Loan: FANNIE MAE UPDATE EFFECTIVE AUGUST 16, 2014

Effective August 16th, 2014, Fannie Mae waiting period guidelines for those with a prior deed in lieu of foreclosure or short sale has changed: The new Fannie Mae guidelines effective August 16, 2014, increased to 4 years after a deed in lieu of foreclosure or short sale to qualify on conventional loans. 5% down payment is required on conventional loans.

Prior to August 16th, 2014, qualifying for conventional loans with a deed in lieu or short sale the waiting period was two years with 20% down payment.

This 2 year waiting period after a deed in lieu of foreclosure or short sale is no longer in effect after August 15, 2014. Effective August 16, 2014, those with a deed in lieu of foreclosure or short sale can qualify for a conventional loan with only 5% down payment after a 4 year waiting period after their deed in lieu of foreclosure or short sale.

Your First Home Awaits—Apply FHA Today

Benefit from competitive rates, low mortgage insurance, and simplified underwriting.

Non-Occupant Co-Borrowers

Other advantages of an FHA loan is that it permits multiple non-occupant co-borrowers. Conventional loan programs do not allow this. Those homebuyers who cannot document income and/or have high debt-to-income ratios can have a family member be a non-occupant co-borrower. FHA loans are the only loan program that allows multiple non-occupant co-borrowers. VA loans only allows spouses of veteran borrowers to become co-borrowers.

Benefits of FHA Loans: FHA 203k Loan

One of the greatest benefits of FHA loans is the HUD 203K rehab loan program. Homebuyers can purchase fixer-uppers and get both the acquisition and construction loan all in one loan. The FHA 203k loan program allows homeowners to purchase a home in need of repairs. It is an acquisition and construction loan underwritten with one appraisal required.

The appraisal needs to be an as is and as complete. There are two different types of FHA 203k loan programs. The FHA 203k streamline and the Standard FHA 203k loan program.

The FHA 203k streamline mortgage loan program limits the maximum construction budget to $35,000. The full FHA 203k loan program enables a home buyer unlimited construction funds up to the maximum FHA loan limit.

One Year Waiting Period After Bankruptcy And Foreclosure

HUD launched the all-new FHA Back to Work Extenuating Circumstances due to an economic event mortgage loan program on August 15, 2014, which turned out to be a total disaster. The Back To Work loan program shortened the waiting period after a bankruptcy, foreclosure, deed in lieu, and short sale to a one year waiting period. Alex Carlucci, a senior mortgage loan originator at Gustan Cho Associates said the following about the ill-fated HUD Back-to-Work Mortgage Program:

To qualify for the FHA Back to Work extenuating circumstances due to an economic event mortgage program, the home buyer needed to have been terminated and/or laid off from their work. Or the employer needed to have gone out of business. This involuntary termination of the home buyer’s employment was the direct cause of them going through a bankruptcy or having their homes foreclosed upon.

The homebuyer also needs to show that due to this involuntary termination that they have had a drop of at least a 20% household reduction of income for at least six or more months. The homebuyer needs to show that he or she had great credit with timely payment history prior to the economic event. Derogatory credit is expected due to the economic event, however, re-established credit is expected after they have obtained full employment. There cannot be any late payment history after the mortgage loan applicant has gotten a new full-time job. A HUD-approved housing course and certificate of completion signed by the HUD counselor was required. 30 days prior to them to be able to start the mortgage application process. The FHA Back To Work Mortgage has been discontinued and is no longer available and offered.

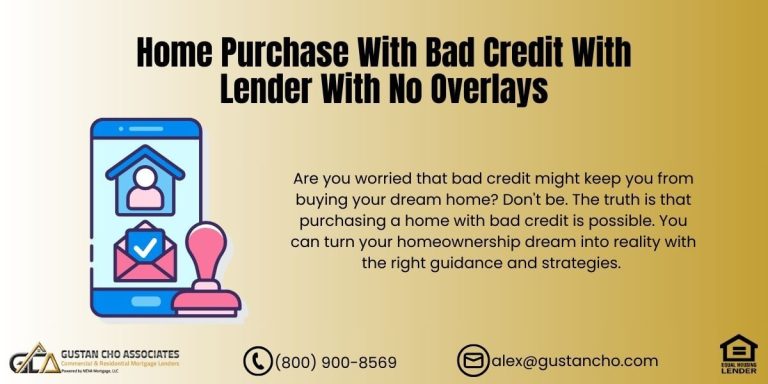

Qualifying For FHA Loans With Lender With No Overlays

Borrowers who need to qualify for FHA Loans with a lender with no mortgage overlays can contact us at Gustan Cho Associates at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com. We have zero overlays on government and conventional loans. Home Buyers can qualify for VA and FHA loans one year into their Chapter 13 bankruptcy repayment plan. We have no mortgage overlays on FHA loans after Chapter 13 bankruptcy discharged date. We are available 7 days a week, evenings, weekends, holidays.

This BLOG on benefits of FHA loans was update and PUBLISHED on August 2, 2025.

Related> Conventional versus FHA Loans

Make Homeownership Possible with FHA Loans

Discover how FHA’s credit-flexible programs help first-time buyers break into the market.