This Breaking News Article Is About States Attracting New Taxpayers Due To Low Taxes And Cost Of Living

2020 is finally over and we are off to a new start in 2021. Americans faced many challenges in 2020. Americans have been able to endure 2020 with the health, economic, and political impact on us as individuals and our families. The U.S. economy was booming prior to the coronavirus outbreak in February 2020.

After President Donald Trump won the 2016 Presidential election, Americans were thriving with a stellar economy, higher wages, low taxes, and historic unemployment rates. Never in history has the unemployment rate of African Americans, Hispanic Americans, Asian Americans, and other non-white Americans have been as low as it was during President Trump’s Presidential tenure. President Trump has pushed Federal Reserve Board Chairman Jerome Powell to lower interest rates. In the Spring of 2020, Fed Chairman Jerome Powell announced the Central Bank will lower the Fed interest rate to zero percent. The Federal Reserve Board lowering the Fed interest rate to zero percent, mortgage rates started to plummet to historic lows.

President Donald Trump had many obstacles during his tenure. Democrats were ruthless in trying to destroy him. The media turned on him and his administration as well as the party. Surprisingly, Joe Biden won the 2020 Presidential election. President Trump alleged voter and election fraud. However, over 60 courts ruled against President Trump’s voter allegations. This holds true with the thousands of pieces of evidence including eyewitness reports and sworn statements.

Concerns With A New President Versus The Housing And Mortgage Market

Over 80 million Americans voted for President Donald Trump in the 2020 Presidential election. President Trump has campaigned hard. Joe Biden, on the other hand, was couped up in the basement of his Delaware home most of the year. It shocked many Americans President Trump did not get re-elected. Nancy Pelosi, Chuck Schumer, Adam Schiff, Barack Obama, Michelle Obama, and dozens if not hundreds of jealous Democrats from U.S. Senators, Congressmen, governors, state and local politicians, judges, corporate CEOs, and city mayors tried everything in their will to take out a duly elected sitting U.S. President.

Democrats have made up the Russian hoax and launched a $50 million dollar two-year Special Counsel investigation to impeach President Trump as well as hundreds of Trump’s allies. After two years and $50 million dollars to U.S. taxpayers, Special Counsel Robert Mueller’s Russian meddling into the U.S. elections investigation turned out there was no wrongdoing from President Donald Trump in the 2016 U.S. elections. We will discuss more how both major U.S. political parties literally had a civil war during President Trump’s presidency. Time is running out and it seems like the nation will have a new president come January 20th, 2021.

What Will A Joe Biden Presidency Mean For Americans

Many Americans wonder what a Joe Biden presidency will mean to the housing and mortgage market:

- Homebuyers are smarter and sharper today than ever before

- The coronavirus pandemic has opened doors for homebuyers

- More and more companies are offering their employees to work remotely

- Remote workers are no longer tied to a specific state

- Remote workers can purchase homes in any city and/or state they like

- Financially mismanaged states like Illinois and New York with high taxes can no longer keep on increasing taxes and not expect a mass exodus of its taxpayers and small business owner

- Many states led by Democrat governors, mayors, lawmakers are seeing a mass exodus of taxpayers to other lower-taxed states with affordable housing and low cost of living

In this breaking news article, we will discuss and cover States Attracting New Taxpayers Due To Low Taxes And Cost Of Living.

How Are States Attracting New Taxpayers

The coronavirus pandemic has changed the way we work and live. Many businesses no longer require all employees to report to a brick-and-mortar location. A large percentage of workers can now work remotely. Remote workers are no longer tied to live in a particular geographical area because they no longer have to commute to work.

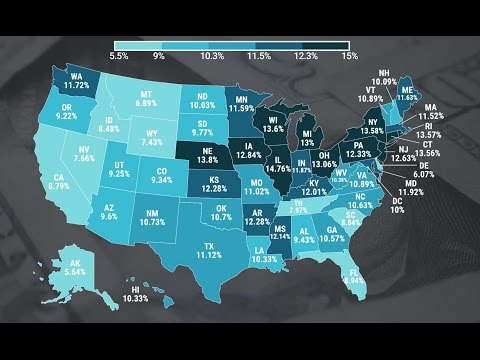

It is a win-win situation for remote workers where they can pick and choose which state they want to relocate to. Many remote workers are fleeing high-taxed states and moving to lower-taxed states with affordable housing and low cost of living. Illinois, New York, California, Connecticut, Vermont, West Virginia are seeing a mass exodus of not just individual taxpayers but small businesses as well. Many low-taxed Sun Belt states are attracting new individual taxpayers and businesses.

Low-taxed states are raking in billions in revenues while states like Illinois and New York keep on increasing new taxes and are sinking deeper into a hole due to the mass exodus of taxpayers and businesses. The coronavirus pandemic has accelerated the mass exodus of people in major cities like Chicago, New York City, Los Angeles, San Francisco to other states with less restrictive measures. Incompetent governors and politicians have tried to politized the coronavirus outbreak and kept restrictive stay-at-home orders which ended up backfiring on them.

States With High Mass Exodus Of Taxpayers

State governors need to wake up and start paying attention to the consequences of raising taxes. For example, Chicago is the highest taxed city out of any other major city in the nation. Freshman rookie mayor Lori Lightfoot seems absolutely clueless in managing Chicago. She keeps on increasing and creating new taxes where she is forcing many individual taxpayers and businesses out of Chicago to other lower-taxed cities and/or states. No matter how much taxes you increase, if you lose your tax base, you have nobody to tax. It is useless. This also holds true with rookie Illinois Governor JB Pritzker. Pritzker’s solution to fix the state’s financial crisis is to keep on increasing and creating new taxes. Taxpayers had enough and you can see the mass exodus of Illinoisans to other low-taxed states. Tesla CEO Elon Musk is the richest man in the world and a savvy businessman. Elon Musk has complained about the high taxes in California. He decided to relocate Tesla’s Fremont, California to low-tax Texas. Other foreign automakers are relocating to tax-friendly states such as Indiana, Florida, Texas, North Carolina, Tennessee, South Carolina, and Alabama.

List Of States Attracting New Taxpayers Due To Low Taxes And Cost Of Living

Here is a list of low-taxed states where it gained population:

- Texas (373,965)

- Florida (241,256)

- Arizona (129,558)

- North Carolina (99,439)

- Georgia (981,997)

- Texas (4.2 million new residents)

- Florida (2.9 million new residents)

- Arizona (989,000)

- Tennessee (879,000)

- Idaho (1.25 million new residents)

In general, Democrat-led states are generally higher-taxed and are losing population. Republican-led states are lower-taxed and are raking in billions in revenue due to being tax-friendly.

I am in forbearance from COVID but I would like to non-credit refinance to get my dad off the loan and to get my interest rate lower. If I also could if equity pay off some debt to help me rebuild from this pandemic.

Hello- Mr. Cho,

My name is Ismael Aguayo and I am a Realtor with the Moreno Real Estate Group, which is the highest rated brokerage in West Texas and in its El Paso, TX county.

I am also a licensed MLO in the states of Texas and Colorado with an interest to simultaneously utilize both licenses (i.e., Realtor & MLO). Please contact me if you are interested in further discussing the possibility and options to join your reputable lending team.

Previous experience that directly or indirectly benefits the roles of Realtor and MLO include my engagement in the Architecture, Engineering and Construction industry through my Licensed Professional Engineering private practice and Master Electrician licensure. I also completed two Master’s degrees from the Colorado School of Mines in Electrical Engineering and Engineering Management (similar to an MBA inclusive of graduate coursework in Finance and Accounting), and a Bachelor’s degree from the University of Colorado in Electrical Engineering.

Excited to speak with you about this very promising collaboration opportunity.

My husband’s credit score is close to 700 but mine is maybe 597 and we are trying to get a home loan. With just his name on it he’s only getting approved for maybe 140k but I would like to be on the loan too, with my income we can get more.

Looking to buy a condotel unit here: http://www.crystalgolfresort.com/stay/grand-cascades-lodge/?nck=brand&gclid=Cj0KCQiArvX_BRCyARIsAKsnTxOrSeZNOFgDcOxmqy-gIjTBfTJ0tz84tCaJpYhwF_f4vG8wJApF6E4aAh1OEALw_wcB

After watching so many videos and reading so many blogs I was convinced that your company is the company that I would like to work with for my mortgage. But I have come across this and other statements from leaders of your company on your sites that contain harsh one sided political opinions. I do not have any issue with your personal beliefs and I do not side with either of these political parties mentioned. Most business see the wisdom in keeping to their business and not pushing political agendas as their clients are obviously from all spectrums and points of view and come to you for mortgage services not politics. This is very disappointing to see.

Al,

Thank you for your comment. You are not the first person that have said this. In no way do we want to make this website get out of context and make it political. If the author of an article want to express their political views, their are many political opinion expression sites on the internet. I will propose that effective immediately any political content of the author will not longer be published on Gustan Cho Associates. I will discuss this issue with Gustan Cho and our senior staff where all blogs that is out of topic be edited so it will not offend any of our viewers, whether Democrats, Republicans, Independents, or those with other political affiliation. Thank you for sharing your thoughts.

My wife and I are in the process of purchasing a home however we have a unique situation. My wife has excellent credit but a little bit of a higher DTI. I have the income so we would both need to probably be on the loan. However I had a few charge of and delinquent accounts that I did not know about until looking at my credit profile. Most of these have been paid in full but are still n he credit report. Unfortunately just as of today I filed a dispute on an account that I was unaware about and never been notified on. Will this hinder us getting approval? Our builder recommended we go through there finance company but now we are worried about to many pulls on our credit.

First time home buyers just want to own my on home for my family. I have been following your blogs at Gustan Cho Associates for a year now. I think I qualify for a mortgage. I have been doing exactly what Mr. Gustan Cho instructed me to do to qualify for a mortgage. Come February 2021, all of my payments have been timely for the past 12 months.

Looking to see if it is possible to obtain a VA loan since Indiana has no minimum score. I am looking for a lender like Gustan Cho Associates where there is no lender overlays on VA loans.