Easy Mortgage Loan Programs for Homebuyers With Bad Credit

Quick Answer Mortgage loan programs for homebuyers include Conventional, FHA, VA, USDA, Jumbo, and Non-QM options. Picking the right option…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Quick Answer Mortgage loan programs for homebuyers include Conventional, FHA, VA, USDA, Jumbo, and Non-QM options. Picking the right option…

Apartment Building Loans: Your Complete Guide in 2025 If you plan to buy or refinance a multifamily property, look for…

Updated Owner-Occupant Multi-Family Mortgage Guidelines for 2025 Are you dreaming of owning a home while earning rental income to help…

In this blog, we will discuss and cover duplex mortgage loans down payment guidelines. A duplex is a two-unit multi-unit…

This blog will discuss the intricacies of buying home with illegal apartment in the basement and attic. Most of these…

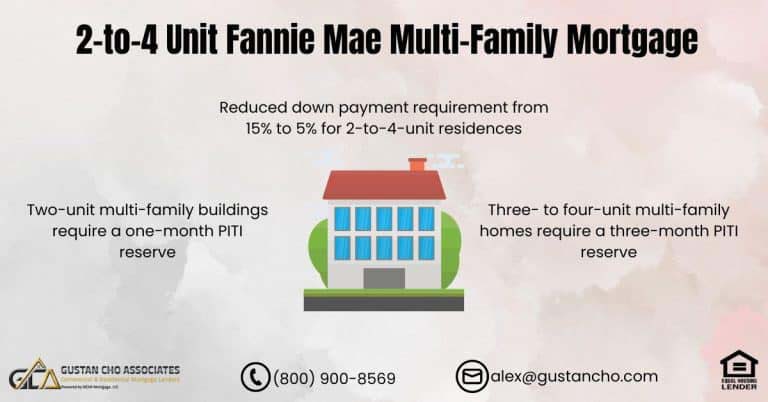

When And Why Do Mortgage Lenders Ask For Reserves? On VA and FHA manual underwriting, one month’s reserves are required. Multi-family units require reserves by homebuyers.

When considering Home Purchase With Illegal Apartment in Chicago, prospective buyers have access to various financing options through government and…

In this article, we will cover and discuss using future rental income to qualify for a mortgage. Some first-time home…

This manual addresses the modifications in down payment and self-sufficiency for multi-family properties designated as owner-occupant primary residences by the…