Tax Settlement for Mortgage Borrowers With Tax Liens: How to Qualify for a Home Loan

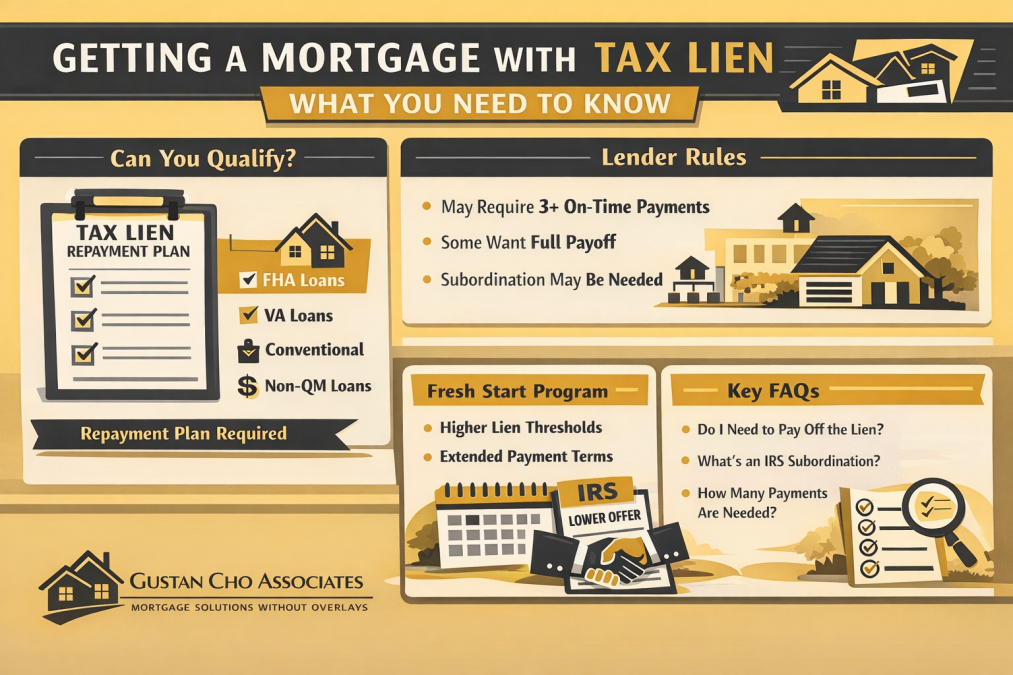

Owing the IRS or your state doesn’t automatically end your homeownership plans. Many borrowers can still get approved for a mortgage—even with an active tax lien—as long as the tax debt is properly documented and structured correctly before closing.

At Gustan Cho Associates, we help home buyers and homeowners understand the mortgage side of tax liens: what lenders look for, what documentation is required, and which loan programs are most flexible. (We’re a mortgage company—not a tax firm—so we coordinate with your tax professional and focus on the lending guidelines.)

The Key: Show the Lien Is Controlled

In most cases, lenders want to see that you’ve taken one of these steps:

- IRS/State Installment Agreement: a formal repayment plan with a documented monthly payment

- Offer in Compromise (when applicable): a negotiated settlement that may reduce what you owe

- Subordination (often required): the IRS agrees your new mortgage can be in first position, allowing the loan to close

When the plan is in place and the paperwork is correct, many borrowers can qualify for FHA, VA, and certain Non-QM programs. Some Conventional lenders may be stricter, depending on the lien status, the repayment history, and lender overlays.

What You’ll Learn in This Guide

In this article, we’ll cover:

- What a tax lien is and why it can delay underwriting or closing

- The most common tax settlement options lenders will accept

- How FHA, VA, Conventional, and Non-QM loans typically treat tax liens

- When you may need an IRS subordination agreement and how it works

- A simple step-by-step checklist to prepare your file for mortgage approval

Need help structuring a mortgage approval with a tax lien? Call or text 800-900-8569 to speak with a Gustan Cho Associates loan specialist and review your options.

What We Do / What We Don’t Do (Gustan Cho Associates)

What We Do

- Review your mortgage options (FHA, VA, Conventional, Non-QM) based on your tax lien status and overall profile.

- Explain lender requirements in plain English—including when something is an agency guideline vs. a lender overlay.

- Help you build an approval-ready file by identifying the exact documents underwriting will request (repayment agreement, proof of payments, transcripts, lien details, etc.).

- Coordinate with your tax professional on timing and documentation—especially if subordination may be needed to close.

- Match you with lenders with no overlays whenever possible to avoid unnecessary denials.

What We Don’t Do

- We do not provide tax or legal advice, and we don’t prepare tax returns.

- We do not negotiate directly with the IRS/state or file an Offer in Compromise on your behalf (that’s for a CPA/EA/tax attorney).

- We do not guarantee approval—final decisions are made by underwriting based on documented guidelines and your complete file.

Tip: If you don’t already have a tax professional, we can tell you what to ask them so your paperwork aligns with mortgage underwriting.

So What Happens When You Make a Mistake?

Most tax software programs run error checks and detect any red flags. These processes are not foolproof. So what happens if you make a mistake? John Strange of Gustan Cho Associates says the following about tax settlements for mortgage borrowers with tax liens:

Well, many times, if you make a calculation error, the IRS will correct it for you and send you a notice. Hopefully, the error is not material.

More than likely, the IRS will issue a proposed assessment and allow you time to agree or disagree with their revised calculations. Once the assessment is final the IRS will send you a bill. If you owe more money than you can pay the IRS has many options available.

Yes, You Can Still Qualify With Tax Liens

Don’t let IRS or state tax debt stop your homeownership goals.

What Is the IRS Fresh Start Program and How Can It Help If You Owe Back Taxes?

The IRS “Fresh Start” initiative isn’t a single application—it’s an umbrella for several IRS relief options (especially payment plans) that were expanded to make it easier for taxpayers to resolve back taxes and reduce the risk of aggressive collection actions, such as liens and levies. The exact thresholds and requirements can change over time, so it’s best to treat the items below as general guidelines and confirm the current rules when you apply.

Common Fresh Start–Related Benefits Borrowers May Use Before a Mortgage:

- Long-term IRS payment plans are available to many taxpayers who owe up to a certain amount (commonly $50,000 or less in combined tax, penalties, and interest) and who have filed required returns.

- Streamlined approval in many cases: streamlined installment agreements generally do not require a full financial statement. They may not require the IRS to file a Notice of Federal Tax Lien—though the IRS can still need additional information depending on the situation.

- Online setup may be available for qualifying balances and taxpayers who are current with required filings.

- If the balance exceeds the streamlined threshold, some taxpayers may choose to reduce it (via a lump-sum payment) to potentially qualify for streamlined terms—subject to IRS rules at that time.

- Lien filing thresholds: many third-party summaries note the IRS has historically used higher dollar thresholds for filing a Notice of Federal Tax Lien than in the past (often cited around $10,000), but lien decisions can be discretionary and fact-specific—so avoid treating any single number as a guarantee.

Mortgage tip: From an underwriting perspective, what matters most is having a formal IRS/state agreement in writing, proof of on-time payments, and (when required) the ability to obtain subordination so the mortgage can close.

Offer In Compromise Tax Settlement With The IRS

Offer in Compromise-

- An Offer in Compromise is generally considered when the offered amount is the most that the IRS can expect to collect or receive from the taxpayer over a reasonable period of time

- Does this sound vague?

- What is the IRS looking for when you apply for an Offer in Compromise?

They are looking at the following:

- income, all sources, for the entire household

- including earned income

- social security

- disability

- rent received from roommates

- social services benefits such as food stamps

- other sources of financial assistance

How To Go About The Tax Settlement Process

They will want to look at your bank accounts, run asset checks, and they want to see if you own real property and whether or not you have equity in your home. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about tax settlement with the IRS:

It is at the discretion of the IRS and nobody really knows the magic formula, but why not apply? The most that could happen is they say no.

The IRS has an Offer in Compromise pre-qualifier on their website where you enter in your financial information and your monthly debt payment. Taxpayers can find the Offer in Compromise Pre-qualifier tool here: http://irs.treasury.gov/oic_pre_qualifier/

Why Should I Pay My IRS Debt and Tax Settlement

If you owe money to the IRS and you are not on a payment plan towards paying the liability, the IRS can and will take summary collection actions such as the following:

- bank levies, federal tax liens

- earnings withhold orders

- many other drastic collection actions

Additionally, if you have unpaid tax liens and owe the IRS money, this can definitely impact the ability to purchase a new home or refinance.

Tax Liens Don’t Have to Mean Loan Denials

Discover options to settle or structure payments and still qualify.

Need to See Tax Advisor for Tax Settlement

The author of this article, tax settlement, was written by Alex Carlucci who is a senior loan officer with Gustan Cho Associates. Alex is a contributing associate editor and writer for Gustan Cho Associates.

Alex Carlucci is a licensed mortgage loan originator for Gustan Cho Associates Empowered by NEXA Mortgage, LLC, and is based in Oakbrook Terrace, Illinois.

Gustan Cho Associates is a mortgage company licensed in 48 states headquartered in Chandler, Arizona. We have offices throughout the United States and are licensed in multiple states. Alex is an expert in all areas of mortgage lending and his expertise is in FHA, VA loans, and Conventional loans with no overlays.

Mortgage Lender Experts With No Overlays on Tax Settlement

Gustan Cho Associates has a national reputation for helping borrowers who had prior credit issues and had a hard time qualifying for home loans due to prior credit issues and/or debt to income ratio issues. A large percentage of Alex’s borrowers are folks who could not qualify at other banks and lenders due to their lender overlays.

A lender overlay is when a bank or lender has higher credit requirements than those of FHA or Fannie Mae. For example, HUD minimum credit score requirement for a buyer to purchase a home is 580 FICO.

However, most banks and lenders may have FHA Lender Overlays. This holds true even though FHA only requires a 580 FICO credit score, they may require a 640. Alex Carlucci, due to not having any overlays on FHA loans, can approve, originate, and fund borrowers who just meet the minimum agency guidelines.

Tax Settlement Solutions for Mortgage Borrowers with Tax Liens

Learn how a tax settlement can help borrowers with tax liens get approved for a mortgage. We explain IRS repayment plans, credit protection, and expert strategies to secure your home loan with Gustan Cho Associates.

Understanding Tax Settlement and Mortgage Approval

When tax liens appear, your mortgage plans can quickly feel derailed. A lien secured by the IRS or state against your home tells lenders you have unpaid tax obligations, which raises their risk level.

Luckily, tax settlement options can clear the path to mortgage approval. At Gustan Cho Associates, we focus on turning mortgage dreams into reality—even for clients with tax debt.

In this article, you’ll learn how to use tax settlement options, IRS repayment plans, and lender guidelines to transform a lien into a cleared credit report and a new front door.

What Tax Liens Are and How They Affect Mortgages

A tax lien pops up when you don’t pay your taxes. The government says, “We want our money, and we’re putting this claim on your property so you can’t sell it until you pay up.”

Tax liens are public record and can impact underwriting, title, and closing requirements even if they’re not showing on your credit report.

They see it as a red flag for how you handle money. The good news is that once you set up a tax settlement or a repayment plan, you can get back on track with your loan.

What’s a Tax Settlement?

A tax settlement is a deal you strike with the IRS or your state tax office to pay off your tax bill on terms you both can live with. It might trim the total, break it into manageable monthly chunks, or put the bill on hold until your finances improve.

Here Are a Few Common Ways to Settle Your Tax Bill:

- Offer in Compromise (OIC): You pay back less than the full amount you owe.

- Installment Agreement: You spread the payment over several months, making smaller, easier-to-handle payments.

- Currently Not Collectible (CNC): The IRS pauses its collection efforts because you can’t afford to pay now.

Can You Get a Mortgage if You Have a Tax Lien?

Yes—many borrowers can still qualify, but approval depends on (1) the loan program, (2) whether the tax debt is formally addressed (repayment plan/settlement), and (3) each lender’s overlays (extra rules beyond the agency baseline).

Below is a more precise breakdown of agency baseline vs. common lender practice.

FHA Loans (Baseline vs. Common Practice)

Agency baseline (typical FHA approach):

- FHA may allow financing with an active IRS/state tax lien if you have a signed repayment agreement and can document the terms.

- The IRS/state may need to subordinate its lien (so the new FHA mortgage can be in first position), depending on the transaction and title requirements.

Common lender practice (what many lenders ask for):

- Proof of on-time payments on the repayment plan (often 3 months is requested).

- Clear paper trail: agreement + payment evidence + transcript/letter if needed.

Overlay warning (varies by lender):

- Some lenders require more than 3 months of payments or a payoff, even when the FHA baseline would allow a plan.

VA Loans (Baseline vs. Common Practice)

Agency baseline (typical VA approach):

- VA financing may be possible with tax debt when the borrower has a repayment plan and can demonstrate the ability to repay.

- Subordination may still be required depending on lien type and closing conditions.

Common lender practice:

- Documentation of the repayment plan + proof of timely payments.

- Some lenders are flexible; others require the lien to be paid off before closing.

Overlay warning:

- Certain lenders apply stricter internal rules than VA requires.

Conventional Loans (Fannie/Freddie) (Baseline vs. Common Practice)

Agency baseline (general expectation):

- Conventional approvals tend to be more conservative when it comes to unresolved tax liens.

- Many conventional scenarios require the lien to be resolved to the lender’s satisfaction, which may mean payoff or a documented agreement plus conditions.

Common lender practice:

- Many lenders prefer the lien be paid and released/withdrawn before closing, especially if it could impact a clear title.

- If allowed at all, lenders may require a more extended repayment history and stricter documentation than FHA/VA.

Overlay warning:

- This is where overlays are most common—some lenders will decline files that another conventional lender might accept.

Non-QM Loans (Baseline vs. Common Practice)

Program baseline (varies by lender):

- Non-QM guidelines are lender-specific, so there is no single “agency rule.”

- Many Non-QM lenders are more open to borrowers with active tax liens, especially with a documented repayment plan.

Common lender practice:

- Proof of the repayment plan + evidence of payments.

- Pricing can be higher depending on risk factors and documentation type.

Overlay warning:

- Because Non-QM is lender-driven, requirements can differ widely—one lender may allow a lien with a plan, another may require payoff.

Bottom Line

A tax lien doesn’t automatically mean “denied.” The key is showing the tax debt is formally managed, documenting payment history, and working with a lender that doesn’t add unnecessary overlays for your loan type.

Steps to Deal with a Tax Lien Before You Buy a Home

- Talk to the IRS or Your State Tax Office – Pinpoint the exact balance you owe.

- Create a Payment or Settlement Plan – Agree to a monthly figure you can realistically handle.

- Stay on Schedule with Payments – Lenders want to see you make regular, on-time payments.

- Ask for a Subordination – The IRS must let your future mortgage rank higher than the tax lien.

- Team Up with a Skilled Mortgage Broker – Firms like Gustan Cho Associates know mortgage options for borrowers with open tax settlements.

Why You Should Clear Liens Before Getting a Mortgage

- Boost your credit scores.

- Avoid a denial caused by outstanding tax bills.

- Get access to broader loan options.

- Move closer to lasting financial wellness.

Overcome Tax Debt and Buy Your Home

With the right lender, IRS and state liens don’t block your mortgage.

How Tax Liens Affect Getting a Mortgage

What’s a Tax Lien?

A tax lien happens when you owe the government taxes and don’t pay. The government places a legal claim on your property, and this claim shows up in public records. This means that the IRS gets first dibs on the value of your property if you sell it.

Why Is This Important to Lenders?

- A tax lien signals that a borrower has unpaid bills and may be in financial trouble.

- Lenders know the IRS is first in line to collect if you don’t pay your mortgage.

- The tax lien can delay or even stop your mortgage closing if it is still open.

If you enter a proper tax settlement, many mortgage programs—including FHA, VA, Conventional, and even Non-QM loans—can still approve your loan.

Tax Settlement Options for Borrowers

IRS Installment Plans

Most borrowers use a monthly installment plan with the IRS to settle taxes. After the plan is active, lenders will usually approve a mortgage if:

- The borrower is up to date with payments.

- Required Documentation: Documentation is sent.

- The monthly installment is counted in the debt-to-income calculation.

Offer in Compromise (OIC)

With an Offer in Compromise, taxpayers can settle for less than what they owe. Although acceptance is tough, the lien may be dropped once the deal is approved.

IRS Fresh Start Program

The Fresh Start Program simplifies long-term installations and lien release. Taxpayers with resolved or settled debt can have easier mortgage approval using this program.

FHA Loans and Tax Liens

FHA Rules on Tax Liens

FHA lets you still qualify for a loan even with an IRS tax lien hanging over you, but a couple of key conditions must be met:

- There’s a signed repayment plan with the IRS.

- You’ve made at least three payments on that plan.

- The tax lien balance isn’t going to delay the loan closing.

The FHA’s Approach to Tax Agreements

The FHA works to help more people buy homes, so it accepts repayment agreements on tax debts as long as the borrower follows the plan. You don’t need to pay the lien in full to get the loan.

VA Loans and Tax Liens

VA Rules for Veterans with Tax Liens

Veterans can still get a VA home loan if they’re on an IRS repayment plan and making on-time payments. The VA does not insist that the entire tax lien be cleared to grant the loan.

Benefits of a Tax Payment Plan for Veterans

A solid tax settlement plan shows lenders that borrowers are handling their debts responsibly. This can help veterans prove their creditworthiness and make the loan approval process a bit easier, even with a past tax issue.

Conventional Loans and Existing IRS Debt

Requirements from Fannie Mae and Freddie Mac

To get a Conventional mortgage, you need:

- A repayment plan for the IRS in a write-up.

- Proof that you’re making the IRS payments right on schedule.

- The IRS payment is counted in your debt-to-income (DTI) ratio.

Conventional loans are tighter than FHA or VA loans. You’ll need a full year of on-time IRS payments before a lender will even look at your file.

Non-QM Loans for Buyers with Tax Liens

Overview of Non-QM Loans

Non-QM mortgages are for buyers who don’t fit the square boxes of traditional approvals.

Non-QM Advantages for IRS Liens

- No, wait, once you’re in an IRS repayment plan.

- For information, you may only need bank statements, an asset draw-down schedule, or a debt-service coverage ratio (DSCR).

- You can get a loan even if you still owe the IRS or have just completed a ledger settlement.

- Self-employed people and property investors often find that a non-QM mortgage closes the loan door on homeownership the quickest when an IRS settlement clouds the landscape.

How to Get a Mortgage with an IRS Tax Debt

- Work Out a Settlement or Payment Plan: Decide on an IRS repayment plan, Offer in Compromise plan, or Fresh Start plan, and get that paper stamped.

- Keep Counting on Time: Make those IRS installments and keep the lender happy with bank records that prove your consistency.

- Provide Documentation: Send your lender IRS transcripts or settlement agreements.

- Choose a Lender with No Overlays: Some banks have strict rules.

- However, mortgage brokers like Gustan Cho Associates specialize in tax lien approvals.

- Review Loan Options: Your credit profile and IRS situation may determine whether you qualify for FHA, VA, conventional, or non-QM programs.

Advantages of Settling a Tax Lien

- Reestablishes eligibility for a mortgage.

- Boosts your credit score.

- Stops IRS wage garnishment or property seizures.

- Gives you greater peace of mind while getting your loan.

Tax Settlement FAQs

Can You Get a Mortgage if You Have a Tax Lien?

Yes, it’s often possible—especially with FHA, VA, and some Non-QM programs—if the lien is being properly addressed (typically via a written repayment agreement) and the lender can document it. Some lenders may still require payoff due to overlays or title/closing requirements.

Do I Have to Pay Off a Tax Lien Before Closing on a Mortgage?

Agency baseline (common): Not always—some programs may allow closing with an active lien if there’s a documented repayment plan and the file meets requirements.

Common overlay: Many lenders (especially on Conventional) require the lien to be paid off and released/withdrawn before closing, even if another lender might allow a plan.

How Many Months of IRS Payments Do I Need Before Applying for a Mortgage?

Common lender practice: Many lenders require at least 3 months of on-time payments under an IRS/state installment plan.

Overlay warning: Some lenders require more (or require payoff), depending on loan type, risk profile, and internal rules.

What is an IRS subordination agreement—and why does it matter for a mortgage?

IRS lien subordination doesn’t remove the lien. It allows another creditor—such as your new mortgage lender—to move ahead of the IRS lien, which can help close a purchase or refinance.

What’s the Difference Between a Tax Lien and a Tax Levy?

A tax lien is when the government puts a claim on your property because you haven’t paid your taxes. A tax levy is when they actually take your stuff or property to cover what you owe.

Does a Tax Lien Show Up on My Credit Report?

Not always. Even when a tax lien isn’t showing on a credit report, it can still appear in public records and affect title/closing and underwriting requirements. That’s why lenders focus on whether the tax debt is documented and controlled (through an agreement, payment history, and, when needed, subordination).

Final Takeaway

Tax settlements help borrowers with tax liens who want to get a mortgage. Options like repayment plans, offers in compromise, and subordination agreements can clear the path. At Gustan Cho Associates, we team up with lenders who get real-world problems and have no lender overlays. That means we can help you become a homeowner—even if you have tax challenges.

Gustan Cho Associates also offers non-QM loans and other alternative financing loan programs. Call us at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

This article about “Tax Settlement For Mortgage Borrowers With Tax Liens” was updated on February 17th, 2026.

Denied by Other Lenders Because of Taxes?

We work with borrowers other banks turn away.