In this blog, we will cover why lenders need credit reports and credit scores to get borrowers a mortgage loan approval. We will also discuss how mortgage underwriters analyze borrowers’ credit reports during the mortgage process. A consumer’s credit score is probably the most important factor that comes into play when applying for credit. When a home buyer applies for a home loan they need to meet the minimum credit score requirement. Mike Gracz of Gustan Cho Associates said the following about why lenders pull credit reports during the mortgage process.

Lenders will pull borrowers’ credit reports and review the overall payment history and patterns. Late payments in the past 12 months are not normally allowed.

One or two late payments in the past 12 months are not a deal killer. However, multiple habitual late payments on credit reports will most likely disqualify a mortgage borrower. Just meeting the minimum credit score requirements is not everything when a mortgage borrower applies for a mortgage. Late Payments after bankruptcy and foreclosure are not normally allowed by most lenders.

When Are Credit Reports Required During Mortgage Process

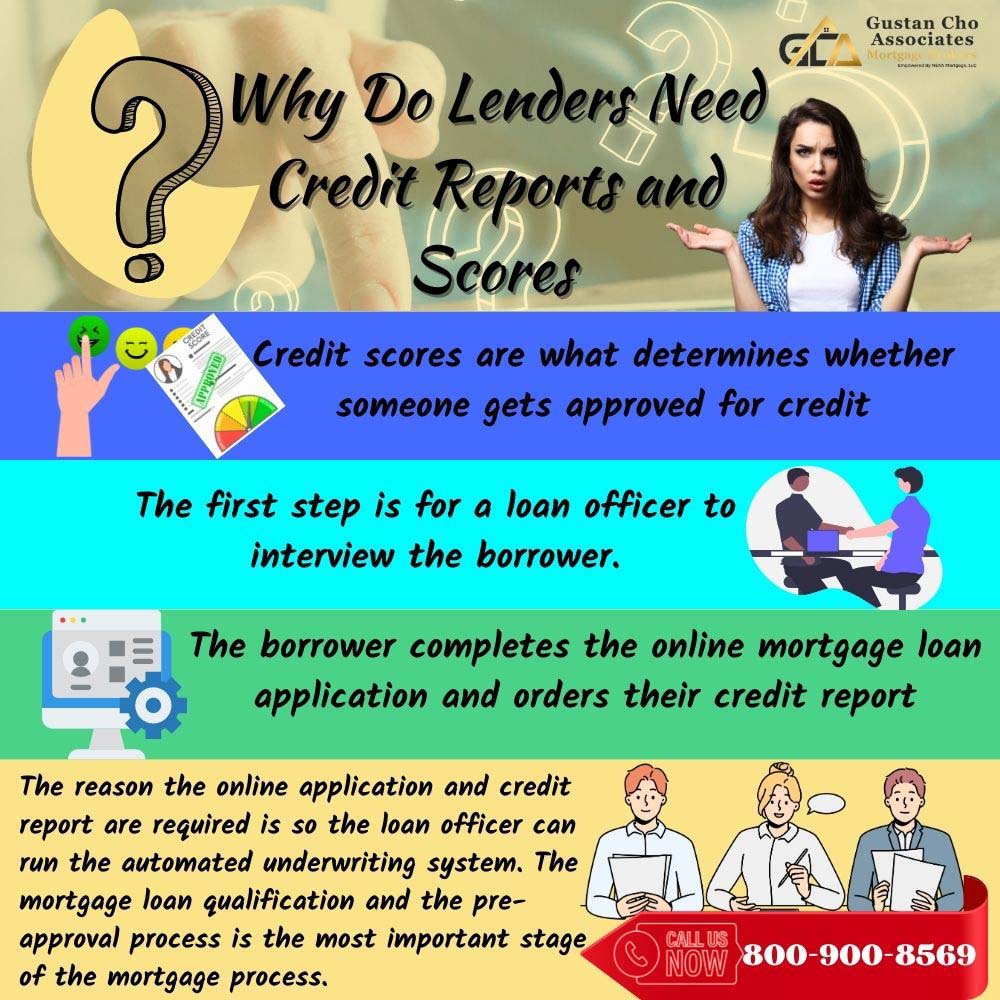

Every lender has their own system for qualifying and pre-approving borrowers. At Gustan Cho Associates, there are three steps in the mortgage qualification and pre-approval process before a pre-approval letter is issued. Before applying for a mortgage, the loan officer will talk with the mortgage loan applicant to see if they qualify.

Once you had a qualification interview with your loan officer, the loan officer feels you qualify, you will be directed to the mortgage loan application link and order your credit report link.

Again, one or two late payments after bankruptcy or housing event is not a deal killer at Gustan Cho Associates. However, multiple late payments may not render an approve/eligible per Automated Underwriting System Findings. In this article, we will discuss and cover How mortgage underwriters analyze borrowers’ credit reports. The first step is for a loan officer to interview the borrower. If the loan officer feels the borrower meets the minimum mortgage lending requirements, the borrower completes the online mortgage loan application and orders their credit report by clicking the Order Credit Report Page.

How Are Credit Reports Ordered

Credit reports can be pulled by loan officers or mortgage loan applicants. In most cases, the loan officer will have the borrower order the credit reports by sending them a link. There is a small fee borrower will pay on their end. Once the credit report is pulled, the loan officer will have dual access to the tri-merger credit report.

In order for the loan officer to be able to submit the mortgage loan application through the automated underwriting system, the tri-merger credit reports need to be pulled by the consumer with the link the borrower has provided.

You can order your tri-merger credit report by clicking the Order Credit Report link and following the steps for yourself and your co-borrower(s). Once you have completed the credit report questionnaire and paid the fees, you will have access to your tri-merger credit report. Your loan officer will have access as well.

Creditors, especially mortgage lenders, want to thoroughly review a borrower’s overall credit profile on their credit report. Although credit scores are very important, more importantly, is the borrower’s past payment patterns reflected on credit reports. Past payment patterns are reflective of the future payment forecast of borrowers. That is why it is so important for mortgage borrowers to make sure they review their credit reports and make sure there are no errors and to pay down maxed-out credit cards prior to applying for a mortgage.

The Importance of Credit Scores

The credit report vendor (Advantage Credit) has additional services such as the FICO simulator which gives you directions on how to maximize your credit scores. The credit report is required to be able to run the file through the automated underwriting system. Credit scores are what determines whether someone gets approved for credit:

- Mortgages

- Credit Cards

- Auto loans

- Any revolving credit accounts

- Or installment credit accounts

Credit scores also determine what a person’s insurance premium is. The lower the credit scores, the higher the insurance premium. Credit scores are derived from credit reports. The credit report is a history of a consumer’s credit and payment history, public records, and personal information.

Accuracy on Credit Reports

The reason the online application and credit report are required is so the loan officer can run the automated underwriting system. The mortgage loan qualification and the pre-approval process is the most important stage of the mortgage process. Credit reports do contain errors and it is up to consumers to dispute errors on the credit reports by notifying the three major credit bureaus:

- Transunion

- Experian

- Equifax

If a consumer is late on a monthly payment, it will be reflected on the credit report and will definitely drop credit scores. Everyone should check their credit reports periodically for errors and accuracy.

Most Common Errors on Credit Reports

Make sure your personal profiles and former addresses are correct. Many times the credit bureaus have incorrect information on the credit report. This is very common for those with common names like Jim Jones or John Smith. Zach Hoyer, a business development manager at Gustan Cho Associates is a credit expert and said the following about errors on credit reports.

There might even have erroneous employer information on the credit report that might raise a red flag when applying for a mortgage or other credit where the underwriting will deny the loan due to errors or inaccuracies.

At best, it will cause delays and the lender might ask to write a letter of explanation. Also, check to see if the name is spelled correctly or if the middle name is correct. If there are other names or variations of name posted on the credit report and have incorrect addresses, this could be a sign that someone other than yourself might have applied for credit.

Monitor Credit Reports For Errors

Also, monitor credit reports for errors. Check to see that all of the credit accounts on the credit report are correct. Review credit report line item per line item for accuracy. Dispute any inaccuracies or errors to the three credit reporting agencies.

Check for the correct spelling of the name and social security number with a different address. Identity theft is one of the fastest-growing crimes in America and anyone can be a victim of identity theft.

This could be a signal being a victim of Identity Theft and that someone has opened a credit account using your name and social security number but a different address. This is very common and many times the victim does not realize this is happening until a later date.

Check For Credit Limit Decrease on Credit Reports

Make sure that all credit card limits are what they are and that the creditor has not posted a lower credit limit than what you have. This is important because it is called the credit utilization ratio and consists of the credit balance divided by the credit limit. The lower the credit utilization ratio, the higher the credit scores. So if there is a credit balance but the credit limit is being reported lower than the actual credit limit, the credit utilization ratio will be higher, thus, hurting credit scores.

Monitor Derogatories Over 7 Years Old Are Removed From Credit Reports

Prior bad credit histories stay on consumer credit reports for a period of 7 years with the exception of bankruptcies which remain on the credit report for 10 years. Make sure that all of your bad credit items that are 7 years old or older have been deleted from your credit reports.

Credit Disputes on Credit Reports During Mortgage Process

I strongly recommend that everyone check credit reports often and dispute errors or items that are inaccurate. Many people go through a credit repair program in hopes of deleting derogatory credit tradelines. Dale Elenteny of Gustan Cho Associates said the following about credit disputes:

The most common method of trying to remove negative items is by credit disputes. Many of the disputed items are accurate but consumers try to get them removed with credit disputes.

Many consumers are hoping that the creditor does not report back to the credit bureaus, thus, having bad credit items deleted. Disputing accurate credit tradelines can often backfire when applying for a mortgage. Lenders prohibit credit disputes with a credit balance during the mortgage process. Borrowers need to retract all credit disputes during the mortgage approval process

How To Prepare To Qualify and Get Pre-Approved For a Mortgage

Homebuyers with bad credit can qualify for a mortgage. Home Buyers needing to qualify for a home loan with a lender with no lender overlays can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

The problem with retracting the dispute, it can plummet credit scores by 80 or more points. This has happened time and time again so please do not dispute derogatory items with credit balances.

Gustan Cho Associates has a national reputation of being able to do mortgage loans other lenders cannot do. Gustan Cho Associates is a national mortgage company with no lender overlays on government and conventional loans. Gustan Cho Associates are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands. We have lending relationships with 210 wholesale mortgage lenders.