This ARTICLE On New York Mansion Tax Plummeting Real Estate Sales Was PUBLISHED On October 12th, 2019

BREAKING NEWS: New York Mansion Tax Plummeting Real Estate Sales after it has been implemented.

- Politicians disagreed with real estate experts about New York Mansion Tax Plummeting Real Estate Sales

- Politicians and lawmakers were wrong: The market was correct

- New York’s newly increased mansion tax has had an impact in the sudden price drop in real estate parcels

- Polls taken by major New York realtor brokerage firms suggest Manhattan real estate prices have plummeted since the New York Mansion Tax went into effect on July 1st, 2019

In this article, we will cover and discuss how New York Mansion Tax Plummeting Real Estate Sales.

First Release Of Data After The Implementation Of Mansion Tax

After the implementation of the New York Mansion Tax, 3rd Quarter data shows that the Manhattan Property Sales number was down the prior quarter.

- It was down 6% to 16% over the prior year

- The largest hit was on higher-end real estate listings

- Real estate sales higher than $3 million dollars were down over 15% since third-quarter 2018

- Real estate sales of $5 million and higher dropped a whopping 49%

Due to the New York Mansion Tax, this third-quarter sales marked the fewest housing units sold that are priced at $3 million and higher in the past four years.

Implementation Of Mansion Tax And How It Works

The lagging housing sales we attributed to the increased New York Mansion Tax.

- The New York Mansion Tax is a progressive real estate tax that charges between 1% to 4.15% on homes that are priced over $1 million

- New York Mansion Tax also includes an additional tax on homes priced $3 million and higher

Per the Business Section of Forbes, the new taxes caused a rush and spike in home sales at the end of the second quarter.

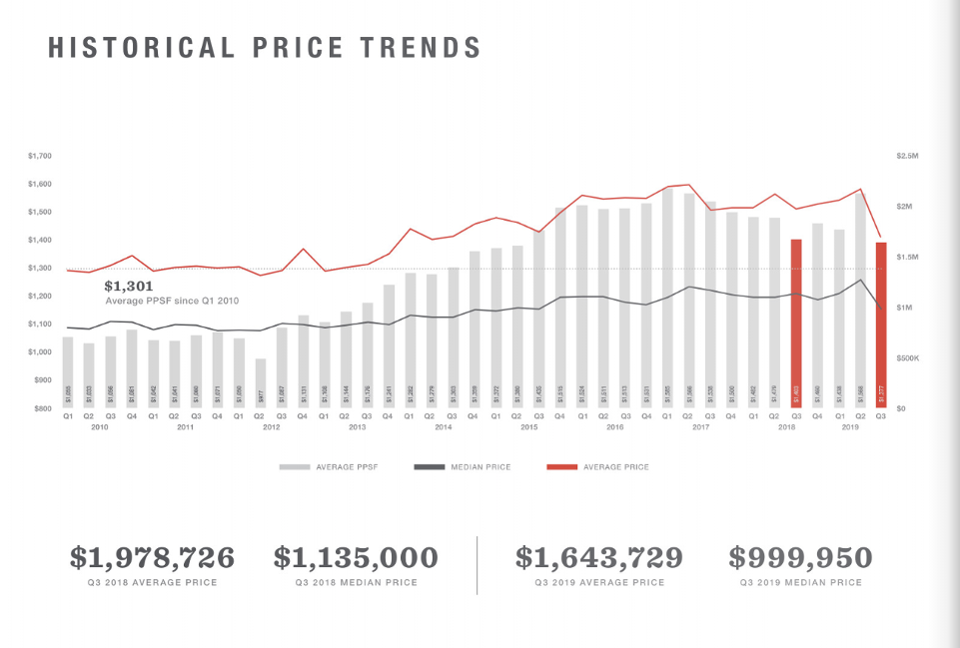

Look at the chart and graph:

Mansion Tax Creates Longer List Times

The new mansion tax will definitely prolong property list times. Most properties spent much longer time on the market than last quarter. The average unit sold in Manhattan spent an average of 152 days in the market. This is the longest average sitting in the market since 2012. Over 33% of the sales took over 180 days to sell.

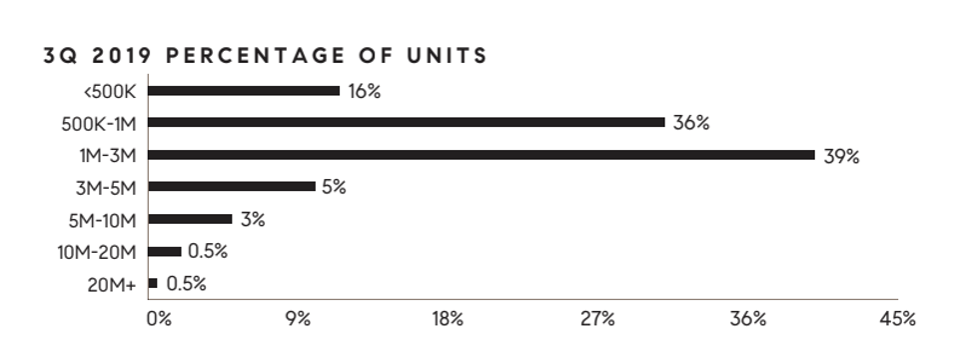

Review the graph and images below:

Other Factors Affecting Lagging New York Real Estate Prices

The New York Mansion Tax is not the only issue that is driving real estate prices lower in the state.

- Both NYC and the state has its share of financial issues

- New Yorkers are fleeing the state in droves to other lower-taxed states

- The state has one of the highest tax rates in the nation

- Home values are skyrocketing throughout the U.S. due to low mortgage rates

However, due to high New York taxes and cost of living, New York property values are stagnant.

Cost Of Doing Business In New York

Many lenders steer away from getting licensed in New York due to massive mortgage regulations and the costs of getting licensed. High property taxes throughout the state is lowering home values. New York is experiencing more businesses and taxpayers leaving the state than any other state except Illinois. Illinois has the most amount of businesses and taxpayers leaving the state due to high taxes. This is a developing story. Gustan Cho Associates Mortgage News will keep our viewers updated on this developing story.