What Is an 80-10-10 or Piggyback Mortgage?

Buying a home can be one of life’s most exciting yet challenging journeys. Given the ongoing rise in home prices and the tightening of lending standards, many potential buyers face difficulties securing conventional mortgage loans. That’s where the 80-10-10 or piggyback mortgage comes in as a creative financing tool. This loan structure can help you avoid private mortgage insurance (PMI), purchase a higher-priced home, or reduce upfront costs.

Let’s dive deeper into how this loan works and how it might be the perfect solution for your home purchase.

Understanding the 80-10-10 Mortgage Structure

An 80-10-10 mortgage, also known as a piggyback mortgage or a combo loan, is a home financing strategy where the total loan amount is split into three parts:

- 80% First Mortgage: Covers most of the home’s purchase price.

- 10% Second Mortgage: A more manageable loan, typically designed as a home equity loan or a line of credit (HELOC), can be beneficial for various financial strategies.

- 10% Down Payment: The amount you contribute upfront.

This structure allows you to finance 90% of the home’s value while avoiding PMI, typically required if your down payment is less than 20%.

Why Consider an 80-10-10 Mortgage in 2024?

With 2024 updates to loan limits and the ongoing rise in home prices, piggyback mortgages are becoming a smart choice for many borrowers. Here’s why:

- Avoiding PMI: PMI can add hundreds of dollars to your monthly mortgage payment. With an 80-10-10 mortgage, you can sidestep this expense entirely.

- Lower Interest Rates: The first mortgage typically carries a lower interest rate than jumbo loans.

- Flexibility for High-Priced Homes: It’s ideal for buying homes above conventional loan limits.

- Tax Benefits: Depending on your financial situation, the interest on the first and second mortgages may be tax-deductible (consult a tax professional).

Start Your Process Towards Buying A Home

Apply Online And Get recommendations From Loan Experts

Updated Loan Limits for 2024

Loan limits for FHA, Conventional, and Jumbo loans adjust annually. As of 2024:

- The FHA Loan Limit is $472,030 in most areas, with higher limits in high-cost counties (up to $1,089,300).

- Conventional Loan Limit: $726,200 for most counties, with limits up to $1,089,300 in high-cost areas.

- Jumbo Loans: Loans exceeding $726,200 are categorized as jumbo loans, requiring stricter qualifications and higher down payments.

If your desired home exceeds these limits, an 80-10-10 mortgage could help you purchase it without jumping into the jumbo loan category.

How Does an 80-10-10 Mortgage Work?

Here’s a simple example:

Imagine you’re buying a home priced at $500,000:

- First Mortgage: 80% of the purchase price = $400,000.

- Second Mortgage: 10% of the purchase price = $50,000.

- Down Payment: 10% of the purchase price = $50,000.

By splitting the financing, you’re able to:

- Avoid PMI.

- Keep the first mortgage within conventional loan limits.

- It’s possible to obtain a more favorable interest rate in comparison to a jumbo loan.

Benefits of an 80-10-10 or Piggyback Mortgage

- Avoid Private Mortgage Insurance (PMI): Private Mortgage insurance (PMI) is needed when a borrower puts down less than 20% on a conventional loan. However, with the 80-10-10 mortgage structure, the first loan is set at an 80% loan-to-value (LTV) ratio. This approach effectively eliminates the need for PMI altogether.

- Lower Down Payment: Instead of needing 20% upfront, you only need 10%, making it easier to purchase your dream home.

- Afford a More Expensive Home: Combining two loans allows you to finance homes priced beyond conventional limits without jumping to jumbo loan requirements.

- Flexibility: Second mortgages, like HELOCs, often come with adjustable terms, allowing you to pay them off faster if you desire.

- Potential Tax Savings: In some cases, the interest on both loans is deductible. Check with a tax advisor for eligibility.

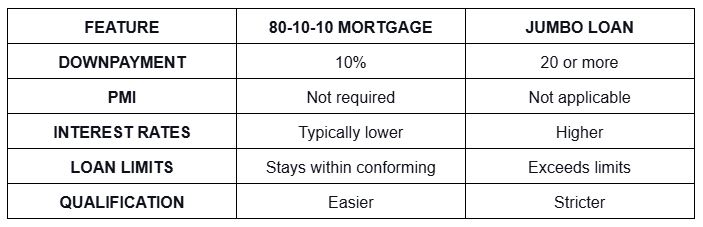

Piggyback Mortgages vs. Jumbo Loans

When purchasing a high-priced home, you might wonder whether to opt for a jumbo loan or an 80-10-10 mortgage. Here’s a quick comparison:

Eligibility for an 80-10-10 Mortgage in 2024

Qualifying for an 80-10-10 mortgage is similar to applying for any other loan, with some additional considerations:

- Credit Score: Most lenders require a minimum FICO score of 620 for the first mortgage and 680-700 for the second mortgage.

- Debt-to-Income (DTI) Ratio: To maintain financial stability, total monthly debt payments should remain below 43% of gross income.

- Income Stability: Lenders will review your income history for the past two years.

- Reserves: Some lenders may require a few months of reserves to cover both loan payments.

How Gustan Cho Associates Can Help

At Gustan Cho Associates, our focus is on assisting borrowers in discovering innovative financing options to achieve their goal of homeownership. Whether you’re considering an 80-10-10 mortgage, need help avoiding PMI, or have unique financial circumstances, our team is here to guide you every step of the way.

- Wide Lender Network: We partner with lenders offering flexible second mortgage options.

- Expert Guidance: Our loan officers understand complex loan structures and can tailor solutions to your needs.

- Fast Approvals: We work quickly to help you secure financing and close on your home.

Next Steps

Thinking an 80-10-10 mortgage might be right for you? Contact us today to learn more! Call us at 800-900-8569, text us for a faster response, or email gcho@gustancho.com. We’re available 7 days a week, including evenings and holidays.

Don’t let high prices or PMI keep you from buying your dream home. With an 80-10-10 mortgage, you can make it happen!

Take First Step Toward Making Your Dream A Reality

Apply Online And Get recommendations From Loan Experts

Frequently Asked Questions About What is an 80-10-10 or Piggyback Mortgage Loan:

Q: What is an 80-10-10 or Piggyback Mortgage?

A: An 80-10-10 mortgage is a home loan strategy where you borrow 80% of the home’s price with a first mortgage, 10% with a second mortgage, and the remaining 10% as a down payment. This helps you avoid paying for private mortgage insurance (PMI).

Q: Why Would I Want an 80-10-10 Mortgage?

A: This loan can help you buy a home without needing a 20% down payment or paying PMI. It’s also useful if you want to avoid higher interest rates from a jumbo loan for a more expensive home.

Q: How Does an 80-10-10 Mortgage Work?

A: The loan is split into three parts: 80% is the first mortgage, 10% is a second mortgage (often a home equity loan or line of credit), and 10% is your down payment. This structure can help you get a better interest rate and avoid PMI.

Q: Can I Use an 80-10-10 Mortgage to Buy a High-Priced Home?

A: Yes, it’s especially helpful for buying homes above the limit for conventional loans, allowing you to avoid jumbo loan rates.

Q: What is the Benefit of Not Having PMI with an 80-10-10 Mortgage?

A: Private mortgage insurance (PMI) can increase your monthly expenses considerably. However, by utilizing the 80-10-10 loan structure, you can eliminate this additional cost, thus making your monthly payments more manageable.

Q: What Credit Score do I Need for an 80-10-10 Mortgage?

A: To obtain financing, a minimum credit score of 620 is usually required for the first mortgage, whereas the second mortgage typically requires a score ranging from 680 to 700. Nonetheless, these criteria may vary according to the lender’s policies.

Q: Is an 80-10-10 Mortgage Better Than a Jumbo Loan?

A: It can be, especially if you want to avoid the stricter qualifications and higher interest rates that come with jumbo loans. The 80-10-10 structure can offer a lower overall interest rate.

Q: How Much Down Payment do I Need for an 80-10-10 Mortgage?

A: You’ll need 10% for the down payment, with the rest of the home’s price covered by the two loans.

Q: Can I Deduct the Interest on Both Loans for an 80-10-10 Mortgage?

A: In some cases, the interest on both loans may be tax-deductible. It’s best to consult a tax professional to determine your qualifications.

Q: How Can I Qualify for an 80-10-10 Mortgage?

A: Lenders typically evaluate several key factors, including credit scores, income stability, and debt-to-income ratios. It is essential to demonstrate that you can manage the loan payments while fulfilling the lender’s other prerequisites.

This blog about “What Is An 80-10-10 Or Piggyback Mortgage Loan” was updated on December 26th, 2024.