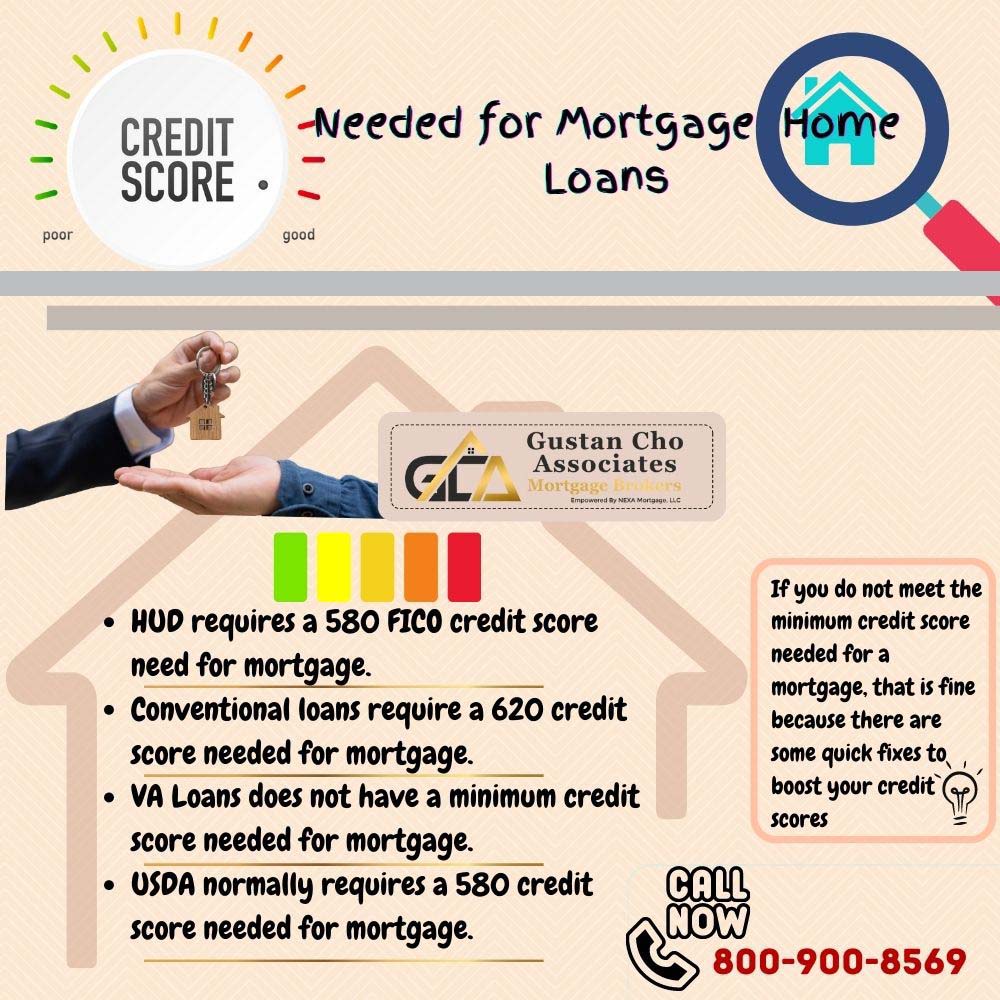

This blog will cover the credit score needed for mortgage on home loans. We will cover the frequently asked question what is the minimum credit score needed for mortgage? Many home buyers, especially first-time home buyers, often question the minimum credit score needed for a mortgage. Credit Scores and Income are the two most important criteria when a mortgage loan originator qualifies as a borrower.

Credit scores and Income determines whether or not borrowers qualify for a home loan.

All mortgage loan programs have minimum credit score requirements. The minimum credit score required for a 3.5% down payment home purchase FHA loan is 580. Home Buyers with under 580 FICO credit scores can qualify for FHA loans. However, a 10% down payment is required for borrowers under 580 credit scores. This article will cover the credit score needed for mortgage on home loans.

Importance of Rental Verification

Homebuyers with credit scores of under 620 FICO may need verification of rent. Rent can only be verified if the renter can provide 12 months of canceled checks. Or if the renter can provide 12 months’ bank statements. It needs to be proven that the monthly rental payments are transferred from the borrower’s bank account to the landlord’s bank account. There cannot be any late rental payments in the past 12 months.

If a renter is renting from a registered, licensed property management company, then the property management company property manager signs a verification of rent form, or VOR, which can be used in lieu of canceled checks and 12 months’ bank statements.

Renters paying their rental payments with cash and getting a cash-paid receipt cannot be a valid verification of rent proof. Cash in the mortgage industry is considered non-existent and does not count. Any cash deposits to a borrower’s bank account cannot be used as sourced assets.

Credit Score Needed For Mortgage on Conventional Loans

The minimum credit score needed for mortgage for borrowers needing to qualify for a Conventional Loan is 620 FICO. For various reasons, a home buyer may need a Conventional instead of an FHA loan.

A home buyer needs a Conventional versus FHA loan because they are buying a Condominium, and the Condo is not FHA Approved.

Conventional loans accept Income-Based Repayment Plans (IBR). FHA loans now offer income-based repayment. You cannot purchase a condominium with an FHA loan if the condominium complex is not FHA Approved. You can only purchase non-FHA Approved Condominiums with Conventional loans. Another reason borrowers can only go with Conventional versus FHA loans is if they need the maximum Conventional loan limit of $726.200. Maximum FHA loan limits in most areas are capped at $472,030 unless the property is located in a high-cost area.

Borrowers Who Cannot Meet Credit Score Needed For Mortgage

As mentioned earlier, all home loan programs have a minimum credit score needed for mortgage.

- HUD requires a 580 FICO credit score need for mortgage.

- Conventional loans require a 620 credit score needed for mortgage.

- VA Loans does not have a minimum credit score needed for mortgage.

- USDA normally requires a 580 credit score needed for mortgage.

If you do not meet the minimum credit score needed for a mortgage, that is fine because there are some quick fixes to boost your credit scores. One great thing about your credit scores is that they can easily be manipulated, and your credit scores fluctuate from month to month.

Improving Credit Score Needed For Mortgage On Home Loans

One of the best ways to maximize credit scores is by paying down all of your credit card balances where the credit card balance is 10% or lower than your credit card limit.

Maxed-out credit cards are one of the biggest reasons consumers have low credit scores.

Consumers should have three to five secured credit cards with less than a 10% balance of their limit. Consumers maxed out can increase their credit scores by more than 100 FICO points by paying down all their credit card balances to 10% of the credit limit.

Tips and Advice In Increasing Credit Score Needed For Mortgage

Consumers with old outstanding collection accounts and charge-off accounts think that paying off their outstanding collection accounts and charge-off accounts will boost their credit scores. This is not the case unless it is a recent collection or charged-off account. Consumers do not have to pay off outstanding unpaid collection accounts or outstanding charge-off accounts to qualify for FHA loans.

Never pay off an outstanding unpaid collection account or charge-off account. By paying off the prior bad debt, will re-activate the aged bad debt. Credit scores will often drop. This is because the credit bureaus will treat it like a new debt. Plus, the statute of limitations on your old date will re-activate and restart.

If you need to pay off your bad debts, then negotiate with the collection agency that you will make a pay-for-delete payment. Pay for delete is when collection agencies agree to delete the derogatory credit items off the credit report in place of the debt payment. Otherwise, do not pay off your old collection accounts or charge off accounts. This is because you do not have to pay off outstanding unpaid collection accounts or charge-offs to qualify for an FHA loan.

What If Lender Requires You To Pay Outstanding Collection Accounts?

There are so many instances where borrowers are told by the lender they go to and are told that they need to pay off their outstanding unpaid collection accounts and charge-off accounts. This is not sound advice, and you should not listen to them. Most bankers are not licensed. They do not know the FHA Guidelines fully.

Paying off outstanding bad debts will often devastate credit scores

Charge-offs and collection accounts do not have to be paid off to qualify for home loans. I had a borrower who recently closed on her home purchase.

Shopping at Different Lenders After Mortgage Denial

She went to different lenders and was told by every single bank and lender she visited that she needed to pay off her second mortgage charge off. My borrower was told that since the second mortgage charge-off had a balance on it, she needed to pay it off. The loan officer that told her was incompetent. This is because most charged-off accounts report a balance on the credit report. You will hardly ever see a charge off accounts with a zero balance. For this borrower, she got lucky because she read one of my blogs about getting a home loan with a mortgage charge off.

The second mortgage charge-off was at least three years old. Borrowers can qualify for an FHA loan after a second mortgage charge-off with an outstanding charge-off balance. This holds as long as the second mortgage charge-off account does not have a lien placed on the property. There is no waiting period after the second mortgage charge-off settlement date. Luckily, she called me, and we were able to approve her FHA loan and close her home on time.

Borrowers with low credit scores or issues with their credit needing a direct mortgage lender with no lender overlays, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team of loan officers at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays to take your phone calls and answer any questions you may have.