Updated explainer for buyers, sellers, and investors

Understanding how the economy affects the housing market helps you make smarter decisions—whether you’re buying your first home, selling a property, or investing for cash flow. In plain language, how the economy affects the housing market comes down to three big levers: the cost of money (mortgage rates), the strength of paychecks (jobs and wages), and the balance of supply and demand (inventory and construction). When you track these levers, you can predict where prices, sales, and affordability are likely to head next.

Why the Economy and Housing Move Together

To understand how the economy impacts the housing market, examine confidence and cash flow. When jobs are steady and wages grow, households feel secure enough to make purchases, which in turn raises demand. When uncertainty rises, buyers pause, sellers negotiate more frequently, and the number of days on the market increases. That is the simple logic behind how the economy affects the housing markets in any cycle.

Mortgage Rates: The Fastest Way the Economy Hits Your Payment

The most visible part of how the economy affects the housing market is mortgage rates. Rates are influenced by inflation, bond yields, and investor demand for mortgage-backed securities. When rates fall, monthly payments drop and more buyers qualify—pushing sales and often prices higher. When rates rise, the payment increases, affordability decreases, and activity slows. A one-point rate change can alter buying power by roughly ten percent, which is why the economy’s effect on the housing market is so sensitive to interest-rate moves.

Smart move: Ask your lender to compare payment options with temporary buydowns (2-1, 1-0) and permanent buydowns (points). These tools turn the rate lever to your advantage and are a practical response to how the economy affects the housing market right now.

See how inflation and rates shape your payment

Model today’s pricing and forecasted scenarios so you can plan confidently

Inflation and Real Borrowing Costs

Inflation is another key channel through which the economy impacts the housing market. Higher inflation usually pushes rates up and squeezes affordability. When inflation cools, the pressure on rates often eases and buying power returns. Builders also watch inflation because higher costs for materials and labor raise new-home prices. If you’re learning how the economy affects the housing market, remember this: inflation changes both what you pay each month and what builders must charge to break even.

Jobs, Wages, and Confidence

Jobs and wages are the backbone of how the economy affects the housing markets. Buyers don’t stretch for a mortgage if layoffs look likely. When paychecks grow faster than home prices, affordability improves even if interest rates remain steady. Consumer confidence measures—how people feel about buying—often forecast next quarter’s activity. Keep an eye on employment trends to see how the economy affects the housing market before the headlines catch up.

Supply: Months of Inventory, Existing vs. New, Permits vs. Starts

Supply is destiny. A tight market, characterized by two to three months of inventory, favors sellers and supports price growth. A looser market with seven or more months favors buyers and pressures prices. This is one of the simplest ways to see how the economy affects the housing market in your zip code.

- Existing homes: When owners are “rate-locked” into low payments, they hesitate to sell. That limits listings even when demand is decent.

- New construction: Builders step in when resale supply is thin. Their incentives (rate buydowns, closing credits, upgrades) are tactical answers to how the economy affects the housing market at any given moment.

- Permits → starts → completions: Permits show intent, starts show investment, completions add real units. Delays between these steps often reflect financing costs and labor bottlenecks—another lens on how the economy affects the housing market in real time.

Credit Availability and Lender Overlays

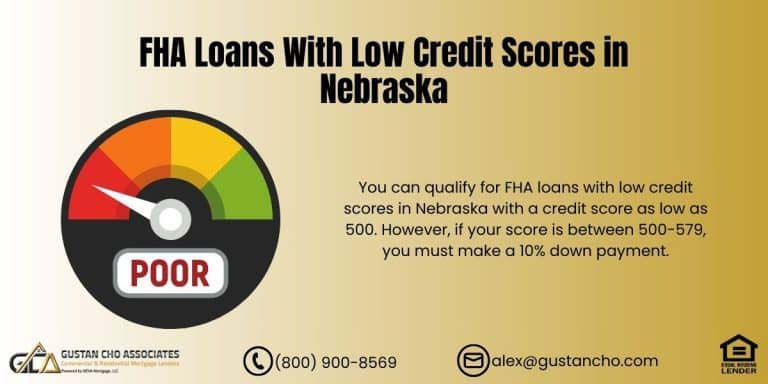

Credit standards fluctuate in response to risk appetite. During uncertain periods, lenders may add overlays—higher minimum scores, tighter debt-to-income ratios, and additional reserves. In stable periods, overlays ease and approvals rise. For many borrowers, this channel decides how the economy affects the housing market more than rates do. If you’re self-employed or an investor, Non-QM and DSCR programs can unlock options even when traditional DTI doesn’t fit.

Regional Shocks: Taxes, Insurance, Climate, and Migration

National averages hide local realities. Insurance costs, property taxes, climate risk, and employer growth patterns influence how the economy impacts the housing market on a regional level. Coastal wind coverage, wildfire zones, flood maps, and reassessments can result in monthly payments being adjusted by hundreds of dollars. Always factor these local costs into your analysis of how the economy affects the housing market where you plan to buy.

Investor Dynamics: Rents, DSCR, and Cap Rates

Investors experience firsthand how the economy affects the housing market through trends in rent and financing terms. When interest rates are high and capitalization rates remain low, some deals stall. When rents rise or financing improves, investors return and absorb entry-level inventory. DSCR loans, seller credits, and permanent buydowns are common ways to make deals pencil, showing again how the economy affects the housing market through the investment channel.

Buyer Playbook: Win in Any Market

- Marry the house, date the rate. Use credits and buydowns today; refinance if conditions improve. This mantra reflects how the economy affects the housing market without freezing your plans.

- Compare programs side by side. FHA, Conventional, VA, and Non-QM can impact your approval and payment options. That’s a direct way the economy affects the housing market, which affects your wallet.

- Stress-test your payment. Add a 0.5%–1.0% rate cushion, and confirm you’re still comfortable.

- Target motivated sellers and builders. Incentives offset rate headwinds created by how the economy affects the housing market.

Seller Playbook: Move the Market to You

- Price to today, not last spring. Watch months of supply and days on market.

- Offer tactical credits. A targeted $10k credit for a buydown can be more powerful than a $15k price cut—because of how the economy affects the housing market at the payment level.

- Pre-inspect and pre-underwrite. Fewer surprises, faster closings, stronger offers.

Investor Playbook: Underwrite for Resilience

- Conservative assumptions. Model higher insurance, realistic maintenance, and a slightly higher exit cap rate.

- Use DSCR strategically. Align term, prepay, and buydown with your hold period.

- Focus on yield and durability. That’s how professionals ride how the economy affects the housing market instead of reacting to it.

Understand jobs data and housing demand

See how employment trends affect competition and pricing in your area

Simple Glossary (Skimmable)

- How the economy influences the housing market: The cause-and-effect of rates, jobs, inflation, credit, and supply on prices, sales, and affordability.

- Months of supply: Active listings divided by monthly sales pace; market-tightness meter.

- DTI (debt-to-income): Monthly debts ÷ gross income; key approval limit.

- MBS spread: The extra yield that investors demand for mortgage bonds; a wider spread means higher mortgage rates relative to Treasuries.

- Non-QM / DSCR: Flexible programs for self-employed borrowers and rental properties when standard DTI falls short.

What to Watch Monthly (and Why)

- Mortgage rates and bond yields: A fast lane for understanding how the economy affects the housing market.

- Inflation trends: Signals relief or pressure on payments.

- Jobs and wage growth: Buyer capacity and confidence.

- Existing/new home sales, months of supply, permits/starts: Demand vs. pipeline.

- Insurance and Taxes: Local affordability shocks.

Final Takeaway and Next Steps

Now you can see how the economy affects the housing market through rates, jobs, inflation, credit, and supply—without the jargon. Use this framework to time your purchase, price your listing, or structure your investment so you win in any cycle.

Gustan Cho Associates can walk you through side-by-side options—FHA, VA, Conventional, USDA, Non-QM, and DSCR—with clear payment comparisons and buydown strategies. If you want a personalized plan aligned to how the economy affects the housing market today, we’re ready to help.

Borrowers who need a five-star national mortgage company licensed in 50 states with no overlays and who are experts on how the economy affects the housing market, please contact us at 800-900-8569, text us for a faster response, or email us at alex@gustancho.com.

Frequently Asked Questions About How the Economy Affects the Housing Market:

What is the Biggest Driver of How The Economy Affects The Housing Markets?

Mortgage rates. Payment changes instantly expand or shrink the buyer pool, illustrating how the economy impacts the housing market in real-time.

How Do I See How The Economy Affects The Housing Markets Locally?

Track months of supply, list-to-sale price ratios, and days on market. These indicators reveal how the economy affects the housing market on your street.

Does Falling Inflation Always Mean Lower Rates and Higher Prices?

Not always, but easing inflation often lowers real borrowing costs, which is a classic path for the economy to re-accelerate.

Why do Builders Offer Buydowns?

To restore affordability. It’s a practical lever for how the economy affects the housing markets when rates are elevated.

Can Tight Inventory Keep Prices Firm Even with High Rates?

Yes. Low supply is a shield. That tension is a prime example of how the economy affects the housing markets through multiple channels at once.

How Do Lender Overlays Fit Into How the Economy Affects the Housing Markets?

Overlays tighten or loosen access to credit. When access tightens, fewer buyers qualify, which is exactly how the economy affects the housing market, as seen beneath the headlines.

What’s the “Rate-Lock” Effect?

Owners with very low existing rates often resist selling, which limits listings. This is a significant way in which the economy affects the housing market, particularly by restricting supply.

How do Insurance and Taxes Change Outcomes?

Higher carrying costs reduce qualification and prompt price adjustments. Another clear link in the chain of how the economy affects the housing market.

Are DSCR Loans Helpful When Rates are High?

Yes. If the rent covers the payment, DSCR can keep deals alive, which is how the economy affects the housing market for investors.

What Should I do First if I’m Unsure I Qualify?

Get a no-pressure pre-approval and compare programs. Seeing options on paper shows how the economy affects the housing market for your numbers.

This article about “How The Economy Affects The Housing Markets: A Clear Guide” was updated on December 7th, 2025.

First-time buyer? Navigate shifting conditions

Plain-English guidance on programs, payments, and approvals right now