This guide covers Freddie Mac student loan guidelines on conventional loans. Conventional loans are called conforming loans because they need to conform to Fannie Mae and/or Freddie Mac agency mortgage guidelines. Conforming loans are not government loans. Conventional loans are private loans originated and funded by private mortgage lenders and banks. Many borrowers ask if conventional loans are private loans why do they need to conform to Fannie/Freddie guidelines? Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about conventional loans needing to conform to Fannie Mae or Freddie Mac guidelines:

The reason conventional loans need to conform to Fannie Mae or Freddie Mac guidelines is in order for private lenders to sell their conventional loans on the secondary market to Fannie/Freddie, they need to conform to their guidelines.

Fannie Mae and/or Freddie Mac will not purchase conventional loans that do not conform to their lending guidelines. All mortgage lenders fund their loans with a warehouse line of credit. Once they fund the loan, they package these loans up and resell them to the secondary market. The secondary market will not purchase loans that do not conform to Fannie Mae and/or Freddie Mac. After selling the loans, they use the proceeds to replenish and pay down their warehouse lines of credit and reuse the lines for new loans. In this article, we will cover and discuss Freddie Mac student loan guidelines on conventional loans.

Freddie Mac Student Loan Guidelines on Conventional Loans

If you’re planning to buy a home and still have student loans, you’re not alone. Many borrowers worry their debt will block their path to homeownership. Luckily, Freddie Mac student loan guidelines on conventional loans are designed to help. They let you qualify even if your loans are in deferment or on a repayment plan that keeps your monthly payments low.

Understand Freddie Mac student loan guidelines on conventional loans. See how your student debt affects approval and learn how to qualify.

In this post, we will discuss how Freddie Mac looks at student debt during the loan application process. You’ll learn what paperwork you need and how to prove you’re ready for a mortgage. After reading, you’ll feel ready to move forward on the home you want.

Freddie Mac & Your Student Debt—What You Need to Know

Discover how to document student loans, calculate DTI, and meet credit criteria for a smooth approval.

How Freddie Mac Student Loan Guidelines for Conventional Loans is Handled

Freddie Mac understands that many buyers—especially those buying a home for the first time—carry student loan debt. To help more people qualify for a mortgage, the agency has tailored its underwriting process to be more realistic. Here’s what you need to know:

When student loans are in deferment, forbearance, or an income-driven repayment program, Freddie Mac lets lenders take a different approach to the monthly payment that goes into your debt-to-income (DTI) ratio.

Even if you are not currently making a repayment, lenders must still include a figure in your DTI. The good news is that Freddie’s requirements are often more lenient than those of other lending programs.

Student Loan Payment Calculation: Freddie Mac vs. Other Guidelines

When you’re applying for a Freddie Mac conventional loan, the rule for your student loan payment goes like this:

- If your student loan has a regular payment above $0 that shows up on your credit report, that amount will be used for DTI.

- Suppose the payment is $0 or the loan is in deferment, forbearance, or income-driven repayment. In that case, lenders will take 0.5% of the total loan balance.

Example of Freddie Mac Student Loan Guidelines:

- Let’s say you have a student loan of $40,000 and it’s currently in deferment.

- Freddie Mac would use $200 ($40,000 × 0.005) as the monthly debt figure that goes into the underwriting process.

- That’s much easier than other lenders, like FHA, which generally count 1% of what you owe.

What If My Loans Are in Income-Driven Repayment?

Good news for you. Freddie Mac lets you use your real IBR (Income-Based Repayment) payment. Even if you’re down to $0 a month, the lender can still consider that. If it’s there on your credit report, you’re all set.

This helps folks whose IBR payments drop to low or zero amounts. It keeps your DTI ratio in check and bumps up your approval chances.

Can I Still Qualify if My Student Loans Are Deferred?

Absolutely. You can still move forward with a Freddie Mac loan if payments are paused. Here’s the drill:

- No payment on the credit report?

- The lender will pencil in 0.5% of the total balance.

- If an IBR line says $0, they’ll use that number first.

- So, there’s no need to hang tight for your loans to go back into repayment.

- You can step into your new mortgage whenever you’re ready.

Key Freddie Mac Requirements to Qualify for a Conventional Loan

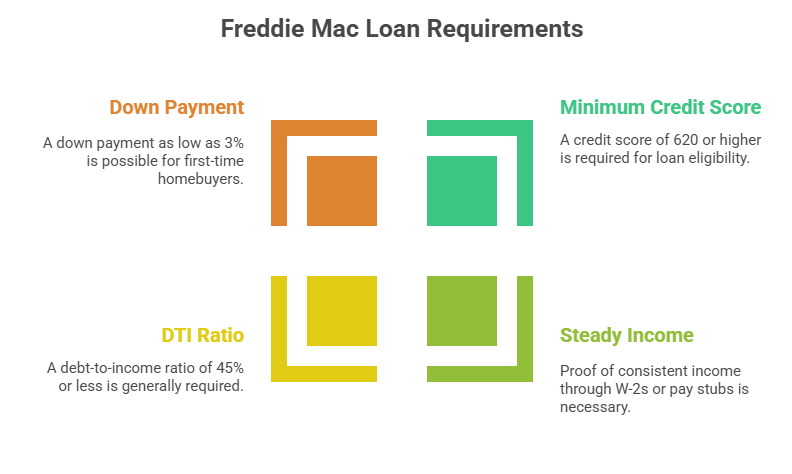

To successfully land a Freddie Mac-backed conventional loan, you’ll need to satisfy a handful of core underwriting rules:

- Minimum Credit Score: 620 or above (some lenders might ask for a little higher).

- Steady Income and Employment: Provide recent W-2s, pay stubs, or self-employment documentation

- DTI Ratio: Usually 45% or below, though it can stretch to 50% in certain situations.

- Down Payment: Starting at just 3% for first-time homebuyers using Home Possible.

- Even with student loan debt in the picture, you can still open the door to homeownership, especially when you partner with a lender who can present your profile the right way.

How Do Freddie Mac Student Loan Guidelines Affect Your Debt-to-Income Ratio?

Your debt-to-income ratio (DTI) plays a big part in whether you get the green light for a mortgage. Student loans count in that number, even when you’ve hit the pause button on payments.

Freddie Mac’s 0.5% rule treats a $50,000 student loan as adding $250 monthly to your debt pile. But if you’re on Income-Based Repayment (IBR) and your bill is $50 or even $0, that number can shrink fast.

Team up with a lender who knows Freddie Mac’s student loan rules, and they can fine-tune your application to keep your DTI in check.

Qualify Despite Student Loans with Freddie Mac

Step-by-step insights on handling deferred payments, loan forgiveness, and repayment plans for your mortgage.

How Do Freddie Mac and Fannie Mae Treat Student Loans Differently?

Freddie Mac counts 0.5% of the total student loan balance each month. At the same time, Fannie Mae wants the actual payment amount you’re making, or 1% of the balance if you’re not in repayment. Freddie Mac’s smaller number may lower your total debt and help you qualify for the loan you want.

Do Defaulted Student Loans Stop You from Qualifying?

Yes, if any student loan defaults, it will hold up your application. You must:

- Rehabilitate the loan or consolidate it.

- Make it current and out of default.

- Show the lender documents proving it’s fixed.

- When that’s done, you can keep going with Freddie Mac financing.

Freddie Mac’s Home Possible and Borrowers with Student Loans

Freddie Mac’s Home Possible® loan is a smart choice for first-time buyers who have student loans.

It comes with:

- A 3% down payment requirement.

- Lower mortgage insurance costs.

- Flexible income cap limits.

- Room for co-borrowers and money from gifts.

- The program works well for new grads or anyone with a short credit history.

How to Improve Your Chances of Getting a Mortgage With Student Loans

Do you have student loans and are worried they’ll sink your mortgage application? Follow these tips to stay on track:

- Choose Income-Based Repayment (IBR): Stick to the lowest payment plan you qualify for.

- Whittle Down Other Debt: Pay off credit cards and loans to decrease your debt-to-income (DTI) ratio.

- Find a Smart Mortgage Broker: Pick one who speaks Freddie Mac fluently.

- Mention Home Possible®:If you’re a first-time buyer, see if this program suits you.

Partner With a Lender Who Knows Freddie Mac Inside and Out

At Gustan Cho Associates, student loans are our specialty. Whether your loans are on deferment, in forbearance, or you’re chipping away at them, we’ll connect the dots and get you the yes when others say no.

We skip lender overlays and have access to more than 180 wholesale mortgage investors across the U.S. If you’ve faced a denial, let us use our expertise to help you.

Student Loan Impact on Your Freddie Mac Loan

Understand how different repayment statuses influence debt ratios—and boost your approval odds.

Obstacles With Student Loans When Qualifying For a Mortgage

It costs a lot of money to attend college. It is very easy to rack up over $100,000 or more in a four-year college education in a state sponsored college or university. Most college graduates have high student loan balances. Angie Torres, the national operations director at Gustan Cho Associates and an associate contributing editor at GCA Forms says the following about student loan guidelines:

Many graduates of graduate and/or post-college degrees will easily amass student loan balances well over six figures. Borrowers with high student loan balances may need to opt for conventional and FHA loans.

Per Fannie Mae and Freddie Mac student loan guidelines, conventional loans accepts income-based repayment plans (IBR Payments). FHA loans did not allow IBR payments until recently. HUD now allows income-based repayment plans.

HUD Versus Freddie Mac Student Loan Guidelines

Deferred student loans that have been deferred for more than 12 months is only accepted by The Department of Veterans Affairs (The VA) for VA loans. Alex Carlucci, a senior mortgage loan originator at Gustan Cho Associates and an associate contributing editor at GCA Forums says the following about HUD, USDA, and Freddie Mac Student Loan Guidelines:

All other loan programs do not accept deferred student loans. This holds true for extended deferment. FHA and USDA have the same student loan guidelines. HUD and USDA now allows income-based repayment plans.

HUD and USDA loans will also allow a fully amortized monthly payment over an extended-term (normally 25 years). Or if the borrower is not on a current fully amortized monthly payment plan, a letter stating a hypothetical fully monthly payment over an extended plan will suffice. Income-based repayment (IBR) is allowed on USDA and FHA loans. With conventional loans, lenders also allow Income-Based Repayment (IBR) as long as the minimum payment reports on the consumer credit report.

Debt To Income Ratio Mortgage Guidelines

Debt to income ratio is the total amount of debts a borrower has divided by the gross monthly income. Here is the debt to income ratio lending guidelines on the particular loan programs:

HUD allows a maximum of a 46.9% front end and 56.9% DTI to get an approve/eligible per automated underwriting system. The VA does not have a maximum debt to income ratio cap on VA loans.

USDA allows a maximum of 29% front end and 41% back end debt to income ratio caps on USDA loans. Fannie Mae and Freddie Mac allow up to a 50% debt to income ratio cap on Conventional loans. There is no front end debt to income ratio cap on Conventional loans. Mortgage Borrowers with high student loan debts and high debt to income ratios may need to go with conventional loans. For more information about the contents of this article and/or other mortgage-related topics, please contact us at Gustan Cho Associates at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com

Frequently Asked Questions (FAQs) on Freddie Mac Student Loan Guidelines

Can I Still Get a Mortgage if I Only Have $100 in Student Loan Debt?

- Absolutely.

- Freddie Mac uses either 0.5% of the balance or your current IBR payment in the DTI, whichever is lower.

What if My Student Loan is Still Being Deferred?

- For loans in deferment, lenders apply 0.5% of the total balance when figuring your monthly debt.

Will Loans in Forbearance Hurt My Mortgage Chances?

- Yes, they will, but you can still get approved.

- They count 0.5% of the balance toward your debt ratios.

Can I Get a Freddie Mac Mortgage With a $0 IBR Payment?

- Absolutely.

- Freddie Mac accepts a $0 IBR payment if that’s what your credit report shows.

What Minimum Credit Score Do I Need?

- You generally need a score of 620 or higher.

- A stronger score can help your terms and rating.

What if My Student Loans Are Defaulted?

- You must clear the default can close on any mortgage loans.

Does Freddie Mac Allow Co-Signers or Co-Borrowers?

- Yes, you can have a co-borrower who doesn’t live in the house help you get approved.

Can My Family’s Gift Money Count Toward The Down Payment?

- For sure.

- Freddie Mac lets you use gift money from relatives for the down payment and closing costs.

How Do Student Loans Factor Into DTI?

- They add to your total monthly debt.

- If you use IBR, the payment can be smaller, which lowers DTI.

How Gustan Cho Associates Makes a Difference

At Gustan Cho Associates, we don’t have lender overlays. This means we can say yes even when other lenders can’t, especially for borrowers with student loans.

Want to Get Approved for a Mortgage Despite Student Loans?

If student loan payment is keeping you from buying a home, we can help you overcome that barrier. Contact us at 800-900-8569 or check out Gustan Cho Associates start your homeownership journey. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

Master Freddie Mac’s Student Loan Rules for Homebuyers

Expert tips on documenting student debt, calculating income-driven payments, and optimizing your application.