This guide covers understanding mortgage forbearance for homeowners who cannot pay their monthly housing payments. Phase three of the coronavirus pandemic economic stimulus package included assistance for homeowners eligible for forbearance.

Homeowners financially affected by the economic meltdown due to the pandemic can defer their mortgage payments for six months. After six months, borrowers can request another six months if they need more time.

So, the bottom line is that homeowners can skip up to 12 months of mortgage payments. Understanding Mortgage Forbearance is very important. If homeowners can make their mortgage payments, it is highly recommended they make it. In the following paragraphs, we will cover understanding mortgage forbearance.

Understanding Mortgage Forbearance and How It Works

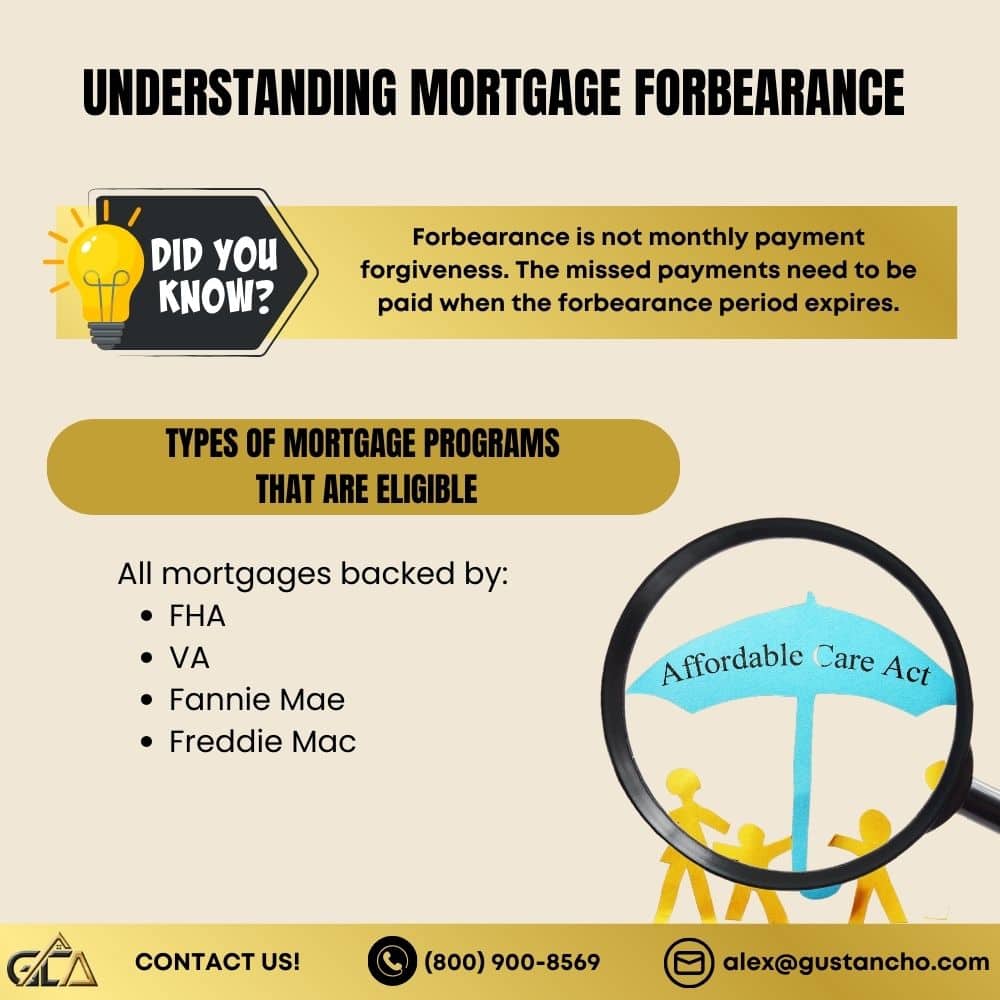

Forbearance is not monthly payment forgiveness. The missed payments need to be paid when the forbearance period expires. Lenders will want the missed payments all at once. However, lenders will entertain a short-term payment plan for six to twelve months. There are no changes to mortgage rates or terms of the original loan. In this article, we will discuss and cover Understanding mortgage forbearance.

Understanding Mortgage Forbearance Versus Loan Modification

Understanding forbearance is a must before agreeing to it with the mortgage servicer. Many people often confuse forbearance versus loan modification. With forbearance, the whole amount due from the forbearance period comes due once the forbearance period expires. Understanding mortgage forbearance is very important:

Once the forbearance period is over, the mortgage servicer may give borrowers a payment plan such as six to 12 months to spread the missed payments

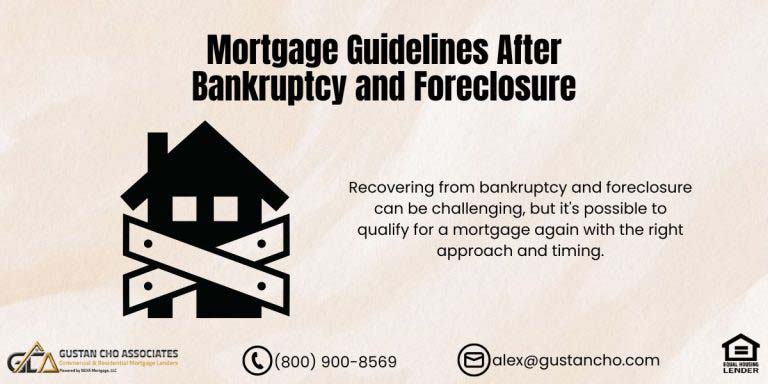

This includes interest and other charges, such as missed escrow payments. The lender will NOT roll the missed payments on the back of the loan balance. The loan balance and all other loan terms, including the rate, remain the same. Going with forbearance during the COVID-19 crisis may also backfire on you when it comes to refinancing at a later date and qualifying for another mortgage.

Understanding Mortgage Forbearance During Economic Crisis

The team at Gustan Cho Associates strongly recommends homeowners pay their mortgage payments during any economic crisis if they can, unless they are financially impacted due to long-term unemployment. The forbearance mortgage program under the CARES Act is intended for homeowners severely impacted due to the pandemic.

Over 16 million Americans have filed unemployment claims in the coronavirus scare tactic by the Democrats.

Mortgage rates are at historic lows. However, lenders keep increasing rates due to liquidity issues in the secondary mortgage bond market. Many experts and analysts expect mortgage rates to plummet once the secondary mortgage bond market stabilizes in a few months. Borrowers with a forbearance may be impacted by refinancing once the refinance boom starts in a few months. We do not know this yet. However, we will keep our viewers posted on any updates.

Understanding Mortgage Forbearance Benefit For Homeowners

Taking up a mortgage forbearance offers many benefits for homeowners laid off from work due to the pandemic. Millions of small businesses in the hospitality and restaurant business have closed their doors, laying off millions of workers until further notice. Homeowners must realize it is not free money and must be repaid under the same terms and rates.

Many businesses will be closed permanently. The federal government is doing everything possible to help small business owners retain employees until the economy reopens.

Many Americans will not return to the same employer. The US economy was booming before the pandemic. How long it will take for the economy to return after the pandemic remains to be seen. Mortgage servicers cannot report borrowers under forbearance on their credit reports. The CARES Act forbearance program greatly benefits homeowners who have exhausted every possible option to pay their mortgage..

Types Of Mortgage Loan Programs That Are Eligible

All government-backed loans qualify under the CARES Act. This means all mortgages backed by FHA, VA, USDA, Fannie Mae, and Freddie Mac qualify under the CARES Act Forbearance Program.

The government is allowing mandatory mortgage forbearance to homeowners to avoid a flood of foreclosures in the coming weeks to months.

Forbearance is an option if you are financially impacted during the coronavirus pandemic. Mortgages not backed by the federal government, such as portfolio loans, may be eligible depending on the lender. It is best to contact the mortgage servicer as soon as possible and see the terms for getting a mortgage forbearance.

Other Options For Surviving The Economic Crisis

After the mortgage forbearance term is over, many servicers require a lump sum payment with accrued interest. Mortgage servicers may allow borrowers to split the lump sum and pay it over a certain timeframe. This will increase the monthly payment until the missed payments are caught up.

Please review the repayment terms with your mortgage servicer before agreeing on a mortgage forbearance.

The surging inflation, skyrocketing home process, and volatile credit markets are causing an economic uproar. The Biden Administration is using the press to gain popularity for the incompetence of his administration by lying about how great the economy is.

How The Economic Crisis Increases Mortgage Forbearance Filings

The economic impact of the coronavirus crisis was an issue with most Americans. The whole US economy is one life support. Literally, we are in a standby mode. The Trump Administration did everything possible to stabilize the financial damage caused by Barack Obama and the Democrats.

President Trump reopened the economy after the democrats tried to shut it down due to the coronavirus scare. The Trump Administration has pumped trillions of dollars by making the stimulus bill into law.

The Federal Reserve Board is increasing interest rates without regard to what it does to the housing and mortgage markets.. Every American worker making up to $99,000 yearly received a stimulus check. The CARES Act allowed Americans affected by the economic crisis access to their 401k accounts up to $100,000 without the 10% penalty.

Economic Unrest With Surging Inflation, Skyrocketing Rates, and Increasing Home Prices

As mentioned earlier, the Trump Administration was looking to reopen the economy. How long will it take for Americans to return to normal? Nobody has a crystal ball.