In this blog, we will cover and discuss turning an owner-occupied to investment home. The exiting home will turn into a rental investment home. By doing so, buying a new primary residence home will not be stressful due to rental income coming in from the exiting home. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about turning an owner-occupied to investment home:

There are cases where a homeowner with an owner-occupied home wants to purchase another owner-occupied home. Then wants to sell their current owner-occupied home after they move in to their new owner-occupied home.

This can get done under certain circumstances. Homeowner needs to qualify for both mortgages. In the following paragraphs, we will cover turning an owner-occupied to investment home. In the following paragraphs, we will cover turning an owner-occupied to investment home.

Expenses on the Exiting Home Needs to Be Calculated on Debt-to-Income Ratio on New Home Purchase

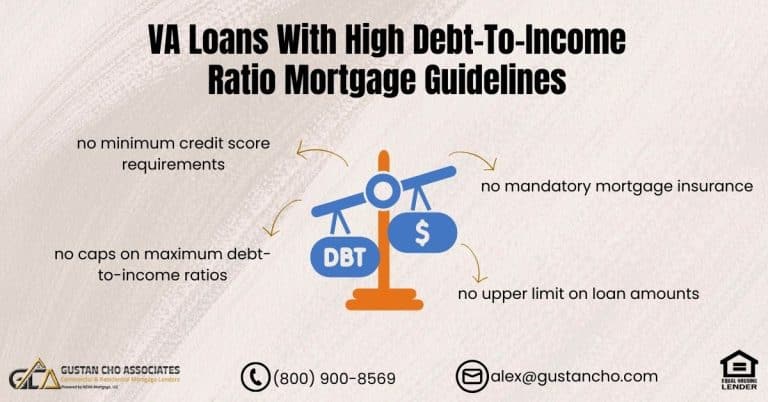

Borrowers needs to meet minimum debt to income ratio requirements. Cannot qualify for both mortgages if they exceed the maximum debt to income ratios. However, there are potential solutions.

A homeowner with an owner-occupied home can convert the owner-occupied to investment home without refinancing. Homeowners can use 75% of the potential market gross rental income as borrowers income.

There are rules and regulations concerning this. It depends on whether the new owner-occupied home purchase is a FHA or conventional loan. In this article, we will discuss and cover exiting an primary home and making it a rental & buying new home.

Turn Your Home Into an Investment

Learn how to convert your primary residence into a rental property.

FHA Owner-Occupied to Investment Home Guidelines

If a homeowner currently lives in a home and needs to convert their owner-occupied to investment home to use potential income, the following applies. If the borrower of the new home needs to use the potential rental income on exiting property in order to qualify, then the homeowner needs to have at least 25% equity in exiting property. The homeowner does not need to refinance their home.

How Can Exiting Home Debts Be Exempted on Debt-to-Income Ratio Calculations

If the loan to value is higher than the 75% LTV required, homeowner can pay down their mortgage so it meets the 75% LTV. Needs to get an investment home appraisal with potential rental income.

Whatever the appraiser comes up with as potential rental income, then 75% of the potential rental can be used as qualified income.

This rental income is necessary for many folks in order to qualify for both mortgages. HUD, the parent of FHA, does not require that the homeowner have a tenant with a signed lease. HUD only requires that the homeowner has 25% equity on the owner-occupied home that will be converted to an investment home.

Fannie Mae Owner-Occupied To Investment Home Guidelines

If a homeowner currently lives in a home and needs to convert owner-occupied to investment property they can use potential rental income as qualified income. If homeowner needs to use potential rental income in order to meet the debt to income ratios under certain circumstances.

Homeowner needs to have at least 25% equity in exiting the owner-occupied home. Under Fannie Mae Guidelines, a one year lease agreement is required on Conventional loans.

In order to use 75% of the potential rental income on conversion of the owner-occupied to investment home. The homeowner also needs two months reserves on both converted exiting owner-occupied to investment homes. Also needed are two months reserves on a new owner-occupied home purchase. The new conventional mortgage loan program is much stricter than the FHA loans.

Build Wealth Through Real Estate

Your current home could be your next income stream.

Owner-Occupied to Investment Home Mortgage Guidelines

Learn how to convert your current owner-occupied home into a rental property smoothly. We break down the mortgage steps, lender requirements, and smart tips to switch while buying your next house.

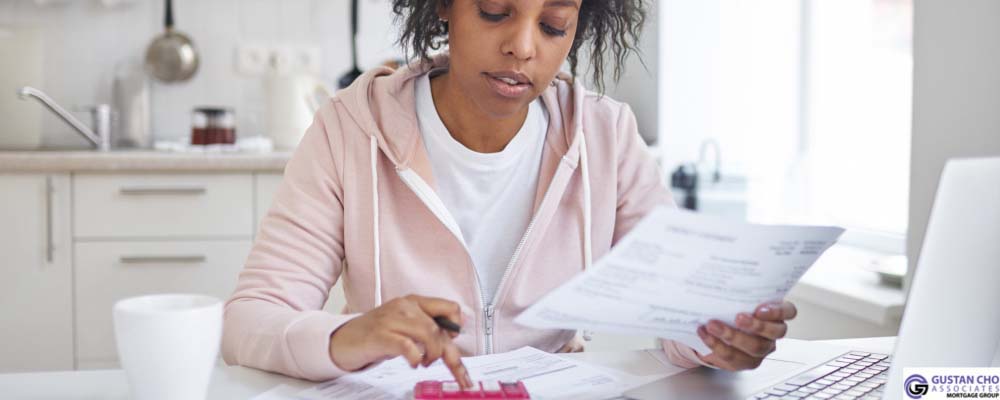

Turning Your Owner-Occupied Home into a Rental

When it’s time to upgrade your living space or downsize, selling your current home isn’t your only option. Many homeowners keep their existing residence and turn it into a rental. Doing this creates a new stream of passive income while you build equity. However, lenders treat these situations differently, so knowing the guidelines is crucial before you make the switch. The right steps now can save you headaches later and put you on the path to long-term wealth through real estate.

What Owner-Occupied Means When You Get a Mortgage

When you buy an owner-occupied home, you promise to live in it as your main home. Lenders typically ask you to move in within 60 days after closing** and stay there for a minimum of 12 months. This rule helps prevent people from snagging lower mortgage rates for primary residences when they want to rent them out.

Changing the Property to Rental Status

Once you’ve completed the occupancy requirement, you can officially change your home to an investment property. You can then choose to:

- Maintain the current mortgage and turn the house into a rental.

- Refinance into an investment property mortgage if you wish to pull out equity or change the terms of the loan.

Mortgage Rules for Switching from Owner-Occupied to Investment Home

Primary Residence Occupancy Expectation

Lenders generally want you to live in the house for **at least 12 months before renting it out. Some exceptions include:

- You get a job transfer to a different city.

- Your household size changes greatly, like a new baby or a lost job.

- You face financial issues that make it necessary to move.

Equity and Loan-to-Value (LTV) Standards

Suppose you’re turning your current home into a rental and refinancing it into an investment loan. In that case, you’ll need to show at least 25% equity in the property. A few programs might let you get away with 20% equity if your credit score and reserve funds are strong.

Using Rental Income

Once the home becomes a rental, you can often use 75% of the future rent to help qualify for the loan. You’ll need a lease signed by a tenant, plus some lenders want to see the first month’s rent in your bank account as proof.

Cash Reserves

Since investment loans are riskier for lenders, be ready to provide 2 to 6 months’ worth of reserve cash when refinancing or buying a new primary home. This reserve should cover the mortgage, taxes, and insurance.

Buying a New Home While Keeping Your Current Home

Qualifying for the New Mortgage

You must qualify for both loans when you buy a new house and plan to rent your old one. Lenders will check your:

- Debt-to-Income (DTI) Ratio.

- Credit Score.

- Assets and Reserves.

Using Rental Income to Qualify

If you have a signed lease for your old place, banks usually let you count some of that rental income as part of your qualifying income. This may help you get approved for the new mortgage.

Advantages of Turning Your Home into a Rental

- Your property can gain value while tenants pay off the mortgage.

- It spreads out your income and can create a steady cash flow.

- You can enjoy long-lasting tax perks like depreciation and writing off expenses.

Things to Watch Out For

- Higher mortgage rates may apply to investment properties.

- Vacancy can hurt your cash flow if tenants move out and the place sits empty.

- You’ll handle property management, repairs, and tenant questions.

Tips for a Smooth Switch

- Make sure you’ve met the 12-month owner-occupancy rule before you move out.

- Get a professional rental analysis to understand your pricing and market demand before you convert.

- Reach out to a lender with zero overlays—like Gustan Cho Associates—so you can explore every possible loan program.

- Keep cash reserves handy to cover repairs and possible empty months.

Unlock Rental Income Potential

We’ll show you how to use your owner-occupied home as an investment.

FAQ: Converting Your Owner-Occupied Home to a Rental Property

How Long Must I Live in My Home Before I Can Make It a Rental?

Generally, you need to reside in the home for at least 12 months.

Can I Rent it Out Before the 12 Months are Up?

Sure, as long as you have a valid reason, such as a new job or a family situation. You’ll need to provide proof.

Do I Have to Refinance When I Switch it to an Investment Loan?

Not at all. You can keep your current mortgage, but a refinance might be a good idea if you want to access your equity or change loan terms.

Can I Use the Rental Income to Help Qualify for Another Home?

Lenders usually accept 75% of the new rent to help balance your mortgage debt.

What if I Rent My Home But Don’t Tell My Lender?

That’s called occupancy fraud and is risky, so always keep your lender in the loop.

What Credit Score Do I Need to Refinance My Investment Property?

Most lenders expect a credit score of at least 620 to 640. You’ll likely score a higher interest rate if your score is higher.

Do I Need To Show Reserve Funds to Convert My Place To a Rental?

Lenders usually want to see 2 to 6 months’ mortgage payments in reserve funds.

What Tax Breaks Do I Get From Rental Properties?

You can write off expenses like repairs, maintenance, property taxes, mortgage interest, and depreciation, which lowers your taxable income.

Can I Buy a New House and Keep My Old One As a Rental?

Yes, as long as you can afford both mortgages. The rental income from your old house can help cover the new mortgage.

What’s The Most Common Mistake When Turning a Home Into a Rental?

Not budgeting for vacancies and maintenance can lead to cash flow problems.

Qualifying For a New Home Without Selling the Existing Home

Homebuyers who need to qualify for mortgage with a mortgage company licensed in 48 states with no mortgage overlays can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Gustan Cho Associates Mortgage Group has no lender overlays on FHA, VA, USDA, and Conventional loans. Gustan Cho Associates is licensed in 48 states are are expert on non-QM loans and bank statement loans for self-employed borrowers. We are available 7 days a week, evenings, weekends, and holidays.

Smart Homeowners Become Smart Investors

Turn your property into a wealth-building tool.