Hard Money Lending in Chicago For Commercial Real Estate

Hard Money Lending Chicago: Fast Financing for Real Estate Investors If you’re an investor looking to close quickly on a…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Hard Money Lending Chicago: Fast Financing for Real Estate Investors If you’re an investor looking to close quickly on a…

There is no sign of any housing market crash, especially in Florida. Home prices are booming with no signs of any correction.

In this article, we will cover and discuss using future rental income to qualify for a mortgage. Some first-time home…

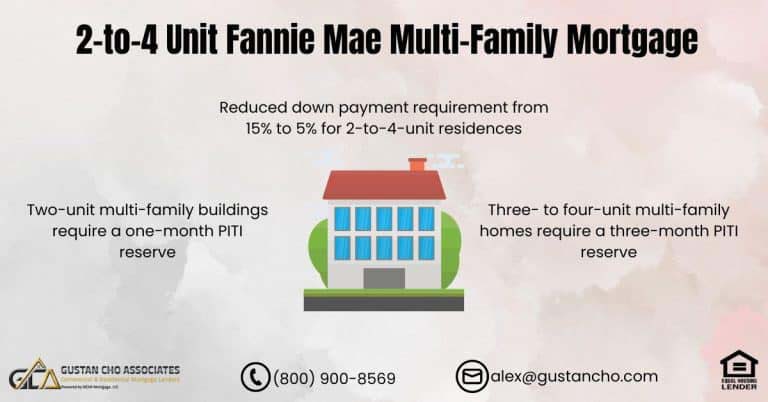

This manual addresses the modifications in down payment and self-sufficiency for multi-family properties designated as owner-occupant primary residences by the…