This BLOG On Insurance Claim By Policyholders Often Yields An Increase Of Premium Was UPDATED On January 3rd, 2025.

Filing for an insurance claim may be a lifesaver when unexpected situation disrupt your financial strength. However, it’s important to understand how claims may impact your premiums. Many policyholders are surprised that their insurance costs rise after filing a claim. Let’s explore why this happens, the types of claims most likely to lead to increases, and strategies to manage your premiums effectively. In this article, we will discuss and cover how an Insurance Claim By Policyholders Often Yields An Increase Of Premium.

Liability Insurance Claim And Effects On Premiums

Liability Insurance Claim, those in which you are found negligent for the cause of bodily injury or property damage to another, will likely increase insurance premiums:

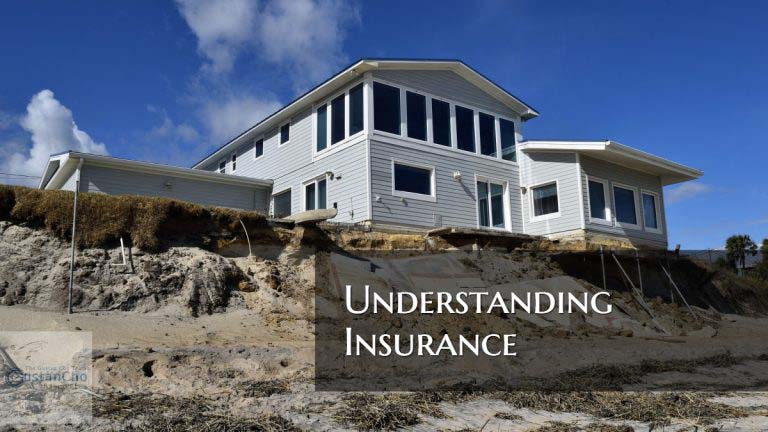

- An at-fault accident on your car insurance, or a “slip and fall” on your property, which would be covered by your homeowners’ insurance will raise insurance premiums

- Homeowners insurance can be tricky

When it comes to property damage to your own vehicle and/or home that is not your fault, the premium may or may not go up depending on the circumstances.

Start Your Process Towards Buying A Home

Apply Online And Get recommendations From Loan Experts

Insurance Claim: Insurance Broker Versus Captive Agents

Here are some reasons why insurance premiums may also increase:

- The type of insurer you are currently with and the type of claim are the two main factors

- Although it can be said your age and history with your company may play a role in the increase as well

If you are with a standard or preferred carrier (they don’t typically insure people with claims), you can expect to pay a hefty increase for your insurance.

- Additionally, if you file a minor claim (dollar-wise) versus a major claim, the premium increase may not be as much, maybe a few hundred or less

- The younger (or older) you are when you file a claim, the more you can expect to pay for your insurance

- If you have driven accident free for 15 years and file a claim, the insurance company may not see you as a higher risk

However, if you file a claim 10 months after receiving your license, the insurers will determine you are much more risky to insure and charge you much more upon renewal.

Options In Choosing Homeowners Insurance

The previously mentioned reasons are given to insurance consumers.

- Most people can’t name 7 top insurance companies

- They don’t know how to find better options

Often they are stuck in the hole of underprivileged insurance premiums or in other words:

- most insurance consumers are stuck paying too much for insurance policies

- many dealing with commission chasing agents who don’t care

The Key is to shop for insurance by consulting with several companies.

Will Insurance Claims Skyrocket My Premiums?

Again to answer the question “will my premiums skyrocket if I have a claim?” the answer is maybe!

- The national insurance companies with large television advertising budgets don’t usually have the best prices

- They rely on bombarding us with commercials and other advertising to convince us they are the best option

- How do you think they pay for an advertisement to be run at every commercial break on every channel 24 hours per day?

- They’re using your premium dollars to do so after they jack up your premiums

When consumers understand economics and the law of supply and demand consumers will get a grasp on how insurance works. By shopping with various insurance companies, consumers will find an agent with excellent insurance services, premiums, and coverage! If homeowners get their homeowners insurance dropped due to insurance claim, lenders will be forced placed homeowners insurance which is extremely expensive.

Take First Step Toward Making Your Dream A Reality

Apply Online And Get recommendations From Loan Experts

Frequently Asked Questions (FAQs)

1. Does filing an insurance claim always increase premiums?

Not always, but frequent or specific types of claims (e.g., at-fault accidents) often lead to higher premiums.

2. Why do premiums increase after a claim?

Insurers view claims as a higher risk of future claims and adjust premiums to account for potential payouts.

3. What type of claims are most likely to increase premiums?

At-fault car accidents, water damage, and liability claims typically increase premiums.

4. How much will premiums increase after a claim?

The increase varies based on the claim type, severity, and insurance provider’s policies.

5. Can a no-claims history prevent premium hikes?

A long history without claims can make you eligible for discounts, offsetting potential increases.

6. Do small claim affects premiums?

If they occur frequently, even small claims can lead to premium hikes

7. How to avoid premium increases after a claim?

Opt to cover minor damages yourself to prevent filing claims that might lead to premium hikes.

8. Do premium increases last indefinitely?

No, increases usually last 3-5 years before reverting to normal, provided no additional claims are made.

9. Does changing insurers prevent premium increases?

Changing may help, but insurers share claims history through databases, so your record follows you.

10. Are there claims that won’t increase premiums?

Other insurers offer accident forgiveness for the first claim or exclude weather-related claims from hikes