HUD Late Payment Mortgage Guidelines During Chapter 13 Bankruptcy (FHA + VA Rules)

Quick Answer: Yes, you may qualify for an FHA or VA mortgage while you’re still in an active Chapter 13…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Quick Answer: Yes, you may qualify for an FHA or VA mortgage while you’re still in an active Chapter 13…

Understanding Hard Pull Credit Inquiries: Your Guide to Smarter Credit Decisions When you’re considering buying a home, every step you…

Qualifying for a Home Loan with Recent Late Payments in 2024 Are you struggling with recent late payments but still…

Why Do Lenders Request Bank Statements? A 2024 Guide for Borrowers If you plan to buy a home or refinance…

Cash to Close and Seasoned Funds for Closing: Your 2024 Guide to a Smooth Home Purchase When you’re ready to…

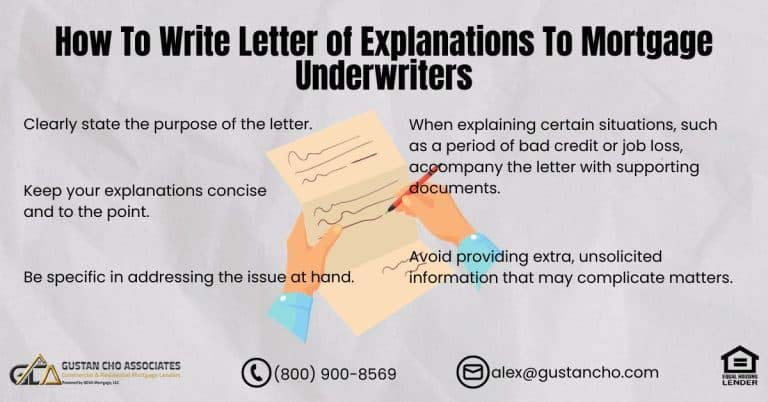

In this blog, we will cover how to write a letter of explanation to mortgage underwriters. Borrowers planning on applying…