This guide covers the frequently asked question do I have to pay collections for FHA loan approval. We will discuss the topic of do I have to pay collections for FHA loan approval. A large percentage of our borrowers are folks who were turned down by other mortgage companies because they had outstanding collection accounts or charge-off accounts. Most of our borrowers at Gustan Cho Associates are familiar with FHA guidelines on collection accounts.

Can I Get Approved For an FHA Loan With Collection Accounts

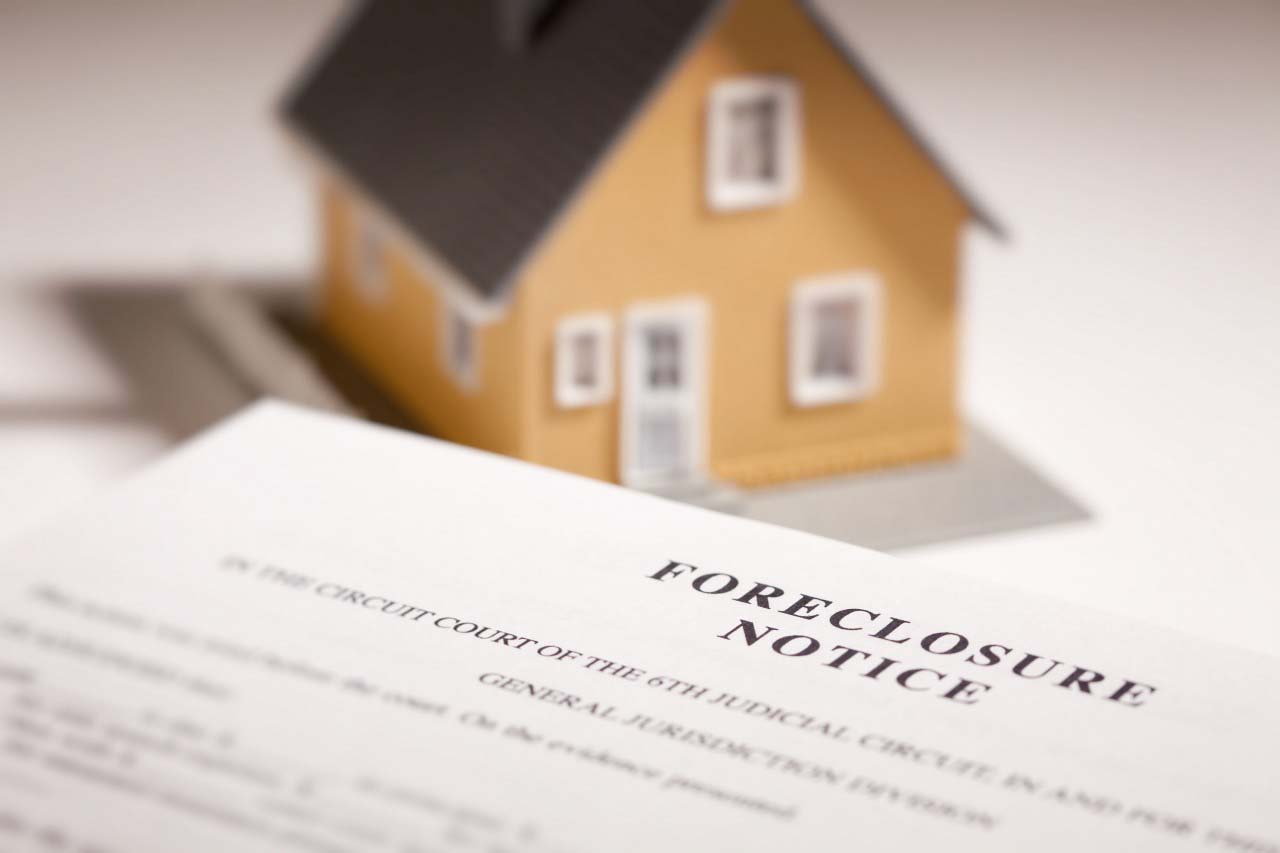

Many borrowers often wonder why they are told that they do not qualify with the lender they just visited to get pre-approved for an FHA loan. Borrowers are told that unless they pay the outstanding collection accounts or charge-off accounts, they are out of luck. Most often, these borrowers get turned down by other lenders due to outstanding collection accounts and charge-off accounts.

After multiple conflicting answers from lenders, borrowers realize HUD does not require borrowers to pay off outstanding collection accounts or charge off accounts to qualify for an FHA loan.

Borrowers are not told that they may not qualify with their particular lender but may qualify with another lender with no overlays on collection accounts. These borrowers often due to their own research online for lenders who have no overlays such as Gustan Cho Associates. They reach out to us about qualifying for an FHA loan with outstanding unpaid collection accounts and charge-off accounts.

Do I Have to Pay Collections for FHA Loan Approval?

Don’t guess—let an expert review your credit and FHA optionsDo I Have To Pay Collections For FHA Loan?

The answer is NO. You do not have to pay outstanding collection accounts or charge off accounts to qualify for FHA loans. In this article, we will cover and discuss do I have to pay collections for FHA loan approval. It is stated in black and white on HUD 4000.1 FHA Handbook that borrowers do not have to pay any outstanding collection accounts and charge-off accounts This holds true no matter what the unpaid outstanding balance is.

Do I Have To Pay Collections For FHA Loan Approval: How HUD Views Collections and Charge-Offs

HUD does not require borrowers to pay off outstanding collection accounts and charge off accounts. However, unpaid non-medical collection accounts with outstanding collection balances can affect a borrower when it comes to qualifying for debt-to-income ratios. HUD classifies collection accounts into three categories:

- Non-Medical Collection Accounts

- Medical Collection Accounts

- Charge-off accounts

HUD does not require non-medical collection accounts with outstanding balances to be paid off. However, if the total sum of the outstanding unpaid non-medical collection accounts is more than $2,000, then HUD requires the lender to take 5% of the outstanding non-medical collection account balance and use that figure as a monthly hypothetical debt. The borrower does not have to make any monthly payments on the 5% of the outstanding unpaid collection account balance. However, it will be used as a paper hypothetical debt and used for DTI calculations.

Solutions For Borrowers With High-Balance Collection Accounts

If the non-medical collection account balance is a substantial amount, then 5% of the outstanding balance can be a significantly large number: It may disqualify the borrower. This is because the DTI will exceed the maximum allowed per HUD Guidelines on debt-to-income ratios. If this is the case, the borrower can arranbe a written payment agreement with the creditor or collection agency. Whatever the monthly payment agreement is, that figure will be used in lieu of the 5% of the outstanding collection account balance.

Case Scenario Collection Accounts Affecting Debt-to-Income Ratios

Let’s take a case scenario where a borrower has $30,000 worth of non-medical collection accounts. A borrower can qualify for an FHA loan without having to pay the $30,000 outstanding collection account balance nor do they need to make any payment arrangements. However, 5% of the $30,000 outstanding collection account balance, or $1,500, will be used as a monthly debt payment by the mortgage underwriter. This holds true even though the borrower does not have to pay anything every month. $1,500 is a large monthly debt obligation payment.

HUD Guidelines on 5% of Outstanding Collections Used as Hypothetical Debt

Unless the borrower makes substantial income, this $1,500 monthly debt payment on paper may disqualify the borrower. This is because it may exceed the maximum debt to income ratio requirement of 56.9% DTI allowed for borrowers with credit scores of greater than 620 FICO credit scores. HUD maximum debt to income ratios is capped at 43% DTI for borrowers with credit scores under 620 FICO. However, if the borrower was to make a written payment agreement with the creditor or collection agency for $200 per month, then the $200 per month per the written payment agreement will be used in lieu of the $1,500 per month debt payment in the calculations of the debt to income ratios.

Do I Have to Pay Collections for FHA Loan Approval or Can I Leave Them?

We’ll show you which accounts matter and which don’tMedical Versus Non-Medical Collections

Medical collection accounts and charge-off accounts are exempt from debt to ratio calculations: This holds true no matter how large the outstanding unpaid medical collection account balance is. No matter how much the charge-off amount is, this guideline still applies. It does not matter whether or not the charge off account is a medical charge-off the account or a non-medical charge off account.

Do I Have To Pay Collection Accounts For FHA loan Approval: Why Lenders Require Collections Paid

Unfortunately, most lenders will require that collection accounts and charge-off accounts be paid off before you can qualify with them: This holds true even though HUD guidelines does not require that outstanding collection accounts be paid off.

Some lenders with lender overlays may have a cap on the collection account balance such as you cannot have any outstanding collection account balances or charge offs that is greater than $5,000.

It is not illegal for a lender to ask for borrowers to have satisfied collection accounts and charge off accounts. This holds true even though HUD guidelines on collection accounts do not require that borrowers pay off collection account balances and charge-off account balances. Lenders can have additional HUD requirements that exceeds the minimum HUD mortgage guidelines. This additional HUD requirement imposed by lenders is called lender overlays.

Lenders With No Overlays on FHA Loans

If you consult with a lender and are told that you do not qualify for an FHA loan because you have outstanding collection accounts and charge off accounts with outstanding unpaid balances, please contact us at Gustan Cho Associates at 800-900-8569. Or text us for a faster response. Or email us at gcho@gustancho.com.

Gustan Cho Associates does not require you to pay off any outstanding collection accounts or charge off accounts. We are lenders with no FHA Lender Overlays.

The Team at Gustan Cho Associates Mortgage Group is available 7 days a week, evenings, weekends, and holidays to take your calls and answer any questions. We can get you pre-approved on an FHA loan or any other mortgage loan program that we offer such as VA, USDA, Conventional, Non-QM, FHA 203k loans, reverse mortgages, non-conforming loans, Jumbo mortgages, and commercial loans.

FAQ: Do I Have To Pay Collections For FHA Loan Approval?

1. Do I have to pay outstanding collection accounts to qualify for an FHA loan? No, HUD does not require borrowers to pay off outstanding collection accounts or charge-off accounts to qualify for an FHA loan.

2. Why do some lenders insist on paying collections before approving an FHA loan? While HUD guidelines do not mandate paying off collections, some lenders may have overlays or additional requirements, including paying off collections.

3. What happens if I have non-medical collection accounts with outstanding balances? HUD classifies collection accounts into three categories: Non-Medical Collection, Medical Collection, and Charge-off accounts. For non-medical collection accounts over $2,000, HUD requires lenders to consider 5% of the outstanding balance as a hypothetical monthly debt for DTI calculations.

4. Can I qualify for an FHA loan even with high-balance collection accounts? Yes, borrowers can still qualify for an FHA loan even with high-balance collection accounts. If the 5% of the outstanding balance results in a high monthly debt payment, borrowers can arrange a written payment agreement with the creditor or collection agency, and that agreed-upon payment will be used for DTI calculations.

5. Are medical collection and charge-off accounts considered in DTI calculations for FHA loans? No, HUD exempts medical collection and charge-off accounts from debt-to-income ratio calculations, regardless of the outstanding balance.

6. What if a lender tells me I don’t qualify due to outstanding collections? Suppose a lender denies your FHA loan application due to outstanding collections. In that case, you can explore lenders with no overlays on FHA loans, like Gustan Cho Associates, who do not require paying off collections for FHA loan approval.