In this article, we will cover and discuss California FHA high-balance loans in high-cost counties. It is no secret to residents of California that the cost of living is high. California FHA High-Balance Loans makes California home buyers purchase California homes. in all parts of the state with a 3.5% down payment.

Find out all you need to know about California FHA High-Balance Loans in High-Cost counties, the eligibility, the application procedure, and the various benefits that you will gain from these specialized mortgage loans.

In the California housing market, expensive counties can pose the greatest challenge. However, FHA High-Balance Loans can help to alleviate this challenge for many prospective homebuyers. FHA High-Balance Loans help buyers access homes in expensive area with more lenient terms and lower down payments. In this case, the aim is to assist you in understanding how high-balance loans work in terms of the benefits, eligibility, and how to California FHA High-Balance Loans application process.

California Housing Prices Surging Due To Buildable Land Shortage and Environmental Regulations

HUD, the parent of FHA, is more than well aware that a large percentage of the state has home values that are double the average home costs of most parts of the United States. Some ask why this is. Maybe it’s the weather, maybe it’s the ocean, maybe it’s the economy.

Whatever the cost may be, HUD realizes the prices of homes in a large portion of California are very high. This is why there are “high balance” counties throughout the state.

FHA High-Balance Loans are a novel addition to the Federal Housing Administration (FHA) loans that assist home purchasers in high-cost centers. These are specialized loans that permits the borrower to go beyond the set FHA loan limits, hence in high-cost real estate markets home buying and buying becomes very easier. In the case of California, where real estate markets is very expensive, these loans becomes even more useful.

Unlock higher FHA limits in CA high-cost counties

Finance more home with county-specific FHA high-balance caps

The Strong California Housing Market Forecasted To Continue

The average cost of a home in California in 2025 was $880,000. With an average listing of $925,000, as you can see statistics show many sellers are getting over the asking price. As a renter, the median rental cost was $3,450 a month.

Many parts of California such as San Francisco have some of the highest-priced rentals in the nation. This is common knowledge, and really drives the prices of homes through the roof.

California is one of the most diverse states in our great nation. Located throughout the state are some of the richest and poorest counties. In this article, we will discuss and cover California FHA High-Balance Loans For High-Cost Areas. Most lenders will want a credit score of no less than 580, though some lenders might allow lower scores for higher down payment borrowers.

HUD Increases 2025 FHA Loan Limits On California FHA High-Balance Loans

We will go over the list of the top ten biggest cities in California, the county they are located in, the FHA loan limit for a single-family home in that county:

- Los Angeles – Los Angeles County – $1,209,750

- San Diego – San Diego County – $1,077,550

- San Jose – Santa Clara County -$1,209,750

- San Francisco – San Francisco County – $1,209,750

- Fresno – Fresno County – $524,225

- Sacramento – Sacramento County – $763,600

- Long Beach – Los Angeles County – $1,209,750

- Oakland – Alameda County – $1,209,750

- Bakersfield – Kern County – $524,225

- Anaheim – Orange County – $1,209,750

Most buyers would prefer an FHA High-Balance Loan as they are most likely to satisfy the criteria because of the lower down payment requirement, as most applicants would be first time homebuyers.

To check your county if not listed above please see the HUD / FHA loan limits for 2025.

How To Qualify For FHA High-Balance Loans In California

California FHA High-Balance Loans are often referred to as FHA Jumbo Loans. This is because it is substantially higher than the standard national median home average FHA loan limits. Gustan Cho Associates is a mortgage broker licensed in 48 states with a heavy presence in California.

The team at Gustan Cho Associates has a national reputation for helping homebuyers with less than perfect credit qualify for FHA loans.

Gustan Cho Associates are also experts on California FHA High-Balance Loans. Homebuyers in California can qualify for California FHA high-balance loans with under 600 credit scores. With these loans, interest rates on these loans tends to be lower compared to other loans, which translates to lower monthly payments. This translates to lower monthly payments on a home, increasing affordability in the long-run.

Mortgage Rates On FHA High-Balance Loans With Under 600 FICO

It is essential to find a lender that provides FHA High-Balance Loans because not all lenders do. Focus your search on lenders with an established history in FHA loans and a solid standing in your region.

Depending on the lender, the application process may require an appraisal home and a title search while satisfying each property’s respective requirements of the FHA.

One thing high-end homebuyers need to realize is that with California FHA high-balance loans, there are substantial loan level pricing adjustments (LLPA). Loan level pricing adjustments are pricing hits for lower score borrowers on FHA jumbo mortgages. We will discuss more mortgage rates on California FHA high-balance loans in the following paragraphs.

FHA Lenders With Overlays on California FHA High-Balance Loans

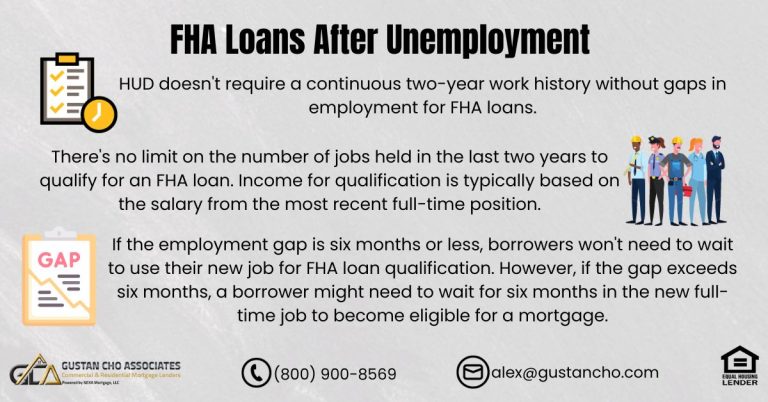

Most lenders have additional higher lending requirements that are above and beyond the minimum HUD guidelines when it comes to California FHA High-Balance Loans. The higher lending requirements are called mortgage overlays.

Gustan Cho Associates has always had a reputation for its no-lender overlays business model. We do not have any lender overlays on California FHA high-balance loans or VA high-balance loans.

We just go off HUD guidelines on California FHA high-balance loans with zero lender overlays. Once the application is signed and all of the requirements are confirmed, the last step is closing the deal, on which you will sign the the remaining documents, as well as clearing the closing costs. Once all is set, the keys will be on your hands and they will be of your new home.

Buy with just 3.5% down—even at higher prices

FHA high-balance can reduce cash to close while keeping payments manageable

HUD Guidelines On California FHA High-Balance Loans

Here are general agency HUD guidelines on California FHA high-balance loans

- Minimum credit scores of 500

- Maximum debt to income ratios of 46.9% front end and 56.9% back end

- Outstanding collections and charged-off accounts do not have to be paid off to qualify for California FHA High-Balance Loans

- Two year waiting period after Chapter 7 Bankruptcy

- Three year waiting period after housing event (foreclosure, deed in lieu of foreclosure, short sale) to qualify for High-Balance Loans

- Buyers can qualify for California High-Balance Loans one year into a Chapter 13 Bankruptcy repayment plan with Trustee Approval

There is no waiting period after the Chapter 13 Bankruptcy discharged date to qualify for High-Balance Loans.

Qualifying For California FHA High-Balance Loans With No Lender Overlays

FHA loans have great low-down payment qualifications and allow many Americans to complete their dream of homeownership. We are FHA mortgage Experts at Gustan Cho Associates and would love to help you get pre-qualified. Unlike other lenders, The team at Gustan Cho Associates specializes in government and conventional loans with zero overlays on California FHA high-balance loans.

Whatever the HUD Guidelines are, that is what we go by. No added requirements and/or mortgage lender overlays. The approve/eligible per automated underwriting system (AUS) is what we go by.

How do California FHA high-balance loans in high-cost counties work in 2025? Get upgraded FHA loan limits, which counties in California are high-cost, what are the high-cost counties, what are the credit score and DTI guidelines, and how do you qualify under flexible FHA loan requirements.

California FHA High-Balance Loans in High-Cost Counties

Home and real estate prices in California are high, particularly along the coast and in metropolitan areas. FHA ignored that reality and created high-balance loan limits for high-cost counties.

These high-balance loan limits enable you to purchase a larger home and avoid entering true jumbo financing. This guide is designed to explain how California FHA high-balance loans in high-cost counties will be in 2025, who the FHA loan borrowers are, how much you can borrow, and how to get approved for these loans if your credit history is less than perfect.

What Is A California FHA High-Balance Loan?

FHA high-balance loans are FHA loans that are insured and exceed the national FHA floor but are equal to or lower than the FHA ceiling allocated for high-cost areas. Any county with an FHA floor is considered a high-cost area, while the rest are not.

Like any other loans, FHA High-Balance Loans also allow refinancing, and you can use it to take cash out as well, which makes sense if you are looking to consolidate other loans with this mortgage, or if you want to refinance at a lower interest rate.

This amount changes by county and tends be modified each year. Even in the most expensive counties, the maximum is still higher than the payment for an FHA loan. For the most accurate figures, talk to your lender or the FHA.

FHA Defines For 2025:

- A nation floor (low cost areas) equal to $524,225 and allocated for one unit per property.

- A national ceiling (high-cost areas) allocated for 1 unit per property is equal to $1,209,750.

- In California, the floor and FHA loan limits for single-family homes reach $1,209,750 in the highest-priced counties.

- A California FHA high-balance loan is any FHA loan within a high-cost county that exceeds the floor and reaches the county’s FHA maximum balance.

2025 California High-Cost County FHA Loan Limits

The FHA has a limit for every county, which is calculated based on the home values in that county. FHA considers a large number of counties in California to be high-cost, which allows California FHA high-balance loans to exceed the national ceiling.

In the case of 2025 cash advances from the Federal Housing Administration,

- An individual unit under a primary residence mortgage in California has a limit in the range from $524,225 to $1,209,750.

- The $1,209,750 ceiling is typical of high-cost counties, such as Los Angeles, Orange, Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, and San Benito, among others.

- Some counties, such as Riverside, San Bernardino, Sacramento, Placer, El Dorado, San Diego, San Luis Obispo, Santa Barbara, Sonoma, and Solano, also have high FHA loan limits that exceed the floor.

- Bottom Line: There is a good chance that anyone purchasing a residence in the stated counties within California is eligible for an FHA high-balance loan, as opposed to a more complicated true jumbo mortgage.

Why Buyers Commend California FHA High Balance Loans In High-Cost Counties

FHA loans, by MIP, include MIP which is part of the loan cover for the life of the loan. And of course, there are standard closing costs to be calculated, which you also have to include in the estimate.

FHA High-Balance Loans can only be used to purchase primary residences. They do not apply for second homes or for rental properties.

Every application is different, but you can expect to take 30 to 45 days, maybe a little less, maybe a little more. Of course, this depends on how complex the loan is, how the agency handles it, and the period it takes to do the appraisal and title search.

Larger Loan Amounts With A Low Down Payment

One of the key features of California FHA High Balance Loans is the ability to combine:

- A down payment of as low as 3.5% (with a credit score of 580 or higher), and

- A loan amount that is commensurate with the hefty California real estate prices.

- This is a much better alternative to trying to save up for a huge down payment to reduce your loan amount to an innovative conventional high-balance or jumbo loan.

- You can use the FHA flexible guidelines and buy in a high-cost region without needing a large down payment.

More Arterial Credit Assessment Processes

FHA has a reputation for being credit-friendly:

- 580 minimum for 3.5% down payment.

- A down payment of 10% or less may be attainable for amounts of $ 500 and below, depending on the lender’s criteria.

- Most Jumbo high-balance and conventional high-balance lenders will not blink below the 700 credit score threshold. They will be on a continuous hunt for perfect credit, deep pockets, and pristine credit reports.

- California FHA high-balance loans in high-cost counties are specifically designed for counties in dire need of flexible high-balance loan options for borrowers.

Flexible Debt-To-Income Ratios

HUD guidelines permit higher debt-to-income ratios more frequently than other lenders, provided the loan is approved through automated underwriting. This is especially helpful in California, where:

- Housing costs are expensive.

- Taxes and insurance are additional hefty costs.

- Commuting and childcare costs are an additional strain on the budget.

- With strong compensating factors, such as a good payment history, reserves, and a stable income, FHA often approves borrowers that many high-balance lenders would decline.

Stretch buying power with lender credits or buydowns

Compare points vs. credits to fit your cash-to-close and monthly goals

Prioritized California FHA High-Balance Loan Rules

Owner-Occupied Primary Residence Requirement

- FHA high-balance loans in California’s more expensive counties can only be used for an owner-occupant primary residence.

This means you can:

- Purchase a single-family home and/or

- Buy a 2 – 4 unit property and reside in one unit with the other three available for rent (FHA has much higher limits for the income-generating multi-unit homes).

First-Time Home Buyers’ Minimum Credit Score and Down Payment

Most lenders follow these core FHA guidelines:

- FICO 580+ | minimum 3.5% down payment.

- FICO 500-579 | minimum 10% down, if these low-score options are accepted.

Some lenders impose stricter lending guidelines, or overlays (such as requiring a credit score of 620 or 640). However, FHA lenders without overlays focus solely on the guidelines the FHA has published, with no additional restrictions.

Debt-To-Income Ratios (DTI)

FHA DTI guidelines for high-balance loans are:

- Front-end DTI, which is the housing DTI ratio, is typically aimed for in the lower 40s.

- Back-end DTI can be in the mid-50s with strong automated approvals and compensating factors.

- In supporting documents, they will ask what the applicant plans to do to manage credit cards, shorter auto loans, lower personal loans, and other debts, as the borrower is in a high-cost area, especially in California, and can afford to pay properly.

FHA Mortgage Insurance

There is a requirement related to the above, which applies to all loans.

- All loans will come with an Upfront Mortgage Insurance Premium, typically included in the loan amount, which is then divided into portions paid over time.

- FHA loans, especially those in coastal counties in California, require mortgage insurance premiums

- MIP is paid through the Mortgage Insurance Premium on high-balance loans, which is typically the case for the duration of your loan.

- Suppose the borrower pays 10 percent or more of the loan. In that case, they will be eligible to refinance under other RHA loans, which are lower, allowing them to improve their equity and credit.

United States Military – Doing Business As – Mil Apartments And Room Rentals In The USA

- FHA is a loan type that enables first-time homebuyers and low- and middle-income households to sustain home loans and repay them easily over an extended period of 30 to 40 years with very affordable and reasonable interest rates.

- Are you booked for an FHA loan?

- The guidelines for FHA loans require borrowers to be middle- or low-income and first-time homeowners to be eligible for the loan.

Comparing FHA High-Balance Loans VS Conventional High-Balance & California Jumbo Loans

Convection High-Balance Loans And FHA High-Balance Loans

- FHA High-Balance Loans.

- A Conventional Down payment is required.

Convection High-Balance Loans

- $625 or more Convection High-Balance Loans.

- It is not required to pay for insurance.

- FHA High-Balance Loans. 40%-$620 for loans.

- Interest rates of $620 or more, based on the DOE rate, are more affordable for borrowers.

Convection High-Balance Loans

- Direct Purchase Guidelines for Second and Investment Properties.

FHA High-Balance Loans VS Jumbo Loans

- When Fannie Mae and Freddie Mack sell them to the secondary market, they sell Jumbo loans.

- Jumbo loans are not equivalent to Fannie and Freddie Mac loans, which they sell to other lenders.

FHA High-Balance Jumbo loans are a good starting point for borrowers, including first-time homebuyers and those paying high-interest loans in remote areas of California.

- You are a first-time buyer.

- You have moderate credit.

- You do not have a jumbo-sized down payment.

- You don’t have much time and still want to get your foot in the door in a competitive market.

Step-By-Step: How To Get A California FHA High Balance Loan

- Check The FHA Loan Limit For Each County.

- You must have a starting point.

- The county has its specific FHA limit and property type.

Make sure of the following:

- Each purchase is priced affordably, and a Mortgage Is taken out with the county loan limit.

- The UFMIP finance increases the ultimate FHA loan amount.

Get Pre-Approved With An FHA High Balance Expert

You should focus on lenders that do the following:

- Lends in California regularly.

- Knows FHA high balance loans.

- Overlays on the credit score/DTI/manual underwrite do not apply.

You will receive a pre-approval that considers the bottom-line California FHA County Limit. Also applies to income, assets, credit, and the DTI ratio.

Search For Properties Meeting Your Set Limits & Affordability

You can now shop with confidence within:

- The maximum high-balance FHA loan limit for your county.

- A reasonable monthly payment within your budget & pre-approval DTI.

This step is particularly vital in areas such as Los Angeles, Orange County, Silicon Valley, and many coastal regions, where listing prices often exceed the FHA limits.

Remove FHA MIP later with a refinance plan

Map a future move to Conventional once equity and scores improve

Full Underwriting & Conditions

Prepare to show the following while under your loan:

- Current bank statements and pay stubs.

- Credit issues explanation letters.

- Gift funds or large deposits: explanation documents.

FHA high-balance loans have stricter criteria on the stability of income, DTI, and funds in the reserves in relation to the total amount of the loan.

Final Approval With Closing And Appraisal

You loan for the California high-balance FHA loan and become the official owner of one of the high-cost counties.

In succession to that:

- Your lender clears the final conditions.

- You sign documents for closing the loan.

- Funds are allocated, and the loan is approved after the FHA appraisal.

Strategic Advice To Settle The Most Affordable High Balance FHA Loan In The State of California

- Improve your credit where possible: Even small improvements to your FICO score can affect pricing and increase approval chances.

- Reduce your outstanding revolving debt: Pay down credit cards to decrease utilization before applying.

- Do not take out any new loans before closing: New car loans, furniture financing, or personal loans can be detrimental to your DTI.

- Use gift funds appropriately: Family can assist an FHA borrower with a down payment, but specific documentation is required.

- Consider 2-4 unit properties: Multi-unit homes can maximize your purchasing power because they have higher FHA limits.

Work With a Lender Who Specializes in California FHA High Balance Loans

Not all lenders are comfortable with California FHA high-balance loans in high-cost counties. A considerable number still prefer the simpler, conventionally underwritten loans.

An Experienced FHA lender can:

- Work with complex county loan limits.

- Assist credit-challenged borrowers.

- Apply manual underwriting.

- Help structure debts to fit HUD guidelines.

- Suppose you were denied elsewhere because your loan amount was too large for an FHA loan or your credit was too thin for a jumbo loan. In that case, it is worth getting a second opinion from a lender who frequently closes California FHA high balance loans.

California FHA Loans With High Balances For High-Cost Counties: Frequently Asked Questions

What is an FHA High-Balance Loan in California?

- An FHA high-balance loan in California is a type of FHA loan for which an applicant is qualified when the national base loan index is exceeded.

- However, it is still less than the California maximum loan limits set forth by the FHA for that property type.

- These loans are only offered in California high-cost counties, where the FHA has increased loan limits due to the high cost of housing.

What Counties in California Have FHA High-Balance Limits?

- A good portion of the metro areas and coastal region counties in California are considered to be high cost, these include but are not limited to Los Angeles, Orange, Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, San Benito, San Diego, Santa Barbara, San Luis Obispo, Riverside, Sacramento, and Placer.

- Loan limits for the FHA vary by county, so it is advisable to check the official lookup tool for your specific county.

What Are The 2025 FHA Loan Limits in California High-Cost Counties?

- For 2025, the California FHA loan limits for a single-family home are estimated to be around $24,225 in lower-cost counties and approximately $1,209,750 in the highest-cost counties.

- The FHA limits are even greater for multi-unit properties (2-4), which have even greater FHA limits.

- The precise amount depends on your county and the number of units you have.

Can I Qualify For a California FHA High-Balance Loan With a Credit Score of 580 or Higher?

- Yes. Many borrowers qualify for California FHA high-balance loans in high-cost counties, provided they have a credit score of 580 or higher. However, they must use a 3.5% down payment and fulfill additional FHA criteria, as well as the county’s loan limits.

- Certain lenders may impose higher score overlays as a requirement.

- Therefore, it is best to work with an FHA-focused lender.

Do California FHA High-Balance Loans Come With Additional Reserve Requirements?

- HUD’s own guidelines do not always require large reserves.

- However, underwriters might require them for high-balance files due to the higher payment and greater risk associated with them.

- More than one unit and riskier configurations are more likely to need reserves.

Can I Use a California FHA High-Balance Loan to Buy an Investment Property?

- No.

- FHA high-balance loans are available only for owner-occupied primary residences.

- However, you can purchase a 2–4 4-unit property where you occupy one unit and rent out the others.

- You must use the property as your primary residence.

How Does Mortgage Insurance Work on California FHA High-Balance Loans?

You Will Pay:

- A one-time Upfront Mortgage Insurance Premium (UFMIP), which is normally rolled into the Mortgage.

- An annual Mortgage Insurance Premium (MIP), which is charged every month, for the duration of the Mortgage if your down payment is less than 10%.

- Due to the larger size of high-balance loans, MIP has a significant impact on the payment.

- That’s alright, MIP is often counterbalanced by the ease of qualification and the option to purchase in high-cost regions.

- It is not uncommon for borrowers to refinance into a conventional loan later, once they have improved their equity and credit score.

How Do I Determine Whether to Choose an FHA High-Balance Loan or a Conventional Loan With a High Balance?

You may lean toward California FHA high-balance loans if you:

- Have moderate or lower credit scores.

- I need financing in a high-cost county for a maximum amount.

- Want slacker standards when it comes to approval.

You may favor the conventional high-balance in case you:

- Possesses exceptional credit and has good earnings.

- Are in a position to pay a **10–20% down payment.

- Prefer not to pay a lifetime FHA mortgage insurance.

- A more comprehensive quote, side by side with an experienced lender in your California high-cost county, is the best way to assess the options.

- I can further assist you with adding inline calls-to-action, internal link recommendations, and tailored sections for California counties you target the most (Los Angeles, Orange County, Bay Area, San Diego, etc.).

For homebuyers in high-cost California counties, California FHA High-Balance Loans can open doors to affordable homeownership with relaxed qualifying criteria and simply structured loans. Knowing the criteria, the benefits, and the loan application process enables you to make the right choice. If you are planning on taking the next positive step, you may reach out to an FHA approved lender to review your possibilities and set out on the voyage to making your dream house in California your reality.

HUD Agency Guidelines on California FHA High-Balance Jumbo Loans Versus Standard FHA Loans

As long as our mortgage borrowers can meet all the conditions on the Automated Underwriting System Approval, they can rest assured that they will not just close their California FHA High-Balance Loans but will close their home loans on time.

All of our pre-approvals are fully underwritten and signed off by our mortgage underwriters. Our pre-approvals are not signed off by loan officers.

Loan Officers should not sign off on pre-approval letters. Mortgage underwriters sign off on pre-approval letters after they fully underwrite a file. Please contact us at Gustan Cho Associates at 800-900-8569 or text for a faster response and for more information on getting approved for California FHA High-Balance Loans.

Talk to a California FHA high-balance specialist

Local expertise, no overlays, and on-time closings statewide

First time home buyer help. I am currently in a chapter 13 bankruptcy for about 2 to 3 years making all payments on time