You can calculate how much your monthly mortgage payment is with PMI, property tax, insurance, and HOA if applicable using the South Dakota Mortgage Calculator. Launched and Powered by Gustan Cho Associates, the South Dakota Mortgage Calculator is the best user-friendly mortgage calculator. There is no other mortgage calculator that is as accurate as the South Dakota Mortgage Calculator.

- Conv

- FHA

- VA

- Jum/Non

- USDA

South Dakota Home Buyers Frequently Asked Questions

Walking You Through Home Buying in South Dakota

How does one go about purchasing a home in South Dakota?

In South Dakota, a typical home-buying process looks like this:

- Check your credit and finances.

- Check whether your score is good enough and save up for a downpayment.

- Obtain a preapproved mortgage.

- Talk to a lender to check how much you can borrow.

Get a Real estate agent.

- A local agent will assist you in identifying the ideal home.

- Look for homes.

- Tour the homes on your list and decide which properties to retain.

Make an Offer.

- Settle the price and terms with the seller of the house.

Get a home inspection.

- Check whether the house is in a good state.

Finalize your mortgage loan and secure your financing.

- Sign the paperwork, obtain the keys, and close the deal.

Congratulations on your home!

First-Time Homebuyer? Access South Dakota Down Payment Assistance

Apply Now And Explore First-Time Buyer Programs

What are the most popular programs for first-time homebuyers in South Dakota?

Moreover, the state of South Dakota has some schemes targeted to assist home buyers as below:

- Offered through the South Dakota Housing Development Authority (SDHDA).

- This gives low-interest mortgage loans as part of the first-time homebuyer program.

- This schemer offers up to three percent of the total loan to cover closing costs and the downpayment under

DPA (down payment assistance).

- Governor’s House Program: Sells houses below the market value for eligible income earners.

- South Dakota Native Homeownership Coalition Programs: Aids Native American home purchasers with targeted help.

Who qualifies for first-time homebuyer programs in South Dakota?

To qualify, you typically must:

- Be a first-time homebuyer (having not owned a home in the last three years).

- You have to fall under a certain income cap relative to the number of people in your household.

- Purchase a home within the price limits set by SDHDA.

- Complete a homeowner education course.

Go to the South Dakota Housing Development Authority: sdhda.org for further information.

What types of mortgage loans are available in South Dakota?

Homebuyers can select from the following types of loans:

- Conventional loans require at least a 3% to 5% down payment.

- FHA Loans: government-backed loans offering a 3.5% down payment.

- VA Loans: These loans require no down payment for qualified ex-military personnel.

- USDA Loans: these loans do not require a down payment for borrowers planning to live in rural areas.

- Jumbo Loans: For homes that cost more than the usual limits for such loans.

- Non-QM Loans: No income docs are required, and 10% to 20% are required.

How much do I need for a down payment on a home in South Dakota?

- The amount depends on the type of loan the borrower intends to get.

Types of Loans: Down Payment Options

- Conventional Loans: 3-20% of the home price.

- FHA Loans: 3.5% down.

- VA & USDA Loans: A 0% down payment is required.

- Non-QM Loans: 10% to 20% down payment required.

- Interest-Free Loans for First Time Homebuyers: South Dakota’s Down Payment Assistance (DPA) Program.

South Dakota Mortgage Calculator

What is the South Dakota Mortgage Calculator?

- South Dakota Mortgage Calculator Powered by Gustan Cho Associates enables homebuyers to estimate their monthly mortgage payments accurately.

Unlike other calculators, it provides:

- ✅ Principal & Interest (P&I)

- ✅ Property Taxes

- ✅ Homeowners Insurance

- ✅ Private Mortgage Insurance (PMI)

- ✅ Homeowners Association (HOA) Fees

- ✅ Debt-to-income (DTI) Ratios

Why is the South Dakota Mortgage Calculator better than other mortgage calculators?

- Most calculators only consider basic P&I and don’t provide a full breakdown of your payment.

- South Dakota Mortgage offers comprehensive details, removing any surprise costs.

How do I use the South Dakota Mortgage Calculator?

Provide the following:

- Home price

- Down payment

- Loan term (ex: 30 years)

- Interest Rate

- Estimated Property Taxes & Insurance

- HOA Fees (if applicable)

You’ll receive an instant full payment breakdown with accurate calculations.

Learn Which Mortgage Option Is Best for You in South Dakota

Apply Now And Get recommendations From Loan Experts

Can I evaluate multiple loan options through the South Dakota Mortgage Calculator?

Of Course! The calculator enables the comparison of the following:

- Conventional with FHA Loans

- VA and USDA Loans

- Mortgages with a 15-Year Term vs. 30-Year Term

Most importantly, it assists homebuyers in selecting the most appropriate financing option, considering their affordability.

Where is the South Dakota Mortgage Calculator available?

You can access the South Dakota Mortgage Calculator Powered By Gustan Cho Associates at:

- https://gustancho.com/south-dakota-mortgage-calculator.

- South Dakota homebuyers enjoy the benefits of accessible mortgage assistance programs, down payment aid, and mortgage calculators that promote informed financial decisions.

For further information on offered first-time homebuyer programs, check out:

🔗 South Dakota Housing Development Authority (SDHDA): sdhda.org

There is no other mortgage calculator in South Dakota that is as user-friendly and as accurate as the South Dakota Mortgage Calculator. The South Dakota Mortgage Calculator is the nation’s most accurate user-friendly mortgage calculator used by loan officers, and mortgage borrowers.

USEFUL LINK: FHA Debt-to-Income Guidelines in South Dakota

How To Calculate The Estimated Monthly Housing Payment in South Dakota?

The South Dakota mortgage calculator is the best mortgage calculator in the market. Added features to the Gustan Cho Associates South Dakota mortgage calculator are the debt to income calculation feature. The South Dakota mortgage calculator was created, designed, engineered, and launched by veteran experienced top-producing loan officers under the management of Alex Carlucci at Gustan Cho Associates for our borrowers, loan officers, and the public. The main reason for launching the South Dakota Mortgage Calculator was not finding a mortgage calculator with all the right features that were user-friendly.

Best Mortgage Lenders For First-Time Homebuyers in South Dakota

In this guide, we will walk you through using the South Dakota mortgage calculator. We will guide you on how to calculate your debt-to-income ratio using the South Dakota DTI Mortgage Calculator. Borrowers no longer have to constantly contact their loan officers for debt to income ratio calculations. Borrowers can now use the South Dakota Debt to Income Calculator and calculate their debt to income ratio. You will see how user-friendly the FHA DTI Mortgage Calculator is to calculate your debt-to-income ratio on your own.

USEFUL LINK: Buying Home in South Dakota for First-Time Homebuyers

Calculate PITI with PMI, Tax, and Insurance for New Home Purchase South Dakota

For people planning to purchase a home in South Dakota, one of the most common first-time homebuyer FAQs is what will the monthly mortgage payment be. However, many consumers are getting numbers way off from the actual data. Many homebuyers got conflicting data from several online South Dakota mortgage calculators. This is because users of online mortgage calculators are not calculating accurate mortgage insurance, property taxes, HOI, HOA fees, and other factors the South Dakota Mortgage Calculator has. Many mortgage calculators did not give the private mortgage insurance numbers while most did not have a debt to income ratio calculator.

USEFUL LINK: Debt To Income Ratio Guidelines

The Best South Dakota Mortgage Calculator With The Best Accuracy

Now, launched and passing quality control for any potential malfunctions, the South Dakota Mortgage Calculator is South Dakota’s premier mortgage calculator in the nation. You will not get any other mortgage calculator that comes close to the closest estimate of your new PITI with mortgage insurance. The South Dakota debt to income ratio calculator will button down your debt to income ratio so you can calculate your DTI without contacting your loan officer.

USEFUL LINK: South Dakota Lender Overlays on Debt to Income Ratio

What Will My PITI and MIP on My Home Purchase Be in South Dakota?

Home prices throughout the state of South Dakota are surging. Homes in have the highest-priced are selling like hotcakes in South Dakota. Despite skyrocketing mortgage rates and soaring inflation rates, the housing market in South Dakota has no signs of a slowdown and/or a housing correction. Most mortgage calculators do not give you an accurate estimate of your monthly housing payment. Most online mortgage calculators give you just the principal and interest. However, the South Dakota Mortgage Calculator gives you the most accurate estimate of your new mortgage payment, including taxes, insurance, and mortgage insurance.

How To Calculate My Housing Payments Using The Best South Dakota Mortgage Calculator

Using the South Dakota Mortgage Calculator is easy. Just plug in the numbers and within seconds you will get the most accurate housing payment than any other mortgage calculator in the market. It has been a seller’s housing market in South Dakota for the past five years. Home prices are surging like never before. Whenever a new home gets listed in South Dakota, there is no shortage of bidders. Most homes are under contract within the first 30 days of listing. Homebuyers placing offers higher than the list price is not uncommon.

USEFUL LINK: How Much House Can I Afford in South Dakota

Buying a Home in South Dakota For First-Time Homebuyers

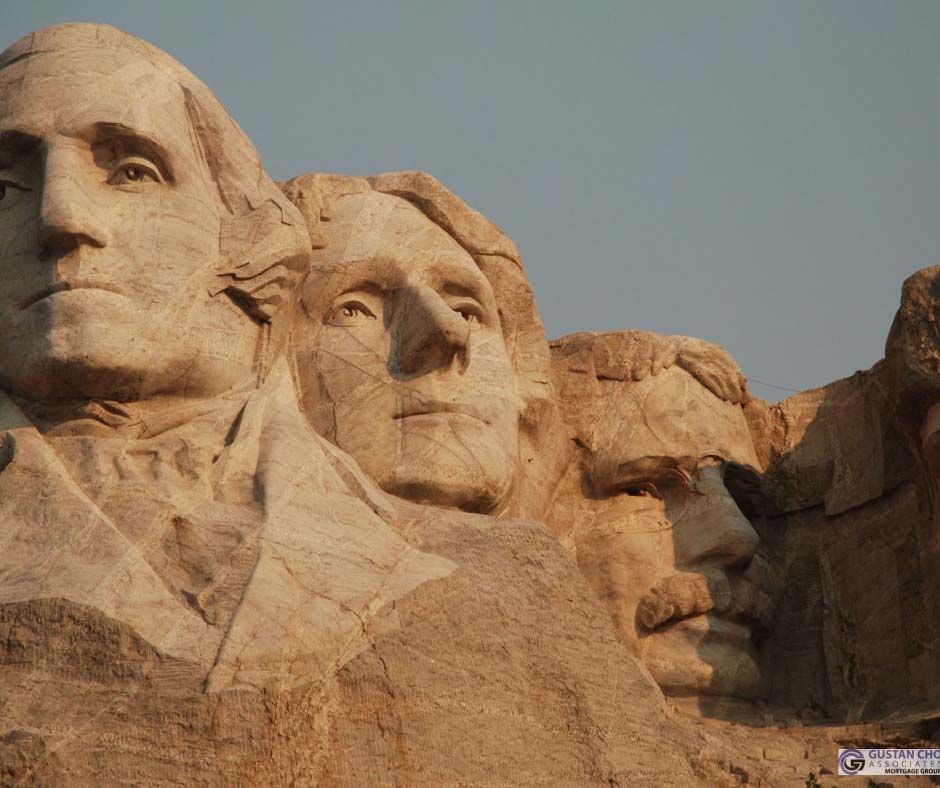

Home prices in South Dakota are priced above the national average. South Dakota experiencing explosive growth in the housing market due to the demand for homebuyers. Despite tens of thousands of taxpayers and businesses migrating to other states due to South Dakota’s high taxes, the strong economy, and demand for high-paying jobs in South Dakota are still attracting thousands of families and businesses from other states such as Pennsylvania, Maine, Connecticut, and New Jersey. The migration of immigrants remains strong with no signs of any slowdown. There are many areas of South Dakota which is beautiful and breathtaking. The state’s home prices are surging like never before. Inventory in South Dakota remains short. Home prices are expected to continue to rise with no signs of a housing correction insight.

How Much Money Is Required To Buy A House In South Dakota

Conventional loans are called conforming loans since they need to conform to Fannie Mae and Freddie Mac guidelines. Conforming loans are the most popular loan program in the nation. First-time homebuyers can get approved for conventional loans with a 3% down payment. A first-time homebuyer is a homebuyer who had no interest in a home for the past three years. FHA loans are the best loan program for first-time homebuyers, homebuyers with less than perfect credit, borrowers with low credit scores, and homebuyers with high debt to income ratio. You can qualify for FHA and VA loans with credit scores down to 500 FICO. USDA and VA loans do not require a down payment. Lenders offer 100% down payment on VA and USDA due to the government guarantee.

Need Guidance on Buying Your First Home?

Apply Now And Get recommendations From Loan Experts

Down Payment Requirements on Government and Conventional Loans in South Dakota

Seasoned home buyers need a 5% down payment on conventional loans. First-time homebuyers can qualify for a 3% down payment conventional loan. Fannie Mae and Freddie define a first-time homebuyer as a homebuyer that had no interest in a home in the past three years. FHA loans require a 3.5% down payment. VA and USDA loans do not require any down payment for a home purchase in South Dakota. Non-QM loans generally require a 20% down payment. There are traditional and non-prime Jumbo mortgages. Jumbo mortgages require a 20% down payment. 90% LTV Jumbo Mortgages require a 720 credit score. Business owners and self-employed borrowers can qualify for a 12-month bank statement mortgage with no income tax returns required.

What Mortgage Programs are Best in South Dakota First-Time Homebuyers

The South Dakota Mortgage Calculator with PMI, Insurance, and Property Taxes will give you the most accurate estimated monthly housing payment than any other mortgage calculator in the market. You will not get any mortgage calculator that will give you the most accurate mortgage payments on a new home purchase on FHA, VA, conventional, jumbo, and non-QM loans.

Calculate Your DTI Using The South Dakota Mortgage Calculator

Every mortgage loan program has its own debt to income ratio caps. The debt to income ratio cap on FHA, VA, conventional, jumbo, and non-QM loans are all different. Non-QM loans are non-prime portfolio loans. Non-prime wholesale mortgage lenders do not have an agency standard they need to follow with regard to debt to income ratio. It is up to every non-prime wholesale lender to set its own non-prime debt to income ratio on non-QM loan programs.

USEFUL LINK: Non-QM Loan DTI Guidelines

FHA Loan Requirements in South Dakota

FHA loans are the most popular loan program in South Dakota for first-time homebuyers, borrowers with bad credit, low credit scores, and homebuyers with high debt to income ratio. The maximum debt to income to get an approve/eligible per automated underwriting system for an FHA loan approval in South Dakota is 46.9% front-end and 56.9% back-end debt to income ratio. Calculate your debt to income ratio using the PA FHA Mortgage Calculator with DTI calculations.

VA Loan Requirements in South Dakota

How much house can you afford with a VA loan in South Dakota? The Veterans Administration does not have a maximum debt to income ratio cap on VA loans. As long as you have strong residual income, the debt to income ratio on VA loans in South Dakota can exceed 60% DTI or higher. Calculate your debt to income ratio using South Dakota VA Mortgage Calculator with DTI.

USEFUL LINK: South Dakota VA Loan with High DTI

Fannie Mae and Freddie Mac Guidelines on Conventional Loans in South Dakota

Fannie Mae and Freddie Mac do not have a maximum front-end debt to income ratio on conventional loans. The maximum debt to income ratio cap on conventional loans in South Dakota is 50% back-end DTI. However, to get mortgage approval in South Dakota on conventional loans with a 50% debt to income ratio, the borrower needs a credit score of 680 FICO or higher.

USEFUL LINK: Fannie Mae DTI Guidelines For Conventional Loans in South Dakota

Debt to Income Ratio Mortgage Calculator For Conventional Loans in South Dakota

Most private mortgage insurance companies will not insure PMI for borrowers with a 50% debt to income ratio unless their credit scores are higher than 680 FICO. Lower credit score home buyers in South Dakota can qualify for conventional loans with a 45% debt to income ratio. Use the South Dakota Conventional Loan Mortgage Calculator with DTI to calculate your debt to income ratio.

USEFUL LINK: Mortgage Guidelines in South Dakota on DTI Ratio on Conventional Loans

Jumbo Mortgage Guidelines For High-End Homebuyers in South Dakota

Any mortgage loan surpassing the maximum conforming loan limit in South Dakota is classified as Jumbo Mortgages. Jumbo loans do not have uniform agency guidelines on credit and debt to income ratio caps like government and conventional loans. Each individual Jumbo mortgage lender in South Dakota sets its own lending guidelines on its jumbo loan program.

USEFUL LINK: Best Lenders for Non-QM Mortgages

South Dakota Jumbo Mortgage Calculator to Determine Maximum DTI Cap on Loan Programs

There are jumbo mortgage lenders for traditional and non-prime jumbo mortgages. In general, jumbo lenders for full-doc traditional jumbo loans cap debt to income ratio between 40% to 45% for prime borrowers. Jumbo lenders for non-prime jumbo mortgages normally can extend debt to income ratio caps up to 50% DTI. Use the South Dakota Jumbo Mortgage Calculator with DTI to calculate your debt to income ratio. You can enter different numbers and figure out what the debt to income ratio yields to see if you qualify for certain loan programs.

Low Down Payment? No Problem!

Apply Now And Find the Best First-Time Homebuyer Programs in SD!