In this comprehensive overview of USDA home loan requirements, we will delve into the various prerequisites for USDA home loans that borrowers need to meet and the categories of qualified properties. The United States Department of Agriculture designates rural or suburban areas, providing homebuyers the opportunity to acquire homes in these specified regions through USDA loans.

USDA home loan requirements stipulate that only specific rural areas qualify for USDA mortgage loans. These loans are exclusively available in designated rural regions.

To be eligible for USDA loans, prospective homebuyers need to meet the USDA home loan requirements. Mortgage lenders provide 100% financing to qualified individuals looking to purchase homes in areas designated by the USDA across the United States. The ensuing paragraphs will delve into the comprehensive details of the eligibility criteria for USDA home loans, covering aspects such as borrower qualifications, property requirements, and the designated geographical areas eligible for USDA loans.

Speak With Our Loan Officer for Mortgage Loan Today

Are USDA Home Loan Requirements Hard To Get Approved?

Consider a scenario where a homebuyer can structure their home acquisition by incorporating a seller concession, wherein the seller contributes towards the buyer’s closing costs. The buyer can secure a home through seller concessions without any upfront expenses.

Suppose a homebuyer needs more of the seller’s concession to cover closing costs. In that case, they can receive a lender’s credit to offset the closing costs associated with the home loan.

You won’t need to provide a down payment when purchasing a home and applying for a USDA loan as per USDA home loan requirements. The closing costs can be addressed by utilizing the seller’s concession provided by the home seller.

A lender’s credit involves a mortgage lender providing funds to the borrower, covering a significant portion of their home closing costs in exchange for a slightly higher interest rate. USDA Loans have gained widespread popularity in various regions across the country.

USDA Home Loan Requirements For Eligible Properties

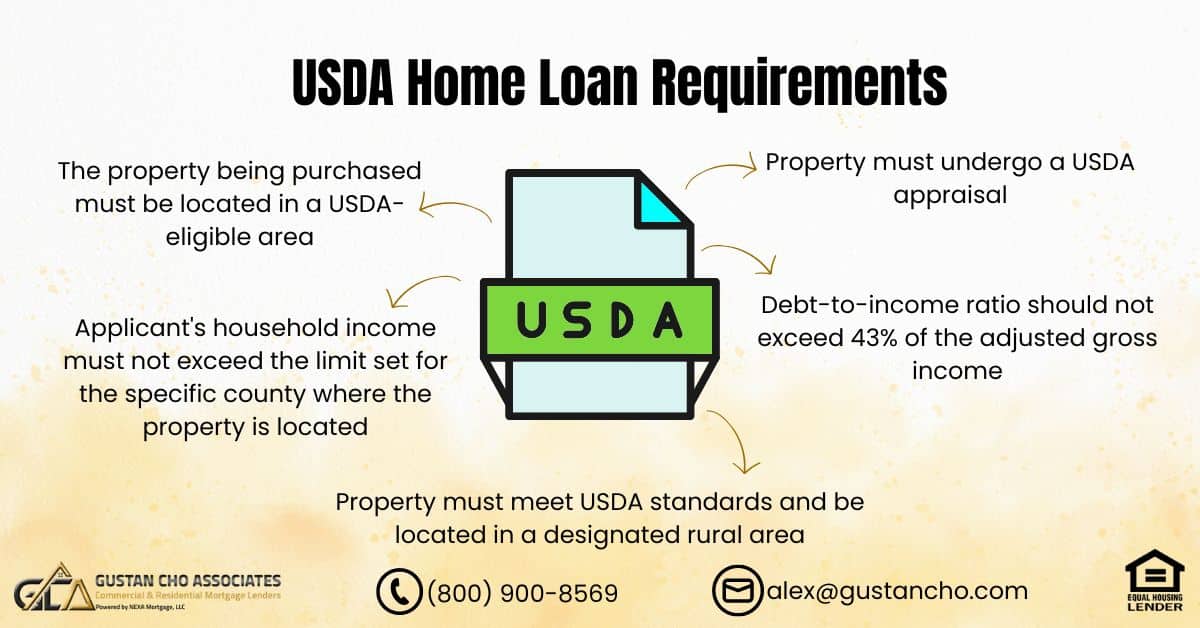

Based on the USDA home loan requirements, the property must be in a USDA-designated area. Applicants for USDA loans must meet specific eligibility criteria, including qualifying for the loan, meeting minimum credit score requirements, and adhering to maximum front-end and back-end debt-to-income ratio caps.

Notably, USDA home loan guidelines distinguish themselves from other loan programs by incorporating a maximum household income limit. The household income cap is determined based on the median income of the area and the number of individuals in the household.

USDA Home Loan Requirements on Household Income

USDA home loan requirements include a maximum household income cap, which varies based on the county where the property is situated. In cases where a married applicant assumes the mortgage loan individually, the spouse’s income is considered part of the household income, even if not listed on the mortgage note.

Other factors, such as the number of dependents, also play a role. It’s important to note that the USDA sets a limit of 28% for the maximum front-end debt-to-income ratio and 41% for the maximum back-end debt-to-income ratio.

How Much Do I Need To Buy a House With a USDA Loan

Acquiring a home in the latter part of 2023 has become increasingly challenging, primarily due to the Federal Reserve implementing six interest rate hikes in the current calendar year—the most significant and rapid increases in decades. Securing a home typically necessitates a down payment if you’re not a veteran who has bravely served our nation.

Nonetheless, a lesser-known mortgage program stands out for not imposing down payment requirements—meet the USDA home loan requirements.

Can I Buy a Home With No Down Payment and No Closing Costs With a USDA Loan?

The purpose behind the rate hikes is evident and focused on addressing inflation, but the outcomes differ significantly. Numerous clients face challenges in securing a down payment for buying a home. Additionally, one must consider the extra expenses associated with closing.

With USDA home loan requirements, it’s possible to receive a seller concession or lender credit of up to 6% to offset closing costs when purchasing a home.

What Area Are USDA Home Loans Eligible?

USDA home loan requirements cover financing options available in rural areas and are administered by the United States Department of Agriculture. In this blog, we will delve into the specifics of USDA mortgages, outline fundamental eligibility criteria, and provide guidance on applying for a USDA loan through Gustan Cho Associates.

A notable advantage of USDA loans is the absence of a mandatory down payment. There is no requirement for a down payment on USDA loans, so the qualification standards are more stringent than conventional or FHA loans.

It is essential to enlighten our readers that the United States Department of Agriculture extends its influence beyond being solely a food and safety organization. While USDA cuts of meat and USDA-certified organic produce are commonly encountered in grocery stores, information on USDA mortgage loans may not be as readily apparent.

USDA Loans Versus Conventional Loans

USDA home loan requirements are less widely embraced than conventional or FHA mortgage lending options; however, they present a viable route to achieving home ownership. The primary objective of USDA is to assist families in rural areas in becoming homeowners. This program is designed for low to moderate-income families seeking to purchase a home.

USDA home loan requirements come with competitive interest rates, contributing to a more affordable homebuying process for individuals with lower to moderate incomes in specified rural areas.

Like a VA mortgage loan, the United States Department of Agriculture directly supports the mortgage, paralleling the support provided by the United States Department of Veteran Affairs. Thanks to this backing from the federal government, mortgage lenders typically extend more competitive interest rates than conventional financing.

USDA Home Loan Requirements on Eligible Properties and Areas

USDA home loan requirements dictate that eligible areas for USDA loans are specifically designated as rural by the United States Department of Agriculture. The Department of Agriculture targets these areas to facilitate homeownership opportunities for families with lower to moderate incomes.

The United States Department of Agriculture mortgage department provides a user-friendly interactive eligibility map, ensuring easy verification of a property’s eligibility for USDA financing.

You can access the map through this link. Input the full address to determine if the property falls within the designated area. Even if the home is in a designated region, USDA strongly recommends contacting them directly for verification. While the interactive map is valuable, it may not only be 100% accurate sometimes.

Click Here To Find Out If You’re Eligible For USDA Home Loan

USDA Home Loan Requirements on Occupancy and Household Income

USDA home loan requirements include meeting the residency and income criteria. To qualify for a USDA loan, one must be either a legal resident of the United States, a non-citizen national, or a permanent resident alien. For detailed information regarding residency qualifications, please get in touch with Gustan Cho Associates.

Income limits are crucial in determining eligibility for a USDA mortgage loan.

Since USDA loans are designed for low to moderate-income families, your mortgage lender will verify your adjusted gross income. Your adjusted gross income must be at most 115% of the median income in your area. The USDA website provides a user-friendly income eligibility tool, allowing you to easily check the median income in the location where you plan to purchase a home.

USDA Mortgage Underwriting Guidelines on USDA Loans

If you satisfy the income limits, the underwriting process will involve confirming the presence of a reliable income source to support forthcoming mortgage payments. The underwriter will examine your credit report, emphasizing a pristine payment history over the preceding 12 months.

While delinquent payments may not automatically disqualify you from FHA mortgage loans, it’s crucial to note that USDA mortgage lending imposes a particularly stringent standard on payment history. This highlights the importance of meeting USDA home loan requirements.

USDA Home Loan Requirements on Debt-To-Income Ratio

Many clients ask if there are debt-to-income requirements with USDA mortgage lending. The short answer is yes. Your debt-to-income ratio is a qualifying factor for a USDA mortgage loan. T

he general recommendation is your debt-to-income ratio should not exceed 43% of your adjusted gross income. While it is possible to go above this number, it will all be part of the automated underwriting system to see if you qualify for a USDA mortgage loan.

How To Calculated Your Debt-To-Income Ratio For USDA Loans

Gustan Cho Associates offers an easy-to-use mortgage calculator to help you estimate your front and back-end debt-to-income ratios. GCA’s user-friendly mortgage calculator will give you an estimate on your mortgage payment.

Thousands of viewers use the GCA mortgage calculator. The GCA mortgage calculator is used by loan officers, realtors, and borrowers throughout the real estate industry.

For any questions on utilizing our state-of-the-art mortgage calculator, don’t hesitate to contact us at Gustan Cho Associates at 262-716-8151 today. Text us for a faster response. The USDA mortgage calculator gives you a field where you can enter other liabilities such as your credit card payments, auto loan payments, student loans, and any other debt you may have reported to your credit report.

Do Lenders Have Different USDA Home Loan Requirements

If you have less-than-perfect credit or high debt-to-income ratios, you must work with a highly skilled mortgage team who knows the ins and outs of a USDA mortgage loan. Not all lenders have the same lending requirements on USDA loans.

USDA Home Loan Requirements on Credit Scores

Credit score – Credit scoring can be very difficult to understand. The USDA automated underwriting system generally wants to see a credit score of 640 or higher. However, purchasing a home with a USDA mortgage loan is possible even if your credit score is below 640.

If your credit score is above 640, the automated underwriting system for USDA loans will typically send you an approval.

While many factors go into a USDA mortgage loan, a credit score is highly important. Gustan Cho Associates is always available to review your credit report in detail. We are experts in credit scoring and can give you pointers to raise your credit score in order to qualify for a home loan.

USDA Loans For Bad Credit

We have seen every credit score from the mid-400s to the mid-800s. There are many little things you can do to raise your credit score. Our team is here to offer our professional advice. While we usually do not recommend credit repair, we are always willing to advise you on raising your credit scores. Borrowers with bad credit can qualify for USDA loans.

Typically, if you have bad credit and lower credit scores, you will need to show other compensating factors. Example of compensating factors are on-time payment history, additional assets in the bank, longevity on your job, and high residual income..

Perks To a USDA Home Loan

In our opinion, the number one perk to a USDA loan is the no down payment requirement. In the economic condition the United States is currently in, saving money is harder than ever. With inflation higher than in decades, many Americans are burning through their savings just to make ends meet.

USDA Home Loan Requirements on Down Payment

Since a USDA loan does not require a down payment and allows the seller to pay closing costs, purchasing a home with little or even no money out of pocket is possible. A USDA mortgage loan will allow the seller to pay up to 6% of the purchase price towards seller-paid closing costs.

While we do not require a copy of the home inspection, you want to make sure the property you are purchasing will pass a USDA appraisal.

If you find a home for $300,000, and the seller can pay up to $18,000 in closing costs. It is unlikely the closing cost will be that high, so in theory, you will not need to bring any money out of pocket if you can negotiate seller-paid closing costs into your contract.

USDA Home Loan Requirements on Mortgage Insurance

Mortgage insurance – Technically, a USDA mortgage loan does not require mortgage insurance. However, they do have a guaranteed fee. Unlike an FHA loan, USDA mortgage loans come with an upfront and annual guarantee fee.

The upfront guarantee fee is something that is financed into your total loan amount and is always equal to 1% of your loan amount.

The annual guarantee fee is added to your monthly payment. The annual fee in the year 2023 is equal to .35% of the loan amount. For example, you have a $250,000 USDA loan, so .35% of $250,000 is $875. This $875 will be divided equally into your 12 monthly mortgage payments, so $72.92 will be collected monthly to pay the annual guarantee fee.

USDA Home Appraisal

Appraisal – Similar to most mortgage programs available, USDA loans require an appraisal conducted by a third party before an underwriter may approve the loan. A USDA appraisal is slightly different from a conventional appraisal.

A USDA appraisal will also include a well and septic report to verify the systems are working correctly and meet USDA guidelines.

Since the USDA appraisal is more in-depth than a conventional appraisal, it is usually in your best interest to complete a home inspection at the beginning of your home-buying process. For more information on the USDA appraisal process or the difference between a home appraisal and a home inspection, please reach out to Gustan Cho Associates today.

Speak With Our Loan Officer For A USDA Home Loan

USDA Versus Conventional Home Appraisal

With a conventional appraisal, the mortgage lender is looking for the home’s value and not much more. That way, a lender can make their decision on how much they can lend you. With a USDA mortgage loan, the lender is looking for the value of the home along with condition of the property. Security, safety, and habitability are the three factors USDA home appraisers look for.

Home Inspection Versus Home Appraisal

A home inspection is not required by lenders or the USDA. However, it is highly recommended homebuyers get a home inspection done. A home appraisal is required by lenders. The appraisal determines the collateral for the lender.

A USDA appraiser will confirm the condition of the home to make sure the home meets USDA standards.

A USDA appraisal will verify the home is up to code and in livable condition. Items such as the HVAC system and roof will be viewed and must meet strict criteria. USDA appraisals also look for damage like broken windows and holes in the wall.

What Is The Mortgage Process for Getting Approved For a USDA Loan

Applying for a USDA loan with Gustan Cho Associate is easier than ever. As mentioned above, you must work with a loan officer familiar with this program, or the process will be a nightmare. Our team of highly skilled loan officers is up to date on all mortgage guidelines on USDA mortgage lending.

The mortgage process of USDA loans differs than other loan programs because the lender underwrites the file and after the lender approves the file, the file needs to be underwritten again by the USDA.

After reviewing your upfront qualifications with a one-on-one mortgage consultation, you will be paired with a licensed loan officer in your state. Your licensed loan officer will send you an online application link. Since the beginning of the COVID-19 pandemic, many Americans have decided to move out of large cities and into more rural areas.

Mortgage Process By USDA Underwriter

A USDA loan can be a great purchasing tool to make this a reality. Every USDA loan is reviewed directly by the United States Department of Agriculture. After you receive a clear to close on our end, the file is sent directly to USDA for final approval.

During the final approval process by the USDA mortgage underwriter, there are things out of the lender’s control that may disqualify you from the mortgage loan.

Since USDA directly endorsed and guaranteed these loans, they have the final say. The USDA will rarely deny a closing, but it is a possibility. With that out of the way, we strongly encourage you to contact our team directly with any USDA-related questions. We are available seven days a week and work in the evenings to fit your schedule.

How Can I Qualify and Get Pre-Approved For a USDA Loan

This online application is easy to navigate and will gather the required information to start the process. This application link will ask you for details surrounding your current residence, employment for the previous two years, income and asset information, and other items based on your application.

Documents Required To Process USDA Loans

After completing the online application, you will be given a secure portal to upload your income and asset documentation. After your loan officer receives your full application with all the requested information and the documentation, they can move forward with the pre-approval process.

Since a USDA mortgage has a few more qualifications such as going through two different underwriting processes, the mortgage process on USDA loans may take longer.

Please remember that even though a down payment is not required, you are still on the hook for closing costs unless you can have the seller pay those for you. The number one hurdle for homeownership is saving for the down payment so that a USDA loan can skip the hardest step for you.

Getting Approved With The Best Lender For a USDA Loan

Now that you understand the basics of USDA lending and how to apply with our team, we encourage you to apply today. We strongly encourage you to search the USDA eligibility map to ensure you are looking in a USDA-eligible area.

Not every lender offers USDA mortgage loans; more importantly, not every loan officer knows the qualifications. Since a USDA home loan can be difficult to finish, it is important to work with a highly skilled mortgage team such as Gustan Cho Associates.

If you have any questions about USDA Home Loan Requirements, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQ – USDA Home Loan Requirements

What areas qualify for USDA mortgage loans? USDA home loan requirements dictate that only specific rural areas designated by the United States Department of Agriculture qualify for USDA mortgage loans. The USDA provides an interactive eligibility map to verify a property’s eligibility easily.

Are USDA home loan requirements hard to get approved? No, USDA home loan requirements offer flexibility. Homebuyers can structure their acquisition using seller concessions or lender credits to cover closing costs, eliminating the need for an upfront payment.

What are the income requirements for USDA home loans? USDA home loan requirements include a maximum household income cap, determined by the property’s county. The income limits are crucial for eligibility, and the USDA sets a limit of 28% for the maximum front-end debt-to-income ratio and 41% for the maximum back-end debt-to-income ratio.

Can I buy a home with no down payment and no closing costs with a USDA loan? Yes, USDA home loan requirements allow for no down payment, and closing costs can be covered by a seller’s concession or lender credit of up to 6%.

What is the USDA’s role in the mortgage process? The United States Department of Agriculture administers USDA home loans, focusing on facilitating homeownership opportunities for low to moderate-income families in rural areas. USDA loans come with competitive interest rates due to federal backing.

How do USDA loans differ from conventional loans? USDA home loan requirements are less widely known than conventional or FHA mortgage lending options. However, USDA loans are designed for families in rural areas, offering affordable homebuying with no down payment requirements and competitive interest rates.

How is the USDA home appraisal process different? USDA home loan requirements include a detailed appraisal process, examining the property’s value, condition, and habitability. The USDA appraisal also includes a well and septic report to verify system functionality.

What are the credit score requirements for USDA loans? While the USDA automated underwriting system prefers a credit score of 640 or higher, it’s possible to qualify with lower scores. Gustan Cho Associates can provide guidance on improving credit scores and navigating USDA home loan requirements.

How can I qualify and get pre-approved for a USDA loan? Prospective homebuyers can apply online, and working with a knowledgeable mortgage team like Gustan Cho Associates is crucial for navigating the USDA home loan requirements and ensuring a smooth approval process.

Are USDA loans available nationwide? USDA home loan requirements cover financing options in rural areas, and the USDA-designated regions determine eligibility. It’s important to check the USDA eligibility map and consult with Gustan Cho Associates for accurate information on eligible areas.

Ready To Start Your USDA Home Loan Journey? Click Here To Qualify

This blog about USDA Home Loan Requirements was updated on February 9, 2024.