FHA Property Standards: What You Need to Know

This article explains the acceptable property standards for FHA home loans.

Many home sellers worry when buyers apply for FHA loans, mistakenly thinking that FHA home appraisals are overly strict and that the appraiser will fail the property. This is not accurate.

HUD oversees the FHA and mandates that the home must be habitable, safe, and marketable. For instance, an older roof can pass an FHA inspection if it has at least three years remaining. However, properties with peeling lead-based paint or broken glass will not pass the FHA property inspection. This article will detail the FHA property guidelines.

What is FHA Guidelines?

The FHA (Federal Housing Administration) guidelines for 2024 have been updated to reflect changes in the housing market. Here are the key points:

- Loan Limits:

- The minimum loan limit for a single-family home in most areas is $498,257, while the maximum limit in high-cost areas is $1,149,825. For special exception areas like Alaska, Hawaii, Guam, and the U.S. Virgin Islands, the limit is even higher at $1,724,725.

- Credit Score Requirements:

- Remember that a minimum credit score of 500 is required when applying for an FHA loan. If your score is between 500 and 579, a 10% down payment is needed. For scores of 580 or more, the minimum down payment is 3.5%.

- Down Payment and Mortgage Insurance:

- FHA loans require a minimum down payment of 3.5%. Additionally, they necessitate an upfront mortgage insurance premium (UFMIP) and annual insurance premiums (MIP). If the down payment exceeds 10%, the MIP can be discontinued after 11 years.

- Debt-to-Income Ratio (DTI):

- The ideal debt-to-income ratio for FHA loans is 50% or less. However, exceptions can be made under certain circumstances.

- Property Requirements:

- Properties must undergo an FHA appraisal to meet safety and health standards. The property must also serve as the borrower’s primary residence.

- Waiting Periods for Past Financial Issues:

- Individuals with past bankruptcy or foreclosure can still qualify for an FHA loan after re-establishing good credit and a solid payment history. Generally, there is a three-year waiting period after a foreclosure and two years after a Chapter 7 bankruptcy discharge.

The following principles are intended to increase the accessibility of home ownership, particularly for individuals purchasing a home for the first time and those with lower credit scores. For more detailed information, refer to the official HUD website or mortgage guides provided by financial experts.

Ready to Apply for an FHA Loan? Let Us Help You Navigate HUD’s Guidelines!

Contact us today to learn how we can help you qualify for an FHA loan and make the process seamless.

What is the Maximum DTI for a FHA Loan?

The maximum debt-to-income (DTI) ratio for an FHA loan generally follows these guidelines:

- Front-End DTI Ratio: This ratio compares your monthly housing costs to your monthly income. FHA guidelines typically allow a maximum front-end DTI ratio of 31%.

- Back-End DTI Ratio: This ratio includes all your monthly debt payments (housing costs, credit cards, car loans, etc.) compared to your monthly income. The FHA allows a maximum back-end DTI ratio of 43%. However, this can be extended to 50% in certain cases, especially if the borrower has compensating factors such as a strong credit score, significant cash reserves, or a substantial down payment.

These ratios are flexible, and lenders may consider higher ratios under specific circumstances, depending on the borrower’s overall financial profile and compensating factors. For more detailed and personalized information, it is recommended that you consult directly with a lender or financial advisor.

Are FHA Home Appraisals Tougher Than Conventional Appraisals?

Many home sellers are hesitant to accept offers from buyers seeking FHA financing, mistakenly believing their home won’t pass an FHA appraisal but would pass a conventional one. This misconception could result in losing a potential sale to a qualified buyer.

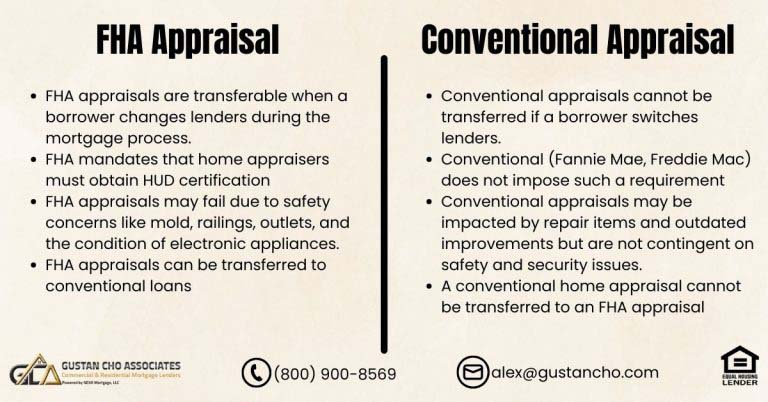

There is minimal difference between a conventional (non-government-backed loan) appraisal and those for FHA, VA, or USDA loans. Because FHA loans are government-insured, the appraisal process includes determining the market value and ensuring the property meets specific health and safety standards set by FHA Property Standards.

For an FHA loan to be approved, issues such as non-functional utilities or furnaces, peeling lead-based paint, loose stair railings, and missing smoke and carbon monoxide detectors must be addressed. These problems can be fixed, with minor issues often resolved before closing.

Suppose the home requires significant repairs to be livable. In that case, buyers can opt for an FHA 203(k) loan, which includes funds for necessary improvements, making the home safe. This loan type can also finance major upgrades for fixer-uppers. Sellers incur no additional costs if the buyer chooses a 203(k) loan over the standard 203(b) loan.

Understanding these FHA Property Standards and addressing common misconceptions can help sellers avoid missing out on good buyers and facilitate smoother transactions.

Related: How Much Home Can You Afford?

FHA Doesn’t Care About Minor Problems

FHA property standards are not especially stringent. Few buyers would want to buy an unsafe home regardless of the loan they get.

The FHA doesn’t care about cosmetic or minor defects, deferred maintenance, and normal wear if they don’t impact safety, security, or soundness of the home. Here are examples of defects that don’t ncessarily safety problems:

- Missing handrails

- Cracked or damaged exit doors

- Cracked window glass

- Peeling (non-lead-based) paint

- Minor plumbing leaks (such as dripping faucets)

- Defective floor finishes or coverings (worn through the finish, badly soiled carpeting)

- Evidence of previous (non-active) termite damage where there is no evidence of unrepaired structural damage

- Rotten or worn-out countertops

- Damaged plaster, sheetrock or other wall and ceiling materials in homes constructed after 978

- Poor workmanship

- Trip hazards (cracked or partially heaving sidewalks, poorly installed carpeting)

- Crawl spaces with debris and trash

- Lack of an all-weather driveway surface

These issues are not pretty but they won’t prevent you from buying a home.

Related: Understanding Your Mortgage Payment

What FHA DOES Care About

The Federal Housing Administration’s FHA property standards are not crazy. Most items that come up would cause also problems for a conventional loan inspection or appraisal.

FHA property standards require that the subject property have separate quarters and rooms for the following:

- Eating

- Cooking

- Sleeping

- Living

- Proper sanitary for bathrooms, showers, sinks

- Safe drinking water

Electrical and Heating

- The electrical box should have no frayed or exposed wires.

- All habitable rooms must have a functioning heat source unless winters are mild

Roofs and Attics

- Roofs must keep moisture out and have at least a two-year life span remaining.

- The appraiser must inspect the attic for roof problems.

- The roof cannot have more than three layers.

- If the inspection reveals the need for roof repairs, and the roof already has three or more layers of roofing, the house needs a new roof.

Water Heaters

The water heater must meet local building codes and must stay with the property.

Hazards and Nuisances

These can make the property uninhabitable, unsafe or unsellable. Common hazards include:

- Contaminated soil

- Nearby hazardous waste site

- Oil and gas wells located on the property

- Heavy traffic

- Airport noise and hazards

- Other sources of excessive noise

- Nearby dangers like a high-pressure petroleum line, high-voltage power line, or radio or TV transmission tower

Any defects that could cause future structural damage must be corrected before the property can be sold. For example, defective construction, extreme dampness, leakage, decay, termite damage, or instability (settlement).

If an area of the home contains damaged or deteriorating asbestos, additional inspection and possible repair are required.

The home must have a toilet, sink, and shower.

Looking to Qualify for an FHA Loan? Let Us Walk You Through HUD’s Guidelines!

Reach out today to get expert advice and start your FHA loan application with confidence.

FHA Property Standards vs Other Loan Programs

There is no difference in FHA property standards and those for conventional loans. All home loans need property standards that are the following:

The subject property needs to have the following:

- Sanitary disposal system

- Working plumbing

- Electrical

- HVAC systems without any building violations and per code

Proper Ventilation Systems

The following areas need proper ventilation systems:

- Basements

- Crawl spaces

- Attics

The above spaces need to have ventilation in place so that moisture and/or heat will not create safety hazards or building deterioration.

See today’s FHA mortgage rates.

FAQs About HUD Guidelines for FHA Loans: FHA Property Standards

- 1. Are FHA home appraisals stricter than conventional appraisals? FHA home appraisals are not necessarily stricter than conventional appraisals. The main distinction is that FHA appraisals must confirm that the residence complies with particular safety and health criteria established by the Department of Housing and Urban Development (HUD). This means that while the property’s market value is assessed, the appraiser also ensures the home is habitable, safe, and marketable.

- 2. What are the primary requirements for a home to pass an FHA appraisal? To pass an FHA appraisal, a home must be habitable, safe, and marketable. The roof should have at least three years of life remaining. The property must be free of hazards such as peeling lead-based paint and broken glass. It’s also essential for the home to have functioning utilities and heating systems and meet local building codes for water heaters.

- 3. What are some examples of issues that would not cause a home to fail an FHA appraisal? Minor issues that do not affect the home’s safety, security, or stability generally won’t result in it failing an FHA appraisal. These defects can range from needing handrails, cracked window glass, and peeling (non-lead-based) paint to minor plumbing leaks, damaged plaster or sheetrock, worn-out countertops, and other cosmetic or minor defects.

- 4. What hazards and nuisances must be addressed for FHA approval? FHA guidelines mandate that the property must be free from any hazards or nuisances that could render it uninhabitable, unsafe, or unsellable. This encompasses a range of issues such as contaminated soil, being located close to hazardous waste sites, nearby oil and gas wells, exposure to heavy traffic or excessive noise, and the proximity to high-pressure petroleum lines, high-voltage power lines, or transmission towers.

- 5. Can a home with major issues still qualify for an FHA loan? A home with major issues can still qualify for an FHA loan through the 203(k) loan program. This program allows buyers to include the cost of repairs in the mortgage, enabling them to fix the problems and make the home safe.

- 6. What specific property features must be present to meet FHA standards? The property must include separate quarters for eating, cooking, sleeping, and living; proper sanitary facilities such as bathrooms, showers, and sinks; safe drinking water; and functioning electrical and heating systems. Additionally, it should have a roof that prevents moisture ingress and is expected to last at least two more years.

- 7. Are there any ventilation requirements for FHA-approved properties? Proper ventilation is necessary in basements, crawl spaces, and attics to avoid safety hazards or building deterioration.

- 8. What are the FHA guidelines for roofs and attics? Roofs are required to keep moisture out, maintain a lifespan of at least two years, and are limited to a maximum of three layers. If repairs are needed and the roof already has three layers, it must be replaced. Additionally, for attics, the appraiser is responsible for inspecting for roof issues, and any necessary repairs must be made.

- 9. What are the FHA loan limits for 2024? The loan limits for 2024 are as follows: In low-cost areas, the minimum limit for a single-family home is $498,257. In high-cost areas, the maximum limit is $1,149,825. Special exception areas like Alaska, Hawaii, Guam, and the U.S. Virgin Islands have a higher limit of $1,724,725.

Homebuyers looking to qualify for a mortgage with a direct lender with no mortgage overlays on government and conventional loans can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.

This blog about HUD Guidelines for FHA Loans: FHA Property Standards was updated on May 22nd, 2024.

Ready to Apply for an FHA Loan? We Can Help You Understand HUD’s Guidelines!

Reach out today to understand HUD’s guidelines and ensure a seamless application experience.