In this blog, we will cover and discuss the down payment guidelines on home purchase mortgage loans. The down payment guidelines and requirements depend on the particular loan program. Government loans have lower down payment requirements due to the lower level of risk lenders take due to the government guarantee.

Understand the difference of Non-QM and Conventional Loans down payment guidelines and how to meet them to get the house of your dreams.

Securing a mortgage Down Payment Guidelines is important to understand, especially if it concerns a Non-QM loan (Non-Qualified Mortgage) or a traditional loan. As a mortgage down payment can have serious implications on your financial planning, this article will discuss the down payment guidelines for both types of loans. In the following paragraphs, we will cover down payment guidelines on non-QM versus traditional loans.

Down Payment Guidelines on Home Purchase on Traditional Mortgages

The first payment a borrower makes when buying a house is the down payment, which is a certain percentage of the loan and cash, and the borrower has to pay it upfront. Every down payment made affects the mortgage terms, interest, and the monthly payments one has to pay.

Fannie Mae and Freddie Mac are the biggest buyers of mortgages in the nation. The role of Fannie Mae and Freddie Mac is to keep a stable housing market.

Lenders are able to sell conventional mortgages they fund on to the secondary market either directly to Fannie and/or Freddie or a mortgage banker who purchases loans from small mortgage bankers. The aggregator mortgage banker will bundle up all the mortgages they purchase and sell them to Fannie Mae and/or Freddie Mac.

Down Payment Guidelines on FHA Loans

For example, under HUD Down Payment Guidelines, the homebuyer needs to come up with 3.5% on FHA loans. Homebuyers need a minimum of a 580 credit score to qualify for a 3.5% down payment FHA loan. Mortgage borrowers can qualify for FHA loans with under 580 credit scores and down to 500 FICO.

Per HUD Down Payment Guidelines, borrowers with under 580 credit scores and down to a 500 FICO need to put a 10% versus a 3.5% down payment on a home purchase.

Many homebuyers can easily afford a new mortgage housing payment. However, coming up with a down payment is the issue most homebuyers face. In this article, we will discuss and cover the Down Payment Guidelines On Home Purchase Mortgage Loans. Every lender sets down payment procedures in place in order to determine if you can secure a mortgage and the muzzle on its value. In trying to gage whether you can afford a loan or a mortgage, the lender, or any other financial institution, anticipates potential risks associated with the bond. Spending shockingly high sums for unexpected new expenses can be avoided through the prudent and cautious use of such procedures.

See minimum down payments by program

Compare FHA/VA/Conventional vs. Non-QM LTVs for primary, second home, and investment.

What Are The Down Payment Guidelines Versus Closing Costs

With the exception of VA and USDA loans, all mortgage programs require a minimum down payment requirement. There are two types of costs involved when buying a home. The first cost is the down payment. The second is the closing costs. Among all other pedagogical mortgages, conventional ones are the most frequently sought. The general rate is 3-5%, whereas if the user opts for a bigger sum, the lower the payments, with enhanced interest rate.

The down payment is a fixed percentage. The amount required depends on the loan program. Closing costs vary on various factors including the area the property is located.

Most of our borrowers at Gustan Cho Associates Mortgage do not have to worry about covering closing costs. Our team of experienced loan originators will instruct the buyer’s realtors on how to get seller concessions so the buyer does not have to pay for closing costs out of their pocket. If the homebuyer is short of covering the closing costs with the sellers’ concessions, the lender can give a lender credit to cover the shortage.

How Much Home Can I Afford Versus Qualify

A home is most people’s largest investment in their lives. There are many thoughts homebuyers should consider prior to pulling the trigger on a home purchase. When homebuyers get a pre-approval by the loan officer, find out what the monthly payments PLUS other housing expenses are.

Mortgage underwriters do not take utilities, personal finances, education expenses, child care, elderly care, vacation, and other personal expenses when qualifying borrowers for a mortgage.

Seriously think about the maximum housing payments you will be able to afford. You do not want to be house rich and poor in keeping up with your lifestyle. In the following paragraphs, we will discuss and cover the frequently asked questions by first-time homebuyers when buying a home.

Down Payment Guidelines For First-Time Homebuyers

Federal Housing Administration loans, or FHA loans for short, are keen on aiding new home buyers, as well as buyers with lower credit scores. An FHA loan allows a potential home buyer to pay 3.5% of the purchase price. More flexibility in credit scores indeed translates into higher premiums.

VA loans are provided to the military, and veterans, along with their significant other. An undeniable positive of the VA loans is that the user will not have to pay a down payment. Saving them costs are of most value, given their low returns.

Many Americans are still under the impression they need a 20% down payment plus closing costs to purchase a home. This is not true. The down payment guidelines for homebuyers depend on the loan program. The down payment is the portion of the home price that buyers pay upfront. It is the buyer’s contribution toward the home purchase.

Down Payment Guidelines on Conventional Loans

In the past, the traditional down payment on a conventional loan was 20%. With a 20% down payment on conventional loans, there is no private mortgage insurance required. Now, first-time homebuyers can qualify for a home with a 3% down payment.

Most homebuyers do not have to worry about paying for closing costs out of pocket.

Closing costs can be covered with a seller’s concession and/or a lender’s credit. Most homebuyers do not have the 20% down payment for a home purchase.

Most homebuyers pay between 3% to 5% down payment. VA and USDA loans offer 100% financing with no down payment required.Down payment guidelines are more stringent when it comes to traditional loans as compared to Non-QM loans. In case borrowers have atypical financial scenarios, Non-QM loans are more preferable as they have much more lenient guidelines. Downside to Non-QM loans is that the loans will probably have higher interest rates and more fees.

Lowering PITI By Putting Larger Down Payment Than The Required Minimum Down Payment Guidelines

Homebuyers can put a larger down payment on a home purchase than the minimum required. Some buyers want a lower monthly housing payment so they put more money down on a home purchase.

Others want to put the bare minimum down. According to the National Association of Realtors, the average down payment for first-time homebuyers was 6%.

The down payment data skyrockets to a 12% down payment for all homebuyers. The average down payment for repeat home buyers is 16% according to NAR data. In the following paragraph, we will discuss and cover the down payment requirements on government and conventional loans.

Use Non-QM when guidelines don’t fit

Flexible down payments for bank-statement, DSCR, and recent credit events

Down Payment Guidelines on Government and Conventional Loans

Below is the minimum down payment mortgage guidelines on government and conventional loans:

- HUD requires a 3.5% down payment for homebuyers with at least a 580 credit score or higher and a 10% down payment for homebuyers with credit scores under 580 down to 500 FICO

- Veteran’s Affairs (VA) loans: 0% down, 100% financing on VA Mortgage

- U.S. Department of Agriculture (USDA) loans: 0% down, 100% financing on USDA Loans

- Conventional loan 97 (available from Fannie Mae and Freddie Mac): 3% down

- Conventional loans for repeat homebuyers require a 5% down payment

- The HomeReady Mortgage (backed by Fannie Mae): 3% down

- Second-home conventional loans require a 10% down payment

- Investment property conventional loans require a 15% to 30% down payment, depending on the type of properties

All conventional loans with greater than 80% loan to value require private mortgage insurance.

Non-QM Down Payment Guidelines Versus Traditional Government and Conventional Loans

In 2023 it was estimated that almost 70% of Americans have $1,000 in their savings account. This information was broken down further where 45% of respondents said they had ZERO dollars in their savings account. This is not a good trend for saving to buy a house. The down payment hurdle is often the hardest obstacle in the home buying journey.

Most homebuyers can easily afford the proposed new housing payment on a home purchase. However, coming up with the down payment is a big barrier for most Americans.

Non-QM loans have a relatively lenient policy on down payment. Though the criteria may differ from one lender to the next, many Non-QM loans will accept down payments of 10% to 20% of the purchase price. Depending on the borrower’s creditworthiness, certain lenders may have more down payment friendly options.

Non-QM Mortgage Guidelines on Down Payments vs Traditional Loans

What are the NON-QM vs traditional loan DOWN PAYMENT guidelines (FHA, Conventional, VA, USDA)? Minimum down payments, LTV, reserves, gift funds, bank-statement loans, DSCR loans, cash to close, jumbo loans, asset depletion loans, and more.

Deciding between the two loans requires you to assess your credit score and your financial health cre as well, along with what you are trying to achieve in the long term. If you have a stable income along with good credit, traditional loans are more preferable.

If you are a self employed borrower with non traditional income, Non-QM loans might suit your financial needs better. Non-QM loans are advantageous to self-employed persons, investors, and borrowers with other forms of income. Such borrowers are freed from the stringent requirements of income and credit history track record checks that conventional lenders mandate.

Why Down Payment Guidelines Are Important

Your down payment significantly impacts nearly every aspect of the mortgage, including the approval process, interest rate, mortgage insurance, closing flexibility, reserves, and more. Non-QM programs (bank-statement, DSCR, interest-only, asset depletion, ITIN, recent-credit-event loans) are customized programs that have traditionally set programs (FHA, Conventional, VA, or USDA), which have established DOWN PAYMENT GUIDELINES.

Non-QM vs Traditional Loans in a Nutshell

- Traditional Loans: Clear, nationwide DOWN PAYMENT GUIDELINES with AUS (Automated Underwriting System) findings.

- Consistent rules for gift funds, seller credits, and source of funds documentation.

- Non-QM Loans: Documentation and credit are generally more lenient, but down payment requirements, reserves, and terms are more expensive, varying by program, property type, and risk profile.

- Gifts: 100% of the 3.5% down payment can be a gift from an approved donor.

- Seller credits (interested-party contributions): Up to 6% of the price to cover closing costs, prepaid items, and upfront MI premium.

- Reserves:One-unit primary residences are usually not required to hold reserves (may be required for 2–4 units or weaker profiles).

- Occupancy: Primary residence only.

Conventional (Fannie Mae/Freddie Mac)

In most cases, the minimum down payment for a conventional loan is 3% to 5% of the price of the home. Homes where the down payment is larger are more likely to come with better interest rates along with a lower monthly payment.

- Minimum Down Payment: Qualifying first-time buyers can qualify for programs with a down payment as low as 3%. In comparison, the standard typically ranges from 5% to 10%.

- Mortgage Insurance: A LTV ratio ranging from 80% or above requires mortgage insurance.

- Mortgage insurance can be removed once the 80% LTV ratio is achieved.

- Gifts: Donors are permitted to allocate a portion of their funds to their members for use toward the mortgage. One unit of primary can be 100% donor, while 2-4 units or investments may require some borrower contribution.

- Seller credits: Usually 3% down if the payment is <10% the remaining mortgage.

- Usually, 6% if the down payment is 10–25%.

- 9% when more than 25% of the down payment is paid.

- 2% reserved cap for investment properties.

- Reserves: Strong profiles concerning 1-unit primary are often not required to hold reserves, but may be for multi-unit, investment, or risk-layered files.

- Occupancy: Primary, second home, or investment properties.

VA (Eligible Veterans/Service Members/Surviving Spouses)

Veteran’s Affairs loans that are accessible to servicemen and women, along with their spouses, often do not have a down payment. This allows veterans with not a lot of savings to have a chance at homeownership which gives them a lot of financial freedom.

- Minimum Down: 0% down for eligible borrowers with respect to entitlement and lender guidelines

- Funding Fee: A financed fee (some individuals with a disability rating do not pay).

- Seller Concessions: Usually capped at 4%, including reasonable discount points and standard closing costs.

- Reserves: Typically not required for a 1-unit primary, although they may be required with added risk.

- Occupancy: Only primary residence.

USDA (Rural Housing)

- Minimum Down: 0% (if you comply with income and property restrictions).

- Guarantee Fee: Typically financed, with upfront and annual fees.

- Seller Credits: Frequently reaches 6%.

- Reserves: Usually not required.

- Occupancy: Only for primary residence in designated rural areas.

- The bottom line for traditional DOWN PAYMENT GUIDELINES: The more complete and organized the documentation, the lower the cash required to close the deal, with faster approvals.

Non-QM Down Payment Guidelines (Bank-Statement, DSCR, Jumbo Non-QM, Asset-Depletion, ITIN, Interest-Only)

Non-QM lenders take on more risk with lower maximum bank-statement loans, enforcing larger required down payments, and stricter reserve limits.

Lower down payment, higher reserves?

Understand reserve requirements and how they change by product and occupancy

Bank-Statement Loans (Self-Employed Cashflow)

- Typical Minimum Down: 10–20% with overall credit considerations, and from 3 to more than 6 months of statement periods.

- Income Documentation: Qualifying income is derived from either business or personal bank statements (with no tax returns).

- Gifts: Borrowers may qualify to receive gifts after making their minimum contributions.

- Refer to the program-specific scales.

- Reserves: Usually 6-12 months.

- May need more for more complex profiles.

- Property/Occupancy: Eligible primary, secondary, and often investment.

DSCR Loans (Investor Cashflow)

- Typical Minimum Down: 20-25%+ minimum down payment; how much depends on DSCR ratio (rent ÷ PITIA), property type, and market.

- No personal income utilized—only qualifies on property cashflow.

- Gifts & Seller Credits: Typically, credits are structured within program constraints, with many limited to 2-6%.

- Reserves: Typically 6-12 months, or longer if properties are multi-unit/short-term rentals.

- Property/Occupancy: Investment properties only.

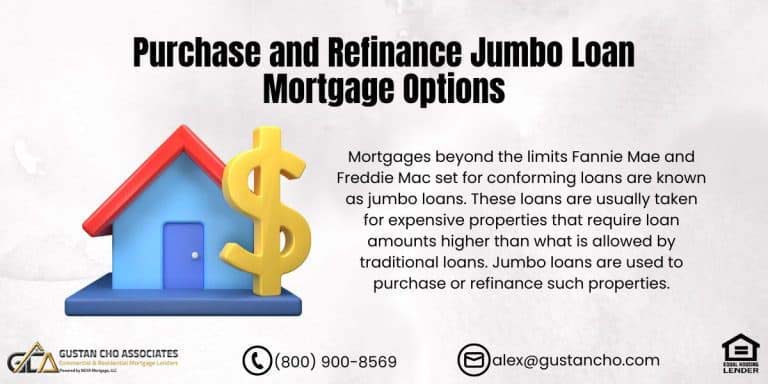

Non-QM Jumbo / Expanded-Prime

A larger down payment demonstrates a buyer’s fiscal prowess. Financially stable buyers will have low interest rates and little to no private mortgage insurance (PMI) and lower mortgage payments.

- Typical Minimum Down: 10-20%+ on loan size, score, and property type.

- Reserves: Usually 6-12 months and higher on larger loan amounts, for multi-units, or second homes.

- Gifts: Often accepted, but some need a portion of the down payment to come from the borrower’s own funds.

Non-QM loans are less stringent and offer greater concessions when it comes to down payments, and may accept 10 to 20 percent of the purchase’s price. Traditional loans have a much more stringent policy and may require between 3 and 20 percent.

Asset-Depletion / Asset-Qualifier

Because self-employed individuals have Non-QM loans, they usually benefit more because Non-QM lenders have easier income and down payment verification. Non-QM loans are other forms of mortgages self-employed individuals can use to qualify easier for a mortgage.

- Typical Minimum Down: 15-25%+

- Income Doc: Eligible liquid accounts are used to derive income.

- Reserves: Substantial-12 months+ of post-close assets.

- Gifts: Typically allowed, but many policies require their own assets to be utilized.

ITIN & Alternative-Credit Programs

Being able to understand the down payment Non-QM and traditional loans have is an important part of the home purchase process. While traditional loans have more stringent policies, they also provide greater stable financing and lower interest rates. Those with more unique financial situations will benefit from the flexible financing and more Non-QM loans. Shifting through the advantages and disadvantages of the loans will provide the person with the option that aligns with their financial goals.

- Typical Minimum Down: 15-25%+, with credit overlays common.

- Gifts: May be allowed, but must be documented.

- Reserves: 6–12 months typical.

Notes:

- Title/closing requirements, as well as sourcing and seasoning/, can be stricter.

Interest-Only Features (Across Non-QM Types)

- Impact on Down Payment: Interest-only can increase the minimum down or reduce the max LTV because of payment-shock risk in the amortization period.

- Reserves: Often higher than those of fully amortizing counterparts.

- Bottom line for Non-QM DOWN PAYMENT GUIDELINES: More flexibility on documentation and credit, but expect larger down payments and reserves—especially for investors, recent credit events, or interest-only structures.

Key Factors That Change Your Required Down Payment

Credit Score & Recent Credit Events

- Lower scores or recent bankruptcy/foreclosure/short sale usually reduce max LTV, increasing required down payment—especially in Non-QM.

Property Type & Occupancy

- Investment and 2–4 unit properties typically require larger down payments and more reserves than 1-unit primary homes.

Loan Size (Conforming vs. Jumbo)

- Jumbo and super-conforming tiers often require larger down payments and stronger liquid assets.

Loan Features (Interest-Only, ARM, Reduced Doc)

- Layered risk features (e.g., interest-only and investment) typically increase the down payment requirement.

Documentation Type

- Bank statements, DSCR, and asset-depletion loans often trade documentation flexibility for higher down payments and reserves.

Gifts and Contributions in Kind to Equity

- FHA: No more than 3.5% from gifts with source documentation.

- The borrower must pay 3.5%.

- Conventional: 1-unit owner-occupied primary with gifts and second homes may have more.

- VA/USDA: No down. Gifts are commonly used to reserve funds or cover closing costs if needed.

Non-QM Loans

- Many programs with “no doc” mortgages have borrower-side gifts.

- Gifts of equity from family members are often accepted with provision, although additional requirements may be necessary.

Lender-Paid Closing Credits and Seller Credits

- FHA: Limited to 6% of the total sale price.

- Conventional: 3% with less than 10% down, 6% with 10-25% down, 9% with 25% down, 2% for investment properties.

- VA: 4% in seller concessions, and in addition to standard closing costs with discount points.

- USDA: Generally, 6%.

- Non-QM: Varies widely, with many under 2-6% in total closing credits.

- Note: Credits used for down payments are very rare. They tend to cover closing costs.

Sourcing, Seasoning, and Large Deposits

Regardless of the program, underwriters must see that your down payment funds are sourced and seasoned:

- Seasoning windows: The past 60 days of statements (some Non-QM may ask more).

- Large deposits require documentation (e.g., pay stub, bill of sale, gift letter, etc.).

- Cash equivalents: Cryptocurrency, Zelle/Venmo, and cash that requires conversion—plus, request to avoid delays.

- Business funds: Acceptable on many loans if you document no adverse impact on the business (CPA letter and/or cash flow review).

- Reserves: The Silent Partner to Down Payment Guidelines.

- Traditional: Often none required on 1-unit primary; multi-unit/2nd/investment may require 2-6 months PITIA.

- Non-QM: Usually 6-12 months (or more), depending on risk layers and property type/loan size.

- Tip: 401(k) and IRA are more often than not counted as reserves—find out how your assets are treated.

First-time buyer vs. investor requirements

Different down payment and LTV caps for primary, second home, and rentals

How Rate, MI, and LTV Interact With The Down Payment

- Conventional: Bigger down payment → lower LTV → lower (or no) PMI → better payment.

- FHA: The program sets MI.

- However, leaving a larger down payment reduces the loan amount and payment.

- Non-QM: Pricing is risk-tiered.

- Larger down payments can improve rate, points, and approval odds.

- Strategy: Choose a path that most closely aligns with your profile.

If You Have Credit Problems or Need Lower Cash to Close.

FHA could offer the most accessible entry point with a 3.5% down and 6% seller credits, particularly advantageous when gift funds are available.

If You Wish to Avoid MI Payments, You Need to Do This Sooner

Consider Conventional with a 20% down payment, or if you are willing to wait, plan for MI removal when you reach an 80% LTV.

If You’re Self-Employed, Have Strong Deposits But Complex Taxes

Bank-Statement Non-QM solves the income documentation problem. Plan for a budget of 10–20% down and more reserves.

If You are an Investor More Interested in Cash Flow

DSCR is a loan that primarily focuses on the property’s income. Plan to spend 20–25% or more and hold strong reserves.

If You Have High-Value Assets But Reported Income is Low

Asset-Depletion or Asset-Qualifier Non-QM allows the holder to access the assets of the file. Expect to spend 15–25% or more down and maintain high reserves.

FAQs: Down Payment Guidelines: Straight Answers

What Are The Lowest Down Payment Guidelines Available Today?

- Traditional programs: 0% (if VA/USDA eligible) and 3–3.5% (Conventional/FHA).

- Non-QM typically starts around 10–20% or higher.

Can All of My Down Payment Be a Gift?

- Most of the time, the answer is yes for FHA loans (100% of the down payment can be a gift), as well as for Conventional 1-unit primary loans.

- Non-QM may require a minimum borrower contribution—please check the program details.

Do Non-QM Loans Always Have a Greater Down Payment?

- Not always, but mostly.

- This is because, for Non-QM, no doc loans, more documentation is exchanged for more equity and reserves in the transaction.

What Impact Do Seller Credits Have On DOWN PAYMENT RULES?

- Credits normally do not apply towards a down payment.

- They apply towards closing costs and prepaid items (subject to program limitations, for example, FHA 6%, Conventional 3-9%, VA 4% plus).

What If My Down Payment Includes a Part With a Large Recent Deposit?

- You will need to verify (such as a pay stub, gift letter, or asset sale documentation).

- Large unexplained deposits can cause approval to be delayed or diminished.

Can I Touch My Business Funds For The Down Payment?

- Almost always, yes, with proof that it won’t negatively impact the business (statements, letter from a CPA).

- Non-QM loans are typically more lenient, but they still require some level of verification.

Do I Carry Reserves Along With The Down Payment?

- Maybe.

- Strong files can have the reserves waived, but traditional loans, such as Non-QM, usually require 6-12 months or more.

Is it True That Interest-Only Mortgages Are More Scrutinized Than Others?

- Yes, they might be.

- Expect higher down payments and more reserves during Non-QM DOWN PAYMENT GUIDELINES.

Can Cash and Crypto Be Used as a Down Payment?

- Funds in crypto or cash must first be converted into a seasoned, well-documented fund before they can be utilized.

- This needs to be arranged properly, so reach out to your loan officer as soon as possible.

Is There a Way to Reduce the Cash I Need to Close?

-

Program choice (FHA/VA/USDA, if applicable), seller credits, lender credits, gifts, and documentable deposits all help.

Immutable Orders for Dominating the Down Payment Guidelines

- Pick your lateral hold.

- Apply a traditional model to minimize down payment and MI.

- If that’s not possible, Non-QM is still an option (bank statement, DSCR, asset depletion).

- Front-load the documentation.

- Two months of asset statements, the paper trail for gifts and transfers, and signed letters complete the outline for your gift documents.

- Use credits.

- Structure seller and lender credits to cover the closing costs so that your cash allocation is focused on the down payment.

- Keep reserves in sight.

- The reserve math needs to be confirmed, along with the assets (and their respective haircuts) that count.

- Test different scenarios.

- Check and equalize payment, MI, and break-even points for FHA (3.5%), Conventional (5%), and Non-QM (15–20%) loans.

Want to Plan Your Down Payment the Right Way

Gustan Cho Associates will provide you with **no-overlay approvals on standard loans and a complete menu of Non-QM self-employed and complex profile loans. We will outline the down payment guidelines that meet your objectives and market targets for a cash-to-close transaction—without any barriers.

Call us today at 800-900-8569 or start your pre-approval now.

Minimum Down Payment Guidelines Versus Private Mortgage Insurance

For more information about this article and/or other mortgage-related topics, please contact us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, on weekends, and holidays.

Build the right mix for your budget

Align down payment, reserves, and MI/points to hit your monthly target