In this article, we will cover how do mortgage lenders view charge-offs. One of the frequently asked questions at Gustan Cho Associates is can I qualify for a home loan and how do mortgage lenders view charge-offs? We will not tell you what you want to hear but rather the FACTS. The simple blunt correct answer on how do mortgage lenders view charge-offs depend on the mortgage lender.

Not all mortgage companies have the same lending requirements on the same mortgage program. Borrowers can have charge-off accounts and qualify for a mortgage with a lender with no overlays. For example, HUD, the parent of FHA, does not require borrowers to pay charge-off accounts to qualify for FHA loans.

Many banks and mortgage lenders require that charge-off accounts be paid off in order to qualify. This is not HUD guidelines but rather a lender overlay. Gustan Cho Associates does not have any overlays on government and/or conventional loans. In this article, we will cover and discuss how do mortgage lenders view charge-offs.

How Do Mortgage Lenders View Charge-Offs?

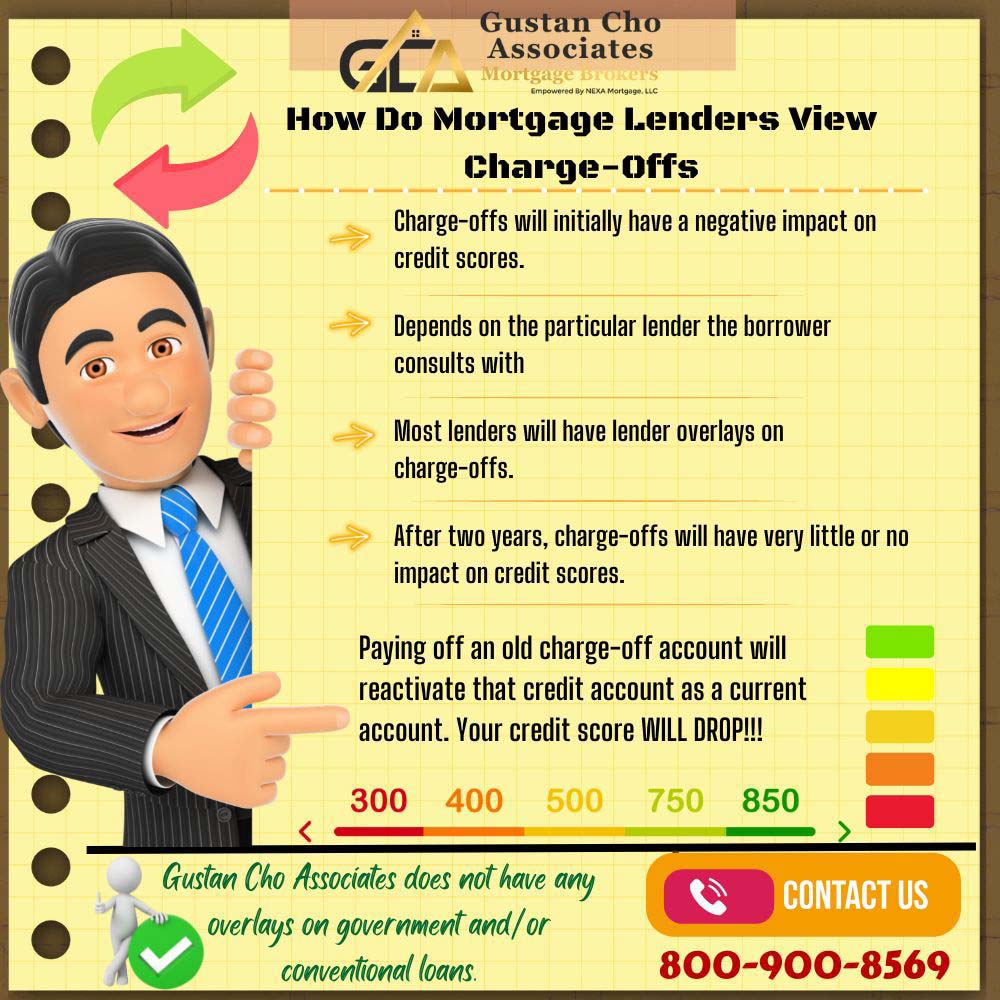

Ever wonder how do mortgage lenders view charge-offs? Many mortgage borrowers wonder if a charge-off or multiple charged-offs will disqualify them from getting a mortgage loan approval. The short answer to that is no. How do mortgage lenders view charge-offs depends on the particular lender the borrower consults with. Most lenders will have lender overlays on charge-offs.

Under HUD, VA, Fannie Mae, and Freddie Mac Guidelines, borrowers do not have to pay charge-offs to qualify for mortgage loans. HUD allows for mortgage borrowers to qualify for an FHA insured mortgage loan with prior charge-offs. Charge-offs will remain on credit report for 7 years from the date the creditor reported from the date of last delinquency. This is a federal law and is mandated and regulated by the FCRA, which is also known as the Fair Credit Reporting Act.

Charge-offs will initially have a negative impact on credit scores. However, after two years, charge-offs will have very little or no impact on credit scores. All negative items, with the exception of a Chapter 7 bankruptcy, remains on a credit report for a period of 7 years. After the 7 years are up, the three credit reporting agencies needs to remove them off the credit report. This 7 year period is called the statute of limitations and is enforced by the Fair Credit Reporting Act, FCRA.

How Are Credit Card Delinquencies Reported?

For consumers who have credit card accounts that are currently open, the three credit reporting agencies will post the date of last payment. All credit reporting history for the past seven years will be reported on the three credit bureaus. Whether you are paying the credit card payments or not, the credit payment history gets reported. The most recent credit card payment history. is reported on all your monthly debt payments.

It does not matter whether credit card payments are being paid on time or are behind on payments, the payment history gets reported by your creditors. For credit card accounts that are closed, the date of last activity gets reported. If the credit card was voluntarily closed, the verbiage that was closed by consumer gets noted on the credit bureaus.

Whether credit card payment histories have been on time or have been a late payer on them, the payment history of the credit card will be on your credit report for seven years. On credit card accounts that have closed, the creditor will post the final closed status of the credit card account to the three credit reporting agencies. After seven years from the date of last activity, derogatory credit tradelines gets deleted off your credit report. Chapter 7 Bankruptcies remain on your credit report for ten years.

Have a Charge-Off? You May Still Qualify for a Mortgage

Apply Online And Get recommendations From Loan Experts

Can I Get Approved For Mortgage With Charge-Off Accounts?

Charge-offs are credit accounts where a creditor writes off the debt consumers owe them. After they try to collect on them and deems it as an uncollectible debt (normally 4 months), the debt is normally charged off. The creditor can possibly sell charge-offs to collection agencies or can pursue in getting a judgment issued.

A mortgage loan borrower can still qualify for FHA loans with charge-offs accounts. Borrowers with charged-off accounts in the past and is still on credit report do not have to pay outstanding balance off to qualify for government and conventional loans.

The team at Gustan Cho Associates are experts in helping borrowers with prior charge-off accounts qualify and get approved for mortgage loans with bad credit all of the time. We have deep knowledge on how do mortgage lenders view charge-offs. We have no problem in closing on the mortgage loan without having to have them paid off as per HUD mortgage guidelines.

Can I Get Mortgage Approval With Judgment?

A judgment is probably one of the worst derogatory items you can have on the credit reports if you intend in applying for a residential mortgage loan. The good news is that I can still qualify borrowers and approve for a residential mortgage loan with an outstanding judgment. As long as the borrower has entered into a written payment agreement with the judgment creditor and made three payments. The borrower needs to provide three month’s of canceled checks and/or bank statements showing proof of payment to the judgment creditor.

What Are Judgments?

A judgment is when a creditor takes a consumer to court for not paying the debt and the court issues a judgment. A judgment stays on credit report for a period for seven years. After 7 years, the judgment record needs to fall off the credit report. Even if borrowers were to pay off the judgment, the judgment report will remain on credit report. However, it will state it as SATISFIED JUDGMENT. Again, as with charge offs, a judgment will eventually plummet credit scores and might affect how do mortgage lenders view charge-offs. But as time passes, it will have less and less impact on credit scores.

Do I Need To Pay Charge-Off Accounts To Get Mortgage Approval?

I do not want to provoke folks not to pay on their old debt obligations. But I strongly recommend not to pay an old derogatory account. Paying older dormant charged-off accounts will re-activate the date of last activity. It will also reactivate the statute of limitations on debt. This might affect how do mortgage lenders view charge-offs.

Paying older charge-offs can lower borrowers credit scores. In the event, if mortgage lender with overlays on charge-offs requires borrowers to pay off old charge-off accounts, you can do that at closing. Do not during the mortgage process.

Paying off an old charge-off account will reactivate that credit account as a current account. Your credit score WILL DROP!!! I have seen so many times where borrowers made this mistake and hurt their chances in getting a mortgage loan approval.

Do Lenders Require Charge-Offs to Be Paid?

Apply Online And Find Out What’s Needed for Mortgage Approval

Frequently Asked Questions (FAQs)

- What is a charge-off?

A charge-off happens when a creditor deems a debt uncollectible after a certain period of delinquency. While the debt is still owed, the creditor no longer considers it an asset. - How do mortgage lenders view charge-offs?

Wondering how do mortgage lenders view charge-offs? They view it as negative entries on a borrower’s credit report, indicating a history of delinquent payments or default on a debt. Charge-offs can impact a borrower’s creditworthiness and ability to qualify for a mortgage. - Do charge-offs affect my ability to qualify for a mortgage?

Yes, charge-offs can affect your ability to qualify for a mortgage, as they indicate a history of financial difficulty and may impact on how do mortgage lenders view charge-offs and raise concerns about your ability to repay a new loan. - Are all charge-offs treated the same by mortgage lenders?

No, it depends on how do mortgage lenders view charge-offs. Mortgage lenders may consider various factors when evaluating charge-offs, including the amount of the charge-off, the date it occurred, the reason for the charge-off, and the borrower’s overall credit history. - Do I need to pay off charge-offs to qualify for a mortgage?

Settling charge-offs might enhance your credit score and raise the likelihood of securing a mortgage approval. However, paying off old charge-offs may only sometimes be necessary, especially if they are already several years old. - How recent do charge-offs need to be to impact my mortgage application?

Recent charge-offs are more likely to impact your mortgage application significantly than older ones. Lenders may be more concerned about recent financial difficulties than past issues. - Can I dispute charge-offs on my credit report when applying for a mortgage?

Yes, you can dispute inaccurate or outdated information on your credit report, including charge-offs. However, disputing charge-offs may only sometimes result in their removal, especially if they are valid. - Are there any exceptions for certain charge-offs when applying for a mortgage?

It depends on how do mortgage lenders view charge-offs. Some lenders may be more lenient toward certain types of charge-offs, such as medical debts, than other types of debt, like credit card charge-offs. However, policies vary among lenders. - How can I improve my chances of getting approved for a mortgage with charge-offs on my credit report?

Enhancing your likelihood of mortgage approval involves showcasing responsible financial habits, like ensuring punctual payments on current debts, minimizing your debt-to-income ratio, and accumulating a larger down payment. - Where can I get more information about how charge-offs may affect my mortgage application?

For tailored guidance on how do mortgage lenders view charge-offs and how it might affect your circumstances and strategies to enhance your chances of mortgage approval, consider consulting with a mortgage lender or a credit counselor.

Best Lenders To Get Mortgage Approval With Charge-Offs

If you have any questions on How Do Mortgage Lenders View Charge-Offs or if you’re a Homebuyer and homeowner needing to qualify for a mortgage with a mortgage lender with no overlays, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

Should You Pay Off Charge-Offs Before Applying for a Mortgage?

Apply Online And Get recommendations From Loan Experts

Hello,

Thank you for your encouraging information online at Gustan Cho Associates about becoming a MLO even though one has a lower Fico score. I recently invested the time, money (letting go of a good paying job) to study and pass the NMLS exam. I passed and I am now in pursuit of finding the right place for me to start working as a MLO.

Due to personal reasons including the loss of my father a few years back, I have a very low credit score. The companies where I am applying all want to do a credit check.

I am so saddened by this and feel foolish that I did not investigate this part of the licensing approval process before I made the jump to start becoming a MLO.

I wanted to reach out to you for advice.

Thank you,

I would like to see if I qualify for a pre qual or pre approval for a new construction home in Smyrna DE.

Si una firma no ha tomado préstamos anteriormente, hacerlo por primera vez puede ayudarla a desarrollar un buen historial de devolución, lo que le facilitará la toma de fondos en el futuro. Un buen historial de pago le permitirá obtener más opciones de financiamiento y mejores términos.

Looking to purchase a home, most likely manufactured due to the area (Washington Coast) I have a 30 day rolling late from a modification. This was a first home purchase and I was nieve at the time and wouldn’t have done it had I known how it would report and shows 30 day rolling from February,March and April of 2020. I have the proceeds from the sale of my townhome, but not looking to do 20% down which is what other lenders are qualifying me for. I don’t want to do FHA or USDA because it’s more expensive over the cost of the loan. My husband and I are missing out on homes if I have to wait until next March or April when I hit the 24 months look back period.

We would like to get pre-qualified or pre-approved as we are planning to purchase a new home. We are early retired (59-1/2 next March) so W2 income is non-existent but we have several million in our retirement accounts and several hundred thousand in stocks and cash outside of retirement accounts. We both have excellent credit scores of 795 as of July 2020. No late payments on any mortgages we have ever had.

Can we get a traditional mortgage loan or do we go with an asset depletion mortgage? Looking for your assistance. We will be doing a virtual tour of a home we’re interested in early this week and may want to make an offer on it. We know that being pre-approved or pre-qualified will make our offer stronger. We currently live in California but the house we are looking at is in Montana. We would be relocating and making this our primary residence. I look forward to hearing from you as soon as possible. Thank You.

Please reach out to us at gcho@gustancho.com. We have several mortgage options for cases like yourself.

Hi did you get Virginia license yet to do mortgages in Virginia, thank you.

Lynda, we are licensed in Virginia. Feel free to contact Michelle McCue at michelle@gustancho.com.