This guide covers credit score changes during underwriting process.

Credit Score Changes During Underwriting Process: What You Need to Know in 2025

Going through the mortgage process can be overwhelming, especially with concerns about credit score changes during underwriting process. Will the lender cancel your loan approval? Will your interest rate go up? Or does it not matter at all?

Lenders routinely check your credit score when you apply for a home loan. In most cases, they also check it again before closing. Here’s the good news: a small change in your credit score during underwriting won’t always negatively affect your mortgage.

Improving your credit score could even lower your interest rate in some situations. And risks are involved, especially if your credit score drops significantly due to derogatory information. In this updated guide on credit score changes during the underwriting process for 2025, we’ll explain everything you need to know about credit score changes during underwriting process, how to protect your score, and what to do if changes occur.

Why Do Credit Scores Matter During Underwriting?

Your credit score is one of the key things lenders look at when determining you as a suitable candidate for a mortgage. This means that when your credit score changes during the underwriting process, it can impact your mortgage approval and even the terms of your loan. It affects:

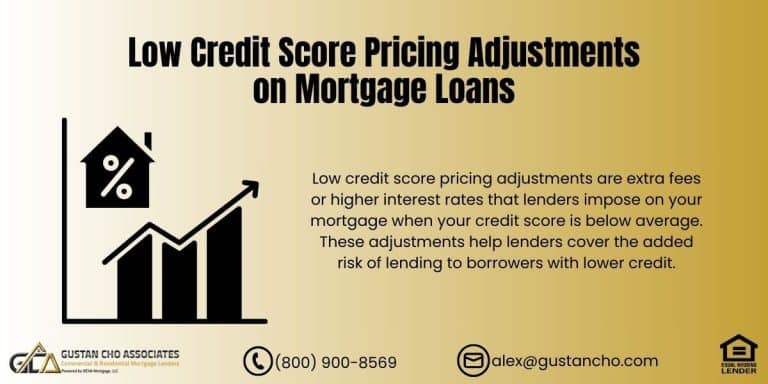

- Your interest rate: Individuals with stronger credit ratings often benefit from more favorable borrowing rates.

- Loan program eligibility: Some loans, like conventional loans, have minimum credit score requirements.

- Debt-to-income (DTI) ratio flexibility: Higher credit scores often allow for higher DTI limits, giving you more borrowing power.

During underwriting, lenders evaluate your financial profile to ensure you’re a low-risk borrower. Your credit score changes during underwriting process are carefully monitored because they could indicate new debt or financial instability.

Take First Step Toward Making Your Dream A Reality

Apply Online And Get recommendations From Loan Experts

When Do Lenders Check Your Credit?

Lenders typically check your credit score at least twice:

- Initial application: To pre-approve you for a loan and determine your eligibility and interest rate.

- Before closing: Before you close on your loan, it’s important to double-check that nothing major has changed with your money situation. This means looking out for any credit score changes during underwriting process, which could affect your approval. Communicate any updates to your lender so everything stays on track.

In 2025, many lenders will be using advanced tools like AI and real-time credit monitoring to flag any changes in your credit report throughout the process. Even small changes could be noticed, so it’s more important than ever to stay financially stable during underwriting.

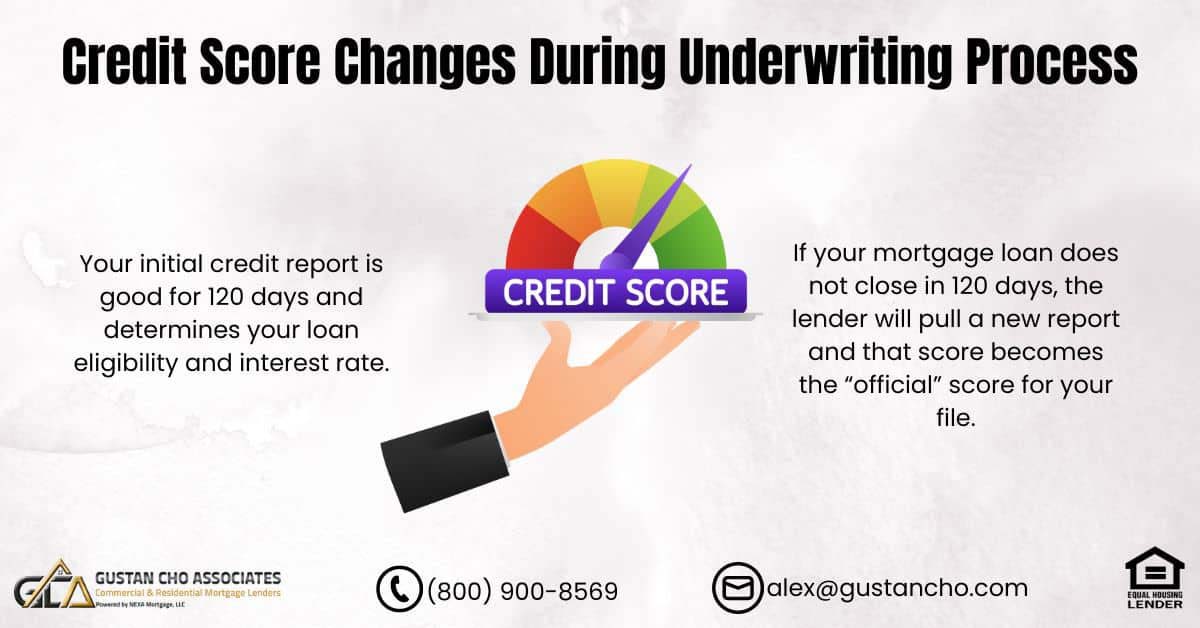

How Long Is Your Initial Credit Report Valid?

Your initial credit report is typically valid for 120 days. The lender will pull a new report if your loan doesn’t close within that timeframe. Any credit score changes during underwriting process within this period can impact your loan terms, so avoiding actions that could lower your score is crucial.

What Happens If Your Credit Score Increases During Underwriting?

An increase in your credit score can be a good thing. Some lenders allow borrowers to adjust their interest rate based on a higher credit score, but only if you haven’t already locked in your rate. For example:

- You might qualify for a better rate tier if your score improves from 679 to 680.

- When your credit score changes during underwriting process, it can have a big impact on your loan. If your score goes up a lot, you could save thousands of dollars over the life of the loan. That means paying less interest and making it easier to manage your monthly payments. Keeping an eye on those credit score changes can pay off in the end!

Pro Tip: Ask your lender if they’ll honor a higher credit score for better loan pricing. At Gustan Cho Associates, we allow borrowers to lock in better rates if their credit score changes during underwriting process and improve.

What Happens If Your Credit Score Drops During Underwriting?

If your credit score drops during underwriting, the impact depends on the severity of the drop and its cause. Here are the possibilities:

- Small drops: Minor fluctuations (e.g., a 5-point decrease) typically don’t affect your approval or interest rate.

- Significant drops: A large drop could:

- Require the lender to reevaluate your loan application.

- Push you below the minimum credit score requirement for your loan program.

- Increase your interest rate if the drop moves you into a lower credit tier.

Key Takeaway: If your credit score changes during underwriting process and goes down a lot, it could slow down your closing or even cause your loan to be denied. If that happens, you might have to look into other loan options or take some time to boost your credit score.

How to Protect Your Credit During the Mortgage Process

To avoid surprises, follow these steps to keep your credit stable:

- Don’t apply for new credit. When you’re going through the underwriting process for a loan, it’s important to keep your credit score in mind. Try not to apply for any new credit during this time. This means you should avoid getting new credit cards, buying furniture on financing, or taking out loans for a car. These actions can cause credit score changes during underwriting process and might hurt your chances of getting approved for the loan you want.

- Keep credit card balances low. To maintain a healthy utilization rate, aim for less than 30% of your credit limit.

- Pay all bills on time. It’s really important to pay all your bills on time. Your payment history is a big part of your credit score — it accounts for 35%! If you miss just one payment, your score could drop by 60 to 100 points. This is especially crucial, as credit score changes during underwriting process can greatly affect loan decisions. Remember, staying on top of your payments helps keep your credit score strong!

- Avoid disputing old collection accounts. Any activity on an old account can bring it back into focus, potentially hurting your score.

- Monitor your credit. Use free tools like Credit Karma or paid services like Experian or Equifax to monitor changes.

What Causes Credit Score Drops During Underwriting Process?

Several factors can cause a credit score to drop:

- New credit inquiries: Applying for credit results in hard inquiries, which can lower your score by 2-5 points per inquiry.

- Increased credit card balances: High utilization rates can significantly impact your score.

- Late payments: A single late payment can cause a sharp drop in your score.

- New derogatory accounts: Collections, charge-offs, or judgments can be devastating.

- Errors on your credit report: When looking at your credit report, look for any mistakes. Mistakes can happen, and they can affect your credit score. Check for errors because inaccuracies can lead to credit score changes during underwriting process. Being aware of your report can help you avoid potential problems down the line.

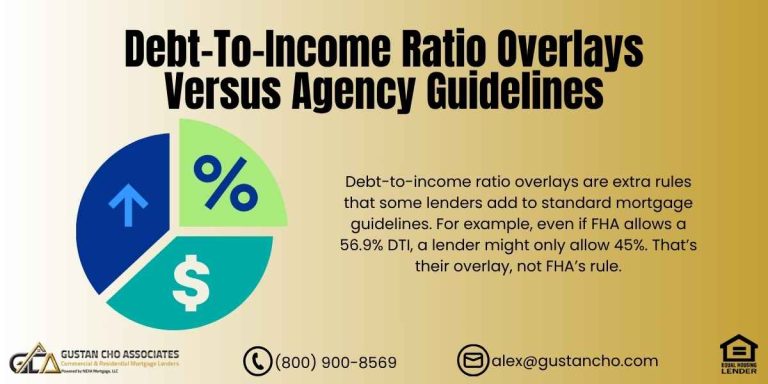

How Credit Scores Impact Debt-to-Income Ratio (DTI)

Credit scores can influence your DTI ratio limits, especially for FHA loans. Here’s how:

- Borrowers scores under 620 often face stricter DTI caps, such as 31% (front-end) and 43% (back-end).

- Borrowers with scores above 620 may qualify for higher DTI limits, up to 46.9% front-end and 56.9% back-end for FHA loans.

Higher credit scores give you more flexibility and improve your chances of approval, even with a higher DTI.

2025 Trends: How Technology Impacts Credit Monitoring

In 2025, lenders increasingly use advanced technology to monitor credit profiles in real time. Here’s what this means for you:

- AI-driven monitoring: Automated tools can flag potential risks during underwriting, such as new accounts or rising balances.

- Trended credit data: New scoring models like FICO 10T analyze your credit behavior over time, not just at a single point. Consistent payments and declining balances can improve your score.

- Faster updates: Errors on your credit report can now be corrected more quickly through digital dispute systems.

Pro Tip: Work with a lender like Gustan Cho Associates, which stays up-to-date with the latest technology to provide seamless mortgage experiences.

What to Do If Your Credit Score Drops

If your credit score drops during underwriting, here’s what you can do:

- Communicate with your lender. Be upfront about the issue and ask for guidance.

- Explore alternative loan options. Consider FHA or non-QM loans if you no longer meet conventional loan requirements.

- Work on improving your score. Pay down credit card balances and resolve any errors on your credit report.

- Delay closing if necessary. A short delay can give you time to address credit issues and qualify for better terms.

Final Thoughts: Stay Prepared and Informed

When you’re going through the mortgage process, it’s important to know that credit score changes during underwriting process can affect whether you’re approved and what your loan terms will be. If you understand how these changes can happen and take steps to protect your credit, you’ll feel more confident navigating this stage.

At Gustan Cho Associates, we help people with all kinds of credit situations. Whether your credit score changes during underwriting process or stays the same, our team is here to help you find the right loan options. If you have any questions or need some advice, feel free to contact us today at 800-900-8569 or email us at alex@gustancho.com. We’re here for you!

Frequently Asked Questions About Credit Score Changes During Underwriting Process:

Q: What Does it Mean if my Credit Score Changes During Underwriting Process?

A: Your credit score can fluctuate during underwriting based on changes in your financial activity, like new debt or missed payments. Lenders monitor these changes to ensure you still qualify for your mortgage.

Q: Will my Loan be Denied if my Credit Score Drops During Underwriting?

A: Not necessarily. Small drops usually don’t impact approval, but a significant drop could delay your closing or lead to denial. It depends on the severity of the drop and your loan program’s minimum credit score requirements.

Q: Can an Increase in my Credit Score Help During Underwriting?

A: Yes! If your credit score increases and you haven’t locked in your interest rate, you might qualify for a lower rate. This could save you money over the life of your loan.

Q: Why do Lenders Care About Credit Score Changes During Underwriting Process?

A: Your credit score reflects your financial stability. Lenders use it to decide your loan eligibility, interest rate, and debt-to-income ratio limits. Big changes could signal financial risks.

Q: How Can I Prevent my Credit Score from Dropping During Underwriting?

A: Avoid applying for new credit, don’t max out credit cards, pay all bills on time, and monitor your credit for errors. These steps can help maintain a stable credit score.

Q: Do Lenders Pull my Credit More Than Once During the Mortgage Process?

A: Yes, lenders typically check your credit at the time of application and again before closing to ensure your financial situation hasn’t changed.

Q: What Should I do if my Credit Score Drops During Underwriting?

A: If your credit score changes during underwriting process, it’s important to talk to your lender as soon as you can. They might offer you different loan options. Also, you can try to boost your score by paying off some debts and fixing any mistakes on your credit report.

Q: Can Errors on my Credit Report Affect my Mortgage Approval?

A: Absolutely. Errors found on your credit report can lead to unwarranted credit score changes during underwriting process. It’s advisable to review your report frequently and promptly address any inaccuracies.

Q: What Happens if my Loan Doesn’t Close Within 120 Days?

A: If your loan doesn’t close within 120 days, your lender will pull a new credit report. Any changes in your credit score at that time will impact your loan terms or approval.

Q: Can I Still Qualify for a Mortgage if my Credit Score Changes During Underwriting Process?

A: Yes, but it depends on the extent of the change. Minor fluctuations are usually fine, but significant changes may require adjustments to your loan terms or even a different loan program. Always discuss any concerns with your lender.

This blog about “Credit Score Changes During Underwriting Process” was updated on January 24th, 2025.

I have a middle credit score of 538 husbands has a score of 610 and need to get approved for a home loan

You can qualify in minutes and get advice from one of our loan officers just by clicking the Prequalify Now link or by contacting Gustan by phone or text. Thank you!

9 year old credit account was removed and that caused my credit score to drop 57 points. I close in 4 weeks. would that affect me.

iF YOU ARE IN THE MORTGAGE PROCESS, LENDERS WILL USE THE ORIGINAL MIDDLE CREDIT SCORE USED TO QUALIFY FOR. IT IS GOOD FOR 120 DAYS.

I just read in your blog the article about becoming an MLO with bad credit. Thank you so much for doing this. I am about to take the exam next week and my only concern is not whether to pass the exam or not but whether I am going to be licensed after that since I have a bankruptcy (discharged) in 2020. Right now my score is 705 and I have 4 credit cards with 0% utilization. I am going to apply in New York. Have you heard anything about this state? Thanks again for your time and help.

P.S. If everything goes well I would very much like to join your network…

The bankruptcy will not affect your licensing. You will get licensed in all 50 states with the bankruptcy.

My credit score from Credit Karma just dropped 60 points. I close on my mortgage in 3 weeks.

What should I do?

Are you in the mortgage process.

I close in 2 weeks credit score dropped because I didn’t pay my credit card balance down on time but I did the same day it dropped 88 points before that and I purchased something for 1100 dollars making auto.atic payments will that affect me

Lenders will use the original credit score they used to qualify you for 120 days.

Why do all over the internet it says underwriting or lendor will check your credit at the beginnin and prior to closing?

To make sure that you have not incurred any new debt

My computer died and I opened up a new line of credit to purchase a new one ( line of credit 4K, amount spent $1500). I then signed all of my loan paperwork and the niters mentioned not opening any new lines of credit.

It was a hard inquiry ( I think a 7 point decrease) and now I’m spiraling. We close in under 2 weeks.

Should I be concerned?

You do not have to be concerned. Lenders use the credit score that was first used when they qualified you. The middle credit score first used to qualify you is the credit used throughout the entire loan process. That credit score is good for 120 days.

My husband has a collection that falls off his credit next month in August. Will the loan officer take that debt off our debt to income ratio?

If the collections is removed, yes, the 5% of the outstanding balance will be taken off.

Hey I had a transunion score of 734, equifax of 734, and experian of 754. I’m in the underwriting process after preapproval. My experian score dropped 20 points due to a balance on one of my credit cards. I close in 3 weeks. Should I be worried? I am paying off the card now

My credit score dropped 70 point and I’m in the paperwork process of the loan. will i be denied my loan? what should I do??? I’m very discouraged at the moment.

Why did your credit score drop so much?

I am supposed to close this week and my credit dropped by 5 points due to an increase of credit card usage. I have an FHA loan. How badly do you think this will affect me closing.

It will not affect your closing at all. Lenders will use the original middle credit score used to qualify you. That credit score is good for 120 days

The last time they checked my credit was in November and my score was 675 and I made the mistake of using my credit limit on a card and they lowered 34 points. now my score is 637 and my closing is in March the reason why I am concerned is because I would prefer the conventional loan instead of the FHA now I pay my entire balance on the card to see if I get my score back before they check my credit . Is it possible to recover 34 points in 30 days just by paying the balance of your cards? what I do?

Yes, your loan officer can do a rapid rescore and rapid rescores take three days to update your credit

I’m in the middle of underwriting, with a credit score of 725. I have only one vehicle on my debt to income. I’m going the FHA route being a first time homebuyer. All of a sudden a $300 medical collections hit my credit. Should I be worried?? It dropped my score 60 points!!!!

Medical collections are exempt with us. You should not be worried. lenders will use the original credit score throughout the loan process. The original credit score is good for 120 days. I would try disputing the medical collection and it will go up the 60 points you have lost.

my score dropped 30 points and we are closing on a house in a week. my score dropped because I was late on my care note due to using that money to pay for the home inspection. normally I would’ve just used my credit card but I was told not to use my credit cards at all. we really haven’t had any good guidance on the do’s and dont’s and I am terrified that I might’ve messed us up due to a misunderstanding.

I would discuss this with your loan officer.

I hat approved for a loans to buy a home, I got a credit card to get my vehicle fixed, my credit dropped a lot, I paid the credit card back full, the lenders did another credit check while my score is low, can I still be approved fir this house?

The credit score you were qualified for is good for 120 days so you have nothing to worry about.

Literally just got a notice from FICO a new debt collection was added to my report but it looks like the original debt(hadn’t been touched in about three years) owed was sold to another collection agency. I was getting these calls from this collection agency and didn’t know why and now I see where it came from. I’ve been under contract since February first credit pull was made in April/May I was in good standing.

Second pull was made at end of July middle Score at 680/690 something like that I Close 9/15 or 9/22 I hope sooner than later…needless to say I’m wondering if I need to advise my loan officer…so torn…I feel like I should just let it be they asked for updated docs since

My closing got pushed back to the dates mentioned above. I’ve already been approved just need that clear to close. Should I speak up or keep it quiet? Let them bring it up?

Talk to your loan officer regardless and let him know. Lenders will do a soft pull prior to a clear to close and prior to funding so they will find out. Regardless, it does not matter and will not affect your loan approval. Even if your credit scores dropped significantly, it does not matter. All lenders use the original middle credit score when you applied and that credit score is used and is good for 120 days. Therefore, you have absolutely nothing to worry about.

To my original post about the late payment. Yes! I was able to close on the house! maybe I just got lucky

Congratulations.

I’m supposed to close on a home in 21 days. But I’m worried that I could have possibly screwed my chances of closing due to a derogatory mark hitting my credit yesterday. I immediately paid the account in full after becoming aware. It’s a Comcast account that I thought was taken care of totaling $300. Did I screw up my chances of closing? Or do you have any solutions.

Thanks,

You should be fine.

Hello,

I am closing on my house Sept 23rd. I found today that a medical bill for 400$ and a gym membership I cancelled 2 years ago apparently charged me 550$. It dropped my points 58 points. I am outraged. The medical bill is only 4 months old and I had no idea I even owed it. The gym membership is outrageous. The location I went to was closed down. I am so nervous I will loose the loan. I am in a position to pay the charges to avoid denial if need be. How concerned should I be? Thank you for any input.

Medical collections do not matter. We normally disregard medical collection accounts altogether. However, many lenders have lender overlays on collections. Your gym membership should not matter due to being under $1,000 dollars. Your drop in credit scores should not matter because lenders normally use the original middle credit score used to qualify you and submit your loan. That middle credit score is good for 120 days. If you run into complications with our current lender, contact us at gcho@gustancho.com. We will be able to do your loan and expedite it through.

My husband has a 537 median credit score. Today we paid off all items on his reports that was in collections. Can I apply for the loan now if I have the confirmation numbers of the payments or did we need to wait until his score is high enough?

We can do a rapid rescore for you. Please reach out to us with your contact information at gcho@gustancho.com or call us at 262-716-8151 or text us for a faster response.

I’m closing in a little under 3 weeks and I just had a derogatory mark go on my record and my score dropped 22 points. It’s $454 Comcast bill. Will this affect my closing? Should I pay this bill today? My credit score was 655

You should be fine. Lenders use the original middle credit score when they first qualified you for 120 days.

I am in the process of purchasing a new manufactured home. I closed on my home yesterday 9/20/21. I was told by the mobile home dealer that they do not receive funds from the bank until after the home has been built and set up on my property. I will then conduct a walk thru and sign off if I approve of the home. In which then the bank will release funds to the dealer. However, I was told yesterday that I can not do anything that would alter my credit situation (buy a car, open new credit accounts), until after the dealer has received the funds? Approximately 2 weeks ago, I purchased a new vehicle, was having problems with my old vehicle. The total price of the new vehicle was less than $1k more than the old. So my debt to income has not drastically changed, however there is a new credit line on my account. I thought at closing, my loan process was finalized and I was just waiting for my house to be set. Apparently the dealership wont even begin building my house until October, meaning I wont even get the house on my property until mid November? The inital credit pull was done approx 3 months ago. But if they pull my credit again once the house gets set in October/November, the new credit line for vehicle will appear. Will they take my house or land away? Will they even pull my credit again after I have already closed on the loan? I did close with a land and title attorney. The land and title attorney did receive funds from bank to cover closing cost.

My rate is locked and my initial approval has been done. My lenders asked me to check on an old account that was still showing a balance but wasn’t reporting, I did and the account has been paid off but for the months it wasn’t it’s now reporting. My score went from a 708 down to 750 (mortgage Experian score.) How will this effect my loan? I’m freaking out and don’t understand why this is happening if the account is paid off.

Sorry it dropped to 650. I’m 26 days from closing.

Hi, we are set to close on 11/23. We were told that our file went through u dee writing and we were successfully approved for fha and just waiting for the final appraisal and title work to get the clear to close. We have a charge off on our account from 3 years ago for 18k and the credit reporting agencies just updated and now it says sent to recovery for that account. Does that mean that it’s been sold and the new collector may now put something on our credit reports? How will that affect our closing if that happens? It seems like they would have considered the possibility of that in underwriting since they saw the charge off but idk…

We do not care about charged-off accounts that the date of activity is older than 12 months. If your lender is giving you issues, please contact us with your contact information at gcho@gustancho.com or call us at 262-716-8151. Text us for a faster response.

Hi, I have a question. Thank you for your help and you have been helpful with the previous post. I am about 2 weeks from closing. Everything has been fine. I am waiting for my clear to close. However, my nursing school placed a debt on my report which they could not confirm the amount (it is for 7500!). My score has dropped about 17 points which I read about my original score it good for 3 months, it has only been a month. They haven’t said anything about it as of yet. I told my officer that it should not be on there. I haven’t opened any accounts or anything. Should I be concerned? Thanks.

They will most likely find out. If the debt is a private school loan delinquency, then it is alright. The underwriter needs to take 5% of the outstanding debt and use that towards your debt to income calculations. If it is not your debt, then show documentation and get a release from the creditor and your loan officer can do a credit supplement.

I am closing on a home in less then 30 days. My score dropped 50pts due to a landlord saying I owed 230 for some damages I didn’t do. Will this affect my closing if I don’t pay?

It should not affect you but it is up to your lender. We just use the credit scores you were qualified with and that credit score is good for 120 days/

Thank you

You are welcome

We were scheduled to close on 12/28/21 we were waiting for the appraisal date,and they called today saying my husband’s credit dropped 30 points bringing the score to 560 and now they said we are done, is this possible?

Please reach out to us at 262-716-8151 or email us at gcho@gustancho.com. Text us for a faster response.

Hello,

I applied for my mortgage with 0 collections or debts on my credit. Now I am in underwriting with a conditional approval. Closing date 12/23. Today, i noticed a collection acct for DirectTV in the Amt of $422 which was previously removed from my credit years ago is now reporting on my credit again. How will this affect my loan? What should i do?

You should be fine. Lenders use the original credit score when you applied. That score is good for 120 days.

My credit score was a 629 on credit karma and I’m under contract the underwriter asked me to remove all disputed remarks. I did and my score dropped to a 580 I close in March supposedly but with the shortage of supple could be longer. I’m devastated. My collections are paid off or settled I just have medical no active credit cards how can I pull credit up by the time I close and will this drop effect me

Dispute your medical collections and it will go up. I can help you boost your credit scores and get you fully approved. We are lenders with no lender on FHA LOANS. Please contact us with your contact information at gcho@gustancho.com or call us at 262-716-8151. Text us for a faster response.

I close in a little over a week, a few days ago a utilities collections popped up and dropped my score 40 point. I’m now looking at a score of 659. I’m in California with a FHA, will this effect me?

As long as the date of last activity is over a year old, it will not affect you but will affect the DTI calculations. 5% of outstanding collections on non-medical collections will be taken as your hypothetical monthly expenses unless they are charged off accounts or medical collections. Credit scores are good for 120 days.

Hi there! So we were PA for a home and my husband had a medical collection show up on credit report…for 287.00 I immediately called my lender to make him aware because we close on 3/4/22….it dropped his score almost 40 points on credit karma….when I called our lender he said he already ran a credit report and should be okay but to call the collection agency to see if we paid it off if they would delete if from the credit acct and if they won’t to not pay it….he said if it’s like 100 PTs it could affect our loan process I’m hoping this isn’t the case what should we do?

You should be fine. Just dispute the medical collection and your credit scores are going to go back up. Medical disputes are exempt from credit disputes. Also, Your original credit scores used is good for 120 days.

I am refinancing my home with cash out. My middle credit score was a 585 when they initially qualify me for the loan on January 25. I just had my home appraised today and had to provide some additional documentation on my 401k balance today. Other than that they have everything they need from me.

So I just looked at my credit last week and saw 2 of my credit accounts went into collections where my new middle score is now 537. So am I in the the mortgage process and are they going to disqualify me for the loan based on the new score?

You can refinance with an FHA cash-out with credit scores down to 500 FICO. Please contact us at gcho@gustancho.com or call us at 262-716-8151 if you need a lender with no lender overlays. Text us for a faster response.

Hi, I’m scheduled for closing on February 25th, today I got a message from Experian advising one of my credit cards reported that I went over the limit. My credit score dropped 48 points. Can you please let me know if my loan can be denied?

I have a FHA loan for first time buyer.

Thank you for your time.

Hi, I was approved for a fha loan thru rocket mortgage and I close March 8 2022 when they first pulled my credit it was 644 and I noticed yesterday it had dropped to 607 and it was a collection from 2017 on Utilites for 351 should this hurt me? What should I do? I have the money to pay it off?? Should I pay it off? I’m worried

I received my preapproval on February 28th with a credit score of 659. I am using the VA loan who require a minimum 620. My closing date is April 12. I am currently in underwriting. Today an old collections account was added to my credit report and even though it’s paid off it’s showing that it dropped my score 50 points. I have proof that it was paid off, it’s just going to deny my loan?

You should be fine. If you have any issues, can can close your loan. Please contact us at gcho@gustancho.com or call us at 262-716-8151. Text us for a faster response.

My lender said they shouldn’t need to pull my credit again because it’s only 42 days from preapproval to close date but I heard they pull right before funding. Is that true? Just scared because my score dropped 12 points below the minimum.

If the process from pre approval to close takes less than 30 days will the underwriter still do a soft pull before closing? I noticed they did a soft pull on 5/1 which was when we first entered underwriting so will they do another?

Yes, underwriters will do soft pull during the mortgage process and prior to clear to close