The team at Gustan Cho Associates is constantly innovating. We have recently developed a mortgage calculator to help educate our clients when budgeting for a home. The residents of Wisconsin must compute their total mortgage payment when qualifying for a home loan. In this article, we will teach you how to use our state-of-the-art mortgage calculator and our added debt-to-income feature. Staying within a comfortable monthly budget and debt-to-income threshold is incredibly important when qualifying for a mortgage loan.

- Conv

- FHA

- VA

- Jum/Non

- USDA

Wisconsin Mortgage Calculator with PITI, PMI, MIP, HOA, and DTI

The residents of Wisconsin know the cost of a house has increased significantly in the past few years. This can make budgeting for a home harder than ever. When you are in the market for a home loan, you must factor in principal and interest, property taxes, homeowners insurance, and homeowner association dues. This is referred to as PITIA in the mortgage industry.

Start Your Homeownership Journey in Wisconsin

Apply Online And Get recommendations From Loan Experts

A Beginner’s Guide to Securing a Mortgage in Wisconsin

With the evolving prices of homes and changing financial standards, getting approved for a mortgage loan may be more daunting now than ever. As experienced professionals at Gustan Cho Associates, we specialize in simplifying this process for our clients. In the following sections, we provide details on securing a mortgage loan in Wisconsin and introduce some of our unique features that assist with budgeting and planning post-approval and pre-approval of loans.

Mortgage Approval Process

Step 1:

- Getting Pre-Qualified/Pre-Approved

- Setting your financial parameters is mandatory before you search for your new home.

- To determine these parameters, it is ideal first to receive a pre-qualification, which estimates your borrowing power based on your income, debts, credit score, and current financial situation.

- Following this step is a more detailed pre-approval step, which consists of a lender reviewing your finances and providing you with a rough estimate.

Step 2:

- Checking Your Financial Limitations

- While applying for a loan, citizens of Wisconsin should pay attention to the total mortgage payments that determine the qualifying criteria for home loans.

- This payment includes:

Homeowners Association (HOA) Dues:

- This is only applicable in case you belong to a property with common amenities usage.

- This combination forms what is known as PITIA.

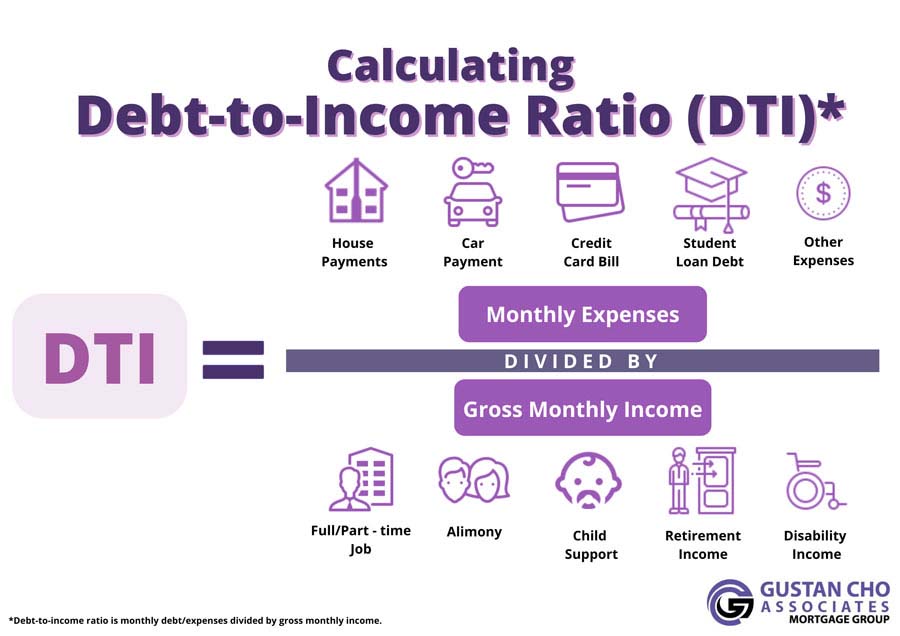

Debt-to-Income (DTI) Ratio:

- The DTI Ratio is one of the critical factors, along with mortgage payment, that needs to be approved.

- It is the sum of your debts compared to your total income and expenses; this ratio considers everything from rent payments to groceries.

- Obtaining a mortgage will be more difficult if you have too much debt relative to your income.

- Generally speaking, lenders like lower DTIs because they show that monthly obligations, including new mortgage payments, will be easy to manage.

What We Do At Gustan Cho Associates

Here at Gustan Cho Associates, we strive for continous growth and improvement for our clients. This is done through the novel technologies every mortgage journey entails. Here are some of our latest developments:

Modern Wisconsin Mortgage Calculator

Feature:

When budgeting for a purchase, this software will allow you to compute your estimated total mortgage payment, including principal, interest, taxes, and insurance.

How to Use the Wisconsin Mortgage Calculator

Add Your Mortgage Loan Details:

- Include your loan amount, applicable interest, and estimated loan period.

Add Other Charges:

- Include expected costs such as property tax, home insurance, and the sum of HOA fees.

Know Your PITIA:

- Using the PITIA calculator, you can break down the payment details and see what is expected monthly, facilitating financial planning.

Other Enhanced Features:

Purpose of the Wisconsin Mortgage Calculator:

- Confirming the DTI ratio is crucial to understanding because it will determine how tight your monthly budget can become.

HOW-TO-USE The Wisconsin Mortgage Calculator:

Provide Your Income and Debt Details – Types:

- Enter all your reliable monthly income sources and each debt obligation separately.

Understand Your DTI:

- Our system calculates the ratio, giving an overview of how much more debt one can accumulate before reaching alarming limits.

Make Decisions:

- You can now plan your house purchase based on the financial balance you intend to achieve.

Why This Matters in Today’s Market

There has been a phenomenal rise in the average costs of houses across Wisconsin over the last few years, which makes it very difficult to plan for a new home. For these particular cases, our tools have been designed to ensure that you:

Stick To Your Budget:

- Knowing all your monthly mortgage payment factors.

Prevent DTI Overextension:

- Maintaining your DTI within the recommended limits is essential for long-term financial health.

Make Smart Choices:

Guiding you through the complicated steps of home financing with expertly designed knowledge lessons. Knowing your mortgage responsibilities is essential if you are a first-time homebuyer or considering refinancing. Gustan Cho Associates has developed a new mortgage calculator with an excellent debt-to-income feature to assist you in every step of the process. Suppose you budget correctly for PITIA and maintain proper DTI levels. In that case, mortgage approval becomes a reality, allowing you to embrace the joy of home ownership in Wisconsin. If you have questions or want to use our services, use the contact link or our web pages. We aim to ensure your home financing experience is as supportive and seamless as possible.

Wisconsin Mortgage Calculator

Home buyers looking for the best house payment calculator Wisconsin are in luck with a newly developed online mortgage calculator with all the components required for a truly accurate monthly payment. The Wisconsin Mortgage Calculator is a state-of-the-art online mortgage calculator with five different types of loan programs for the best accuracy. The housing market in Wisconsin is booming despite historic high inflation numbers and skyrocketing mortgage interest rates. Most online mortgage calculators only give you the principal and interest portions of the total housing payment.

Pre-Qualify For a Home Loan

The Wisconsin Mortgage Calculator is the best pre-qualify for a home loan calculator in the nation. No other pre-qualifying for a home loan calculator is as accurate as the Wisconsin Mortgage Calculator powered by Gustan Cho Associates. Other online mortgage calculators only give the user the principal and interest payments and not the overall mortgage payment like the Wisconsin Mortgage Calculator. Whether you are buying a home or need to estimate a refinance payment, the Wisconsin mortgage calculator is the best mortgage calculator. Homeowners looking to get rid of the hefty FHA mortgage insurance premium by finding the best refinance calculator for FHA to conventional refinance calculator, you are in luck. The Wisconsin mortgage calculator is the best VA home loan mortgage refinance calculator because the VA funding fee is already populated in the VA funding fee section.

Purpose For Wisconsin Mortgage Calculator

The Wisconsin Mortgage Calculator will give you the most accurate data on your monthly mortgage payment. This calculator can be used as a home purchase calculator, cash-out refinance calculator, home refinance calculator, or to find out if you meet the DTI guidelines of certain mortgage loan programs. You will be surprised at how accurate the Wisconsin Mortgage Calculator is.

The Booming Housing Market in Wisconsin

A few facts about the Wisconsin housing market. The housing market in Wisconsin is still on fire. Even though there have been slowdowns based on the economy, annual sales prices have increased by over 16%. The median sales price for a home in the Kenosha area is now over $500,000. According to recent information, houses are selling in approximately 25 days! While the days of multiple offers and bidding wars may soon come to an end, the housing market is incredibly strong throughout the state.

How Do Mortgage Underwriters Qualify Borrowers in Wisconsin?

An underwriter must qualify you based on the total housing payment in qualifying for a mortgage loan. This is why our team created an easy-to-use mortgage calculator where you simply type in the purchase price of your home, down payment, annual property taxes, and annual property insurance. If your neighborhood has homeowners association dues, there is also a field to enter those dues. This will easily calculate your total mortgage payment. And more importantly, help you stay within your comfortable monthly budget.

How Mortgage Underwriters Compute Debt-To-Income Ratios

Besides a comfortable housing budget, you must also think about your other monthly liabilities. An underwriter must qualify you based on agency debt to income guidelines. Depending on the program you select, an underwriter has very specific thresholds based on your income. An underwriter must consider all monthly liabilities when calculating your debt to income ratio. These liabilities will include everything from your car payment, student loans, personal credit cards, and other recurring monthly liabilities. When utilizing the Wisconsin mortgage calculator, there is also a tool to help you quickly calculate your debt to income ratio. This will help you stay within your qualifications when shopping for a house.

The Best Wisconsin Mortgage Calculator

We searched the internet for an easy-to-use mortgage calculator, but we were unable to find one, so we created our own. Many of our clients and many real estate professionals rely on our mortgage calculator. When out shopping for homes or doing online research, this tool will allow you to quickly know if a home is in your budget or not. Our team is happy to roll this out for the residents of Wisconsin. If you or anyone you know needs assistance qualifying for a mortgage in the state of Wisconsin, please reach out to Gustan Cho Associates today. We offer no overlay options on all conventional, VA, FHA, USDA, and manual underwriting mortgage loans.

Your Dream Home in Wisconsin Is Within Reach

Apply Online And Get recommendations From Loan Experts