This blog will discuss FHA mortgage guidelines on credit disputes during the mortgage process. In general, you cannot have credit disputes during the mortgage process. There are a few credit disputes exempt from removal. Gustan Cho Associates is an expert in working with borrowers who have credit disputes. The following sections will discuss the FHA mortgage guidelines on credit disputes during the loan process and how credit disputes can halt the mortgage process. In the following paragraphs, we will cover FHA mortgage guidelines on credit disputes. We will discuss why borrowers with outstanding credit disputes cannot qualify for an FHA loan until the credit disputes are retracted.

What Are Credit Disputes

Credit disputes are a process where individuals challenge or question the accuracy of specific information on their credit reports. When inaccuracies or errors are detected—such as incorrect personal information, account details, or unjustified listings—consumers can file credit disputes with credit reporting agencies(CRAs). In the following paragraphs, we will cover how the credit dispute process works.

Identifying Errors on Credit Report

Identification of Errors: The first step in a credit dispute is for the consumer to identify any incorrect information on their credit report. Common errors include mistaken identities, accounts that don’t belong to the individual, incorrect account statuses, or outdated information.

How To File Credit Disputes With Credit Reporting Agencies

Once you have identified errors on your credit reports, you are now ready to file credit disputes. There are three credit reporting agencies and you need to file credit disputes on each credit bureau that is reporting errors: Transunion, Experian, and Equifax. Once an error is identified, the consumer can file a dispute directly with the credit reporting agency (CRA) that issued the report. This can typically be done online, by mail, or by phone. The dispute must include documentation supporting the claim, such as account statements or letters from a creditor.

Investigation by Credit Reporting Agency

Upon receiving a dispute, the CRA has a legal obligation under the Fair Credit Reporting Act (FCRA) to review and investigate the disputed claim within 30 to 45 days. The agency will review the provided documents, check with the information furnisher (the entity that provided the data, like a lender or creditor), and determine whether the disputed information is inaccurate or needs to be updated.

Have a Credit Dispute? It Could Delay Your FHA Loan

FHA guidelines require certain disputes to be resolved before closing—we’ll help you fix it fast. Get a Free FHA Credit Review Today!Resolution and Response From the Credit Reporting Agencies

The CRA will provide the consumer with the results after the investigation. If the dispute results in changes to the credit report, the agency will update the records and send the consumer a new copy of the credit report free of charge.

Further Dispute or ADR

If the dispute is not resolved to the consumer’s satisfaction, they can request that a statement of the dispute be included in their file and future reports. Additionally, they might seek alternative dispute resolution options or legal advice. It’s important for individuals to regularly review their credit reports from the three major CRAs—Equifax, Experian, and TransUnion—to ensure all information is accurate and up-to-date. Errors in a credit report can negatively impact credit scores, potentially leading to higher interest rates or denial of credit. Therefore, understanding how to manage credit disputes effectively is crucial for maintaining financial health.

Can I Get a Mortgage Approval With a Credit Dispute

FHA mortgage guidelines on credit disputes during the loan process require the following: All credit disputes that are non-medical collection accounts with outstanding balances (total outstanding aggregate outstanding balances of $2,000 or greater) of $1,000 or greater need to be retracted. It needs to be retracted before the mortgage application and approval process.

FHA is the most popular mortgage loan program in this country for borrowers with low credit scores and bad credit with outstanding collection and charged-off accounts.

The FHA mortgage guidelines on credit disputes throughout the loan process necessitate the following steps: Any credit disputes related to non-medical collection accounts with outstanding balances equal to or exceeding $1,000 must be resolved before initiating the mortgage application and approval process. This prerequisite applies specifically to accounts with total outstanding aggregate balances of $2,000 or more. It’s important to note that FHA is the nation’s most widely embraced mortgage loan program.

Can You Have Disputes Based on FHA Mortgage Guidelines on Credit Disputes?

Frequently, prospective homebuyers inquire about the possibility of credit disputes affecting FHA loans. It’s important to note that credit disputed tradelines do not influence the credit scoring model reflected in the borrower’s credit report. Consequently, a credit dispute on a credit report holds no weight in the credit scoring algorithm.

It is imperative to highlight that HUD, the parent organization of FHA, prohibits credit disputes on FHA loans throughout the mortgage application process.

In cases where disputed accounts amount to $1,000 or more, they must be either removed or subject to manual underwriting. It’s worth noting that medical collections are an exception to this rule. FHA home loans boast the most lenient and relaxed FHA mortgage guidelines on credit disputes than any other mortgage loan program.

FHA Loans With Bad Credit

FHA loans are excellent mortgage loans for first-time home buyers and home buyers with credit issues looking for a home loan with bad credit. FHA Loans benefit borrowers with higher debt-to-income ratios. HUD, the parent of FHA, does not require borrowers to pay off outstanding collections and charged-off accounts in order to qualify for FHA loans.

Borrowers do not have to pay outstanding collections and charge-off account to qualify for FHA loans. However, outstanding collection accounts do affect borrowers debt-to-income ratios.

Homebuyers can qualify for FHA loans without having to pay off outstanding collection accounts with balances and charge off accounts without having to settle with them. However, FHA mortgage guidelines on credit disputes during mortgage application and mortgage approval process defines rules and regulations with regards to credit disputes.

Disputed Credit Tradelines That Are Exempt From Being Removed

FHA mortgage guidelines on credit disputes provide exemptions for specific types of credit disputes. Borrowers can have credit disputes related to outstanding balances on medical collection accounts. Additionally, mortgage borrowers can dispute non-medical collection accounts with zero balances. HUD permits credit disputes for all non-medical collection accounts with aggregate outstanding balances of less than $1,000.

FHA Guidelines on Credit Disputes With Under $1,000 Balance

As long as the cumulative outstanding balances on the credit report remain below $1,000, borrowers can initiate credit disputes for outstanding collection balances unrelated to medical bills. This can be done without requiring them to withdraw the dispute. HUD grants exemptions for medical collections and charged-off accounts, excluding them from debt-to-income calculations. Nevertheless, credit disputes are prohibited on charge-off accounts. Any credit disputes related to charge-off accounts must be resolved and removed to advance the mortgage process. Credit disputes on charged-off accounts are strictly disallowed.

HUD Guidelines on Medical Collections

As previously stated, FHA does not mandate the repayment of outstanding collection accounts. It’s important to note that this 5% of the outstanding collection account balance represents a hypothetical monthly payment that needs to be used for debt-to-income ratio calculations even though borrowers do not have to pay. Medical collection accounts and charge-off accounts are excluded from the 5% hypothetical debt used on debt-to-income calculations.

For borrowers with non-medical collection account balances exceeding $2,000 on their credit report, HUD stipulates that 5% of the outstanding collection balances must be factored into debt-to-income calculations.

orrowers are not obligated to make an actual monthly payment. Nevertheless, mortgage underwriters must consider 5% of the unpaid outstanding collection balance on non-medical collection accounts as a monthly paper debt for debt-to-income ratio calculations. This rule does not apply to outstanding medical collections, irrespective of the outstanding balance.

Pre-Approval With Credit Disputes Are Null and Void

This message is mainly to mortgage loan originators who issue pre-approval letters to home buyers. I have seen many home buyers who were issued pre-approval letters by loan officers without the loan officer reviewing the borrower’s credit report. The pre-approval phase is the most important stage of the mortgage loan application process.

A loan originator who issues a pre-approval letter without thoroughly reviewing the borrower’s following information can cause a potential disaster.

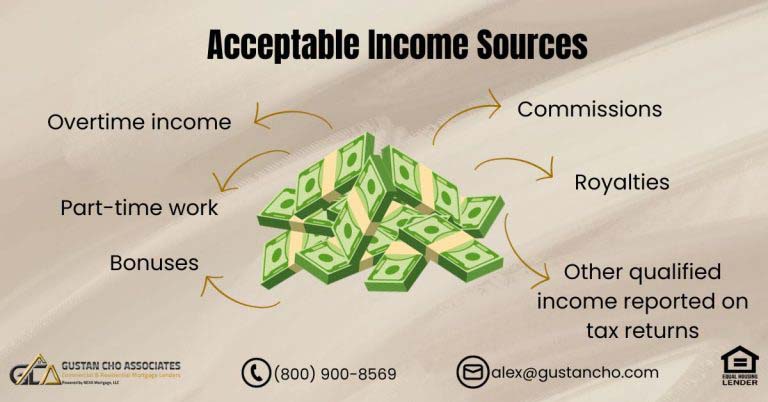

The loan officer should thoroughly review borrowers’ credit reports and itemizing every collection, charge-off, and late payments. The loan originator should make sure there are no credit disputes on non-medical collections, charged-off accounts, late payments. The loan officer should thoroughly review two years of tax returns, two years of W-2s and 30 days paycheck stubs. Loan officers should review credit scores and make sure there are no non-exempt credit disputes.

FHA Mortgage Guidelines on Credit Disputes—Know the Rules Before You Apply

Disputed accounts over $1,000 can cause issues—but you have options. Check Your FHA Eligibility With a Free ConsultationHow To Avoid Stress During Mortgage Process & Last Minute Loan Denial

Loan officers who issue pre-approval letters without conducting a thorough review of borrowers for pending credit disputes on credit reports can cause significant problems. This doesn’t just affect home buyers but also home sellers and everyone involved in the mortgage process.

Unfortunately, many loan originators rely solely on the borrower’s self-reported income and a simple credit pull. They merely check the borrower’s credit score to confirm if it meets the minimum requirements for a home loan.

However, loan officers need to scrutinize the borrower’s credit reports meticulously. They must ascertain the presence of any credit disputes and ensure there are no errors on the credit report. If credit disputes require resolution, loan officers should address them before issuing a pre-approval letter.

Dangers of Retracting Credit Disputes

Numerous loan officers make the error of issuing pre-approval letters and assuming it’s acceptable to initiate the credit dispute retraction process sometime later, particularly after the home buyer secures an executed real estate purchase contract. This proves to be a critical mistake for loan officers. Loan officers must understand that when a consumer retracts a credit dispute, their credit scores will inevitably decrease.

Case Scenario of Borrower With Credit Disputes

HUD minimum credit score requirement to qualify for a 3.5% down payment home purchase FHA Loan is 580. The borrower will not qualify for a 3.5% down payment FHA loan if the credit scores drop below 580.

HUD requires borrowers under 580 FICO and down to a 500 credit score to put a 10% down payment versus a 3.5% down payment. I get calls from borrowers because they are upset with their loan originators who got them pre-approved and an executed real estate purchase contract and now no longer qualify.

How Credit Disputes Can Be Exempt From Retraction

There’s a valuable technique in handling credit disputes related to late payments and derogatory credit tradelines. There’s no obligation to retract disputes when it comes to credit tradelines with a credit balance below $1,000. For instance, if a consumer disputes a $2,000 balance on a credit card, reducing it to under $1,000 allows them to maintain the dispute without retraction. The same principle applies to collections; if the balance of a collection account is $1,100, settling it to $999 exempts borrowers from retracting the dispute.

FHA Mortgage Guidelines on Disputed Accounts During Mortgage Process

Many people question why credit disputes cannot be initiated during the mortgage application process. The rationale behind this restriction is that a credit dispute involving a tradeline automatically prompts the three credit bureaus to exclude the contested tradeline from the credit scoring calculation.

Consequently, a disputed account will display the notation “Consumer Disputes: Not Resolved” on the credit report, leading the bureaus to temporarily subtract the negative score associated with it from the consumer’s overall scores.

In essence, this increases consumer credit scores since the negative score is effectively nullified. The credit scoring model eliminates the impact of disputed credit tradelines from the credit scoring formula, underscoring precisely why credit disputes are prohibited during the mortgage application process.

FHA Mortgage Guidelines on Medical Disputes

Conversely, it’s important to note that disputes related to medical collections are an exception. Contesting medical collection accounts is permitted and can positively impact consumer credit scores. Loan Officers may leverage this strategy of challenging medical collections to boost borrowers’ credit scores potentially. However, it’s crucial to be aware that once disputes are resolved, credit scores may decrease.

Credit Disputes Can Freeze Your FHA Loan—Get Ahead of It Now

We’ll help you identify which disputes are allowed and which need action. Start Your FHA Loan the Right Way Today!Applying For an FHA Loan With Credit Disputes and No Overlays

If the mortgage loan officer made a mistake and issued a pre-approval letter with credit disputes and now no longer qualifies because credit dispute retraction lowered credit scores, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

Gustan Cho Associates Mortgage is a mortgage company licensed in multiple states with no lender overlays on FHA, VA, USDA, and Conventional loans.

Our pre-approvals are fully underwritten and signed off by our mortgage underwriters. All of our pre-approvals close 100% because they are full credit approvals. Our licensed and support staff at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays, to answer your questions.

FAQs: FHA Mortgage Guidelines on Credit Disputes

-

1. Can I get a mortgage with a credit dispute on my credit report according to FHA mortgage guidelines? According to FHA mortgage guidelines, all credit disputes related to non-medical collection accounts with outstanding balances of $1,000 or more (and total outstanding aggregate balances of $2,000 or greater) must be retracted before the mortgage application and approval process.

-

2. Can you have disputes based on FHA mortgage guidelines on credit disputes? No, HUD, the parent organization of FHA, prohibits credit disputes on FHA loans during the mortgage application process. However, credit-disputed tradelines do not influence the credit scoring model reflected in the borrower’s credit report.

-

3. What types of credit disputes are exempt from being removed? FHA mortgage guidelines provide exemptions for specific types of credit disputes. Borrowers can have credit disputes related to outstanding balances on medical collection accounts. Disputes for non-medical collection accounts with zero balances or aggregate outstanding balances of less than $1,000 are also permitted.

-

4. What happens if credit disputes are not resolved during the mortgage process? If credit disputes are not resolved, it can halt the mortgage process or even lead to disqualification for certain loan programs, especially if the disputes result in a drop in credit scores below the minimum requirement.

-

5. How can credit disputes affect the pre-approval process? Issuing a pre-approval letter without thoroughly reviewing the borrower’s credit report for pending credit disputes can lead to significant problems later in the mortgage process. Retracting credit disputes can also cause a decrease in credit scores, potentially affecting loan qualification.

-

6. Are disputes related to medical collections treated differently? Yes, disputes related to medical collections are an exception. Contesting medical collection accounts is permitted and can potentially improve credit scores. However, it’s essential to be aware that once disputes are resolved, credit scores may decrease.

-

7. How can I apply for an FHA loan with credit disputes and no overlays? If credit disputes have affected your loan qualification and you need assistance, you can reach out to Gustan Cho Associates Mortgage. They offer FHA loans with no lender overlays and provide fully underwritten pre-approvals. Their team is available to answer your questions seven days a week.

This blog about FHA Mortgage Guidelines on Credit Disputes was updated on April 15th, 2024.

Have good DTI, and good income but a 570ish credit score. I served in the Army National guard. Are you able to help?