This ARTICLE On Illinois Housing Recovery Lags Behind The Rest Of The U.S. Was PUBLISHED On September 25th, 2019

Illinois has the second-highest property taxes in the Nation.

- Property taxes in the state of Illinois is the second-highest in the U.S. right behind New Jersey

- The bad news is that property taxes in Illinois keep on going up

- Recent data released by Gustan Cho Associates News show that DuPage County Illinois home values decreased by 24% while property taxes increase by 7% since the Great Recession

- There are many attributes to the Illinois Housing Recovery

In this article, we will cover and discuss Illinois Housing Recovery Lags Behind The Rest Of The U.S. and the reasons why.

Illinois Housing Recovery Is Worst In The Nation

Home values are increasing throughout the country.

- Many homes have appreciated double digits for the past few years

- Due to skyrocketing home prices, both HUD and the Federal Housing Finance Agency (FHFA) and HUD have increased FHA and Conventional Loan Limits for the past three consecutive years

- FHA Loan Limit for 2019 is $314,827

- Conforming Loan Limits are capped at $484,350 for 2019

- President Trump recently signed a bill eliminating VA Loan Limits for eligible veterans on VA Loans

- There is no longer a VA Loan Limit Cap on VA Home Loans

- All of these new rules and regulations is due to rising home prices

- Unfortunately, Illinoisans are not enjoying the housing boom with the rest of the country

- Illinois is one of the very few handfuls of states with declining home values

- Illinois ranks as the number one state with homeowners who still have underwater mortgages

Underwater mortgages are mortgage balances that are higher than the value of the home.

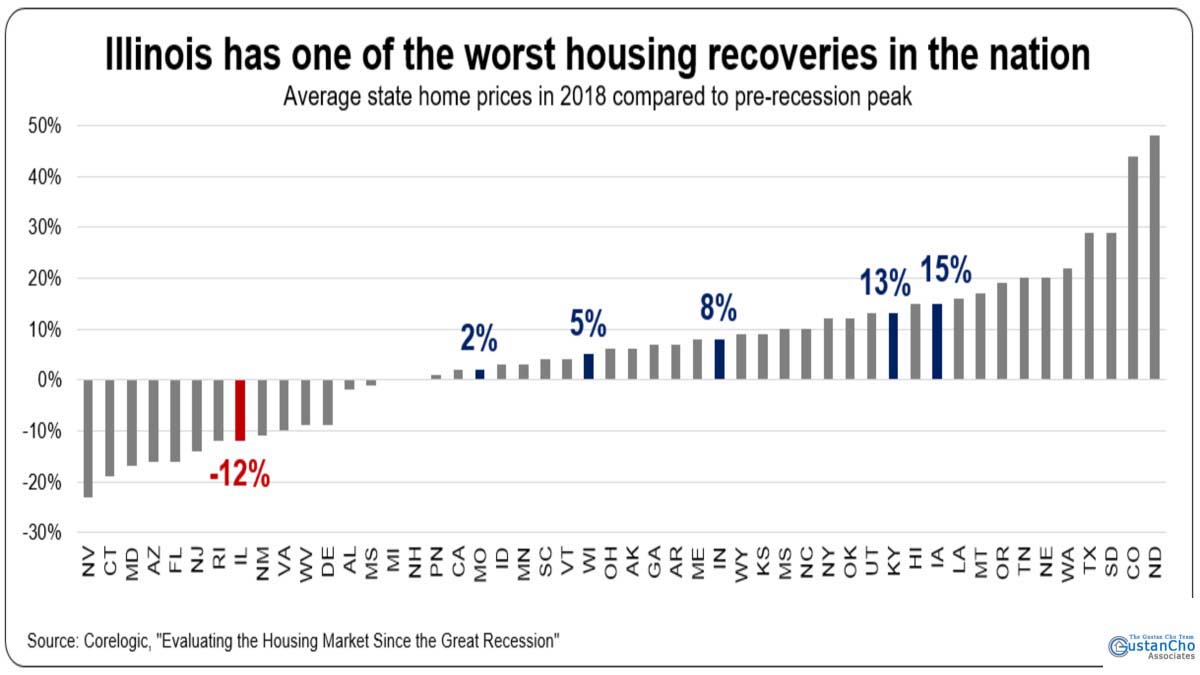

Data And Statistics On Illinois Housing Recovery Versus Other States

The average Illinois homeowner still has home values that are 12% under the pre-Great Recession peak home value levels.

- The data was gathered and released in late 2018 by Corelogic, an international home analysis giant

- Illinois is not alone

- There are 13 other states that have not yet recovered since the Great Recession of 2008

- There are many areas in Chicago and its suburbs where home prices have deteriorated and owners are abandoning their properties

- Most states are not like Illinois

- Many states like Tennessee, Alabama, North Carolina, Georgia, Texas, Kentucky, Mississippi, Colorado, Michigan, Ohio, Indiana are enjoying rising home values where underwater mortgages are now non-existent

Home values throughout the state of Missouri are now 2 percent higher than they were just before the 2007 recession. Many Illinois taxpayers are fleeing to Indiana. Indiana’s home prices increased over 9%. Average home values in Iowa increased by 15%.

The Main Reasons Why Illinois Homeowners Are Hurting Versus Other State Residents

There are many reasons why Illinois taxpayers are worse off than residents of other states.

- Illinois is in a financial crisis. The new governor of Illinois, JB Pritzker, seems to be clueless, incompetent and is expediting Illinois into bankruptcy

- JB Pritzker’s solution to solving the financial mess of Illinois seems to be to raise taxes on anything he can think of

- He recently doubled the state’s gas tax

- Whatever he can think of, he thinks raising taxes is the solution

- Pritzker is becoming increasingly unpopular among the voters

- Pritzker recently approved legislation that gives Illinois lawmakers a raise why the state is on the verge of bankruptcy

- There seems to be no end of rising property taxes

- One thing Governor Pritzker does not realize is that it is not how much you make but rather what you spend

- With increasing taxes, Pritzker has no intention of cutting spending

- Actually, JB Pritzker is increasing spending

Many Illinoisans are becoming scared of Pritzker’s leadership skills and where he is taking the state to. Many are fleeing Illinois to lower-taxed states.

This is a developing story. Gustan Cho Associates Mortgage News will keep our viewers updated on the developments of the Illinois Housing Recovery and the finances of Illinois.