BREAKING NEWS: Stocks Recover After 3000 Point Drop On Monday But Mortgage Rates Up

This breaking news article on Stocks Recover After 3000 Point Drop On Monday But Mortgage Rates Up was PUBLISHED On March 17th, 2020

The Dow Jones plummeted nearly 3,000 points yesterday after the Fed cut rates on Sunday.

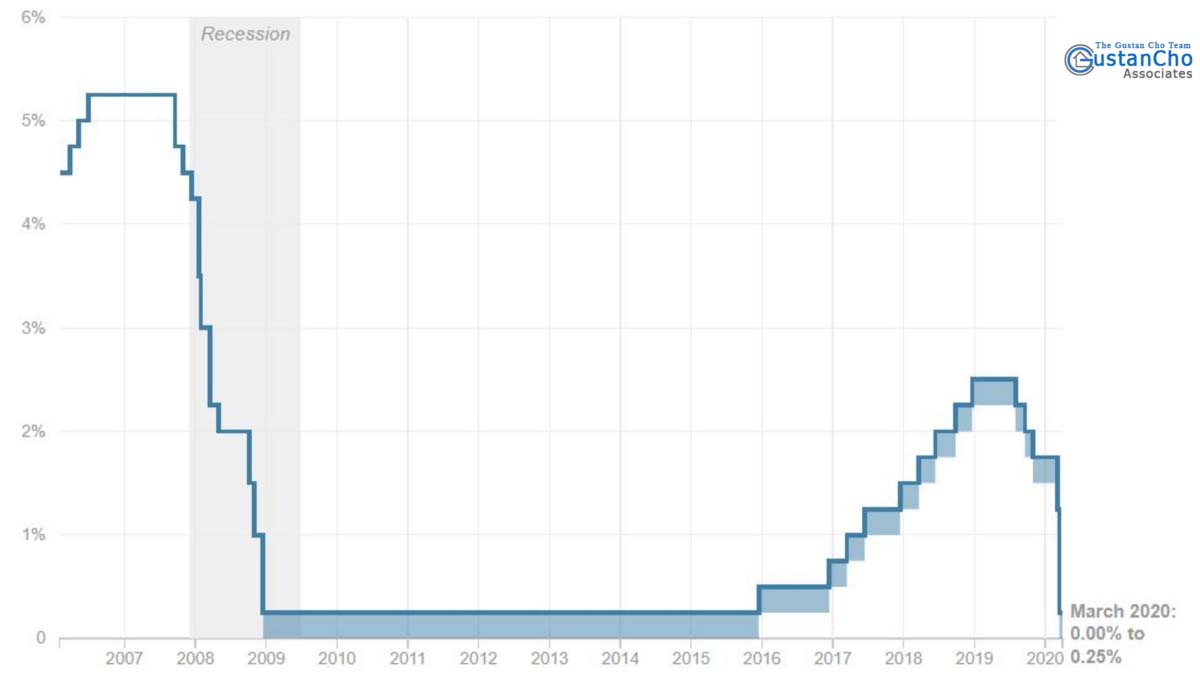

- The emergency rate cut by the Fed was announced on Sunday, cutting rates to 0.0%

- Many cities, county, and state governments announced they will declare a state of emergency in ordering bars, restaurants, and other public places closed until further notice due to the coronavirus pandemic

- As the coronavirus pandemic spreads, the economy is getting damaged and is affecting American consumers

- This holds especially true for homebuyers and homeowners

- Par mortgage rates are at an all-time historic low

- However, lenders keep on increasing mortgage rates due to the fact they are at full capacity

- As the yield on the 10-year Treasury is dropping, so are mortgage rates

- However, lenders are increasing rates even though mortgage rates are at historic lows

- However, the Dow Jones recovered over 1,048.46 today as investors regained some confidence in the Trump Administration coronavirus stimulus package

In this article, we will discuss and cover Stocks Recover After 3000 Point Drop On Monday But Mortgage Rates Up.

Stocks Recover After 3000 Point Drop On Monday But Mortgage Rates Up Amid Midst Of Coronavirus Fear And Uncertainty

Stocks recover over 1,000 points today after falling sharply yesterday one day after the Fed cut interest rates to zero.

- The Fed announced they will do an emergency rate cut to zero

- This move was done to stop the US economy from proceeding to a financial meltdown and crashing

- On Monday, the Dow dropped 2,997.20 points which translates in a 13% drop

- On Monday, the Dow Jones Industrial Average closed at 20,188.52

- The Dow lost 31.7% since its all-time record high on February 12th, 2020

- The 11-year bull market winning streak was broken by the coronavirus outbreak

- Other equity markets plummeted Monday

- The S&P 500 slid more than 12%

The Dow Jones Industrial Average dropped 2,997.20 points, or about 13%, as coronavirus measures rapidly expanded. The drop of the Dow was the biggest single-day point drop since the Black Monday crash of October 1987, when the Dow and other market index lost over 22%. Monday’s drop signals the country is going to a recession. How bad will the next recession and the economic downturn be? It depends on how long the coronavirus pandemic lasts. As of today, there is no vaccine for the widely spreading deadly coronavirus. The Dow has recovered over 1,000 points today after yesterday’s nearly 3,000 point drop in the Dow.

Consumers Still Worried After Stocks Recover After Monday’s 3,000 Point Drop

Although the Dow recovered over 1,000 points Tuesday, Americans are worried about the uncertainty of the coronavirus pandemic. More and more cities, counties, and states are coming to an economic standstill. Financially strapped Illinois may be facing bankruptcy as the governor declared a state of emergency ordering all bars and restaurants closed until further notice. The shutdown will affect many small business owners, workers, and the state due to its lack of revenues. Other cities in New York and California followed Illinois’ lead in shutting down restaurants and bars. Many Corporate CEO’s and small business owners have ordered all employees to work from home. Many cities and towns in California have ordered a total shutdown of not just restaurants and bars but all businesses. Only police and fire agencies, medical centers and hospitals, pharmacies, gas stations, grocery stores, and a few other exempt businesses are allowed to remain open. Many industries such as transportation and hospitality are being hard-hit by the coronavirus pandemic. The plummeting yield on the 10-year US Treasury has plummeted mortgage rates. However, due to lenders being beyond full capacity, lenders have been increasing mortgage rates instead of lowering them.

Look at the graph below:

Mortgage Rates Are Getting Worse

With the stock market down close to 30% in a matter of a few weeks, mortgage rates have plummeted to historic record lows. However, lenders had a rush of refinance mortgage applications. Lenders are at full capacity and do not have the staffing to take on more loans. Some lenders have completely stopped taking new loan applications. Others have increased mortgage rates to ridiculous levels where it stopped borrowers from applying for a mortgage. Once the current mortgage locks have been closed, lenders will most likely not lower rates. How long will this take? It may take a few days to a few weeks. Lenders will lower mortgage rates and price them accordingly. In the meantime, home buying has slowed dramatically due to the coronavirus pandemic. Many are speculating the US will have another housing market crash due to the coronavirus pandemic.